A bank is a financial institution, that deals with money and credit. It is an institution that provides a great variety of financial services. It accepts deposits from the public and mobilizes the fund for productive sectors. It also provides a remittance facility to transfer money from one place to another. Generally, the bank accepts deposits from business institutions and individuals, which are mobilized into productive sectors mainly business and consumer lending. So it is also called a dealer of money. Banks are regulated by the laws and central banks of their home countries; normally they must receive a charter to engage in business. Banks are usually organized as corporations. In the present context, a bank may engage in different types of functions such as remittance, exchange currency, joint venture, underwriting, bank guarantee, discounting bills, etc. In the rest of this article, we are going to know about the definition of a Bank and the types of Banks.

Definitions of Banks:

Different Authors and Economists have given some essential and useful definitions of banks from different perspectives:

“Bank is a financial intermediary institution which deals in loans and advances”— Cairn Cross.

“Bank is an institution which collects idle money temporarily from the public and lends to other people as per need.” — R.P. Kent.

“Bank provides service to its clients and in turn receives perquisites in different forms.” — P.A. Samuelson.

“Bank is such an institution which creates money by money only.” — W. Hock.

“Bank is such a financial institution which collects money in current, savings or fixed deposit account; collects cheques as deposits and pays money from the depositors’ ‟account through cheques.” — Sir John Pagette.

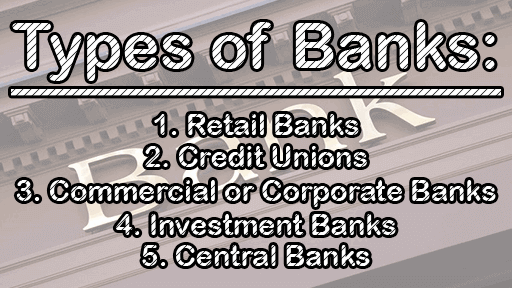

Types of Banks:

- Retail Banks: Retail banking, also known as consumer banking or personal banking, is the provision of services by a bank to the general public, rather than to companies, corporations, or other banks, which is often described as wholesale banking. Banking services that are regarded as retail include the provision of savings and transactional accounts, mortgages, personal loans, debit cards, and credit cards. Retail banking is also distinguished from investment banking or commercial banking. It may also refer to a division or department of a bank that deals with individual customers (Wikipedia).

Retail banks deal specifically with retail consumers, though some global financial services companies contain both retail and commercial banking divisions. These banks offer services to the general public and are also called personal or general banking institutions. Retail banks provide services such as checking and savings accounts, loan and mortgage services, financing for automobiles, and short-term loans such as overdraft protection. Many larger retail banks may also offer their customers credit card and foreign currency exchange services. Larger retail banks also often cater to high-net-worth individuals with specialty services such as private banking and wealth management. Examples of retail banks include TD Bank and Citibank (Investopedia).

- Credit Unions: A credit union is a type of bank that is open to a specific category of people who are eligible for membership. It is member-owned and is operated by the members on the basis of people helping people. Traditionally, credit unions served either residents of a local community, members of a church, employees of a specific company or school, etc.

The ownership structure of credit unions allows them to offer more personalized and lower-cost banking services to their members. Due to their small operating size, credit unions may pay higher interest rates than banks, and customers can build a better relationship with the banking staff. On the downside, the credit unions’ operations are limited, and the customer’s deposits are less accessible (Corporate Finance Institute).

- Commercial or Corporate Banks: Typically, a commercial bank was established for business purposes. Commercial banks were responsible for the creation of modern banking. In the words of Professor Roger, “the bank which deals with money and money’s worth with a view to earning profit is known as “Commercial bank.”

Professor Hart says, “A banker is one who, in the ordinary course of business, honors cheques drawn upon him by persons for and for whom he receives money on the current account.”

Commercial or corporate banks offer specialized services to their business customers, from sole proprietors to major corporations. Along with day-to-day business banking, these banks also provide their clients with credit services, cash management, commercial real estate services, employer services, and trade finance, among other services. JPMorgan Chase and Bank of America are two popular examples of commercial banks, though both have large retail banking divisions as well (Investopedia).

- Investment Banks: Investment banking pertains to certain activities of a financial services company or a corporate division that consist of advisory-based financial transactions on behalf of individuals, corporations, and governments (Wikipedia).

Investment Banks focus on providing corporate clients with complex services and financial transactions such as underwriting and assisting with merger and acquisition (M&A) activity. As such, they are known primarily as financial intermediaries in most of these transactions. Clients commonly range from large corporations, other financial institutions, pension funds, governments, and hedge funds. Morgan Stanley and Goldman Sachs are examples of U.S. investment banks (Investopedia).

- Central Banks: A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a state or formal monetary union, and oversees its commercial banking system (Wikipedia).

The bank which governs the banking system and money market is Central Bank. The primary function of a central bank is to assist Government in formulating economic policy, controlling and conducting the money market, and also controlling the bank’s credit. Some specialized Bankers, Economists, and thinkers have given different definitions:

“A central bank is a bank whose essential duty is to maintain the stability of the monetary standard.”

In the words of Decock, “The central bank is a banking system in which a single bank has either a complete or a residuary monopoly of note issue.”

Professor Hatley says, “Central Bank is the lender of the last resort.”

Central banks are not market-based and don’t deal directly with the general public. Instead, they are primarily responsible for currency stability, controlling inflation and monetary policy, and overseeing a country’s money supply. They also regulate the capital and reserve requirements of member banks. Some of the world’s major central banks include the U.S. Federal Reserve Bank, the European Central Bank, the Bank of England, the Bank of Japan, the Swiss National Bank, and the People’s Bank of China (Investopedia).

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College