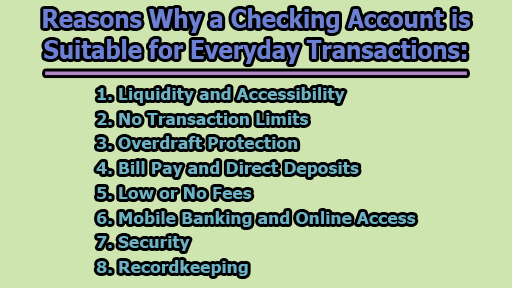

Reasons Why a Checking Account is Suitable for Everyday Transactions:

For everyday transactions, a checking account is generally considered the best option. Checking accounts are designed to facilitate frequent and regular transactions, providing easy access to your funds. Here are some reasons why a checking account is suitable for everyday transactions:

1. Liquidity and Accessibility: A checking account is highly liquid, meaning you can easily access your funds whenever you need them. This liquidity is essential for day-to-day transactions, allowing you to make purchases, pay bills, and cover various expenses promptly.

The accessibility of funds is facilitated through methods such as checkbooks, debit cards, and online banking. Debit cards linked to checking accounts are widely accepted, providing a convenient way to make in-person and online transactions. Additionally, ATMs allow easy cash withdrawals, adding to the overall accessibility.

2. No Transaction Limits: Checking accounts typically do not impose limits on the number of transactions you can perform within a specific timeframe. This lack of restrictions is especially advantageous for individuals who engage in numerous financial activities regularly.

Whether you are making payments, transferring funds, or depositing money, a checking account allows you to carry out an unlimited number of transactions without incurring additional charges or facing restrictions.

3. Overdraft Protection: Overdraft protection is a valuable feature offered by many checking accounts. It acts as a safety net, preventing declined transactions in cases where your account balance goes below zero.

When you have overdraft protection, the bank may cover the shortfall, sparing you from potential fees and ensuring that your transactions go through smoothly. However, it’s important to be aware of any associated fees or interest charges related to overdraft protection.

4. Bill Pay and Direct Deposits: Checking accounts often come equipped with features like online bill pay, allowing you to easily schedule and make payments for recurring expenses such as rent, utilities, and subscriptions.

Direct deposit is another convenient feature of checking accounts. It enables your employer or other income sources to deposit funds directly into your account, ensuring timely and secure access to your earnings. This feature not only streamlines the process but also eliminates the need for physical checks, reducing the risk of loss or theft.

5. Low or No Fees: Many checking accounts offer low or no monthly maintenance fees, especially if you meet certain criteria such as maintaining a minimum balance or setting up direct deposits. It’s crucial to choose an account that aligns with your financial habits to minimize fees and maximize the value of your everyday transactions.

6. Mobile Banking and Online Access: Modern checking accounts provide convenient mobile banking apps and online access, allowing you to manage your finances from your smartphone, tablet, or computer. This accessibility enables you to check your account balance, review transactions, transfer funds, and even deposit checks remotely. The convenience of banking at your fingertips enhances the overall efficiency of everyday transactions.

7. Security: Checking accounts typically come with robust security features to safeguard your funds. These may include two-factor authentication, account monitoring for unusual activity, and notification alerts for transactions or changes to your account. The focus on security helps protect you from fraud and unauthorized access, ensuring that your everyday transactions are conducted in a secure environment.

8. Recordkeeping: Checking accounts offer detailed statements and transaction histories, providing a comprehensive record of your financial activities. This recordkeeping is valuable for budgeting, tracking expenses, and analyzing your spending patterns. With easy access to statements online or through mobile apps, you can quickly review your transactions and stay informed about your financial health.

When selecting a checking account for everyday transactions, it’s essential to consider above factors collectively. Look for an account that not only meets your immediate transactional needs but also aligns with your long-term financial goals. Additionally, be mindful of any terms and conditions, fees, and additional features offered by different banks to make an informed decision that suits your preferences and lifestyle.

Frequently Asked Questions (FAQs):

What is a checking account?

A checking account is a type of bank account that is designed for everyday transactions. It allows account holders to deposit and withdraw money, make purchases, pay bills, and transfer funds. Checking accounts typically come with features such as debit cards and checkbooks.

How is a checking account different from a savings account?

While both checking and savings accounts are types of bank accounts, they serve different purposes. A checking account is primarily used for everyday transactions, offering easy access to funds, whereas a savings account is designed for saving money over time and often accrues interest. Savings accounts may have limitations on the number of withdrawals allowed per month.

What fees are associated with checking accounts?

Fees associated with checking accounts may include monthly maintenance fees, overdraft fees, ATM fees, and transaction fees. However, many banks offer fee-free checking accounts or provide ways to waive fees by maintaining a minimum balance or setting up direct deposits.

How can I avoid overdraft fees?

To avoid overdraft fees, you can opt for overdraft protection, monitor your account balance regularly, and set up alerts for low balances. Some banks also offer features like email or text notifications to alert you when your balance is running low, giving you the opportunity to transfer funds and avoid overdrawing your account.

What is overdraft protection?

Overdraft protection is a service offered by banks to help prevent declined transactions when an account balance goes below zero. It may involve linking a savings account, credit card, or line of credit to your checking account. If a transaction would overdraw your account, funds are transferred from the linked account to cover the shortfall, often avoiding overdraft fees.

Can I access my checking account online?

Yes, most banks offer online banking services, allowing you to access and manage your checking account through a secure website or mobile app. Online banking provides features such as checking your account balance, reviewing transactions, transferring funds, and even depositing checks remotely.

What is mobile banking, and how does it work?

Mobile banking refers to the use of a mobile device, such as a smartphone or tablet, to access banking services. Mobile banking apps provided by banks allow users to perform various transactions, including checking balances, transferring funds, paying bills, and depositing checks by taking photos.

How can I choose the right checking account for me?

When choosing a checking account, consider factors such as fees, interest rates (if applicable), accessibility, online and mobile banking features, and additional perks offered by the bank. Assess your financial habits to find an account that aligns with your needs and helps you manage your everyday transactions effectively.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College