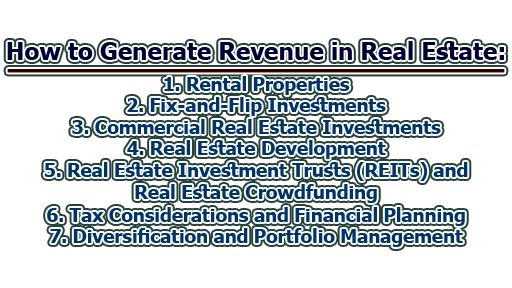

How to Generate Revenue in Real Estate:

Real estate investment has long been regarded as one of the most profitable and sustainable wealth-building strategies. However, generating revenue in the real estate industry requires careful planning, market analysis, and strategic decision-making. In this comprehensive guide, we will explore how to generate revenue in real estate.

1. Rental Properties:

1.1. Property Selection and Analysis: One of the most popular methods of generating revenue in real estate is rental properties. To ensure success, thorough property selection, and analysis are crucial. Factors such as location, market demand, property condition, and potential rental income must be carefully evaluated. Research local market trends, analyze rental rates in the area, and consider the target tenant demographic. Additionally, assess the property’s maintenance requirements and potential for future appreciation. By conducting a comprehensive analysis, you can identify properties with the highest potential for generating consistent rental income.

1.2. Rental Pricing Strategies: Determining the right rental price is essential for maximizing revenue while ensuring tenant retention. Conduct a comparative market analysis to evaluate similar rental properties in the area. Consider factors such as location, property size, amenities, and overall condition. Strike a balance between competitive pricing and achieving an attractive return on investment. Additionally, stay updated on market trends and adjust rental prices periodically to remain competitive.

1.3. Property Management: Effective property management is crucial for maintaining high occupancy rates and generating consistent rental income. Create streamlined processes for tenant screening, lease agreements, rent collection, and property maintenance. Promptly address tenant concerns and ensure that the property is well-maintained to attract and retain quality tenants. Consider outsourcing property management to professionals if you own multiple properties or lack the time and expertise to handle them yourself.

1.4. Maximizing Rental Income: Explore strategies to maximize rental income. Consider implementing rent increases over time to keep pace with inflation and market rates. Additionally, offer value-added services or amenities to justify higher rental prices, such as laundry facilities, parking spaces, or fitness centers. Evaluate the potential for additional income streams, such as laundry or vending machines. Regularly review expenses to identify cost-saving opportunities and improve cash flow.

2. Fix-and-Flip Investments:

2.1. Market Research and Property Acquisition: Fix-and-flip investments involve purchasing properties in need of renovation, improving them, and selling them at a profit. Thorough market research is essential to identify emerging or undervalued areas with potential for appreciation. Once a target market is identified, conduct due diligence on individual properties to assess their purchase price, renovation costs, and potential after-repair value (ARV). Look for distressed properties, foreclosures, or properties in need of cosmetic updates that can be acquired at a favorable price.

2.2. Renovation and Repairs: Successful fix-and-flip investments require effective renovation and repair strategies. Develop a detailed renovation plan, obtain accurate cost estimates, and hire skilled contractors to complete the work. Focus on improvements that provide the highest return on investment, such as kitchen and bathroom upgrades, fresh paint, flooring replacements, and enhancing curb appeal. Keep a close eye on the budget and timeline to avoid cost overruns and delays.

2.3. Timing and Selling Strategies: Timing is crucial in fix-and-flip investments. Monitor the local real estate market to identify favorable selling conditions, such as high demand and low inventory. Aim to sell the property at a time when market prices are on an upward trajectory. Collaborate with real estate agents or brokers who have expertise in your target market to determine the optimal time to list the property. Implement effective marketing strategies, including professional staging, high-quality photography, and widespread online and offline advertising. Consider hosting open houses and networking with local real estate professionals to generate interest and attract potential buyers. Be flexible and willing to adjust your selling strategy based on market conditions.

2.4. Mitigating Risks: Fix-and-flip investments come with inherent risks, and it’s essential to mitigate them to protect your revenue potential. Conduct thorough due diligence on the property’s condition, potential structural issues, and any legal or zoning restrictions that may affect the renovation process or future resale. Obtain the necessary permits and inspections to ensure compliance with local regulations. Develop a detailed budget and contingency plan to account for unexpected expenses or delays. Consider obtaining insurance coverage to protect against unforeseen events such as property damage or liability claims. Finally, maintain a realistic mindset and be prepared for potential setbacks or market fluctuations that may impact your profitability.

3. Commercial Real Estate Investments:

3.1. Identifying Profitable Commercial Properties: Commercial real estate investments offer the potential for substantial revenue, but careful property selection is crucial. Analyze market demand and economic indicators to identify sectors with growth potential, such as retail, office spaces, or industrial properties. Evaluate factors like location, demographics, accessibility, and rental demand. Consider engaging the services of a commercial real estate agent or broker with expertise in the target market to identify lucrative opportunities and negotiate favorable deals.

3.2. Analyzing Lease Terms and Negotiations: When investing in commercial properties, lease agreements play a critical role in revenue generation. Thoroughly review lease terms, including rental rates, lease duration, escalation clauses, and tenant responsibilities. Negotiate leases that offer competitive rental rates while ensuring steady income streams. Consider the creditworthiness and stability of potential tenants to minimize the risk of lease defaults. Engage legal professionals experienced in commercial real estate to assist with lease negotiations and ensure compliance with local laws and regulations.

3.3. Property Management and Tenant Relationships: Efficient property management is essential for commercial real estate investments. Develop strong tenant relationships and provide exceptional customer service to encourage lease renewals and minimize vacancies. Regularly inspect the property, address maintenance issues promptly, and ensure compliance with building codes and regulations. Consider offering additional services or amenities that enhance tenant satisfaction and differentiate your property from competitors. Establish a reliable system for rent collection, property accounting, and financial reporting. Depending on the scale of your commercial property portfolio, you may choose to hire a professional property management company.

3.4. Capitalizing on Market Trends: Stay informed about market trends and emerging opportunities in the commercial real estate sector. Monitor economic indicators, vacancy rates, and rental trends to make informed investment decisions. Stay updated on regulatory changes that may impact commercial property investments, such as zoning or environmental regulations. Consider adapting the property to accommodate evolving market demands, such as incorporating sustainable features or incorporating technology solutions to attract modern businesses. Continuously evaluate and optimize your commercial property portfolio to maximize revenue potential.

4. Real Estate Development:

4.1. Identifying Development Opportunities: Real estate development involves identifying opportunities to create new properties or redevelop existing ones for profit. Conduct extensive market research to identify areas with high growth potential and demand for specific property types, such as residential, commercial, or mixed-use developments. Consider factors such as population growth, employment trends, infrastructure development, and demographic changes. Collaborate with real estate professionals, including architects, engineers, and urban planners, to assess the feasibility of development projects in your target market.

4.2. Conducting Feasibility Studies: Before embarking on a development project, conduct comprehensive feasibility studies to evaluate its financial viability. Assess factors such as land acquisition costs, construction expenses, permitting and regulatory requirements, and projected market demand and rental/sales prices. Calculate the projected return on investment (ROI) and assess the risks associated with the development project. Engage professionals, including financial analysts and consultants, to ensure accurate financial modeling and risk assessment.

4.3. Obtaining Financing and Managing Costs: Real estate development projects often require significant capital investments. Explore various financing options, such as bank loans, private investors, partnerships, or crowdfunding platforms. Prepare a detailed business plan and financial projections to present to potential lenders or investors. Implement effective cost management strategies, including obtaining multiple construction bids, negotiating favorable supplier contracts, and closely monitoring project expenses. Keep a contingency fund to address unforeseen costs or delays during the development process.

4.4. Marketing and Selling the Developed Properties: Effectively marketing and selling the developed properties are crucial steps in revenue generation in real estate development. Develop a comprehensive marketing strategy to attract potential buyers or tenants. Utilize online and offline advertising channels, showcase the unique selling points of the property, and highlight the benefits of the location. Consider staging model units or providing virtual tours to give potential buyers a realistic view of the property. Collaborate with real estate agents or brokers who specialize in the target market to leverage their expertise and reach a broader audience. Implement effective pricing strategies based on market conditions and property valuation.

5. Real Estate Investment Trusts (REITs) and Real Estate Crowdfunding:

5.1. Understanding REITs and Their Revenue Generation: Real Estate Investment Trusts (REITs) are investment vehicles that pool funds from multiple investors to invest in income-generating real estate properties. By investing in REITs, individuals can generate revenue through dividends from rental income and capital appreciation of the underlying properties. Research and identify REITs that align with your investment goals and risk tolerance. Evaluate their track record, portfolio diversification, management team, and distribution policies before investing.

5.2. Real Estate Crowdfunding Platforms and Strategies: Real estate crowdfunding platforms provide opportunities for individuals to invest in specific real estate projects or properties. These platforms allow investors to pool their capital with others to fund real estate ventures. Research reputable crowdfunding platforms that align with your investment criteria. Analyze the investment opportunities available, including project details, financial projections, and the track record of the project sponsors. Diversify your investments across multiple projects to mitigate risk.

6. Tax Considerations and Financial Planning:

6.1. Tax Benefits of Real Estate Investments: Real estate investments offer various tax advantages that can enhance revenue generation. Consult with tax professionals to understand tax deductions, such as mortgage interest, property taxes, depreciation, and expenses related to property management. Explore strategies like 1031 exchanges to defer capital gains taxes when selling properties and reinvesting the proceeds into like-kind properties. Additionally, consider structuring your real estate investments within tax-advantaged entities such as Limited Liability Companies (LLCs) or partnerships to optimize tax benefits.

6.2. Real Estate Investment Strategies for Tax Optimization: Implementing tax optimization strategies can significantly impact your real estate investment revenue. Work with experienced tax advisors to develop a comprehensive tax strategy tailored to your investment goals. Consider strategies such as cost segregation, which allows you to accelerate depreciation deductions for certain components of a property. Explore the benefits of utilizing self-directed retirement accounts, such as Individual Retirement Accounts (IRAs) or Solo 401(k)s, to invest in real estate and defer taxes on investment returns. Stay updated on tax laws and regulations to take advantage of any new incentives or credits related to real estate investments.

7. Diversification and Portfolio Management:

7.1. Portfolio Diversification Strategies: Diversification is essential for mitigating risk and maximizing revenue potential in real estate investments. Avoid putting all your capital into a single property or market. Instead, diversify your portfolio by investing in different property types, geographic locations, and investment strategies. Consider a mix of residential, commercial, and industrial properties to balance risk and reward. Allocate investments across different markets or cities to minimize the impact of local economic fluctuations.

7.2. Evaluating Real Estate Investments within a Portfolio: Regularly assess and evaluate the performance of your real estate investments within your portfolio. Monitor key metrics such as cash flow, occupancy rates, rental income, and property appreciation. Conduct periodic reviews to identify underperforming properties and explore strategies to optimize their revenue potential. Consider leveraging the expertise of financial advisors or portfolio managers to gain insights into market trends, potential investment opportunities, and risk management strategies.

It is apparent that real estate offers numerous avenues for generating revenue and building long-term wealth. From rental properties to fix-and-flip investments, commercial real estate, real estate development, and alternative investment options like REITs and real estate crowdfunding, each approach has its unique opportunities and challenges. By carefully analyzing market conditions, conducting thorough due diligence, and implementing effective strategies, you can maximize your revenue potential in the real estate industry. Additionally, understanding tax considerations, diversification strategies, and financial planning can further enhance your overall profitability and protect your investments. Remember, successful real estate revenue generation requires patience, perseverance, and a commitment to ongoing learning. With this guide as your foundation, you are now equipped to embark on a successful real estate investment journey. Continuously educate yourself, stay informed about market trends, and adapt your strategies to capitalize on opportunities in the ever-evolving real estate landscape.

References:

- Smith, G. (2019). The Book on Rental Property Investing: How to Create Wealth and Passive Income Through Intelligent Buy & Hold Real Estate Investing. BiggerPockets Publishing, LLC.

- Blank, J., & Gady, S. (2019). The Ultimate Guide to Flipping Houses: Real Estate Investing for Beginners. Independently Published.

- Gallinelli, F. (2015). What Every Real Estate Investor Needs to Know About Cash Flow… And 36 Other Key Financial Measures. McGraw-Hill Education.

- McLean, A. L., & Eldred, G. (2018). Commercial Real Estate Investing For Dummies. For Dummies.

- Martin, D. L., & Schindler, C. (2017). Real Estate Development Principles and Process. Routledge.

- DeRoos, J., & Rushmore, S. (2017). Commercial Real Estate Analysis & Investments. Wiley.

Library Lecturer at Nurul Amin Degree College