Balance of Payments (BOP):

The balance of payments is a summary of transactions between domestic and foreign residents for a specific country over a specified period of time. It accounts for transactions by businesses, individuals, and the government. It encompasses all transactions i.e. goods, services, and income; financial claims on and liabilities, and transfers such as gifts. In this article, we are going to present you about components of Balance of Payments, deficit and surplus in the balance of payments.

The balance of payments summarizes the economic transactions of an economy with the rest of the world. These transactions include exports and imports of goods, services, and financial assets, along with transfer payments (like foreign aid) (Reserve Bank of Australia).

The balance of payments is a statistical statement that summarizes transactions between residents and nonresidents during a period. It consists of the goods and services account, the primary income account, the secondary income account, the capital income account, and the financial income account (International Monetary Fund – IMF).

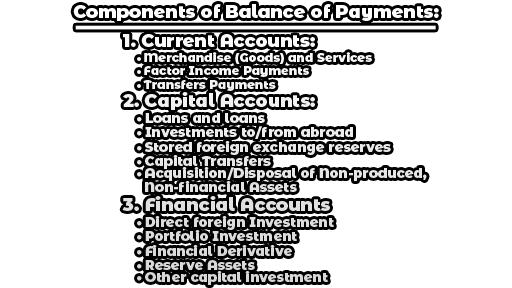

Components of Balance of Payments:

Some of the necessary components of Balance of Payments are given below with a brief description:

1. Current Accounts: The current account represents a summary of the flow of funds between one specified country and all other countries due to purchases of goods or services. Current accounts include the following components:

- Merchandise (Goods) and Services: Merchandise exports and imports represent tangible products, such as computers and clothing that are transported between countries. Service exports and imports represent tourism and other services, such as legal, insurance, and consulting services, provided for customers based in other countries

- Factor Income Payments: These represent income (interest and dividend payments) received by investors on foreign investments in financial assets (securities). Factor income received by BD investors reflects an inflow of funds into Bangladesh. Factor income paid by the BD reflects an outflow of funds from Bangladesh.

- Transfers Payments: A third component of the current account is transfer payments, which represent aid, grants, and gifts from one country to another.

2. Capital Accounts: The capital account represents a summary of the flow of funds resulting from the sale of assets between one specified country and all other countries over a specified period of time. It compares the new foreign investments made by a country with the foreign investments within a country over a particular time period. The capital accounts include the following components:

- Loans and loans: These include all loans and loans granted or received abroad. It includes both private equity loans, as well as state-owned loans.

- Investments to/from abroad: These are investments made by non-citizens with shares in their home country or investments in real estate.

- Stored foreign exchange reserves: Foreign exchange funds are held by the central bank to regulate the exchange rate and ultimately balance the BOP.

- Capital Transfers: Transactions where one party has transferred ownership of something to another party without receiving anything specific in return.

- Acquisition/Disposal of Non-produced, Non-financial Assets: Transactions that involve intangible assets (e.g. brand names, copyrights, and trademarks) and rights to use land or water (e.g. for mining or fishing).

(Capital and Financial Accounts: The capital account includes the value of financial assets transferred across country borders by people. It also includes the value of non-produced non-financial assets that are transferred across country borders, such as patents and trademarks. The sale of patent rights by a U.S. firm to a Canadian firm reflects a Debit to the U.S. balance-of-payments account, while a U.S. purchase of patent rights from a Canadian firm reflects a Credit to the U.S. balance-of-payments account.)

3. Financial Accounts: A financial account monitors the flow of funds associated with investments in businesses, real estate, and stocks. It also includes state-owned assets such as gold and Special Drawing Rights (SDRs) held by the International Monetary Fund (IMF). In addition, it includes foreign investment and foreign assets. Similarly, a financial account includes a record of assets held by outsiders. The financial accounts include the following components:

- Direct foreign Investment: Direct foreign investment represents the investment in fixed assets in foreign countries that can be used to conduct business operations. Examples: a firm’s acquisition of a foreign company, its construction of a new manufacturing plant, or its expansion of an existing plant in a foreign country.

- Portfolio Investment: Portfolio investment represents transactions involving long-term financial assets (such as stocks and bonds) between countries.

- Financial Derivative: The buying or selling of financial derivatives (i.e. financial agreements between two parties where the value is derived from another financial instrument, such as a bond or share, or a market index). These transactions contain the exchange of risk between parties, rather than funds.

- Reserve Assets: The buying or selling of reserves that the Reserve Bank is holding. These reserves are property that the Reserve Bank controls in order to achieve policy goals like participating in the foreign exchange market and helping the government to fulfill its commitments to the IMF.

- Other capital investment: represents transactions involving short-term financial assets (such as money market securities) between countries. Example: Treasury bill and other govt. securities.

Deficit and Surplus in the Balance of Payments:

A balance of payments deficit in a country can arise if said country imports more capital, goods, and services than it exports. A balance of payments surplus occurs when a country’s total exports are higher than its imports (Vedantu). The current account shows the net amount a country is earning if it is in surplus, or spending if it is in deficit. It is the sum of the balance of trade (net earnings on exports minus payments for imports), factor income (earnings on foreign investments minus payments made to foreign investors), and cash transfers.

It is apparent that the balance of payment monitors the transaction of all the imports and exports of services and goods for a given period, helps the government to analyze a particular industry’s export growth potential and formulate policies to sustain it, and gives the government a comprehensive perspective on a different range of import and export tariffs. The government then increases and decreases the tax to discourage imports and encourage export, individuals, and self-sufficiency.

Library Lecturer at Nurul Amin Degree College