Basic Banking Terminologies

The terms and concepts that are typically utilized by all different sorts of banks are referred to as banking terminologies. It might be tricky to comprehend banking terms and concepts. But if you grasp them, navigating the banking world will be simple. You should be familiar with the basic banking terminologies which are listed below:

A

Account: It refers to the continuous record of all financial dealings between involved individuals. The involved sides in the banking industry are the banks and the clients. Simply, it is the account of nominal interest.

Account Agreement: The contract governing your open-end credit account, provides information on changes that may occur to the account.

Account Balance: The total amount of all funds in your account.

Adjustable Rate: A variable interest rate applied to the loan that may change over its term. Typically used to discuss banks.

Accrued Interest: Accrued interest is the interest accumulated over an investment but not yet paid. It is also termed interest receivable. Some banks call it Interest earned but not yet paid.

Annual percentage rate (APR): The annual percentage rate, fees, or other expenditures you pay for a loan or credit card. A lower rate is always preferable for you as the consumer.

Annual percentage yield (APY): The effective yearly rate of return on savings, checking, CD, or money market account after taking compound interest into account. The higher the rate, the better.

ATM (Automated Teller Machine): An accessible facility for basic banking operations like cash withdrawals, check deposits, and balance inquiries. Access to a network of fee-free ATMs is provided by several banks.

Automated Teller Machine (ATM) card: A card that gives you access to your account through an ATM. If it’s a debit card, it will also work at retailers.

Annuity: It is the fixed amount of cash that is given to someone on an annual basis, typically for the rest of his/ her life.

Assets: It is a resource having economic worth that a person, organization, or nation owns or manages with the expectation that it will be useful in the future.

Auto Loan: A loan for the procurement of a vehicle you pay off over time. This is more costly than buying a car outright since you’re paying interest, but you also get to use the car while you’re paying for it.

Automated Clearing House (ACH): The electronic network that allows money to be transferred between accounts at different institutions. When you sign up for direct deposit of your paycheck at work, that money often moves into your bank account via ACH.

Available balance: The amount of money available for instant withdrawal from your account.

B

Bailout: It is done to save the business from severe financial difficulties.

Balance Sheet: A basis for calculating return rates and assessing a company’s capital structure, it is a financial statement that lists a company’s assets, liabilities, and shareholder’s equity at a certain point in time.

Bank Identifier Code (BIC): A number used to identify each bank and branch.

Blue chip: Adjective used to describe the high quality and specifically in the banking world to describe stocks which are a reliable investment, but less so than gilt-edged stock. Originates either from a high-value poker chip or from a sliver of the diamond.

Bond: A loan to a corporate or government for a defined period at a fixed interest rate.

Boutique: An investment bank that offers some but not all banking services, generally in corporate finance.

Bank Credit: It describes how banks lend money to their clients in a variety of ways, including loans and the discounting of bills of exchange.

Bank Deposits: It operates in opposition to bank credit. It refers to placing one’s personal savings in a bank account for a variety of reasons, such as security or interest.

Banknote: A banknote that is issued by the bank promises to pay a specific amount of cash when being presented.

Bank Rate: It refers to the interest rate a central bank charges commercial banks on advances and loans they extend.

Bankrupt: A bankrupt person, firm, or corporation has insufficient assets to cover its debts. The debtor seeks relief through a court proceeding to work out a payment schedule or erase debts. In some cases, the debtor must surrender control of all assets to a court-appointed trustee.

Bankruptcy: It is a legal procedure whereby individuals or other entities that are unable to pay their debts to creditors may ask for partial or complete relief from such debts.

Beneficiary: A person who is entitled to receive the benefits or proceeds of a will, trust, insurance policy, retirement plan, annuity, or other contracts.

Bridge Loan: The bank is providing a very short-term loan to cover the temporary financial backup.

Bancassurance: It refers to the sharing of insurance policies and products by insurance companies through the bank branches operating as corporate agents. Banks usually charge a fee for this service from insurance companies.

Bouncing off a Cheque: Any form of a cheque that is not payable due to inadequate money is returned by the bank with the excuse that it “exceeds arrangement” or “funds insufficient”.

Base Rate: Generally speaking, banks base their lending rates on the rate of interest. It is clear that loans are granted at rates greater than base rates while savings rates are lower.

Basis Point: It is a fraction of a percentage point that is typically used to denote the cost of financing.

Bills of Exchange: According to section 5 of the Negotiable Instruments Act of 1881, a bill of exchange is an instrument in writing containing an unconditional order signed by the maker, directing a certain person to pay a certain amount of money, only to, or to the order of, a certain person, or the bearer of the instrument.

C

Call Money: It is a very short-term loan with a low-interest rate that is only made available for a few days.

Capital Assets: The asset that isn’t purchased or sold as part of regular company business.

Cash: It alludes to the currency that comes in the form of coins and/or banknotes.

Capital: Assets that are available for a purpose such as investment or starting a company. It is different from money because money is used only to purchase things, capital is used to generate wealth, e.g. through investment.

Capital Expenditure: Capital assets are purchased with non-recurring expenditures.

Capital market: The financial system which raises capital by dealing in shares, bonds, and long-term investments.

Cash Cow: Those enterprises that produce great earnings but frequently have a limited opportunity for expansion.

Check: It is an individual written to transfer money between two accounts at the same and/or a different bank.

Clearing: Clearing of a cheque is done by the Clearing House. Further, in this process, the amount of the cheque is debited from the issuer’s account and credited to the beneficiary’s account.

Canceled Check: A check that a bank has paid, charged to the account holder’s account, and then endorsed. Once canceled, a check is no longer negotiable.

Cashier’s Check: A check drawn on the funds of the bank, not against the funds in a depositor’s account. However, the depositor paid for the cashier’s check with funds from their account. The primary benefit of a cashier’s check is that the recipient of the check is assured that the funds are available.

Core Banking: It is a broad word used to describe the services offered by a networked set of bank branches.

Core Banking Solutions (CBS): In CBS, all of the bank’s branches are interconnected, allowing customers to access their accounts and/or transactions from any other branch.

Cash Reserve Ratio (CRR): It refers to the amount of cash that a bank must hold on deposit with the Reserve Bank. The amount with the bank commission will decrease and vice versa when the CRR percentage rises.

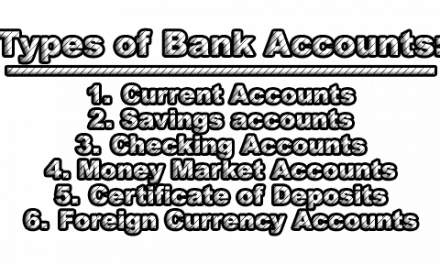

Current Account: It is a business account that can be opened in general with no withdrawal limitations and no interest paid.

Checking account: The basic account for easy access to your money. Helpful for managing day-to-day expenses and recurring (monthly) bills.

Cash Discount: When money is exchanged, a discount is granted.

Cash Flow: It describes the flow of funds into and out of a company as products are bought and sold.

Cheap Money: It is a credit or loan with a low-interest rate.

Cease and Desist Letter: A letter requesting that a company stops the activity mentioned in the letter.

Certificate of Deposit: It is the certificate issued by a bank to someone who deposits money for a specified amount of time at a predetermined interest rate.

Certificate of Release: A certificate signed by a lender indicating that a mortgage has been fully paid and all debts satisfied, also known as release of lien.

Certified Check: A personal check drawn by an individual that is certified (guaranteed) to be good. The face of the check bears the words “certified” or “accepted,” and is signed by an official of the bank or thrift institution issuing the check. The signature signifies that

-

- The signature of the drawer is genuine, and

- Sufficient funds are on deposit and earmarked for payment of the check.

Collateral Security: It is the asset that a borrower must pledge or deposit with a lender as a requirement of receiving a loan; this asset can be sold off if the loan is not repaid.

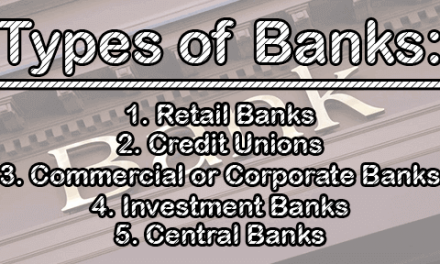

Commercial Banks: They are a financial establishment that accepts deposits, provides checking account services, makes various loans, and gives both people and small companies access to fundamental financial products like savings accounts and certificates of deposits.

Credit: An increase in a savings or checking account, such as a deposit made to the account. A person or company’s ability to borrow money, with the expectation the money will be paid back in the future.

Credit Card: It is a payment card provided to the users that enable the cardholder to pay a merchant for goods and services on the basis of the cardholder’s commitment to the card issuer to pay them for the amounts plus any extra charges that have been agreed upon.

Credit limit: The maximum amount you’re allowed to charge on a credit card. Once you’ve shown a habit of paying bills consistently on time, a lender may raise your credit limit—giving you more spending power.

Credit rating: An evaluation of creditworthiness based on financial resources and credit history. Strictly speaking, ratings are usually applied to businesses or governments and expressed as a letter grade (A, B+, etc.)

Credit score: In contrast to a credit rating, a credit score is a number (600, 700, etc.) indicating an individual’s credit worthiness. Credit bureaus look at factors such as your total debt, number of open accounts, and whether you rent or own your home. A good credit score can result in a lower interest rate for loans.

Crossing the Cheque: The amount on the check must be deposited directly into the payee’s bank account. It is ordering the banker to pay a specific amount exclusively through the banker.

Charge-Off: The balance on a credit obligation that a lender no longer expects to be repaid and writes off as a bad debt.

Compound Interest: When you save money in an interest-earning account, such as a savings account or CD, compound interest is the powerful financial effect that helps your savings grow over time. With compound interest, your savings multiply over time by earning interest on top of the principal plus interest, year after year.

Conditions: Also known as terms and conditions, this is the fine print of a bank account or loan agreement. Make sure you read and understand the implications of your financial accounts and obligations.

D

Debit: A debit may be an account entry representing money you owe a lender or money that has been taken from your deposit account.

Debit card: It is a card that the bank has issued so that its customers can use online banking to withdraw money from their accounts.

Demat Account: It describes how a bank maintains funds in deposit accounts in a manner similar to how a depository institution translates share certificates into electronic form and maintains them in a Demat account.

Dishonor of Cheque: It refers to the paying banker’s inability to deposit a cheque along with an explanation in the return memo.

Debt-to-Income Ratio (DTI): The percentage of a consumer’s monthly gross income that goes toward paying debts. Generally, the higher the ratio, the higher the perceived risk. Loans with higher risk are generally priced at a higher interest rate.

Decedent: A deceased person, ordinarily used with respect to one who has died recently.

Deferred Payment: A payment postponed until a future date.

Delinquency: A debt that was not paid when due.

Demand Deposit: A deposit of funds that can be withdrawn without any advance notice.

Deposit Slip: An itemized memorandum of the cash and other funds that a customer presents to the bank for credit to his or her account.

Derogatory Information: Data received by a creditor indicating that a credit applicant has not paid his or her accounts with other creditors according to the required terms.

Direct Deposit: A payment that is electronically deposited into an individual’s account at a depository institution.

Direct Dispute: A dispute submitted directly to the furnisher about the accuracy of the information in your consumer report that relates to an account or other relationship you have with the furnisher.

Disclosures: Certain information that Federal and State laws require creditors to give to borrowers relative to the terms of the credit extended.

Draft: A signed, written order by which one party (the drawer) instructs another party to pay a specified sum to a third party (the payee), at sight or at a specific date. Typical bank drafts are negotiable instruments and are similar in many ways to checks.

Diversification: The strategy of investing broadly across a number of different investments to reduce risk; a hallmark of mutual fund investing.

E

Early withdrawal penalty: A fee for withdrawing funds from an account—or closing it—before its maturity date. This applies to CDs and individual retirement accounts (IRAs).

E-banking: It is a form of banking that allows customers to transact money online. E-banking includes RTGS, credit cards, debit cards, UPI, and other services.

Electronic Check Conversion: Electronic check conversion is a process in which your check is used as a source of information for the check number, your account number, and the number that identifies your financial institution. The information is then used to make a one-time electronic payment from your account-an electronic fund transfer. The check itself is not the method of payment.

Electronic deposit verification (EDV): A way to verify an account at another bank that you want to link to. Many banks will electronically send two micro-deposits to your linked account. Once you report the deposit amounts back to the bank, you can transfer funds to and from the linked account.

EMV chip: Developed as an update to simple magnetic stripe cards. By encrypting data, this feature helps prevent data from being intercepted. EMV stands for “Europay, MasterCard, and Visa,” as it was their joint effort that created the standard to ensure security and global acceptance.

EFT (Electronic Fund Transfer): Under this, money is transferred between accounts in the same or separate banks using computers, wire transfers, and ATMs.

Embezzlement: In most states, embezzlement is defined as theft/larceny of assets (money or property) by a person in a position of trust or responsibility over those assets. Embezzlement typically occurs in employment and corporate settings.

Endorsement: To cash or deposit a check, you must sign your name on the back. This is known as an endorsement.

Encoding: The process used to imprint or inscribe MICR characters on checks, deposits, and other financial instruments.

Enforcement Action: A regulatory tool that the OCC may use to correct problems or effect change in a national bank.

Equal Credit Opportunity Act (ECOA): Prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age, or because an applicant receives income from a public assistance program.

Error Resolution: The required process for resolving errors involving electronic transfers to and from deposit accounts.

Escheat: Reversion of real or personal property to the state when a) a person dies without leaving a will and has no heirs, or b) when the property (such as a bank account) has been inactive for a certain period of time.

Escrow: A financial instrument held by a third party on behalf of the other two parties in a transaction. The funds are held by the escrow service until it receives the appropriate written or oral instructions-or until obligations have been fulfilled. Securities, funds, and other assets can be held in escrow.

Escrow Analysis: The periodic examination of escrow accounts by a mortgage company to verify that monthly deposits are sufficient to pay taxes, insurance, and other escrow-related items when due.

Escrow Funds: Funds held in reserve by a mortgage company to pay taxes, insurance, and other mortgage-related items when due.

Estate Account: An account held in the name of a decedent that is administered by an executor or administrator of the estate.

External accounts: Accounts owned at another financial institution.

Exception Hold: A period of time that allows the banks to exceed the maximum hold periods defined in the Expedited Funds Availability Act.

F

Fiscal Deficit: It is the amount of money that the government has borrowed to cover its expenses.

Finance: It is a term that refers to issues with the formation, management, and study of money and assets.

Flat Money: It is a kind of transaction established as money, frequently through governmental regulation, that has no inherent worth.

Federal Deposit Insurance Corporation (FDIC): A government corporation that insures the deposits of all national and State banks that are members of the Federal Reserve System.

Federal Emergency Management Agency (FEMA): Federal agency responsible for the emergency evaluation and response to all disasters, natural and man-made. FEMA oversees the administration of flood insurance programs and the designation of certain areas as flood prone.

Federal Reserve System: The Federal Reserve System is composed of a central governmental agency. You can divide the Federal Reserve’s duties into four general areas:

-

- Conducting monetary policy

- Regulating banking institutions and protecting the credit rights of consumers

- Maintaining the stability of the financial system

- Providing financial services to the U.S. government

Fiduciary: Undertaking to act as executor, administrator, guardian, conservator, or trustee for a family trust, authorized trust, testamentary trust, or receiver or trustee in bankruptcy.

Finance Charge: The total cost of credit a customer must pay on a consumer loan, including interest. The Truth in Lending Act requires disclosure of the finance charge.

Financial Regulatory Agency: An organization authorized by statute for ensuring the safe and sound operation of financial institutions chartered to conduct business under that agency’s jurisdiction.

First Mortgage: A real estate loan that is in a first lien position, taking priority over all other liens. In case of a foreclosure, the first mortgage will be repaid before any other mortgage.

Fixed Rate Loan: The interest rate and the payment remain the same over the life of the loan. The consumer makes equal monthly payments of principal and interest until the debt is paid in full.

Fixed Rate Mortgage: A mortgage with payments that remain the same throughout the life of the loan because the interest rate and other terms are fixed and do not change.

Foreign Transaction Fees: A fee assessed by your bank for making a transaction at another bank’s ATM.

Funds on hold: Funds are not available until they’re processed.

Fraudulent charges: Many banks have strong protections against fraudulent transactions. If a suspicious transaction occurs on your account, your bank may prevent the payment from going through until they talk with you to confirm that the purchase is valid.

G

Guaranteed Student Loan: An extension of credit from a financial institution that is guaranteed by a Federal or State government entity to assist with tuition and other educational expenses. The government entity is responsible for paying the interest on the loan and paying the lender to manage it. The government entity also is responsible for the loan if the student defaults.

Guarantor: A guarantor creates a trust which takes the responsibility for the repayment of a loan. Usually, a guarantor is not liable for the repayment of the loan. However, in some cases, the liability and responsibility of repaying the loan lie with the guarantor.

Garnishment/Garnish: A legal process that allows a creditor to remove funds from your bank account to satisfy a debt that you have not paid. If you owe money to a person or company, they can obtain a court order directing your bank to take money out of your account to pay off your debt.

Gross Domestic Product (GDP): The monetary value of all the finished goods and services produced within a country’s borders in a specific time period, usually annually.

Gold Standard: A now obsolete exchange whereby the value of a currency is defined by gold.

Golden Rule of Banking: Short-term transactions should be financed with short-term money and long-term transactions with long-term funds.

Government Bond: A bond issued by a national government to finance spending. While this means the bond is free of credit risk because the government can always pay the debt by raising taxes or printing money, it does depend on a stable political system.

Gross: The full amount of income, profit, or interest without any deductions from tax or costs.

Grace period: A certain amount of time when a borrower can delay making a payment on a loan or credit card account without paying a penalty or incurring interest charges. It can also refer to the period after the maturity date of a certificate of deposit when you can withdraw funds without penalty.

H

Hot Money: It is capital that financiers regularly transfer between economies and financial markets to revenue from the maximum short-term interest rates.

Hypothecation: It is the practice of a debtor pledging property to secure a debt or as a prerequisite to an obligation, or of a third party pledging property on the debtor’s behalf. The typical tool for fulfilling the agreement is a letter of hypothecation.

Hold: Used to indicate that a certain amount of a customer’s balance may not be withdrawn until an item has been collected, or until a specific check or debit is posted.

Hedge: An attempt to protect against loss on a bet or investment by making a compensating transaction.

Hedge Fund: Investments of a few (normally wealthy) people pooled together and managed professionally. Their goal is to aggressively maximize return on the investment but the term actually originates from their previous strategy of “hedging risk”.

Holding Company: A parent corporation, limited liability company, or limited partnership that owns enough voting stock in another company to control its policies and management. This means the holding company is protected against the other company’s losses or liabilities but reaps the rewards of its profits. It can also be based in jurisdictions with lower tax rates while allowing the other company to continue to operate wherever.

Home Equity Line of Credit (HELOC): A line of credit based on the estimated value of your home, or on the amount of equity in your home.

Home Equity Loan: A home equity loan allows you to tap into your home’s built-up equity, which is the difference between the amount that your home could be sold for and the amount that you still owe. Homeowners often use a home-equity loan for home improvements, to pay for a new car, or to finance their child’s college education. The interest paid is usually tax-deductible. Because the loan is secured by your home’s equity, if you default, the bank may foreclose on your house and take ownership of it. This type of loan is sometimes referred to as a second mortgage or borrowing against your home.

I

International Monetary Fund (IMF): Created to promote monetary and exchange stability in the global economy. This means it monitors financial developments around the world and lends funds to needy countries.

Idle Money: It is the money that isn’t invested and isn’t producing any interest or investment revenue.

Insolvency: When a person or business is unable to pay its debts, it is considered to be in financial difficulty.

Interest: It is the payment of funds above the principal amount, at a specific rate, made by a borrower or deposit-taking financial institution to a lender or depositor.

Interest Income: Your earnings on savings accounts, certificates of deposit, and money markets. Banks or other organizations or individuals who pay interest usually report it on Form 1099-INT.

Interest Rate: The annual percentage paid on an interest-bearing savings account or CD, or the interest charged on loans. The interest paid on a deposit account is the “annual percentage yield” (APY) and the rate charged on a loan is the “annual percentage rate” (APR).

Interest transfer: A process that allows interest earned on one account to be transferred to another account. For example, the interest earned on a CD can be transferred to a money market account.

Inflation: There is an unnatural rise in the price level as a result of an increase in the amount of money in circulation without a commensurate increase in commodities.

Initial Public Offering (IPO): It signifies the time when a corporation launches its first public offering of shares.

Internet Banking: Most banks allow account holders to access their accounts using the internet. You can also perform certain transactions using this system. This is internet banking or online banking or e-banking.

Inactive Account: An account that has little or no activity; neither deposits nor withdrawals having been posted to the account for a significant period of time.

Index-linked Certificate of Deposit: An index-linked CD is a deposit obligation of the issuing bank and is often sold through bank branches and affiliated and unaffiliated brokers. Index-linked CDs provide the investor the ability to participate in the appreciation, if any, of a particular index, during the term of the CD. Index-linked CDs may have complicated payout structures and may not be suitable or appropriate for all investors. Investors should carefully review the investment risk considerations detailed in the relevant offering documents and disclosure statements. Index-linked CDs are not securities and are not registered under securities laws.

Individual Account: An account in the name of one individual.

Individual Retirement Account (IRA): A retirement savings program for individuals to which yearly tax-deductible contributions up to a specified limit can be made. The amount contributed is not taxed until withdrawn.

Insufficient Funds: When a depositor’s checking account balance is inadequate to pay a check presented for payment.

Insurance (Hazard): Insurance to protect the homeowner and the lender against physical damage to a property from sources such as but not limited to fire, wind, or vandalism.

Insured Deposits: Deposits held in financial institutions that are guaranteed by the Federal Deposit Insurance Corporation (FDIC) against loss due to bank failure.

Investments: Investments are financial assets that are purchased and sold by investors, with the goal of earning a return on investment (ROI). Common types of investments include stocks, bonds, mutual funds, index funds, exchange-traded funds, and real estate. There are also various alternative investments like gold, commodities, fine art, wine, and more. Unlike bank savings and checking accounts, investments are not FDIC insured and have a risk of loss.

J

Joint Account: An account owned by two or more persons. Either party can conduct transactions separately or together as set forth in the deposit account contract. Each person on the account has equal ownership. The primary account holder receives the bank statements and any other correspondence.

Junk Bond: Risky investments which can offer higher yields than safer bonds. Often issued by companies with a low credit rating as investors demand higher rewards as compensation for the risk of investing in them.

K

Kiosk Banking: It alludes to conducting banking from a cubicle that also sells goods like food, newspapers, etc.

Kiting: Writing a check in an amount that will overdraw the account but making up the deficiency by depositing another check in another bank. For example, mailing a check for the mortgage when your checking account has insufficient funds to cover the check but counting on receiving and depositing your paycheck before the mortgage company presents the check for payment.

L

Leverage Ratio: A company’s capacity to absorb financial losses can be estimated or measured using this financial ratio.

Letter of Credit: A letter that a bank sends to another bank (especially one that is located in a different country) that serves as a guarantee for payments made to a certain individual under particular circumstances.

Liabilities: It is a debt that a person or business has, typically in the form of money.

Lender: An individual or financial institution that lends money with the expectation that the money will be returned with interest.

Lien: A legal right to retain control over someone else’s property until a debt is paid off.

Line of Credit: A pre-approved loan authorization with a specific borrowing limit based on creditworthiness. A line of credit allows borrowers to obtain a number of loans without re-applying each time as long as the total of borrowed funds does not exceed the credit limit.

Loan-to-Value Ratio (LTV): The ratio of the loan principal (the amount borrowed) to the appraised value (selling price). For example, on a $100,000 home, with a mortgage loan principal of $80,000, the loan-to-value ratio is 80 percent. The LTV will affect programs available to the borrower; generally, the lower the LTV, the more favorable the program terms offered by lenders.

Loan Contract: The written agreement between a borrower and a lender in which the terms and conditions of the loan are set.

Loan Fee: A fee charged by a lender to make a loan (in addition to the interest charged to the borrower).

Loan Modification Provision: A contractual agreement in a loan that allows the borrower or lender to permanently change one or more of the terms of the original contract.

Loan Proceeds: The net amount of funds that a lending institution disburses under the terms of a loan, and which the borrower then owes.

Local Check: A check payable by, at, or through a bank in the same check processing region as the location of the branch of the depository bank. The depository bank is the bank into which the check was deposited. As of February 27, 2010, the Federal Reserve consolidated its checking processing centers into one processing center. Therefore, all checks are now considered local.

Liquid Assets: It is a resource that can be quickly and readily transformed into cash.

Liquidation: When a business is terminated or bankrupt, its assets are sold to pay creditors.

Liquidity: It is the capacity to quickly turn an investment into cash without suffering any value loss.

Late Charge: The fee charged for delinquent payment on an installment loan, is usually expressed as a percentage of the loan balance or payment. Also, a penalty is imposed by a card issuer against a cardholder’s account for failing to make minimum payments.

Lease: A contract that, in exchange for rent, grants the right to use a property for a specific amount of time.

M

Market Capitalization: It is the outcome of the share price and the actual amount of outstanding common shares for the company.

Mortgage: It is a type of security provided to a lender in exchange for an advance or loan.

Mortgage Loan: A loan used to purchase or refinance a home or real property, with payments usually spread over 10 to 30 years. It’s secured by real estates, such as the borrower’s primary residence.

Manufactured (Mobile) Home: A structure, built on a permanent chassis, transported to a site in one or more sections, and affixed to a permanent foundation. The term does not include recreational vehicles.

Maturity: The date on which the principal balance of a loan, bond, or other financial instrument becomes due and payable.

Merger: The combining of two or more companies.

Mezzanine: A type of financing that combines debt and equity financing. It is debt capital that gives the lender the right to ownership and equity if the loan is not paid. It is often a quite high risk so it can also be a high yield for the lender. The word is derived from the Latin for “middle” as the risk is medium.

Minimum Balance: The amount of money required to be on deposit in an account to qualify the depositor for special services or to waive a service charge.

Minimum Payment: The minimum dollar amount that must be paid each month on a loan, line of credit, or other debt.

Missing Payment: A payment that has been made but not credited to the appropriate account.

Mobile Home: To be eligible for coverage under the National Flood Insurance Program, a mobile home must be on a permanent foundation and meet specific anchoring requirements for its location. See the manufactured (mobile) home definition.

Money Market Deposit Account: A savings account that offers a higher rate of interest in exchange for larger than normal deposits. Insured by the FDIC, these accounts have limits on the number of transactions allowed and may require higher balances to receive the higher rate of interest.

Money Market Fund: An open-ended mutual fund that invests in short-term debts and monetary instruments such as Treasury bills and pays money market rates of interest. Money market funds usually offer check writing privileges. They are not insured by the FDIC.

Mutual Fund: These are investment plans that assist in combining funds from numerous participants to buy assets.

Microfinance: It is a group of financial services aimed at people and small companies without access to traditional banking and related services.

Monetary Policy: It relates to the monetary policy of the central bank as well as interest rates and exchange rates.

N

Non-Performing Assets (NPAs): They are bank loans for which interest and/or repayments are not being made on schedule.

Non-sufficient funds (NSF): An account balance too low to cover a check presented for payment.

Near Money: Highly liquid assets that aren’t actual money but can be quickly turned into it makeup near or quasi money.

Net: Gross income which has had tax deducted.

Negotiable Instruments: It is a document that guarantees the payment of a certain sum of money, either immediately upon demand or at a predetermined period, and whose payer is typically identified.

National Bank: A bank that is subject to the supervision of the Comptroller of the Currency. A national bank can be recognized because it must have “national” or “national association” in its name.

National Credit Union Administration (NCUA): The Federal regulatory agency that charters and supervises Federal credit unions. (NCUA also administers the National Credit Union Share Insurance Fund, which insures the deposits of Federal credit unions.

Negotiable Order of Withdrawal Account (NOW): A savings account from which withdrawals can be made by negotiable orders of withdrawal (the functional equivalent of checks). This is an interest-bearing account for which the bank must reserve the right to require the depositor to provide at least seven days’ notice of his/her intent to withdraw funds.

Not Automatically Protected: There are several types of Federal benefits that are not automatically protected under 31CFR 212: Federal benefits received by check rather than direct deposit; Federal benefits received more than two months before the bank received the garnishment order or Federal benefits that were transferred to another bank account. The benefits may be exempt from garnishment but you will have to alert the court or creditor.

O

Overdraft: When money is taken out of a bank account and the available balance falls below zero, it happens. The term “overdrawn” refers to this circumstance.

Overdraft protection: An arrangement made between you and your bank that allows you to withdraw more than the balance in your account without incurring any penalties.

Overdraw: To write a check for an amount that exceeds the amount on deposit in the account.

Over limit: An open-end credit account in which the assigned dollar limit has been exceeded.

Official Check: A check drawn on a bank and signed by an authorized bank official. Also known as a cashier’s check.

Offset, Right of: Banks’ legal right to seize funds that a guarantor or debtor may have on deposit to cover a loan in default. It is also known as the right of setoff.

Online Banking: A service that allows an account holder to obtain account information and manage certain banking transactions through a personal computer via the financial institution’s website on the internet. This is also known as internet or electronic banking.

Open-End Credit: A credit agreement (typically a credit card) that allows a customer to borrow against a preapproved credit line when purchasing goods and services. The borrower is only billed for the amount that is actually borrowed plus any interest due. Also called a charge account or revolving credit.

Options: An agreement for the right to buy or sell a financial asset at an agreed price during a certain time period. If the price of the asset rises, the option buyer can buy it at the agreed lower price and sell it for a profit. On the other hand, if the price drops, the option writer can sell at the agreed price which is now higher, making themselves a profit instead.

Operating Subsidiary: National banks conduct some of their banking activities through companies called operating subsidiaries. These subsidiaries are companies that are owned or controlled by a national bank and that, among other things, offer banking products and services such as loans, mortgages, and leases. The Office of the Comptroller of the Currency supervises and regulates the activities of many of these operating subsidiaries.

Outstanding Check: A check written by a depositor that has not yet been presented for payment to or paid by the depositor’s bank.

P

Permanent Account Number (PAN): It is a number given to taxpayers by the Income Tax department.

Plastic Money: It is the term used to refer to bank-issued credit cards, ATM cards, debit cards, and foreign cards.

Point of Sale (PoS): It indicates the place where a card transaction’s payment is made.

Prime Lending Rate (PLR): It is the interest rate at which a bank lends money to one of its most trustworthy clients, or a client who poses “zero risks.”

Pass Book: All bank transactions are documented in this book. They are typically given to people who have current or savings bank accounts.

Participating Community: A community for which the Federal Emergency Management Agency (FEMA) has authorized the sale of flood insurance under the National Flood Insurance Program (NFIP).

Past Due Item: Any note or other time instrument of indebtedness that has not been paid on the due date.

Payday Loans: A small-dollar, short-term loan that a borrower promises to repay out of their next paycheck or deposit of funds.

Payee: The person or organization to whom a check, draft, or note is made payable.

Paying (Payor) Bank: A bank upon which a check is drawn and that pays a check or other draft.

Payment Due Date: The date on which a loan or installment payment is due. It is set by a financial institution. Any payment received after this date is considered late; fees and penalties can be assessed.

Payoff: The complete repayment of a loan, including principal, interest, and any other amounts due. Payoff occurs either over the full term of the loan or through prepayments.

Payoff Statement: A formal statement prepared when a loan payoff is contemplated. It shows the current status of the loan account, all sums due, and the daily rate of interest.

Payor: The person or organization who pays.

Periodic rate: The interest rate over a specific period of time. A monthly periodic rate is the cost of credit per month. A daily periodic rate is the cost of credit per day, and so forth.

Periodic Statement: The billing summary is produced and mailed at specified intervals, usually monthly.

Personal Identification Number (PIN): A number issued with your debit or credit card so you can withdraw money from ATMs. To help prevent fraud, keep your PIN secret. A PIN should be memorized, and never written down or disclosed to anyone else.

Phishing: The activity of defrauding an online account holder of financial information by posing as a legitimate entity.

PITI: Common acronym for principal, interest, taxes, and insurance—used when describing the monthly charges on a mortgage.

Power of Attorney: A written instrument that authorizes one person to act as another’s agent or attorney. The power of attorney may be for a definite, specific act, or it may be general in nature. The terms of the written power of attorney may specify when it will expire. If not, the power of attorney usually expires when the person granting it dies.

Preauthorized Electronic Fund Transfers: An EFT authorized in advance to recur at substantially regular intervals.

Preauthorized Payment: A system established by a written agreement under which a financial institution is authorized by the customer to debit the customer’s account in order to pay bills or make loan payments.

Preferred Risk Policy (PRP): A policy that offers fixed combinations of building/contents coverage or contents-only coverage at modest, fixed premiums. The PRP generally is available for property located in B, C, and X Zones in Regular Program Communities that meets eligibility requirements based on the property’s flood loss history.

Prepayment: The payment of a debt before it actually becomes due.

Prepayment Clause: A clause in a mortgage allowing the mortgagor to pay off part or all of the unpaid debt before it becomes due.

Prepayment Penalty: A penalty imposed on a borrower for repaying the loan before its due date. In the case of a mortgage, this applies when there is not a prepayment clause in the mortgage note to offset the penalty.

Previous Balance: The cardholder’s account balance as of the previous billing statement.

Principal Balance: The outstanding balance on a loan, excluding interest and fees.

Private Mortgage Insurance (PMI): Insurance offered by a private insurance company that protects the bank against loss on a defaulted mortgage up to the limit of the policy (usually 20 to 25 percent of the loan amount). PMI is usually limited to loans with a high loan-to-value (LTV) ratio. The borrower pays the premium.

PAYE- Pay as you earn: Employers deduct income tax from employees’ paycheques and remit it to the government.

Penny Stock: Originally denoting stocks with less than $1 a share, they now can refer to stocks with more worth but which still operate outside of the major exchanges. They are generally very illiquid.

Portfolio: The collective noun for financial assets held by investors or managed by financial professionals.

Public company: A company that has issued securities through an IPO and consequently the value of their company is determined by the markets.

R

Repo Rate: When commercial banks’ reserves are low, it is common for them to borrow money from the Reserve Bank. It gets more expensive to borrow money from the Reserve Bank if the REPO rate rises, and vice versa.

Reverse Repo Rate: When the Reserve Bank notices that there is an excess of money floating around in the financial system, it borrows money from the banks at a rate that is the opposite of the repo rate.

Routing Number: The first nine numbers that appear at the bottom of a check to identify the financial institution responsible for holding the account.

Real Estate Settlement Procedures Act (RESPA): Federal law that, among other things, requires lenders to provide “good faith” estimates of settlement costs and make other disclosures regarding the mortgage loan. RESPA also limits the number of funds held in escrow for real estate taxes and insurance.

Reconciliation: The process of analyzing two related records and, if differences exist between them, finding the cause and bringing the two records into agreement. Example: Comparing an up-to-date checkbook with a monthly statement from the financial institution holding the account.

Redlining: The alleged practice of certain lending institutions of not making mortgage, home improvement, and small business loans in certain neighborhoods-usually areas that are deteriorating or considered by the lender to be poor investments.

Refinancing: A way of obtaining a better interest rate, lower monthly payments, or borrowing cash on the equity in a property that has built up on a loan. A second loan is taken out to pay off the first, higher-rate loan.

Refund: An amount paid back because of an overpayment or because of the return of an item previously sold.

Regular Program Community: A community wherein a Flood Insurance Rate Map is in effect and full limits of coverage are available under the Flood Disaster Protection Act (FDPA or Act).

Release of Lien: To free a piece of real estate from a mortgage.

Renewal: A form of extending an unpaid loan in which the borrower’s remaining unpaid loan balance is carried over (renewed) into a new loan at the beginning of the next financing period.

Residual Interest: Interest that continues to accrue on your credit card balance from the statement cycle date until the bank receives your payment.

Return Item: A negotiable instrument—principally a check—that has been sent to one bank for collection and payment and is returned unpaid by the sending bank.

Reverse Mortgage: A reverse mortgage is a special home loan product that allows a homeowner aged 62 or older the ability to access the equity that has accumulated in their home. The home itself will be the source of repayment. The loan is underwritten based on the value of the collateral (home) and the life expectancy of the borrower. The loan must be repaid when you die, sell your home, or no longer live there as your principal residence.

Right of Offset: Banks’ legal right to seize funds that a guarantor or debtor may have on deposit to cover a loan in default. It is also known as the right of set-off.

Right of Rescission: Right to cancel, within three business days, a contract that uses the home of a person as collateral, except in the case of a first mortgage loan. There is no fee to the borrower, who receives a full refund of all fees paid. The right of rescission is guaranteed by the Truth in Lending Act (TILA).

Redeem: Repay a financial instrument at its maturity date.

Remittance: Sending money to pay a bill, invoice, tax, or similar.

Retail banks: Banks that provide high street services such as savings accounts and mortgages.

S

Savings account: An interest-bearing deposit account used for storing money, like an emergency fund.

Scheduled transfer: Moving money from one account to another on a regularly recurring basis, often monthly.

Secure Socket Layer (SSL): A type of technology that protects your credit card and personal details when you shop or bank online.

Special Drawing Rights (SDR): It is a reserve asset known as “Paper Gold” that was developed inside the IMF’s framework in an effort to boost global liquidity.

Safe (or Safety) Deposit Box: A type of safe usually located in groups inside a bank vault and rented to customers for their use in storing valuable items.

Safekeeping: A service provided by banks where securities and valuables are protected in the vaults of the bank for customers.

Satisfaction of Mortgage: A document issued by a mortgagee (the lender) when a mortgage is paid in full.

Service Charge: A charge for a service or a penalty for not meeting certain requirements, such as insufficient funds in a checking account.

Simple interest: Interest computed only on the principal balance, without compounding.

Surcharge: An amount charged by the owner of an ATM. This generally applies to out-of-network ATMs.

Signature Card: A card signed by each depositor and customer of a bank which may be used as a means of identification. The signature card represents a contract between the bank and the depositor.

State Bank: A bank that is organized under the laws of a State and chartered by that State to conduct the business of banking.

State Banking Department: The organization in each State that supervises the operations and affairs of State banks.

Statement: A summary of all transactions that occurred over the preceding month and could be associated with a deposit account or a credit card account.

Stop Payment: An order not to pay a check that has been issued but not yet cashed. If requested soon enough, the check will not be debited from the payer’s account. Most banks charge a fee for this service.

Student Loan: Loans made, insured, or guaranteed under any program authorized by the Higher Education Act. Loan funds are used by the borrower for education purposes.

Substitute Check: A substitute check is a paper copy of the front and back of the original check. A substitute check is slightly larger than a standard personal check so that it can contain a picture of your original check. A substitute check is legally the same as the original check if it accurately represents the information on the original check and includes the following statement: “This is a legal copy of your check. You can use it the same way you would use the original check.” The substitute check must also have been handled by a bank. Substitute checks were created under Check 21, the Check Clearing for the 21st Century Act, which became effective on October 28, 2004.

Share index: A measure of change in an economy or securities market.

Shares: Either a financial asset or a unit of ownership interest in a company.

SME: Small and Medium Sized Enterprises.

Speculation: Essentially the same as an investment but with a much higher risk of losing the initial outlay, though with a potential for a very high return. It sometimes has negative connotations such as irresponsibility.

Stocks: The same as shares and equity.

Society for Worldwide Interbank Financial Telecommunications (SWIFT): A system for secure financial transactions such as transfers.

Solvency: When banks have enough money to cover potential losses. Banks are expected to maintain a sufficient level of capital to remain solvent and avoid failure. The FDIC and other federal regulators work with banks to maintain standards for solvency.

T

Terms: The period of time and the interest rate arranged between creditor and debtor to repay a loan.

Total value: The current worth of an account, including funds on hold or pending approval.

Teller: It is a member of the bank’s staff who handles a variety of banking tasks for the bank’s clients, including cashing checks and accepting deposits.

Time Certificate of Deposit: A time deposit evidenced by a negotiable or nonnegotiable instrument specifying an amount and maturity.

Time Deposit: A time deposit is a type of bank deposit. In this deposit, the investor cannot withdraw his funds before a fixed time elapses.

Trust Administrator: A person or institution that manages trust accounts.

Truth in Lending Act (TILA): The Truth in Lending Act is a Federal law that requires lenders to provide standardized information so that borrowers can compare loan terms. In general, lenders must provide information on

-

- what credit will cost the borrowers,

- when charges will be imposed, and

- what the borrower’s rights are as a consumer.

Takeover: When one company buys another company. Occasionally a publicly listed company will be acquired in a hostile takeover against its will when the buying company suddenly buys all the shares.

Tax avoidance: A legal attempt to minimize the amount of tax owed.

Tax evasion: An illegal attempt to minimize the amount of tax owed.

The Treasury: Government department responsible for formulating and implementing financial and economic policy.

Trader: Someone who engages in the transfer of financial assets in a market, but for a much shorter time than an investor.

U

Universal Banking: It is typically referred to as “universal banking” when financial organizations and banks carry out banking-related tasks including investing, issuing debit and/or credit cards, etc.

Uncollected Funds: A portion of a deposit balance that has not yet been collected by the depository bank.

Uniform Commercial Code (UCC): A set of statutes enacted by the various States to provide consistency among the States’ commercial laws. It includes negotiable instruments, sales, stock transfers, trust and warehouse receipts, and bills of lading.

Uniform Gift to Minors Account: A UGMA provides a child under the age of 18 (a minor) with a way to own investments. The money is in the minor’s name, but the custodian (usually the parent) has the responsibility to handle the money in a prudent manner for the minor’s benefit. The parent cannot withdraw the money to use for his or her own needs.

Usury: Charging an illegally high-interest rate on a loan.

Usury Rates: The maximum rate of interest lenders may charge borrowers. The usury rate is generally set by State law.

V

Virtual Banking: Internet banking is also called virtual banking as there are no bricks or boundaries involved. It is mainly operated by the internet.

Variable Rate: Any interest rate or dividend that changes on a periodic basis.

Volatility: Volatility refers to the amount of fluctuation in the price of a security. Generally speaking, the higher the volatility the riskier the investment.

W

Wholesale Banking: With the modest exception that it primarily focuses on the financial requirements of institutional clients and the industry, it is quite similar to retail banking.

Wire Transfer: A transfer of funds from one point to another by wire or network such the Federal Reserve Wire Network (also known as Fed Wire). Wire transfers are guaranteed funds for the recipient, meaning the payment cannot be revoked by the sender after the transfer.

Wall Street (NY Stock Exchange): The original home of the New York Stock Exchange and historic headquarters of the largest US banks. A collective noun for the financial community in NY.

World Bank: An international organization dedicated to aiding developing nations by providing finance, advice, and research.

Y

Yield: The income return on an investment, usually expressed as a percentage based on the investment’s cost.

Z

Zero Coupon Bond: They are sold at a good discount as they have no coupon.

Zero-balance Account: Usually, account holders are required to maintain a certain minimum or average balance in their account. However, banks at times offer accounts that do not have this minimum or average balance requirement. This is a zero-balance account.

Information Sources:

- https://www.toppr.com/guides/commercial-knowledge/common-business-terminologies/banking-terminology/

- https://www.helpwithmybank.gov/glossary/index-glossary.html#z

- https://www.nationwide.com/lc/resources/personal-finance/articles/financial-and-banking-definitions-glossary

- https://www.brightnetwork.co.uk/career-path-guides/investment-banking/glossary-banking-terms-h/

- https://www.forbes.com/advisor/banking/glossary-of-basic-banking-terms/

Library Lecturer at Nurul Amin Degree College