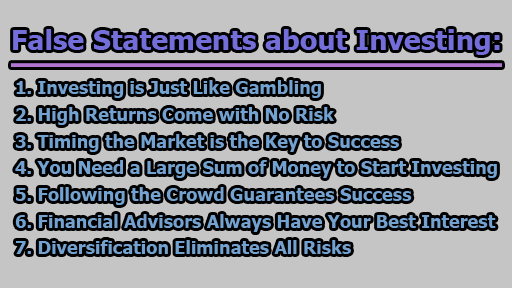

False Statements about Investing:

Investing is a complex and dynamic field that demands a keen understanding of market dynamics, risk management, and a disciplined approach. In the pursuit of financial success, investors often encounter a myriad of myths and misconceptions that can lead them astray. In this article, we will dissect and debunk some of the most prevalent false statements about investing, shedding light on the truth to empower investors with the knowledge they need to make informed decisions.

1. Investing is Just Like Gambling: The notion that investing is akin to gambling is a widespread misconception that oversimplifies the intricacies of both activities. While both involve an element of risk, the fundamental difference lies in the approach and methodology. Gambling is largely a game of chance, where outcomes are unpredictable and often based on luck. On the contrary, investing is a strategic endeavor that requires careful research, analysis, and a long-term perspective.

In investing, success is not solely determined by chance but rather by understanding the fundamentals of the assets in which one invests. Investors must delve into financial statements, assess market trends, and evaluate the competitive landscape. Additionally, a diversified portfolio, spread across various asset classes, can help mitigate risk. By taking a strategic and informed approach, investors can significantly increase their chances of achieving favorable outcomes, distinguishing investing from the arbitrary nature of gambling.

2. High Returns Come with No Risk: The allure of high returns without risk is a tempting proposition that has led many investors down a perilous path. Every investment involves some degree of risk, and the relationship between risk and return is a fundamental principle of finance. While it’s true that certain investments may offer higher returns, they often come with a corresponding increase in volatility and uncertainty.

Investors need to carefully assess their risk tolerance and financial goals before pursuing high-return opportunities. It’s crucial to understand that seeking elevated returns inherently involves accepting a higher level of risk. Diversification, another key principle in risk management, allows investors to spread their investments across different assets, reducing the impact of poor performance in any single investment. The key is to strike a balance that aligns with individual risk tolerance and financial objectives, recognizing that high returns come with an inherent level of risk.

3. Timing the Market is the Key to Success: The belief that consistently timing the market is the key to investment success is a pervasive myth that has ensnared even experienced investors. Market timing involves predicting short-term fluctuations in asset prices, a task that is notoriously challenging due to the multitude of unpredictable factors influencing financial markets.

Attempting to time the market can lead to emotional decision-making, often resulting in missed opportunities and financial losses. Instead of trying to predict short-term market movements, investors are better served by adopting a disciplined, long-term investment strategy. Dollar-cost averaging, the practice of consistently investing a fixed amount at regular intervals, allows investors to benefit from market fluctuations over time, smoothing out the impact of volatility.

4. You Need a Large Sum of Money to Start Investing: A prevalent misconception is that substantial capital is a prerequisite for entering the world of investing. In reality, there are various investment options that cater to individuals with different budgetary constraints. Mutual funds, exchange-traded funds (ETFs), and robo-advisors are accessible investment vehicles that allow individuals to start with modest amounts of money.

The key to successful investing is consistency and discipline. Regardless of the initial investment amount, regularly contributing to investments over time can leverage the power of compounding, allowing even small amounts to grow substantially over the long term. This dispels the myth that substantial wealth is necessary to participate in the world of investing, making it more inclusive and accessible to a broader range of individuals.

5. Following the Crowd Guarantees Success: The misconception that success in investing comes from following the crowd oversimplifies the complexities of the financial markets. While market trends and sentiment can influence investment decisions, blindly following the crowd without conducting independent analysis can lead to poor outcomes. Market movements are influenced by a myriad of factors, and blindly conforming to popular sentiment may result in buying at inflated prices or selling during downturns.

Successful investors conduct thorough research, stay informed about market conditions, and make decisions based on their individual financial goals and risk tolerance. While it’s essential to be aware of market trends, relying solely on the consensus can expose investors to the herd mentality, where decisions are driven by emotion rather than rational analysis. Striking a balance between market awareness and independent judgment is key to navigating the complexities of the financial markets.

6. Financial Advisors Always Have Your Best Interest: Trusting a financial advisor blindly can be a risky assumption. While many financial advisors operate with integrity and prioritize their clients’ interests, it’s crucial for investors to exercise due diligence. Financial advisors may be compensated through fees or commissions, potentially creating conflicts of interest. Investors should seek advisors who are transparent about their fees, disclose any potential conflicts, and tailor their recommendations to individual financial goals.

It’s important for investors to actively participate in the decision-making process, ask questions, and understand the rationale behind recommended strategies. Regular communication with the financial advisor ensures that the investment approach aligns with changing financial circumstances and evolving goals. Ultimately, a collaborative and informed relationship with a financial advisor can be valuable, but blind trust should be avoided.

7. Diversification Eliminates All Risks: Diversification is a fundamental risk management strategy, but the belief that it eliminates all risks is a misunderstanding. While spreading investments across different asset classes can mitigate specific risks, it doesn’t guarantee immunity from market fluctuations. During extreme market events, various asset classes may become correlated, leading to simultaneous declines.

Effective diversification involves understanding the correlation between different assets and continually reassessing portfolios based on changing market conditions. Over-reliance on a single asset class or neglecting to adjust portfolios in response to evolving market dynamics can undermine the benefits of diversification. Investors should aim for a well-balanced and diversified portfolio that aligns with their risk tolerance, time horizon, and financial objectives.

In conclusion, in the world of investing, distinguishing between truth and myth is essential for making informed decisions and achieving financial success. Debunking prevalent false statements allows investors to navigate the complexities of the financial markets with clarity and confidence. By understanding the nuanced nature of investing, embracing a disciplined approach, and continually educating themselves, investors can build a robust financial future and sidestep the pitfalls of misleading advice. In the dynamic landscape of finance, knowledge is the key to unlocking the potential for sustainable and fulfilling investment outcomes.

Frequently Asked Questions (FAQs):

What is the most common false statement about investing?

One of the most common false statements about investing is the notion that it is similar to gambling. While both involve an element of risk, investing requires strategic planning, research, and a long-term perspective, distinguishing it from the unpredictable nature of gambling.

Are high returns always associated with high risks in investing?

Yes, the belief that high returns come with no risk is a misconception. Every investment carries some level of risk, and the potential for higher returns is often correlated with increased volatility. Investors should carefully assess their risk tolerance and financial goals before pursuing high-return opportunities.

Is timing the market essential for investment success?

No, attempting to time the market consistently is a common myth. Successful market timing requires predicting short-term fluctuations accurately, a task that is challenging even for seasoned investors. A disciplined, long-term investment strategy and dollar-cost averaging are often more effective approaches.

Do you need a large sum of money to start investing?

No, substantial capital is not a prerequisite for investing. There are various investment options, such as mutual funds, ETFs, and robo-advisors, that allow individuals to start with modest amounts. Consistency and discipline, rather than a large initial investment, are key to building wealth over time.

Is following the crowd a reliable strategy for investment success?

No, blindly following the crowd does not guarantee success in investing. While market trends and sentiment can influence decisions, it’s essential to conduct independent analysis and make decisions based on individual financial goals and risk tolerance. Relying solely on popular sentiment can lead to poor outcomes.

Can you trust financial advisors completely?

Trusting financial advisors blindly is not advisable. While many operate with integrity, investors should exercise due diligence, understand their advisor’s compensation structure, and actively participate in decision-making. Regular communication ensures that investment strategies align with evolving financial circumstances and goals.

Does diversification eliminate all risks in investing?

No, diversification does not eliminate all risks. While it is a crucial risk management strategy, various factors can impact different asset classes simultaneously, especially during extreme market events. Effective diversification requires understanding correlations and regularly reassessing portfolios based on changing market conditions.

Library Lecturer at Nurul Amin Degree College