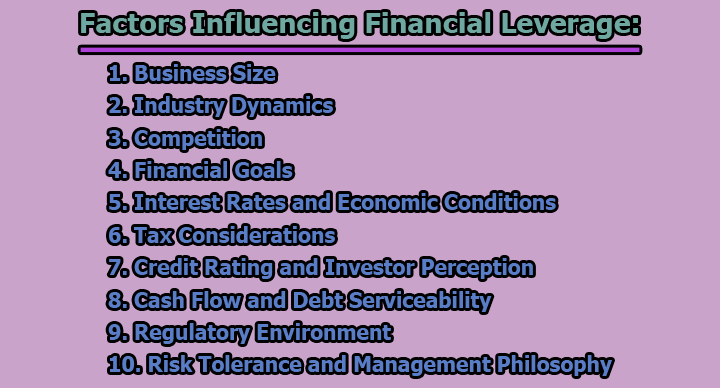

Factors Influencing Financial Leverage:

Financial leverage refers to the use of various financial instruments or borrowed capital to increase the potential return on investment. It involves using debt to finance a portion of a firm’s assets, with the aim of magnifying returns for shareholders. While financial leverage can enhance returns, it also introduces additional risks. Several factors influence a company’s decision to employ financial leverage, and understanding these factors is crucial for effective financial management. In this article, we will explore some of the necessary factors influencing financial leverage, including business size, industry dynamics, competition, financial goals, and additional considerations.

1. Business Size: The size of a business is a fundamental factor influencing financial leverage decisions. Larger corporations often have access to a broader range of financing options due to their scale and established creditworthiness. These companies can negotiate better terms with lenders, including lower interest rates and more favorable repayment terms. Additionally, large businesses may have a more diversified revenue stream, which can provide stability in meeting debt obligations even during economic downturns.

On the other hand, smaller businesses may find it challenging to access debt capital on favorable terms. Lenders might perceive smaller businesses as riskier and may require higher interest rates to compensate for the perceived risk. Smaller enterprises also tend to have more limited resources, making it essential for them to carefully assess the level of financial leverage they can comfortably manage without jeopardizing their financial stability.

2. Industry Dynamics: The industry in which a company operates has a significant impact on its financial leverage decisions. Certain industries, such as capital-intensive ones like manufacturing and infrastructure development, often require substantial upfront investments in machinery, equipment, and facilities. Companies in these industries may choose to use financial leverage to spread the cost of these investments over time, allowing them to benefit from the income generated by these assets while repaying the debt.

Conversely, industries that are less capital-intensive may not need to rely heavily on debt financing. Technology or service-oriented companies, for example, may have lower initial capital requirements and may prefer equity financing or retained earnings over debt to avoid the financial risks associated with high leverage.

3. Competition: The competitive landscape plays a crucial role in determining a company’s financial leverage strategy. In industries with intense competition, companies may use financial leverage to gain a competitive advantage by investing in new technologies, expanding production capacity, or undertaking strategic acquisitions. The ability to access debt capital can be a key differentiator, enabling companies to respond quickly to market opportunities.

However, the level of competition also affects the risk associated with financial leverage. In highly competitive markets, where profit margins may be thin, the burden of debt repayment can become onerous, particularly if economic conditions deteriorate. Companies must carefully evaluate the trade-off between leveraging for growth and the potential risks of increased financial leverage.

4. Financial Goals: The financial goals of a company play a pivotal role in determining its optimal level of financial leverage. Different companies may have varying objectives, such as maximizing shareholder value, achieving sustainable growth, or maintaining financial stability. Financial leverage can be employed strategically to align with these goals.

- Maximizing Shareholder Value: Companies focused on maximizing shareholder value may use financial leverage to magnify returns on equity. By borrowing at a lower cost than the expected return on investment, shareholders can benefit from increased earnings per share.

- Achieving Sustainable Growth: Companies aiming for growth may utilize financial leverage to fund expansion projects or enter new markets. Debt can provide the necessary capital to invest in opportunities that might otherwise be unattainable through internal funds alone.

- Maintaining Financial Stability: Some companies prioritize financial stability and opt for conservative financial structures with lower levels of debt. This approach minimizes the risk of financial distress during economic downturns and provides a safety net for the business.

5. Interest Rates and Economic Conditions: The prevailing interest rates and overall economic conditions significantly influence a company’s decision regarding financial leverage. When interest rates are low, the cost of borrowing is reduced, making it more attractive for companies to use debt to finance their operations or expansion initiatives. Conversely, during periods of high interest rates, companies may be more cautious about taking on additional debt due to the increased cost of servicing that debt.

Economic conditions, including the stage of the business cycle, also play a role. During economic upswings, companies may be more inclined to leverage up to capitalize on growth opportunities. However, in economic downturns, the focus may shift to deleveraging and reducing financial risk to weather potential challenges.

6. Tax Considerations: The tax environment is another critical factor influencing financial leverage decisions. Interest on debt is typically tax-deductible, providing a potential tax shield for companies. This tax advantage makes debt financing more attractive compared to equity financing in certain situations.

Companies may strategically use financial leverage to optimize their overall cost of capital by taking advantage of the tax benefits associated with interest payments. However, it’s essential to balance the tax advantages with the potential risks and costs of servicing debt.

7. Credit Rating and Investor Perception: The credit rating assigned to a company by credit rating agencies influences its ability to secure debt financing and the cost of that financing. A higher credit rating indicates lower credit risk, allowing the company to access debt capital at more favorable terms. Conversely, a lower credit rating may result in higher interest rates and more stringent lending terms.

Investor perception also plays a role, particularly for publicly traded companies. Shareholders and potential investors closely monitor a company’s debt levels and financial leverage. Excessive leverage may be viewed negatively, leading to a lower stock price and higher borrowing costs. Companies need to strike a balance between leveraging for growth and maintaining a financial structure that instills confidence in investors.

8. Cash Flow and Debt Serviceability: A critical consideration when determining financial leverage is the ability of the company to generate sufficient cash flow to service its debt obligations. Cash flow is essential for meeting interest payments and repaying principal amounts. Companies need to conduct thorough cash flow analyses to ensure that they can comfortably service their debt without compromising their day-to-day operations or long-term strategic initiatives.

Unforeseen disruptions, such as economic downturns or operational challenges, can impact a company’s cash flow. Therefore, companies must assess their debt serviceability under various scenarios to gauge the resilience of their financial structure.

9. Regulatory Environment: The regulatory environment in which a company operates can influence its approach to financial leverage. Regulatory bodies may impose restrictions on the amount of debt a company can undertake, especially in industries deemed critical or sensitive to the overall economy. Additionally, changes in regulations, such as alterations to tax laws or financial reporting requirements, can impact the cost-effectiveness of financial leverage.

Companies need to stay abreast of regulatory developments and ensure compliance with applicable laws to avoid any adverse consequences associated with non-compliance or unexpected regulatory changes.

10. Risk Tolerance and Management Philosophy: The risk tolerance and management philosophy of a company’s leadership are integral to shaping its approach to financial leverage. Some companies embrace a more aggressive stance, leveraging up to pursue high-growth opportunities despite higher associated risks. Others may adopt a more conservative approach, prioritizing financial stability and minimizing risk exposure.

The management’s philosophy towards risk and leverage often reflects the company’s overall strategic vision. Effective risk management practices are crucial to ensuring that the benefits of financial leverage are realized without exposing the company to undue financial distress.

In conclusion, financial leverage is a complex and multifaceted aspect of corporate finance that is influenced by a myriad of factors. Business size, industry dynamics, competition, financial goals, interest rates, tax considerations, credit ratings, cash flow, regulatory environment, and risk tolerance collectively shape a company’s decision regarding the optimal level of financial leverage.

Companies must conduct thorough analyses, considering both the potential benefits and risks associated with financial leverage. Striking the right balance is crucial, as excessive leverage can lead to financial instability, while too little leverage may limit growth opportunities. Ultimately, a well-informed and strategic approach to financial leverage is essential for companies seeking to optimize their capital structure and achieve their long-term financial objectives.

Library Lecturer at Nurul Amin Degree College