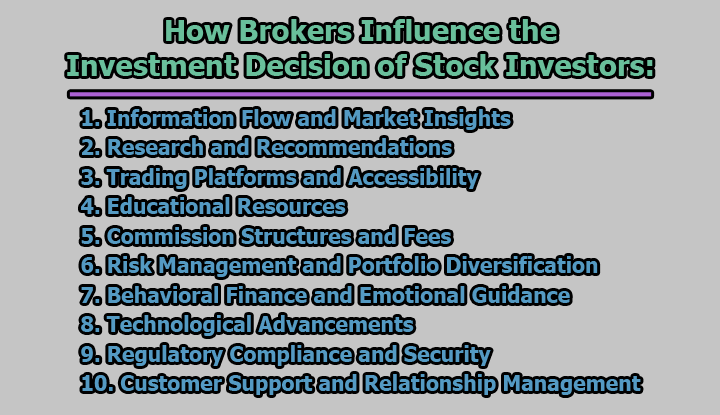

How Brokers Influence the Investment Decision of Stock Investors:

In the dynamic landscape of stock markets, individual investors often find themselves at a crossroads, grappling with the decision of where to invest their hard-earned money. In this complex web of financial choices, brokers emerge as influential players, wielding the power to shape and guide the investment decisions of individual stock investors. In this article, we explore how brokers influence the investment decision of stock investors, shedding light on the complexities of this relationship and offering insights into how investors can navigate this intricate terrain.

1. Information Flow and Market Insights: In the fast-paced realm of stock markets, timely and accurate information is paramount. Brokers play a pivotal role in bridging the information gap between the complex dynamics of the market and individual investors. Through various channels such as research reports, market analysis, and newsletters, brokers provide investors with a continuous stream of valuable insights.

Investors often rely on brokers to distill the vast amount of market data into actionable information. This includes updates on market trends, company performances, economic indicators, and potential investment opportunities. The ability of brokers to deliver relevant and up-to-date information empowers investors to make well-informed decisions, aligning their investment strategies with the prevailing market conditions.

For instance, during earnings seasons, brokers may release detailed reports on companies’ financial performances, helping investors gauge the health of their investments. The influence of brokers in shaping investors’ perspectives through the lens of market insights is undeniable.

2. Research and Recommendations: Brokers employ dedicated research teams to conduct in-depth analyses of various stocks, industries, and market trends. These research efforts result in specific recommendations that carry weight in the decision-making processes of individual investors. These recommendations often come in the form of buy, hold, or sell ratings, accompanied by detailed explanations.

Investors, especially those without the time or expertise to conduct exhaustive research themselves, may heavily rely on these broker recommendations. The reputation and track record of a broker’s research department can significantly sway investor sentiments. Positive recommendations can create buying pressure on a stock, while negative ones may lead to sell-offs, influencing stock prices and overall market dynamics.

The challenge for investors lies in discerning the objectivity and reliability of these recommendations, considering that brokers may have conflicts of interest, such as promoting stocks from companies with which they have business ties. As such, while broker research can be a valuable resource, investors should approach it with a critical eye, considering multiple sources of information.

3. Trading Platforms and Accessibility: The evolution of technology has transformed the landscape of stock trading, with brokers at the forefront of providing accessible and user-friendly trading platforms. These platforms serve as the interface through which investors execute trades, monitor their portfolios, and access market information.

The design, functionality, and reliability of these platforms can significantly influence an investor’s choice of broker. A seamless and intuitive trading experience enhances investor satisfaction and can lead to long-term relationships. On the contrary, a platform with glitches, delays, or a confusing interface may prompt investors to seek alternative brokerage services.

Additionally, the accessibility of trading platforms, particularly the availability of mobile apps, has become a crucial factor. Investors, in today’s fast-paced world, value the ability to trade on the go. Brokers that offer responsive mobile applications gain a competitive edge by meeting the evolving needs of investors seeking real-time access to their portfolios.

4. Educational Resources: The journey of an investor is an ongoing learning process, and brokers play a key role in facilitating this process through the provision of educational resources. Recognizing that well-informed investors are more likely to make prudent decisions, brokers offer a variety of learning materials, including webinars, tutorials, articles, and educational courses.

These resources cover a spectrum of topics, ranging from basic financial concepts to advanced investment strategies. By empowering investors with knowledge, brokers aim to build a more confident and capable investor base. Investors benefit from understanding market intricacies, financial instruments, and risk management strategies, ultimately leading to more informed and rational investment decisions.

The influence of brokers in the educational aspect extends beyond just imparting information. By demystifying complex financial concepts and providing actionable insights, brokers contribute to the development of a more discerning and financially literate investor community. Investors, in turn, can make investment decisions grounded in a deeper understanding of the market dynamics.

5. Commission Structures and Fees: The financial aspect of the broker-investor relationship is a vital factor that shapes investment decisions. One of the most tangible elements in this regard is the commission structure and fees charged by brokers for their services. Investors weigh these costs against the value they perceive in the services offered by a particular broker.

Competitive commission rates and transparent fee structures are often attractive to investors seeking to optimize their returns. Brokers that offer lower fees can be particularly appealing, especially for frequent traders or those managing smaller portfolios. However, it’s essential for investors to consider the overall value proposition, as very low fees may be accompanied by trade-offs in terms of research quality, customer support, or trading platform features.

Moreover, some brokers have adopted commission-free models for certain types of trades, which can be a compelling factor for cost-conscious investors. This trend has been transformative in the industry, challenging traditional commission structures and prompting investors to reevaluate their broker relationships based on a broader set of considerations.

In the ever-evolving landscape of commission structures and fees, investors must carefully assess the balance between costs and the overall quality of services provided by brokers. The decision-making process involves weighing short-term savings against the long-term benefits of a comprehensive and reliable brokerage relationship.

6. Risk Management and Portfolio Diversification: Brokers contribute significantly to the risk management practices of individual investors. Many brokerage platforms offer tools and features that help investors assess and manage the risks associated with their portfolios. These tools may include risk assessment questionnaires, portfolio analysis, and risk tolerance calculators.

Moreover, brokers often provide guidance on the importance of diversification – spreading investments across different asset classes, industries, and geographical regions to reduce overall risk. They may offer model portfolios, investment strategies, or even automated portfolio management services that align with investors’ risk profiles and financial goals.

The influence of brokers in this regard is crucial, especially for novice investors who may not have a comprehensive understanding of risk management principles. By encouraging sound risk practices and emphasizing the importance of a diversified portfolio, brokers contribute to the creation of more resilient and adaptive investment strategies.

7. Behavioral Finance and Emotional Guidance: Understanding investor behavior is an integral part of a broker’s role. Brokers often leverage principles from behavioral finance to guide investors through emotionally charged market conditions. The psychological aspect of investing, characterized by emotions such as fear and greed, can lead to impulsive decisions that may not align with rational investment strategies.

Brokers employ various tactics to address behavioral biases and help investors make more objective decisions. This includes providing educational content on common biases, offering market commentaries that contextualize short-term fluctuations, and implementing features like stop-loss orders to automate sell decisions during market downturns.

The ability of brokers to act as emotional stabilizers is particularly relevant during periods of market volatility, where knee-jerk reactions can lead to significant financial losses. By incorporating behavioral finance insights into their guidance, brokers aim to foster a disciplined and rational approach to investing, ultimately benefiting investors over the long term.

8. Technological Advancements: The landscape of stock trading has undergone a technological revolution, and brokers are at the forefront of these advancements. The introduction of innovative technologies such as algorithmic trading, mobile trading apps, and robo-advisors has reshaped how investors interact with financial markets.

Algorithmic trading, facilitated by brokers, allows investors to execute trades based on predefined algorithms and strategies. This technology enables quicker and more efficient trades, often with lower transaction costs. Mobile trading apps provide investors with real-time access to their portfolios, market news, and the ability to execute trades from anywhere with an internet connection.

Robo-advisors, offered by some brokers, use algorithms to automate investment decisions based on investors’ risk profiles and financial goals. This form of automated investing has gained popularity for its accessibility and cost-effectiveness, particularly for investors who prefer a hands-off approach.

Investors often factor in the technological capabilities of brokers when making decisions. A broker’s commitment to staying at the forefront of technological advancements can enhance the overall trading experience and attract tech-savvy investors seeking cutting-edge tools and features.

9. Regulatory Compliance and Security: Investors entrust brokers with sensitive financial information, making regulatory compliance and security paramount considerations in the decision-making process. Brokers operate within a regulatory framework set by financial authorities to ensure fair and transparent practices. Investors often prioritize brokers that demonstrate a commitment to compliance, as it instills confidence in the integrity of the financial services provided.

Security measures implemented by brokers to protect clients’ data and assets also play a crucial role. Investors seek assurances that their personal and financial information is secure from unauthorized access and cyber threats. Brokers invest in robust cybersecurity infrastructure, encryption technologies, and secure authentication processes to safeguard client accounts.

The influence of brokers in this context extends beyond mere legal obligations. Investors view brokers as custodians of their financial well-being, and a strong emphasis on regulatory compliance and security can be a decisive factor in selecting a trustworthy partner for their investment journey.

10. Customer Support and Relationship Management: The quality of customer support and the effectiveness of relationship management services are vital components of the broker-investor relationship. Investors value prompt and reliable customer support, especially in scenarios involving technical issues, account management, or clarification of financial instruments.

Brokers that excel in customer service create a positive experience for investors, fostering trust and loyalty. Effective relationship management involves not only addressing issues but also proactively engaging with investors, providing updates, and offering personalized guidance based on individual needs.

Investors often consider the responsiveness and accessibility of customer support when choosing a broker. A broker’s commitment to building strong, client-centric relationships contributes to long-term satisfaction and can lead to continued collaboration.

In conclusion, brokers wield a multifaceted influence on the investment decisions of individual stock investors. By understanding and evaluating the impact of information flow, research and recommendations, trading platforms, educational resources, commission structures, risk management, behavioral guidance, technological advancements, regulatory compliance, and customer support, investors can navigate the complexities of the financial landscape more effectively. A well-informed investor, cognizant of the various factors at play, is better positioned to make sound investment decisions and build a successful, enduring relationship with their chosen broker.

Library Lecturer at Nurul Amin Degree College