Technical Analysis

Technical analysis is an evaluation process used in the financial industry to predict the future price movement of an asset based on an analysis of past price movements. Technical analysis carefully examines securities’ trading activity in an attempt to spot market trends such as price movement patterns, trade signals, and volume variations. Any security that offers historical trading data stocks, futures, commodities, fixed-income, currencies, and other securities can be subjected to technical analysis. However, it is significant to note that technical analysis immensely differs from fundamental analysis, which is more focused on the evaluation of the intrinsic value of securities. In this article, we are going to know about Technical Analysis Indicators.

Definition of Technical Analysis in Finance:

In finance, technical analysis is an analysis methodology for analyzing and forecasting the direction of prices through the study of past market data, primarily price and volume (Wikipedia).

Technical analysis is a tool or method, used to predict the probable future price movement of a security – such as a stock or currency pair – based on market data (Corporate Finance Institute – CFI).

Technical analysis is a means of examining and predicting price movements in the financial markets, by using historical price charts and market statistics (Glossary Trading Terms – IG).

Technical analysis may be less about predicting specific price movements and more about anticipating a range of possible outcomes based on historical price behavior (Britannica Money).

Technical Analysis Indicators:

Technical analysis indicators are mathematical calculations, which are plotted as lines on a price chart and may help traders identify certain signals and trends within the market. In general, technical analysts look at the following broad types of indicators:

1. Trend Indicators:

It includes the following indicators; Simple Moving Average (SMA), Exponential Moving Average (EMA), Moving Average Convergence/Divergence (MACD), and Average Directional Movement Index (ADX) which are briefly being:

Simple Moving Average (SMA): This is the easiest moving average to construct. It is calculated as the average price over the specified period. The average is called “moving” because it is plotted on the chart bar by bar, forming a line that moves along the chart as the average value changes.

How does It work?

Determine trend direction:

- If the SMA is positively sloping, the trend is up.

- If the SMA is negatively sloping, the trend is down.

Determine trend duration:

- 200-bar SMAs are common proxies for long-term trends.

- 50-bar SMAs are typically used to gauge intermediate trends.

- Shorter-period SMAs can be used to determine short-term trends.

Determine trading signals via price crosses:

- When prices cross above the SMA, you may want to go long or cover short.

- When prices cross below the SMA, you may want to go short or exit long.

Using moving average crossovers to generate trading signals: When a more sensitive (faster) SMA crosses above a less sensitive (slower) SMA from below, it is considered bullish.

When a more sensitive (faster) SMA crosses below a less sensitive (slower) SMA from above, it is considered bearish.

Exponential Moving Average (EMA): The EMA measures trend direction over a period of time. It applies more weight to data that is more current. Because of its unique calculation, EMA will follow prices more closely than a corresponding SMA.

Technical Analysis Indicators, Technical Analysis Indicators, Technical Analysis Indicators, Technical Analysis Indicators

How does It work?

Identify trends earlier: Use the same rules that apply to SMAs when interpreting EMAs. Keep in mind that EMAs are generally more sensitive to nearer-term price movement.

Determine trend direction: When the EMA rises, you may want to consider buying when prices dip near or just below the EMA. When the EMA falls, you may consider selling when prices rally toward or just above the EMA.

Indicate support and resistance areas: A rising EMA tends to support the price action, while a falling EMA tends to provide resistance to price action.

Both the EMA and the SMA here represent 30 days.

EMA reacts faster to the first pullback and the subsequent rally.

Moving Average Convergence/Divergence (MACD): MACD is a momentum oscillator primarily used to trade trends.

How does It work?

Determine bullish or bearish:

- MACD crossing above the zero line is considered bullish while crossing below the zero line is bearish. When MACD turns up from below the zero line, it is considered bullish. When it turns down from above the zero line, it is considered bearish.

- When the MACD line crosses from below to above the signal line, the indicator is considered bullish. The further below the zero line this cross occurs, the stronger the signal.

- When the MACD line crosses from above to below the signal line, the indicator is considered bearish. The further above the zero line this cross occurs, the stronger the signal.

Following the figure we see; A. Bullish, B. Bullish, C. Bearish, and D. Bearish.

Average Directional Movement Index (ADX): ADX can be used to help measure the overall strength of a trend.

How does It work?

Measure the strength of the trend:

- A strong trend is present when ADX is above 25; no trend is present when ADX is below 20.

- If the ADX is declining, it could indicate that the current trend is weakening.

- If the ADX is rising, it could indicate a strengthening trend.

- The ADX indicator incorporates two different components in its construction which are commonly plotted along with the ADX.

‐ Positive Directional Indicator (+DMI) shows the difference between today’s high price and yesterday’s high price. These values are then added up from the past 14 periods and then plotted.

‐ Negative Directional Indicator (–DMI) shows the difference between today’s low price and yesterday’s low price. These values are then summed up from the past 14 periods and plotted.

ADX is less than 25 on the left side of the chart.

+DM is greater than -DMI throughout the uptrend, though this is not a requirement.

ADX has fallen below 25 on the right side of the chart and -DM has crossed up above +DM.

Remember that ADX shows trend show trend strength – not direction.

2. Momentum Indicators:

It includes; Stochastic Oscillator, Relative Strength Index (RSI); which are briefly being:

Overbought/Oversold in Oscillators:

- In bounded indicators, also called “oscillators,” a limit exists as to how high or low they can reach.

- When the oscillator reaches a zone close to its highest bound, it is called “overbought.”

- When it reaches a zone close to its lowest bound, it is called “oversold.”

- An oscillator value in these zones indicates that the market is vulnerable to reversal. A signal often occurs when the oscillator exits one of these zones.

- In some cases, the reaching of extreme levels indicates that a new trend has begun. In these instances, the oscillator will remain in a zone for the period of the trend and will give many false signals on corrections to the trend.

- The interpretation of oscillator oversold and overbought is thus dependent on the underlying trend.

- They don’t work when a trend is strong but excel in trading range markets.

Stochastic Oscillator: The Stochastic Oscillator is a momentum indicator that shows the location of the close relative to the high-low range over a set number of periods. The indicator can range from 0 to 100. Stochastic Oscillators are most effective in broad trading ranges or slow-moving trends.

How does It work?

Determine exit and entry:

- Generally, the area above 80 indicates an overbought region, while the area below 20 is considered an oversold region.

- A sell signal is given when the oscillator is above the 80 levels and then crosses back below 80. Conversely, a buy signal is given when the oscillator is below 20 and then crosses back above 20.

- A crossover signal occurs when the two lines cross in the overbought or oversold region.

- Divergences form when a new high or low in price is not confirmed by the Stochastic Oscillator.

This example is using a Slow Stochastic; note the effectiveness of the signals during the sideways trend.

Divergences between price and oscillators can also generate signals.

Relative Strength Index (RSI): RSI measures the speed and change of price movements.

How does It work?

Determine the speed and change of price:

- The RSI oscillates from zero and 100. Traditionally, the RSI is considered overbought when above 70 and oversold when below 30.

- In an uptrend or bull market, the RSI tends to remain in the 40-90 range with the 40-50 zone acting as support.

- During a downtrend or bear market, the RSI tends to stay in the 10-60 range with the 50-60 zone acting as resistance.

- If underlying prices make a new high or low that isn’t confirmed by the RSI, this divergence can signal a price reversal.

Overbought and oversold signals on the chart indicate price movement in the short term.

3. Volume Indicators:

It includes; On Balance Volume (OBV), Money Flow Index (MFI), and Accumulation/Distribution; which are briefly being;

General Rules of Volume Theory:

- Increasing volume reinforces the trend direction.

- Declining volume diminishes the trend direction.

- A price peak or trough on ultrahigh volume is often an important reversal point in a trend.

- Volume indicators should be considered warnings but not signals of change in trend direction.

On Balance Volume (OBV): OBV measures buying and selling pressure as a cumulative indicator that adds volume on up days and subtracts volume on down days.

How does It work?

- The actual value of the OBV is unimportant; concentrate on its direction.

- When the price continues to make higher peaks and OBV fails to make higher peaks, the upward trend is likely to stall or fail. This is called a negative divergence.

- When the price continues to make lower troughs and OBV fails to make lower troughs, the downward trend is likely to stall or fail. This is called a positive divergence.

Bearish divergence: OBV is not confirming the higher peaks in price, which preceded the selloff.

Money Flow Index (MFI): MFI is a volume indicator that measures the flow of money into and out of a security over a specified period of time. It is related to the Relative Strength Index (RSI) but incorporates volume, whereas the RSI only considers the price.

How does It work?

- Oversold levels typically occur below 20 and overbought levels typically occur above 80. These levels may change depending on market conditions.

- Oversold or overbought levels are generally not reason enough to buy or sell and traders should consider additional technical analysis or research to confirm the security’s turning point.

- If the underlying price makes a new high or low that isn’t confirmed by the MFI, this divergence can signal a price reversal.

Bearish divergence: Price peak not confirmed by MFI.

Bullish divergence: Price trough is not confirmed by MFI.

Accumulation/ Distribution: Accumulation/Distribution looks at the proximity of closing prices to their highs and lows to determine if accumulation or distribution is occurring in the market.

How does It work?

Determine the direction of a trend:

- When both price and Accumulation/Distribution are making higher peaks and higher troughs, the uptrend is likely to continue.

- When both price and Accumulation/Distribution are making lower peaks and lower troughs, the downtrend is likely to continue.

- When the price continues to make higher peaks but Accumulation/Distribution fails to make a higher peak, the uptrend is likely to stall or fail. This is known as a negative divergence.

- When the price continues to make lower troughs and Accumulation/Distribution fails to make lower troughs, the downtrend is likely to stall or fail. This is known as a positive divergence.

The negative divergence between price and Accumulation Distribution.

4. Volatility Indicators:

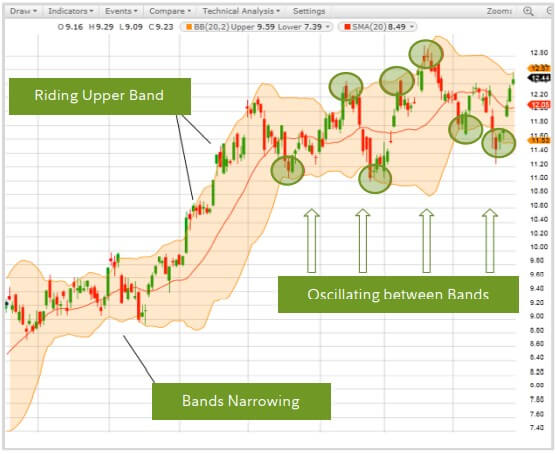

It includes; Bollinger Bands, and Average True Range (ATR); which are briefly being:

Bollinger Bands: Bollinger Bands are a type of price envelope plotted at a standard deviation level above and below a Simple Moving Average of the price. Bollinger Bands help determine whether prices are high or low on a relative basis.

How does It work?

Determine relative price:

- When the bands tighten during a period of low volatility, it raises the likelihood of a sharp price move in either direction.

- When the bands are separated by an unusually large amount, volatility increases, and any existing trend may be ending.

- Use swings within the band’s envelopes to help identify potential profit targets.

Following the figure, we see how to work Riding Upper Band, Oscillating between Bands, and Bands Narrowing.

Average True Range (ATR): ATR is the average of true ranges over a specified period. ATR measures volatility, taking into account any gaps in the price movement.

How does It work?

Determine market volatility:

- An expanding ATR indicates increased volatility, whether that’s selling or buying pressure.

- A low ATR value indicates decreased volatility, a series of periods with small ranges.

- ATR is useful for stops or entry triggers, signaling changes in volatility.

Periods of increased volatility are clearly identified by ATR.

5. Support and Resistance Indicators:

Fibonacci Retracements: Plot percentage retracement lines based on the mathematical relationship within the Fibonacci sequence. These retracement levels provide support and resistance levels that can be used to target price objectives.

How does It work?

Provide support and resistance levels:

- Applying these percentages to the difference between the high and low prices for the period selected creates a set of price objectives.

- Depending on the direction of the market, up or down, prices will often retrace a significant portion of the previous trend before resuming the move in the original direction.

These countertrend moves tend to fall into certain parameters, which are often the Fibonacci Retracement levels.

Here, we have drawn a down-sloping Fibonacci Retracement line from the absolute peak to the absolute trough to determine the levels of resistance we may meet.

In this example, the first major correction occurred at 61.8% retracement.

In this example, we have drawn a Fibonacci Retracement line from the trough to the peak of the price move for which we’re trying to determine retracement levels.

In this instance, we found support at 38.2% retracement.

Finally, we can say that Technical Analysis focuses on market action – specifically, volume and price. Technical analysis is only one approach to analyzing stocks. When considering which stocks to buy or sell, you should use the approach that you’re most comfortable with. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. Past performance is no guarantee of future results.

References:

- Technical Analysis Financial Markets: a Comprehensive Guide to Trading Methods and Applications Written by John J. Murphy

- https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/learning-center/Understanding-Indicators-TA.pdf

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College