Role of International Financial Institutions in Global Financial Stability:

International Financial Institutions (IFIs) play a crucial role in maintaining and enhancing global financial stability. In a world where economic interdependence is the norm, the stability of financial systems across countries is essential to foster sustainable economic growth. IFIs, such as the International Monetary Fund (IMF), World Bank, and regional development banks, contribute significantly to achieving this objective. In the rest of this article, we will explore the multifaceted role of International Financial Institutions in global financial stability.

1. Financial Surveillance and Monitoring: One of the primary functions of IFIs is to monitor and assess the global economic and financial landscape. The IMF, for instance, conducts regular surveillance of its member countries’ economic and financial policies. Through reports like the World Economic Outlook, the IMF provides in-depth analyses of global economic trends, risks, and potential vulnerabilities. This monitoring allows IFIs to detect emerging issues and risks that could threaten the stability of the international financial system.

2. Crisis Prevention and Early Warning: IFIs play a crucial role in preventing financial crises by providing early warnings and policy advice. Through their surveillance activities, these institutions identify imbalances and potential vulnerabilities in member countries’ economies. By issuing recommendations and policy prescriptions, IFIs help countries address these issues before they escalate into full-blown financial crises. The IMF’s Article IV consultations, for example, provide a platform for member countries to discuss their economic policies and receive expert advice on how to mitigate risks.

3. Financial Assistance and Crisis Management: In times of economic or financial crises, IFIs serve as lenders of last resort, offering financial assistance to countries facing balance of payments problems. The IMF, with its financial resources, provides short- to medium-term financial support to member countries, helping them stabilize their economies and restore confidence in financial markets. The conditionalities attached to these financial assistance packages often include structural reforms aimed at addressing the root causes of the crisis and ensuring long-term stability.

4. Capacity Building and Technical Assistance: IFIs contribute to global financial stability by enhancing the capacity of member countries to design and implement effective economic policies. The World Bank, for instance, focuses on providing technical assistance, knowledge sharing, and capacity-building programs. By improving the institutional and policy frameworks in member countries, IFIs contribute to building resilience against external shocks and promoting sustained economic development.

5. Coordination and Cooperation: Global financial stability requires coordinated efforts among countries and international organizations. IFIs serve as platforms for cooperation, bringing together policymakers, central banks, and other stakeholders to address common challenges. The G20, with the involvement of the IMF and World Bank, has become a key forum for coordinating global economic policies. This collaboration helps align monetary, fiscal, and structural policies to foster stability and sustainable growth on a global scale.

6. Debt Sustainability and Restructuring: Addressing issues related to sovereign debt is crucial for financial stability. IFIs play a role in promoting debt sustainability by providing guidelines for responsible borrowing and lending. In cases of debt distress, the IMF can assist in negotiating debt restructuring agreements that balance the interests of debtor countries and creditors. This helps prevent systemic risks associated with widespread sovereign default, contributing to overall financial stability.

7. Global Regulatory Standards: IFIs contribute to financial stability by promoting the development and adoption of global regulatory standards. Institutions like the Financial Stability Board (FSB), closely associated with the G20, work to enhance the resilience of the global financial system by setting and monitoring international financial regulations. Through these efforts, IFIs contribute to creating a level playing field, reducing the risk of regulatory arbitrage, and ensuring that financial institutions operate under consistent and robust frameworks.

8. Addressing Global Challenges: IFIs also play a crucial role in addressing global challenges that have implications for financial stability. Issues such as climate change, pandemics, and income inequality can have profound effects on economic and financial systems. IFIs are increasingly recognizing the importance of integrating these challenges into their policy frameworks, supporting member countries in building resilience to such systemic risks.

9. Exchange Rate Stability: IFIs contribute to exchange rate stability by providing guidance on exchange rate policies and interventions. Through their surveillance activities, particularly in the context of the IMF, IFIs help countries avoid competitive devaluations and promote exchange rate regimes that contribute to global economic stability.

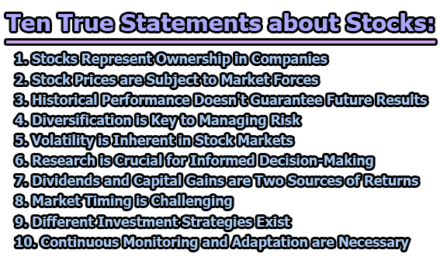

10. Research and Policy Analysis: IFIs engage in extensive research and policy analysis, producing reports and publications that contribute to a better understanding of global economic and financial trends. This research helps policymakers make informed decisions, fosters transparency, and facilitates the dissemination of best practices in economic and financial management.

11. Financial Inclusion and Development: IFIs support initiatives aimed at promoting financial inclusion and development. By providing funding for projects that enhance access to financial services, infrastructure development, and poverty reduction, IFIs contribute to creating more stable and inclusive economies, reducing the risk of social unrest and instability.

12. Surveillance of Non-Banking Financial Institutions: In addition to monitoring traditional banking systems, IFIs increasingly focus on non-banking financial institutions, such as shadow banks. This extended surveillance helps identify potential risks and vulnerabilities in the broader financial system, ensuring a comprehensive approach to maintaining stability.

13. Technology and Innovation: IFIs play a role in addressing challenges and opportunities arising from financial technology and innovation. By providing guidance on regulatory frameworks and supporting countries in adopting technological advancements, IFIs contribute to a stable financial environment that embraces innovation without compromising security and integrity.

14. Strengthening Financial Regulations: IFIs work towards strengthening financial regulations globally. This includes efforts to enhance the resilience of financial institutions, improve risk management practices, and ensure the effectiveness of regulatory frameworks. These measures contribute to reducing the likelihood of financial crises and systemic failures.

15. Preventing Illicit Financial Flows: IFIs contribute to the prevention of illicit financial flows, such as money laundering and corruption. Through anti-money laundering initiatives and support for transparent financial systems, IFIs help create an environment where financial resources are used for legitimate economic activities, contributing to stability and sustainable development.

16. Social Protection Programs: IFIs often support social protection programs that provide a safety net for vulnerable populations during economic downturns. These programs contribute to social stability by mitigating the impact of economic shocks on the most disadvantaged, reducing the potential for social unrest and political instability.

17. Promoting Sustainable Finance: IFIs actively promote sustainable finance by encouraging responsible investment and financing practices. By integrating environmental, social, and governance (ESG) criteria into their operations, IFIs contribute to building a financial system that is not only stable but also environmentally and socially sustainable in the long term.

18. Regional Financial Stability Initiatives: Regional development banks and other IFIs play a critical role in addressing regional financial challenges. By providing tailored solutions to specific regional issues, these institutions contribute to overall global financial stability, recognizing the interconnectedness of economies and financial systems.

In conclusion, the role of IFIs in ensuring global financial stability extends across a broad spectrum of activities, ranging from macroeconomic surveillance to targeted interventions and support for sustainable development. As the global economic landscape continues to evolve, the adaptability and effectiveness of IFIs in addressing emerging challenges will remain pivotal to fostering stability and resilience in the international financial system.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College