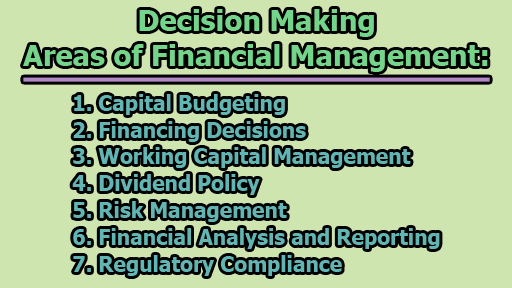

Decision Making Areas of Financial Management:

Financial management is an essential function within any organization, encompassing a myriad of decisions that can significantly impact its success and sustainability. Efficient financial management involves a careful examination of various decision-making areas to ensure the optimal allocation and utilization of resources. In this article, we will delve into the key decision making areas of financial management.

1. Capital Budgeting: Capital budgeting is the process of evaluating and selecting long-term investment projects that align with the organization’s strategic goals. This decision-making area involves assessing the potential returns and risks associated with capital expenditures, such as the purchase of new machinery, expansion of facilities, or the launch of new products. Techniques like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period are commonly employed to make informed investment decisions. Organizations must strike a balance between maximizing returns and managing risk to ensure sustainable growth.

2. Financing Decisions: Financing decisions revolve around determining the optimal mix of debt and equity to fund the organization’s operations and growth initiatives. The capital structure, which represents the proportion of debt and equity in a company, plays a crucial role in shaping the financial risk and cost of capital. Financial managers must weigh the advantages and disadvantages of various financing options, considering factors such as interest rates, maturity periods, and the impact on the company’s creditworthiness. Striking the right balance in financing decisions is essential to maintain financial flexibility and minimize the cost of capital.

3. Working Capital Management: Effective working capital management is vital for maintaining the day-to-day operations of a business. It involves decisions related to managing current assets (e.g., cash, accounts receivable, and inventory) and current liabilities (e.g., accounts payable). Striking the right balance between these components ensures liquidity, allowing the organization to meet its short-term obligations while optimizing operational efficiency. Financial managers must make informed choices regarding inventory levels, credit policies, and cash flow management to prevent inefficiencies and enhance the overall financial health of the organization.

4. Dividend Policy: Dividend policy decisions involve determining the portion of profits to be distributed to shareholders as dividends and the amount to be retained for reinvestment in the business. Financial managers must assess the organization’s financial performance, growth prospects, and shareholder expectations when formulating dividend policies. Factors such as tax implications, capital requirements, and the cost of external financing also influence these decisions. Striking a balance between rewarding shareholders and retaining earnings for future growth is crucial for sustaining investor confidence and long-term value creation.

5. Risk Management: Financial risk management is a multifaceted decision-making area that involves identifying, assessing, and mitigating risks that could impact the organization’s financial stability. This includes market risks (e.g., interest rate risk, currency risk), credit risks, operational risks, and liquidity risks. Implementing risk management strategies such as hedging, insurance, and diversification helps organizations navigate uncertainties and safeguard against potential financial losses. Decision-making in risk management requires a thorough understanding of the risk landscape and a proactive approach to mitigate potential threats.

6. Financial Analysis and Reporting: Financial analysis and reporting are fundamental to decision-making in financial management. This involves interpreting financial statements, ratios, and other performance indicators to assess the organization’s financial health. Financial managers must communicate these findings to key stakeholders, including investors, creditors, and internal decision-makers. Timely and accurate financial reporting facilitates informed decision-making by providing insights into profitability, liquidity, solvency, and efficiency. Additionally, financial analysis helps identify trends and areas for improvement, guiding strategic decisions to enhance overall financial performance.

7. Regulatory Compliance: Adhering to regulatory requirements is a vital aspect of financial management decision-making. Financial managers must stay abreast of local and international regulations, accounting standards, and tax laws that impact their operations. Compliance decisions involve ensuring accurate financial reporting, transparency, and adherence to ethical practices. Failure to comply with regulations can lead to legal consequences, reputational damage, and financial penalties. Therefore, decision-making in this area is focused on establishing robust internal controls, monitoring changes in regulations, and implementing necessary adjustments to maintain compliance.

In conclusion, financial management encompasses a diverse range of decision-making areas that collectively shape an organization’s financial trajectory. From capital budgeting to regulatory compliance, each decision requires careful consideration and strategic thinking. Financial managers play a pivotal role in steering organizations through the complexities of the financial landscape, balancing risk and reward to achieve sustainable growth and long-term success. As the business environment continues to evolve, staying agile and making well-informed decisions in these key areas becomes even more crucial for organizations seeking to thrive in an ever-changing economic landscape.

Library Lecturer at Nurul Amin Degree College