Ten True Statements about Check Cashing Companies:

Check cashing companies have become an integral part of the financial landscape, providing a valuable service to individuals who may not have access to traditional banking. These establishments offer a quick and convenient way for people to turn their checks into cash, but the industry has also garnered its fair share of scrutiny. In this article, we will delve into ten true statements about check cashing companies.

1. Accessible Financial Services:

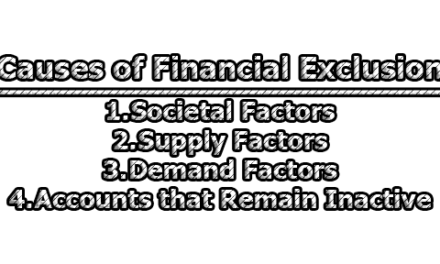

Check cashing companies play a pivotal role in addressing the financial needs of individuals who, for various reasons, find themselves unbanked or underbanked. The unbanked population comprises individuals without a traditional bank account, while the underbanked have limited access to mainstream financial services. For these demographics, check cashing companies offer a lifeline by providing a straightforward and immediate solution to convert checks into cash.

One of the primary advantages is the elimination of the requirement for a bank account. Traditional banking often involves a range of prerequisites, including credit checks, minimum balance requirements, and the need for a permanent address. Check cashing companies, in contrast, offer a more inclusive approach, allowing individuals without a banking history or a fixed address to access their funds easily.

Moreover, these establishments are strategically positioned in various communities, making them easily accessible. This accessibility is particularly beneficial for individuals who may face challenges reaching traditional banking institutions due to distance, lack of transportation, or other logistical constraints.

Despite their convenience, it is essential to acknowledge that this accessibility comes with a trade-off – fees associated with the services provided. These fees, while a potential drawback, are often considered a reasonable compromise for the convenience and accessibility check cashing companies offer to those excluded from traditional banking systems.

2. Convenience Comes at a Cost:

The convenience offered by check cashing companies is undeniable, providing customers with immediate access to their funds without the bureaucratic hurdles associated with traditional banks. However, this convenience comes at a cost in the form of fees charged by these establishments.

Check cashing fees can vary based on factors such as the type of check being cashed, the amount, and the company’s policies. Critics argue that these fees can be disproportionately high, particularly for individuals who may already be facing financial challenges. It is crucial for consumers to be aware of these fees and factor them into their decision-making process when opting for check cashing services.

Additionally, the fee structure may include flat fees or percentage-based fees, adding complexity to the overall cost calculation. Transparency regarding fee structures is crucial for building trust between check cashing companies and their customers. As the industry evolves, there is a growing call for increased transparency and standardized fee disclosures to empower consumers to make informed choices.

Despite the cost implications, many individuals still opt for check cashing services due to the speed and simplicity they offer, emphasizing the delicate balance between convenience and associated expenses in the financial landscape.

3. Varied Check Types Accepted:

One of the strengths of check cashing companies lies in their versatility regarding the types of checks they accept. These establishments typically accommodate various check types, including payroll checks, government checks, personal checks, and more. This flexibility contributes significantly to their appeal, as customers can consolidate their check-cashing needs in one location.

This broad acceptance of check types aligns with the diverse financial situations of their customer base. Whether individuals are cashing their paychecks, government assistance checks, or personal checks from friends or family, check cashing companies streamline the process, making it a one-stop solution for a range of financial transactions.

The ability to cash different types of checks in a single location reduces the need for individuals to navigate multiple financial institutions or services, simplifying their financial interactions. This consolidation not only saves time but also contributes to the overall accessibility and ease of use associated with check cashing companies.

However, it is essential for customers to be aware of the specific policies of each check cashing company regarding the types of checks they accept and any associated fees. Clear communication on accepted check types and fee structures enhances the overall customer experience and helps build trust within the community.

4. Identification Requirements:

To mitigate the risk of fraud and ensure compliance with regulatory standards, check cashing companies typically have stringent identification requirements. Customers are generally required to provide valid identification before their checks can be processed.

Valid identification serves multiple purposes within the check cashing industry. Firstly, it helps establish the identity of the individual conducting the transaction, reducing the risk of fraudulent activities such as check forgery or identity theft. Secondly, it aligns with anti-money laundering (AML) regulations, which mandate financial institutions to verify the identity of individuals engaging in monetary transactions.

Common forms of identification accepted by check cashing companies include government-issued IDs, driver’s licenses, and passports. Some establishments may also require additional documentation, especially for larger transactions or when cashing certain types of checks.

While these identification requirements contribute to the security and integrity of check cashing operations, it is essential for companies to strike a balance between compliance and customer convenience. Striving for a streamlined identification process ensures a positive customer experience without compromising the industry’s commitment to security and regulatory compliance.

5. Risk of Predatory Practices:

Critics of the check cashing industry often raise concerns about the potential for predatory practices, emphasizing the financial vulnerability of the demographic it serves. The argument centers around the fees charged by check cashing companies, which can be perceived as disproportionately high, particularly when compared to traditional banking services.

The risk of predatory practices arises when check cashing companies exploit the financial circumstances of their customers, who may have limited access to alternative financial services. While these fees are necessary for the business model to remain sustainable, there is an ongoing discussion about finding a balance that ensures fair compensation for services rendered without placing an undue burden on financially vulnerable individuals.

Consumer education plays a crucial role in mitigating the risk of predatory practices. By being aware of the fees associated with check cashing services, customers can make informed decisions and explore alternative financial options when feasible. Additionally, advocates for consumer rights emphasize the importance of regulatory oversight to prevent excessive fees and ensure a level playing field for all participants in the financial industry.

Addressing the concerns related to predatory practices requires collaboration between check cashing companies, regulators, and consumer advocacy groups. Striking a balance between profitability and social responsibility is essential for the long-term sustainability and legitimacy of the check cashing industry.

6. Regulatory Compliance:

The check cashing industry operates within a framework of state and federal regulations designed to ensure transparency, protect consumers, and prevent illicit financial activities. Compliance with these regulations is essential for the legitimacy and sustainability of check cashing companies.

Regulations governing the check cashing industry vary by jurisdiction but often include measures to combat money laundering, terrorist financing, and other financial crimes. Anti-money laundering (AML) and know your customer (KYC) regulations require check cashing companies to implement robust identity verification processes, report suspicious transactions, and maintain detailed records.

In addition to financial crime prevention, regulatory frameworks may address issues such as fee disclosure, customer rights, and fair business practices. Companies operating in compliance with these regulations not only contribute to the overall integrity of the financial system but also build trust with customers and regulators.

Given the dynamic nature of regulatory environments, check cashing companies must stay informed about changes in laws and adjust their practices accordingly. Continuous efforts to enhance compliance mechanisms not only protect the industry from legal repercussions but also foster a positive relationship with regulators, reinforcing the industry’s commitment to ethical conduct.

7. Alternative to Traditional Banking:

Check cashing companies serve as a viable alternative to traditional banking, catering to individuals who, for various reasons, opt not to have a bank account. Some individuals may have had negative experiences with traditional banks, such as account closures, high fees, or credit issues, leading them to seek alternative financial solutions.

For this demographic, check cashing companies offer a straightforward and accessible means of managing their finances. The absence of a requirement for a bank account allows individuals to receive immediate access to their funds without the complexities associated with traditional banking relationships.

Moreover, check cashing companies often attract customers who prioritize anonymity in financial transactions. These individuals may be wary of providing personal information to traditional banks and find the discreet nature of check cashing services appealing.

While these establishments provide an essential service for those who choose not to engage with traditional banking, it is essential for consumers to weigh the convenience against the associated fees. Understanding the implications of utilizing check cashing services helps individuals make informed decisions aligned with their financial preferences.

8. Financial Inclusion Impact:

Despite the criticisms directed towards the check cashing industry, it undeniably contributes to financial inclusion by providing services to individuals who might be excluded from mainstream banking. Financial inclusion refers to the availability and accessibility of financial services to all individuals, regardless of their economic status.

Check cashing companies play a significant role in reaching marginalized communities, including those with low incomes, limited credit history, or a lack of permanent addresses. By offering a simple and immediate solution for cashing checks, these establishments empower individuals who might otherwise face barriers in accessing financial services.

Furthermore, the industry’s commitment to serving a diverse customer base aligns with broader societal goals of reducing economic disparities. Financial inclusion fosters economic stability, as individuals gain the ability to manage their funds and participate more actively in the economy.

However, it is crucial to acknowledge the ongoing debate about the most effective means of achieving financial inclusion. While check cashing companies contribute to this goal, ongoing efforts are needed to address systemic issues and create a more inclusive financial infrastructure.

9. Technological Advancements:

The check cashing industry has not been immune to the wave of technological advancements reshaping the financial services landscape. Some companies within the sector have embraced digital innovations, offering mobile applications and online platforms to enhance customer convenience.

These technological advancements aim to streamline the check-cashing process, allowing customers to initiate transactions from the comfort of their homes. Mobile applications may facilitate remote check deposits, reducing the need for in-person visits to brick-and-mortar locations.

Additionally, online platforms can provide customers with real-time information about fees, transaction history, and other relevant details. This transparency contributes to an improved customer experience, as individuals can make informed decisions without the need for face-to-face interactions.

However, the integration of technology in the check cashing industry raises questions about data security, privacy, and the digital divide. Companies must prioritize robust cybersecurity measures to protect customer information while ensuring that technological advancements do not exacerbate existing disparities in access to financial services.

10. Consumer Education Imperative:

Amid the intricacies of check cashing services, consumer education emerges as an essential component in navigating the landscape. Customers must be well-informed about the terms and conditions associated with check cashing to make decisions aligned with their financial interests.

Understanding the fee structures, identification requirements, and alternative financial options empowers consumers to make choices that best suit their needs. Educational initiatives, both from within the industry and through external organizations, play a vital role in ensuring that individuals are aware of their rights and responsibilities when utilizing check cashing services.

Consumer education also extends to promoting financial literacy, empowering individuals to make sound financial decisions beyond the realm of check cashing. This broader perspective includes budgeting, saving, and exploring long-term financial solutions that may reduce reliance on check cashing services over time.

Subsequently, a well-informed consumer base is essential for the check cashing industry to thrive ethically and sustainably. By prioritizing consumer education, check cashing companies contribute to the financial empowerment of their clientele, fostering a more resilient and informed community. Advocating for financial literacy becomes a shared responsibility among industry players, regulators, and community organizations to ensure a well-rounded and equitable financial landscape.

In conclusion, check cashing companies serve as a double-edged sword in the financial realm, offering convenience to some while raising concerns for others. The industry’s impact on financial inclusion, coupled with the potential for predatory practices, underscores the need for a balanced perspective. As technology continues to shape the financial landscape, check cashing companies must adapt while maintaining a commitment to transparency, regulatory compliance, and consumer education. In this ever-evolving landscape, a nuanced understanding of the check cashing industry is essential for policymakers, consumers, and industry stakeholders alike.

Frequently Asked Questions (FAQs):

What is a check cashing company?

A check cashing company is a financial service provider that offers the service of converting checks into cash for a fee. These establishments cater to individuals who may not have access to traditional banking services or prefer immediate access to funds without going through the process of depositing a check into a bank account.

What types of checks do check cashing companies accept?

Check cashing companies typically accept various types of checks, including payroll checks, government checks, personal checks, and more. The versatility in the types of checks accepted contributes to the appeal of these establishments, offering customers a one-stop solution for different financial transactions.

Why do people use check cashing services instead of traditional banks?

People may choose to use check cashing services instead of traditional banks for several reasons. Some individuals may be unbanked or underbanked, facing barriers to opening a traditional bank account. Others may prioritize immediate access to cash without the complexities associated with traditional banking processes.

What are the fees associated with check cashing services?

Fees for check cashing services can vary based on factors such as the type and amount of the check. These fees are typically disclosed by the check cashing company and may be presented as flat fees or as a percentage of the check amount. It’s important for customers to be aware of these fees before using check cashing services.

How do check cashing companies ensure security and prevent fraud?

Check cashing companies implement stringent security measures to prevent fraud and comply with regulatory standards. This often includes requiring customers to provide valid identification before processing a transaction. These establishments may also have internal processes and systems in place to detect and report suspicious activities in accordance with anti-money laundering (AML) regulations.

Are check cashing companies regulated?

Yes, check cashing companies are subject to state and federal regulations to ensure transparency, consumer protection, and compliance with anti-money laundering laws. Regulatory requirements may vary by jurisdiction, and check cashing companies are obligated to operate within the legal framework to maintain legitimacy.

How have technological advancements impacted the check cashing industry?

Technological advancements have influenced the check cashing industry, with some companies adopting digital solutions such as mobile applications and online platforms. These innovations aim to enhance customer convenience, streamline processes, and provide real-time information about fees and transactions. However, the integration of technology also raises concerns about data security and the digital divide.

Can check cashing companies contribute to financial inclusion?

Yes, check cashing companies can contribute to financial inclusion by providing services to individuals who may be excluded from mainstream banking. These establishments reach out to marginalized communities, including those with low incomes or limited access to traditional banking, offering them a means of accessing financial services.

What steps should consumers take to make informed decisions when using check cashing services?

Consumers should educate themselves about the fees associated with check cashing services, understand the identification requirements, and explore alternative financial options. Being aware of the terms and conditions empowers individuals to make informed decisions that align with their financial interests.

How can the check cashing industry promote consumer education?

The check cashing industry can promote consumer education through initiatives that provide clear information about fees, identification requirements, and alternative financial options. Collaboration with external organizations and regulators to enhance financial literacy can contribute to a well-informed consumer base, fostering a positive and transparent financial landscape.

Library Lecturer at Nurul Amin Degree College