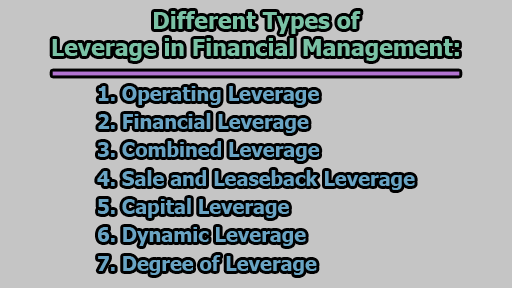

Different Types of Leverage in Financial Management:

Leverage is a crucial concept in financial management that refers to the use of various financial instruments or borrowed capital to increase the potential return on investment. While leverage can amplify profits, it also amplifies risks, making it a double-edged sword. In this article, we will delve into the different types of leverage in financial management, exploring their definitions, mechanisms, advantages, and risks.

1. Operating Leverage:

Operating leverage relates to the fixed costs of a business. It measures the degree to which a company uses fixed costs in its operations as opposed to variable costs. When fixed costs are high, a company has high operating leverage, meaning that a small change in sales can lead to a significant change in profits. The formula for operating leverage is given by:

Operating Leverage = (Percentage Change in Sales / Percentage Change in Operating Income)

Mechanism: The fixed costs, such as rent, salaries, and depreciation, remain constant regardless of the level of production or sales. As production increases, these fixed costs are spread over a larger number of units, leading to higher profitability.

Operating Income = Sales − Variable Costs − Fixed Operating Costs

Advantages:

- Economies of Scale lead to lower per-unit fixed costs, enhancing profitability.

- Increased Profitability during high sales periods.

- Strategic Cost Management allows for efficiency improvements.

- Enhanced Return on Investment through amplified returns for shareholders.

- Competitive Pricing enabled by cost efficiencies.

Risks:

- Magnified Losses during low sales or economic downturns.

- Fixed Cost Burden in challenging economic conditions.

- Vulnerability to Business Cycles impacting overall profitability.

- Limited Flexibility due to high fixed costs.

- Risk of Overproduction leading to excess inventory and reduced profit margins.

Illustrative Example: Suppose a company has fixed operating costs of $500,000, variable costs of $20 per unit, and sells 50,000 units at $50 each. The operating leverage can be calculated as follows:

Operating Income = (50,000 × 50) − (50,000 × 20) − 500,000 = 1,000,000

Now, if sales increase by 10%, the new operating income becomes:

New Operating Income = (55,000 × 50) − (55,000 × 20) − 500,000 = 1,100,000

The percentage change in operating income is (1,100,000 − 1,000,000) / 1,000,000 × 100 = 10, and the percentage change in sales is (55,000 − 50,000) / 50,000 × 100 = 10. Therefore, the operating leverage is 10, indicating a 1-to-1 relationship between the percentage change in sales and the percentage change in operating income.

This example illustrates how operating leverage works and its impact on operating income in response to changes in sales.

2. Financial Leverage:

Financial leverage involves the use of debt to increase the return on equity. It is the ratio of debt to equity in a company’s capital structure. While debt can amplify returns, it also increases the financial risk as interest payments must be made regardless of the company’s profitability. The financial leverage ratio is calculated using the formula:

Financial Leverage = (Percentage Change in Earnings before Interest and Taxes (EBIT) / Percentage Change in Earnings per Share (EPS))

Mechanism: Companies borrow funds to finance their operations, acquisitions, or capital expenditures. The interest on the borrowed funds is a fixed cost that remains constant irrespective of the company’s performance.

EBIT = Revenue − Operating Expenses

Net Income = EBIT − Interest − Taxes

EPS = (Net Income / Number of Outstanding Shares)

Advantages:

- Lower Cost of Capital enhances overall profitability.

- Amplified Return on Equity magnifies returns for shareholders.

- Tax Benefits through deductible interest payments.

- Increased Financial Flexibility with access to debt markets.

- Capital Efficiency by funding projects without diluting ownership.

Risks:

- Financial Distress due to obligations of fixed interest payments.

- Increased Financial Risk with higher debt levels.

- Interest Rate Sensitivity leading to elevated interest expenses.

- Limited Strategic Flexibility with high debt levels.

- Investor Perception cautious due to higher financial risk.

Illustrative Example: Consider a company with a net income of $1,000,000, interest expenses of $200,000, and 100,000 outstanding shares. The EPS without financial leverage is 1,000,000 / 100,000 = 10.

Now, if the company borrows $500,000 at an annual interest rate of 5%, the new interest expense is $25,000 (500,000 × 0.05), and the new net income is $975,000 (1,000,000 − 25,000). The new EPS becomes 975,000 / 100,000 = 9.75.

The percentage change in EPS is (9.75 − 10) / 10 × 100 = − 2.5, and the percentage change in EBIT is (1,000,000 − 975,000) / 1,000,000 × 100 = 2.5. Therefore, the financial leverage is − 2.5, indicating an inverse relationship between the percentage change in EBIT and the percentage change in EPS.

This example demonstrates how financial leverage can impact EPS and the importance of carefully managing the balance between debt and equity.

3. Combined Leverage:

Combined leverage is the integration of both operating leverage and financial leverage, providing a comprehensive view of how changes in sales affect a company’s earnings before interest and taxes (EBIT) and, consequently, its earnings per share (EPS). The combined leverage can be expressed as the product of operating leverage and financial leverage.

Combined Leverage = Operating Leverage × Financial Leverage

Mechanism: The combination of operating leverage and financial leverage illustrates how changes in sales impact both fixed operating costs and interest expenses, influencing a company’s overall profitability. It helps financial managers understand the joint effect of operating and financial decisions on earnings.

Advantages:

- Offers a holistic view of how both operating and financial leverage impact earnings.

- Facilitates better decision-making regarding the optimal mix of fixed costs and financial obligations.

- Provides a complete understanding of the joint effects of operating and financial decisions on profitability.

- Enables dynamic alignment of capital structure with business objectives.

- Assists in evaluating the impact of changes in sales and earnings on overall financial health.

Risks:

- Potential for significant fluctuations in earnings with high levels of combined leverage.

- Requires sophisticated analysis to manage both types of leverage effectively.

- High combined leverage may restrict adaptation to rapidly changing market conditions.

- Company becomes more sensitive to economic downturns or fluctuations.

- Managing the joint impact of operating and financial leverage adds complexity to financial management.

Illustrative Example: Suppose a company has an operating leverage of 2 and a financial leverage of 1.5. The combined leverage is 2 × 1.5 = 3. This implies that for a 1% change in sales, the company’s earnings per share (EPS) will change by 3%.

If the operating income without leverage is $1,000,000, and the percentage change in sales is 5%, the new operating income is

1,000,000 × 1.05 = 1,050,000. The percentage change in operating income is (1,050,000 − 1,000,000) / 1,000,000 × 100 = 5. With a financial leverage of 1.5, the percentage change in EPS would be 5% × 1.5 = 7.5.

This example demonstrates the joint impact of operating and financial leverage on a company’s earnings when both types of leverage are considered.

4. Sale and Leaseback Leverage:

Sale and leaseback leverage involves selling assets and then leasing them back. This strategy allows a company to convert owned assets into leased assets, providing immediate cash inflows while still retaining the use of the assets.

Mechanism: A company sells its assets to a third party and then leases them back under agreed-upon terms. This can be particularly beneficial for companies needing capital for expansion or to pay off debt.

Advantages:

- Generates immediate liquidity by selling assets and leasing them back.

- Allows continued use of essential assets while converting them into leased assets.

- Provides flexibility in using the immediate cash inflows for various strategic purposes.

- Supports ongoing operations without the burden of ownership.

- Enables strategic allocation of capital by unlocking the value of owned assets.

Risks:

- The long-term costs associated with lease payments may exceed the initial cash inflows.

- Company forfeits ownership of critical assets, potentially impacting control.

- The value assigned to the assets in the sale may not align with market conditions.

- Company’s flexibility is contingent on the terms negotiated in the lease agreement.

- Sale and leaseback transactions can impact financial ratios and reporting.

Illustrative Example: Suppose a company owns a manufacturing facility valued at $10 million. It decides to sell the facility and lease it back for an annual payment of $1 million over a 10-year period. The immediate cash inflow from the sale is $10 million.

The advantages include an immediate cash inflow of $10 million, providing liquidity for the company’s strategic initiatives. However, the long-term cost of the leaseback arrangement amounts to $1 million annually for 10 years, totaling $10 million.

5. Capital Leverage:

Capital leverage refers to the use of various types of capital, such as debt, equity, and preferred stock, to optimize a company’s capital structure. The goal is to strike a balance that maximizes returns while minimizing risks.

Mechanism: Companies strategically allocate different types of capital in their capital structure based on factors like cost, risk tolerance, and financial objectives. This mix of capital is crucial in determining the overall leverage of a company.

Advantages:

- Optimization of the cost of capital by strategically balancing debt, equity, and preferred stock.

- Enhanced financial flexibility through diversification of the capital structure.

- Improved ability to fund projects without diluting ownership by utilizing different types of capital.

- Efficient allocation of resources based on risk tolerance, market conditions, and financial objectives.

- Reduced overall financing costs by achieving a balanced and well-managed capital structure.

Risks:

- Increased financial risk associated with inappropriate capital allocation and high debt levels.

- Impact of market conditions and interest rate fluctuations on the cost of capital.

- Complexity in managing diverse forms of capital, requiring careful financial planning.

- Limited flexibility in adjusting the capital structure quickly in response to changing circumstances.

- Investor perception cautious if the chosen capital structure poses higher financial risk.

Illustrative Example: Consider a company deciding on its capital structure, with the following options:

- Option A: $5 million in debt at 4% interest, $5 million in equity.

- Option B: $7.5 million in equity, $2.5 million in preferred stock with a 6% dividend, and no debt.

Option A may result in lower overall financing costs due to the tax deductibility of interest payments, but it introduces financial risk. Option B offers financial flexibility but may have a higher cost of equity.

6. Dynamic Leverage:

Dynamic leverage involves adjusting a company’s capital structure in response to changes in market conditions, industry trends, or the company’s financial performance. This adaptability allows the company to optimize its leverage based on the prevailing circumstances.

Mechanism: Companies actively monitor market conditions and adjust their capital structure by issuing or repurchasing shares, raising or paying down debt, and making strategic financial decisions to respond to changing circumstances.

Advantages:

- Improved responsiveness to changing market conditions through proactive adjustments to the capital structure.

- Enhanced financial performance by aligning the capital structure dynamically with evolving business needs.

- Strategic decision-making agility in capital restructuring based on real-time market dynamics.

- Minimized impact of economic fluctuations through timely adjustments to optimize leverage.

- Adaptive financial management to capitalize on opportunities and mitigate risks swiftly.

Risks:

- Complexity in monitoring and interpreting real-time market conditions for effective dynamic adjustments.

- Transaction costs associated with restructuring the capital may impact short-term financial performance.

- Potential challenges in accurately predicting and responding to rapidly changing economic scenarios.

- Risk of suboptimal decisions if there is a delay or miscalculation in adjusting the capital structure.

- Balancing short-term gains with long-term stability requires strategic acumen and vigilant oversight.

Illustrative Example: Consider a company facing an economic downturn. Dynamic leverage allows the company to respond by repurchasing some of its shares, reducing equity and potentially lowering the overall cost of capital. This strategic move could improve financial performance during challenging economic conditions.

7. Degree of Leverage:

The degree of leverage is a metric that measures the sensitivity of a company’s earnings per share (EPS) to changes in its earnings before interest and taxes (EBIT). It quantifies the impact of operating and financial leverage on a company’s profitability and risk, helping investors and financial analysts assess the potential impact of changes in operating performance.

Mechanism:

Degree of Leverage= (Percentage Change in EBIT / Percentage Change in EPS)

The degree of leverage formula calculates the ratio of the percentage change in EPS to the percentage change in EBIT. A higher degree of leverage indicates a greater sensitivity of EPS to changes in operating performance.

Advantages:

- Provides insights into how changes in operating performance affect a company’s profitability.

- Assists in assessing the level of risk associated with a company’s capital structure and operational decisions.

- Quantifies the impact of operating and financial leverage on a company’s overall financial risk and return.

- Enhances risk management strategies by understanding the sensitivity of earnings to changes in operating income.

- Facilitates informed decision-making regarding the appropriate balance of operating and financial leverage.

Risks:

- High degree of leverage indicates greater sensitivity to economic fluctuations, exposing the company to increased risk.

- Requires sophisticated financial analysis to accurately calculate and interpret the degree of leverage.

- Investor perception may be cautious if the company has a high degree of leverage due to increased financial risk.

- The company becomes more vulnerable to economic downturns or fluctuations with a higher degree of leverage.

- Managing a high degree of leverage requires careful consideration of both short-term and long-term financial implications.

Illustrative Example: Suppose a company with a degree of leverage of 2 experiences a 10% increase in EBIT. According to the formula, the expected percentage change in EPS would be 2 × 10. This means that for every 1% change in EBIT, the EPS is expected to change by 2%.

In conclusion, leverage is a multifaceted concept in financial management, encompassing various types that impact a company’s profitability, risk exposure, and overall financial health. Operating leverage, financial leverage, combined leverage, sale and leaseback leverage, capital leverage, dynamic leverage, and the degree of leverage are all integral components of a company’s financial strategy. Striking the right balance between risk and return is crucial for leveraging to contribute positively to a company’s success. Financial managers must carefully consider the advantages and risks associated with each type of leverage, making informed decisions to optimize the company’s capital structure and maximize shareholder value.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College