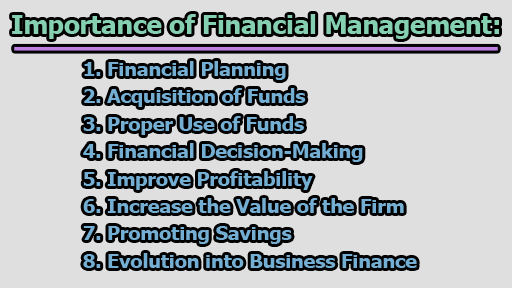

Importance of Financial Management:

Financial management stands as the beating heart of any business concern, orchestrating a symphony of financial decisions that shape the destiny of enterprises. At its core, financial management encompasses various facets, from financial planning and acquisition of funds to the proper use of resources, sound financial decision-making, and the pursuit of increased profitability and wealth. In this article, we are going to know about the importance of financial management, dissecting its role in financial planning, fund acquisition, resource allocation, decision-making, and its profound impact on the profitability and value of a firm.

1. Financial Planning (The Blueprint for Success): At the helm of financial management is the crucial task of determining the financial requirements of a business concern, laying the groundwork for robust financial planning. Financial planning, an integral part of business strategy, serves as the blueprint for the enterprise’s future. It involves forecasting financial needs, identifying potential sources of funds, and aligning financial resources with the overarching goals of the business.

2. Acquisition of Funds (Ensuring Financial Viability): Financial management takes center stage in the acquisition of necessary funds for a business. This process involves a meticulous exploration of potential sources of finance at the minimum cost. Whether through equity, debt, or a combination of both, the financial manager plays a pivotal role in ensuring the availability of funds crucial for the operational vitality of the business.

3. Proper Use of Funds (Enhancing Operational Efficiency): The proper use and allocation of funds are keystones to enhancing the operational efficiency of a business concern. When funds are judiciously utilized, the cost of capital can be reduced, and the overall value of the firm is increased. Financial management, therefore, becomes a strategic tool for resource optimization and efficiency improvement.

4. Financial Decision-Making (Navigating Business Dynamics): Financial management is the compass that guides sound financial decision-making within a business concern. These decisions resonate across the entire organizational landscape, establishing a direct relationship with various departments such as marketing, production, and personnel. The financial manager, acting as a navigator, ensures that financial decisions align with broader business objectives.

5. Improve Profitability (Sailing Towards Prosperity): Profitability, the lifeblood of any business, hinges on the effective and proper utilization of funds. Financial management introduces robust control devices such as budgetary control, ratio analysis, and cost-volume-profit analysis to fine-tune the financial machinery. By optimizing these controls, financial management becomes a catalyst for improving the profitability position of the business concern.

6. Increase the Value of the Firm (Maximizing Wealth): Financial management plays a pivotal role in the realm of increasing the wealth of investors and the business concern itself. The ultimate aim of any business concern is to achieve maximum profit, and higher profitability becomes the pathway to maximizing the wealth of both investors and the nation at large. Through effective financial management, the business concern seeks to ascend the ladder of prosperity, creating a win-win scenario for all stakeholders.

7. Promoting Savings (Mobilizing Resources): Savings become a tangible outcome of effective financial management. When a business concern earns higher profitability and maximizes wealth, it not only secures its own financial well-being but also promotes and mobilizes individual and corporate savings. This positive cycle strengthens the financial fabric of the business and contributes to the broader economic ecosystem.

8. Evolution into Business Finance (The Modern Facet): In contemporary contexts, financial management is colloquially known as business finance or corporate finance. This evolution underscores the dynamic nature of financial management, adapting to the ever-changing landscape of business practices. Recognizing its pivotal role, the corporate sector operates with an understanding that effective financial management is indispensable for sustainable growth and success.

In conclusion, the importance of financial management is akin to the core of a successful business. It serves as the strategic architect, paving the way for financial planning, fund acquisition, and resource optimization. Through sound financial decision-making, it not only enhances profitability and the value of the firm but also contributes to the broader economic landscape by promoting savings. In the modern business lexicon, financial management is the linchpin, steering enterprises toward resilience and sustained growth. Its significance is clear: it’s not just about managing funds but sculpting the success and prosperity of businesses and the communities they impact.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College