Best Ways to Invest in Real Estate:

Real estate has long been considered a lucrative investment avenue, offering the potential for long-term wealth creation and financial stability. However, navigating the vast landscape of real estate investing can be daunting, especially for beginners. This comprehensive guide aims to provide you with a detailed overview of the best ways to invest in real estate, equipping you with the knowledge and tools necessary to make informed investment decisions.

1. Understanding Real Estate Investment:

1.1 Defining Real Estate Investment: Real estate investment refers to the purchase, ownership, management, rental, or sale of real estate properties with the primary goal of generating income or capital appreciation. Real estate can include residential properties (such as houses, apartments, or condominiums), commercial properties (such as office buildings, retail spaces, or warehouses), industrial properties, vacant land, and even properties with specialized uses like hotels or healthcare facilities.

Investing in real estate provides individuals with the opportunity to generate cash flow through rental income, benefit from property value appreciation over time, and diversify their investment portfolio. Real estate investments can offer both short-term returns through rental income and long-term gains through property appreciation.

1.2 Benefits of Investing in Real Estate: Investing in real estate offers several benefits that make it an attractive asset class for many investors. Some key benefits include:

1.2.1 Potential for Appreciation: Real estate has the potential to appreciate in value over time. While the market can fluctuate, well-chosen properties in desirable locations have historically shown long-term value appreciation.

1.2.2 Cash Flow and Passive Income: Rental properties can generate consistent cash flow and provide a steady stream of passive income. The rental income received from tenants can help cover mortgage payments, property maintenance costs, and generate profits.

1.2.3 Portfolio Diversification: Real estate investments have the potential to diversify an investment portfolio. Real estate often exhibits a low correlation with other asset classes like stocks and bonds, which can help reduce overall portfolio risk.

1.2.4 Tax Benefits: Real estate investors can take advantage of various tax benefits. These may include deductions for mortgage interest, property taxes, depreciation, and other property-related expenses. Additionally, 1031 exchanges can allow for the deferral of capital gains taxes when reinvesting in like-kind properties.

1.2.5 Inflation Hedge: Real estate investments can act as a hedge against inflation. As the cost of living increases, rental prices, and property values tend to rise, providing a potential safeguard against the erosion of purchasing power.

1.2.6 Control and Appreciation: Unlike other investment options like stocks, bonds, or mutual funds, real estate investments provide investors with a certain degree of control over their properties. Investors can make strategic improvements, manage rental rates, and implement value-adding strategies to increase property value and cash flow.

1.3 Key Factors to Consider Before Investing: Before diving into real estate investing, it’s crucial to consider several key factors to ensure informed decision-making and maximize the chances of success. These factors include:

1.3.1 Investment Goals: Clarify your investment objectives. Are you looking for long-term capital appreciation, immediate cash flow, or a balance of both? Clearly defining your goals will guide your investment strategy.

1.3.2 Risk Tolerance: Evaluate your risk tolerance level. Real estate investments, like any other investment, carry inherent risks. Assessing your comfort with potential risks, market volatility, and the financial impact of potential losses is essential.

1.3.3 Market Research: Conduct thorough market research to identify favorable locations, growth potential, and market trends. Understanding local market dynamics, demand-supply imbalances, and economic factors can help in making informed investment decisions.

1.3.4 Financial Considerations: Assess your financial situation, including your available capital, creditworthiness, and financing options. Determine your budget and investment capacity, taking into account upfront costs (down payment, closing costs), ongoing expenses (mortgage payments, property management, maintenance), and potential income.

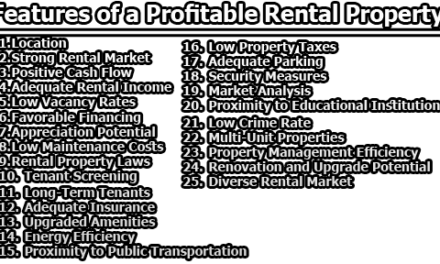

1.3.5 Property Analysis: Perform a detailed analysis of potential properties. Factors to consider include location, property condition, rental market demand, rental rates, vacancy rates, potential renovation or improvement costs, and potential return on investment (ROI). Analyzing these factors will help you determine whether a property aligns with your investment goals and financial capabilities.

1.3.6 Legal and Regulatory Considerations: Familiarize yourself with local laws, regulations, and zoning restrictions related to real estate investments. Ensure compliance with building codes, rental regulations, and any other legal requirements specific to the area where you intend to invest.

1.3.7 Exit Strategy: Develop a clear exit strategy for each investment. Consider factors such as the holding period, potential market conditions, and options for selling or refinancing the property. Having an exit strategy in place will help you make timely decisions and optimize returns.

1.3.8 Property Management: Decide whether you will manage the property yourself or hire a professional property management company. Property management involves tasks such as tenant screening, rent collection, maintenance, and dealing with any legal or tenant-related issues. Assess your capabilities and resources to determine the best approach for managing your investment.

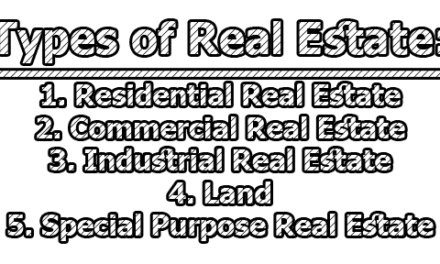

1.4 Types of Real Estate Investments: Real estate offers various investment options, each with its own characteristics, potential returns, and level of involvement. Here are some common types of real estate investments:

1.4.1 Residential Rental Properties: Investing in residential properties for long-term rental income is a popular choice. This can include single-family homes, multi-family properties, apartments, or condominiums. Residential rentals provide stable cash flow and the opportunity for property appreciation.

1.4.2 Commercial Properties: Commercial properties include office buildings, retail spaces, warehouses, and industrial properties. Investing in commercial real estate can offer higher rental income potential, longer lease terms, and the opportunity to work with corporate tenants. However, commercial properties often require a larger initial investment and may involve more complex leasing agreements.

1.4.3 Vacation Rentals: Purchasing properties in popular tourist destinations and renting them out on a short-term basis can be lucrative. Vacation rentals, such as beach houses or mountain cabins, can generate high rental income during peak seasons. However, they may also have higher operating costs and require active management and marketing.

1.4.4 Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate properties. Investing in REITs allows individuals to gain exposure to real estate without directly owning or managing properties. REITs are publicly traded and can be bought and sold on stock exchanges.

1.4.5 Real Estate Crowdfunding: Crowdfunding platforms enable investors to pool their resources to invest in real estate projects. These platforms provide access to a range of properties or development projects, allowing investors to participate with smaller amounts of capital. Crowdfunding offers diversification and the potential for higher returns, but it also carries certain risks.

1.4.6 Real Estate Development: Investing in real estate development involves purchasing land or properties with the intention of developing and selling them for a profit. This strategy requires expertise in market analysis, construction, and project management. Development investments offer the potential for significant returns but also entail higher risks and longer time horizons.

1.4.7 Real Estate Flipping: Flipping involves purchasing properties, renovating or improving them, and selling them quickly for a profit. Successful flipping requires knowledge of the local market, renovation costs, and the ability to identify undervalued properties. Flipping can be highly profitable but involves higher risks and requires active involvement.

2. Residential Real Estate Investment:

2.1 Single-Family Homes:

2.1.1 Advantages and Considerations: Investing in single-family homes involves purchasing properties intended for residential use by a single family or household. Here are some advantages and considerations of investing in single-family homes:

Advantages:

- Broad Market Appeal: Single-family homes attract a wide range of tenants, including families, young professionals, and retirees. This broad market appeal can help reduce vacancy rates and ensure a consistent rental income stream.

- Easier Financing: Financing options for single-family homes are typically more accessible compared to larger commercial properties or multifamily buildings. This makes it easier for individual investors to secure loans and enter the real estate market.

- Potential for Appreciation: Single-family homes, particularly in desirable locations, have the potential for long-term appreciation in value. This can provide significant returns on investment over time.

- Tenant Stability: Families often seek stable, long-term housing arrangements, resulting in potentially longer lease terms and reduced turnover rates. This can lead to consistent rental income and minimize the costs associated with finding new tenants.

Considerations:

- Property Management: Managing multiple single-family homes can be more time-consuming and resource-intensive compared to other types of real estate investments. Each property requires individual attention, including tenant screening, lease management, and property maintenance.

- Higher Vacancy Risk: Single-family homes are susceptible to vacancy risk if a tenant moves out. Unlike multifamily properties, a vacant unit means a complete loss of rental income until a new tenant is secured.

- Limited Economies of Scale: Managing multiple single-family homes may not benefit from economies of scale that can be achieved with larger multifamily properties. Repairs, maintenance, and other property expenses can be costlier on a per-unit basis.

- Market Demand: The demand for single-family homes can vary depending on location and local market conditions. Conduct thorough market research to assess demand, rental rates, and potential occupancy rates.

2.1.2 Financing Options: Financing options for single-family homes include:

- Conventional Mortgages: Traditional mortgages offered by banks and lending institutions are commonly used to finance single-family home investments. These mortgages typically require a down payment (usually 20% of the purchase price) and have varying interest rates and terms.

- FHA Loans: The Federal Housing Administration (FHA) provides loans with lower down payment requirements (as low as 3.5%) and more flexible credit requirements. FHA loans are suitable for first-time investors or those with limited upfront capital.

- Portfolio Loans: Some banks offer portfolio loans specifically for real estate investors. These loans consider the investor’s entire real estate portfolio rather than individual property qualifications, allowing for more flexibility in financing multiple single-family homes.

2.1.3 Managing Single-Family Homes: Managing single-family homes involves several key considerations to ensure smooth operations and maximize returns:

- Tenant Screening: Implement a thorough tenant screening process, including background checks, credit checks, income verification, and rental history. Selecting reliable tenants can minimize the risk of late payments, property damage, and evictions.

- Lease Agreements: Develop comprehensive lease agreements that outline the terms and conditions of the tenancy, including rental payment schedules, maintenance responsibilities, and property rules. Clear and enforceable lease agreements can help prevent disputes and protect the landlord’s interests.

- Property Maintenance: Regularly inspect and maintain the property to ensure it remains in good condition. Promptly address repair requests and conduct preventive maintenance to preserve the property’s value and tenant satisfaction.

- Rent Collection: Establish a reliable system for rent collection, whether it’s through online payment platforms or traditional methods. Consistent rent collection is essential for cash flow management and maintaining a positive landlord-tenant relationship.

- Legal Compliance: Stay updated with local landlord-tenant laws, fair housing regulations, and property maintenance requirements. Adhering to legal requirements is crucial to avoid legal issues and potential penalties. Consider consulting with an attorney or property management professional to ensure compliance.

- Communication and Relationship Building: Foster open communication with tenants to address concerns, resolve issues, and maintain a positive landlord-tenant relationship. Promptly respond to inquiries, provide clear instructions, and address any maintenance or repair needs in a timely manner.

- Insurance Coverage: Obtain appropriate insurance coverage for your single-family homes, including property insurance and liability coverage. Insurance protects against potential damages, natural disasters, and liability claims, providing financial security and peace of mind.

- Accounting and Record-Keeping: Maintain accurate financial records, including rental income, expenses, and tax-related documentation. This facilitates efficient accounting, tax filing, and financial analysis for evaluating the profitability of your single-family home investments.

2.2 Multifamily Properties:

2.2.1 Advantages and Considerations: Investing in multifamily properties involves purchasing buildings or complexes with multiple rental units. Here are some advantages and considerations of investing in multifamily properties:

Advantages:

- Economies of Scale: Managing multiple units within the same property allows for economies of scale. Shared expenses such as maintenance, property management, and utilities can be spread across multiple units, potentially reducing costs and improving profitability.

- Diversification of Income: Multifamily properties with several units provide diversified rental income streams. If one unit becomes vacant, the income from the remaining units can help mitigate the financial impact.

- Professional Management: Multifamily properties often benefit from professional property management services. Hiring experienced property managers can streamline operations, tenant screening, rent collection, and property maintenance.

Considerations:

- Higher Initial Investment: Multifamily properties generally require a higher upfront investment compared to single-family homes. Down payments and financing requirements are typically more substantial. However, the potential for higher returns may offset the initial investment.

- Market Volatility: Multifamily properties may be more sensitive to market fluctuations and economic conditions. Changes in the local rental market, job market, or demographic shifts can impact occupancy rates and rental prices.

- Property Management Complexity: Managing multifamily properties can be more complex than single-family homes. Dealing with multiple tenants, lease agreements, and maintenance requests requires efficient systems and effective communication.

2.2.2 Financing Options: Financing options for multifamily properties include:

- Commercial Mortgages: Commercial mortgages are specifically designed for financing income-generating properties, including multifamily properties. These loans typically have different terms, interest rates, and qualifying criteria compared to residential mortgages.

- Government-Sponsored Enterprises (GSEs): Entities like Fannie Mae and Freddie Mac offer loan programs specifically tailored for multifamily properties. These programs may provide competitive interest rates and favorable terms for eligible borrowers.

2.2.3 Managing Multifamily Properties: Managing multifamily properties involves the following key considerations:

- Effective Property Management: Engage professional property management services or build an experienced in-house management team to handle tenant screening, rent collection, maintenance, and day-to-day operations. A competent property management team can streamline processes, ensure tenant satisfaction, and maximize occupancy rates.

- Lease Administration: Develop comprehensive lease agreements that outline tenant responsibilities, rental rates, lease terms, and property rules. Proper lease administration helps set expectations, enforce policies, and protect the landlord’s interests.

- Maintenance and Repairs: Implement proactive maintenance practices to preserve the property’s condition and minimize potential issues. Respond promptly to maintenance requests, conduct regular inspections, and ensure compliance with safety standards.

- Tenant Retention: Prioritize tenant satisfaction and retention to minimize vacancy rates. Provide quality living conditions, responsive communication, and timely resolution of maintenance issues to encourage long-term tenancy and reduce turnover.

- Financial Management: Maintain accurate financial records, track rental income, and monitor expenses. Establish systems for rent collection, expense management, and financial reporting. Regularly review the financial performance of the property, analyze cash flow, and make necessary adjustments to optimize profitability.

- Market Analysis: Stay informed about local market trends, rental rates, and demographic factors that may impact the demand for multifamily properties. Conduct periodic market analyses to assess competition, identify opportunities for rent increases, and make informed investment decisions.

- Community Development: Foster a sense of community within the multifamily property by organizing social events or providing amenities that encourage tenant interaction and a positive living environment. Building a strong community can contribute to tenant satisfaction, reduce turnover, and enhance the property’s reputation.

2.3 Vacation Rentals:

2.3.1 Advantages and Considerations: Investing in vacation rentals involves purchasing properties in popular tourist destinations and renting them out on a short-term basis. Here are some advantages and considerations of investing in vacation rentals:

Advantages:

- High Rental Income Potential: Vacation rentals can generate substantial rental income, especially during peak seasons when demand is high. Renting out the property on a short-term basis allows for higher nightly rates compared to traditional long-term rentals.

- Personal Use Possibility: Vacation rentals provide the opportunity for the personal use of the property during non-rental periods, allowing owners to enjoy vacationing themselves while generating rental income during other times.

- Location Appreciation: Properties located in desirable vacation destinations often experience appreciation in value over time. As the popularity of the location grows, property values may increase, potentially resulting in capital gains upon resale.

Considerations:

- Seasonal Demand: Vacation rentals are subject to seasonal fluctuations in demand. Depending on the location, there may be high and low seasons where rental income can vary significantly. It’s essential to plan for potential periods of lower occupancy and adjust pricing strategies accordingly.

- Operating Expenses: Vacation rentals typically have higher operating expenses compared to long-term rentals. These can include maintenance, marketing, utilities, furnishings, and management fees. It’s important to factor in these costs when evaluating the profitability of the investment.

- Active Management: Managing vacation rentals requires more active involvement compared to other types of real estate investments. This includes tasks such as marketing, guest communication, booking management, cleaning, and property maintenance.

2.3.2 Financing Options: Financing options for vacation rentals are similar to those for residential properties, including conventional mortgages, FHA loans, and portfolio loans. However, lenders may have specific requirements or restrictions when financing vacation rental properties. It’s advisable to consult with lenders experienced in vacation rental financing to explore suitable options.

2.3.3 Managing Vacation Rentals: Managing vacation rentals requires a comprehensive approach to ensure guest satisfaction and maximize rental income:

- Online Listing Platforms: Advertise the property on popular vacation rentals platforms such as Airbnb, Vrbo, or Booking.com. Create attractive listings with detailed descriptions, high-quality photos, and competitive pricing to attract potential guests.

- Guest Screening: Implement a screening process to vet potential guests, including verifying their identities, checking reviews and ratings from previous hosts, and setting specific guest criteria. This helps ensure responsible and respectful guests, reducing the likelihood of property damage or other issues.

- Property Maintenance: Regularly inspect the property to ensure it meets the expectations of guests. Promptly address maintenance and repair needs, maintain cleanliness, and provide essential amenities to ensure a positive guest experience.

- Guest Communication: Establish clear communication channels with guests to address inquiries, provide check-in instructions, and offer assistance during their stay. Promptly respond to messages or issues that may arise, ensuring guests feel supported and satisfied.

- Pricing and Availability Management: Implement dynamic pricing strategies to optimize rental income based on demand, seasonality, and local events. Adjust pricing accordingly to attract bookings and maximize occupancy rates. Additionally, actively manage the availability calendar to maximize occupancy while allowing sufficient time for property cleaning and maintenance between guest stays.

- Guest Experience Enhancement: Consider adding extra touches and amenities to enhance the guest experience. This can include providing welcome baskets, and guidebooks with local recommendations, and ensuring the property is well-stocked with essential supplies and equipment.

- Housekeeping and Cleaning Services: Depending on the scale of your vacation rental operation, you may opt to hire professional cleaning services to ensure the property is thoroughly cleaned and prepared for each guest’s arrival. Regular inspections can also help maintain cleanliness and identify any necessary repairs or replacements.

- Reviews and Feedback Management: Encourage guests to leave reviews and provide feedback about their experience. Positive reviews can attract more bookings, while constructive feedback helps identify areas for improvement and enhances the overall guest experience.

- Compliance with Local Regulations: Familiarize yourself with local laws and regulations regarding vacation rentals, including zoning restrictions, permit requirements, and tax obligations. Ensure that your rental operations are fully compliant to avoid legal issues and potential penalties.

3. Commercial Real Estate Investment:

3.1 Office Buildings:

3.1.1 Advantages and Considerations: Investing in office buildings involves acquiring properties designed and utilized for professional or business purposes. Here are some advantages and considerations of investing in office buildings:

Advantages:

- Long-Term Lease Agreements: Office leases typically have longer terms compared to residential leases. This can provide stability and a steady income stream for investors, as tenants often sign multi-year leases.

- Higher Rental Income Potential: Office buildings in prime locations can generate higher rental income compared to residential properties. The value of office space is influenced by factors such as location, amenities, and proximity to business hubs.

- Professional Tenants: Office buildings attract professional tenants, such as businesses, corporations, and service providers. These tenants typically have established operations and higher creditworthiness, reducing the risk of rental defaults.

- Potential for Capital Appreciation: Well-located office buildings in thriving business districts have the potential for capital appreciation over time, resulting in increased property value and potential for profitable exits.

Considerations:

- Market Dynamics: Office building investments are influenced by economic conditions, business trends, and local market demand. Changes in the job market, business expansions or contractions, or shifts in industry preferences can impact occupancy rates and rental prices.

- Tenant Turnover: Office tenants may relocate or downsize due to changes in their business needs or market conditions. This can result in periods of vacancy, requiring proactive marketing and tenant acquisition efforts to maintain high occupancy levels.

- Property Maintenance: Office buildings often require regular maintenance, including common area upkeep, security systems, HVAC maintenance, and ongoing repairs. Budgeting for these expenses is essential to maintain the property’s appeal and functionality.

3.1.2 Financing Options: Financing options for office buildings include:

- Commercial Mortgages: Commercial mortgages specifically cater to financing commercial properties, including office buildings. These loans typically have different terms, interest rates, and qualifying criteria compared to residential mortgages.

- SBA Loans: Small Business Administration (SBA) loans are available for eligible borrowers seeking financing for owner-occupied office buildings. SBA loans offer favorable terms and lower down payment requirements, making them attractive to small business owners.

- Private Investors or Equity Partnerships: Investors may consider partnering with private investors or forming equity partnerships to finance office-building acquisitions. This approach allows for shared financial responsibility and potential access to additional capital.

3.1.3 Managing Office Buildings: Managing office buildings involves several key considerations to ensure efficient operations and tenant satisfaction:

- Property Management: Engage professional property management services experienced in commercial real estate to handle tenant relations, lease administration, maintenance, and financial management. Skilled property managers can effectively oversee day-to-day operations, tenant retention, and property upkeep.

- Lease Negotiations: Office leases are typically more complex than residential leases, involving negotiations on rent escalations, lease terms, tenant improvements, and shared expenses. Engage experienced professionals, such as leasing agents or attorneys, to navigate lease negotiations and ensure favorable terms.

- Tenant Relations: Foster positive relationships with tenants by promptly addressing their needs, providing clear communication channels, and offering excellent customer service. Regularly engage with tenants to understand their requirements and proactively address any concerns.

- Property Upkeep: Maintain the office building to high standards to attract and retain tenants. Regularly inspect the property, address maintenance and repair needs promptly, and ensure common areas are well-maintained. Enhance the property’s curb appeal to make a positive impression on current and potential tenants.

- Lease Renewal Strategies: Develop strategies to retain existing tenants and facilitate lease renewals. Stay updated on market rental rates and industry trends to offer competitive lease terms, incentives, and tenant improvements to encourage lease extensions.

- Market Analysis: Stay informed about market trends, including local office market dynamics, supply and demand factors, and rental rates. Conduct periodic market analyses to assess the competitiveness of your office building, identify potential tenant prospects, and make informed decisions regarding lease terms and rental pricing.

3.2 Retail Properties:

3.2.1 Advantages and Considerations: Investing in retail properties involves acquiring properties that are specifically designed and used for retail businesses. Here are some advantages and considerations of investing in retail properties:

Advantages:

- Prime Location Value: Retail properties located in high-traffic areas, commercial districts, or shopping centers have the potential for high visibility and foot traffic. This can attract reputable retail tenants and generate substantial rental income.

- Diverse Tenant Mix: Retail properties often feature a mix of tenants, including retailers, restaurants, service providers, and entertainment venues. This diversification can help mitigate risks associated with tenant turnover and market fluctuations.

- Lease Structure: Retail leases often include a base rent plus a percentage of the tenant’s sales, known as a percentage lease. This structure allows investors to benefit from the success of the tenants and potentially increase rental income as the tenant’s sales grow.

- Consumer Spending Stability: Retail properties tend to be less sensitive to economic downturns compared to other commercial sectors. People continue to spend on essential goods and services, providing a level of stability to retail investments.

Considerations:

- Tenant Dependence: Retail properties are often heavily reliant on the success and stability of their tenants. Changes in consumer preferences, competition, or economic factors can impact tenant viability and occupancy rates.

- Market Competition: The retail sector can be highly competitive, with constant changes in consumer behavior and evolving retail trends. It’s important to stay updated on market trends, analyze the competition, and attract tenants that align with the property’s target market.

- Seasonality: Some retail businesses experience seasonality, with fluctuating sales and foot traffic during different times of the year. This can impact rental income and require strategic planning to manage potential seasonal downturns.

3.2.2 Financing Options: Financing options for retail properties are similar to those for other commercial real estate investments. These can include:

- Commercial Mortgages: Commercial mortgages provide financing for the purchase of retail properties. Lenders typically consider factors such as the property’s location, tenant strength, and rental income potential when evaluating loan applications.

- Small Business Administration (SBA) Loans: SBA loans can be used for owner-occupied retail properties and offer favorable terms for qualified borrowers.

- Private Investors or Equity Partnerships: Collaborating with private investors or forming equity partnerships can provide access to additional capital for retail property acquisitions.

3.2.3 Managing Retail Properties: Managing retail properties requires a comprehensive approach to attract and retain tenants while maintaining a vibrant and profitable shopping environment:

- Tenant Selection: Carefully screen and select tenants based on their retail concept, business viability, financial stability, and compatibility with the property’s target market. Seek tenants that complement each other to create a diverse and appealing tenant mix.

- Lease Negotiations: Engage in lease negotiations to establish favorable terms, including rent escalations, lease duration, and tenant improvement allowances. Consider percentage leases that allow for a percentage of tenant sales in addition to base rent.

- Property Maintenance: Regularly maintain the property’s appearance and functionality to provide an inviting and safe shopping environment. Attend to repairs, cleanliness, landscaping, and parking facilities to enhance the overall tenant and customer experience.

- Marketing and Promotion: Develop marketing strategies to attract customers and enhance the visibility of the retail property. Utilize various channels such as digital marketing, social media, signage, and local advertising to promote the property and its tenants.

- Tenant Relations: Build strong relationships with tenants by establishing open communication channels, addressing their concerns promptly, and fostering a collaborative environment. Encourage tenant involvement in property-related decisions and community initiatives to create a sense of partnership and enhance tenant satisfaction.

- Community Engagement: Foster community engagement by organizing events, promotions, and activities that attract local residents and drive foot traffic to the retail property. Collaborate with tenants to create joint marketing campaigns and community-oriented initiatives that benefit both the property and the surrounding neighborhood.

- Lease Renewals and Tenant Retention: Proactively work with tenants to understand their needs, address any issues or concerns, and develop strategies to encourage lease renewals. Offer incentives, such as rent concessions or tenant improvement allowances, to retain desirable tenants and maintain a stable occupancy rate.

- Competitive Analysis: Stay informed about market trends, retail developments, and competitor activities. Analyze consumer preferences, monitor emerging retail concepts, and adapt the property’s offerings and amenities to meet changing demands and stay competitive in the market.

- Financial Management: Implement effective financial management practices to monitor rental income, operating expenses, and overall property performance. Regularly review financial statements, analyze cash flow, and identify areas for cost optimization and revenue enhancement.

- Security and Safety: Prioritize security measures to ensure the safety of tenants, employees, and customers. Implement surveillance systems, well-lit parking areas, and adequate security personnel to create a secure environment that instills confidence in tenants and visitors.

- Lease Administration: Efficiently manage lease administration, including rent collection, lease renewals, lease enforcement, and compliance with lease terms and regulations. Keep accurate records of lease agreements, tenant correspondence, and important dates to ensure smooth operations and mitigate potential legal issues.

- Adaptability and Flexibility: Retail environments are subject to changing market dynamics and evolving consumer behavior. Stay agile and adaptable by monitoring market trends, anticipating shifts in retail preferences, and being open to reconfiguring spaces or attracting new tenants that align with emerging trends.

Effective management of retail properties requires a blend of strategic planning, proactive tenant engagement, continuous market analysis, and meticulous financial oversight. By implementing these strategies, investors can maximize the potential of their retail investments and create thriving and profitable retail environments.

3.3 Industrial Properties:

3.3.1 Advantages and Considerations: Investing in industrial properties involves acquiring properties specifically designed and used for manufacturing, warehousing, distribution, or logistics purposes. Here are some advantages and considerations of investing in industrial properties:

Advantages:

- High-Demand Sector: Industrial properties are in high demand due to the growth of e-commerce, online retail, and the need for efficient supply chain management. The increasing demand for warehousing and distribution centers creates opportunities for rental income and potential capital appreciation.

- Long-Term Tenant Stability: Industrial leases often have longer terms and stable occupancy due to the logistical challenges and costs associated with relocating industrial operations. Tenants typically require specialized facilities and infrastructure, providing a level of stability for investors.

- Diverse Tenant Base: Industrial properties attract a wide range of tenants, including manufacturers, distributors, wholesalers, and logistics companies. This diversification helps mitigate risks associated with tenant turnover and market fluctuations.

Considerations:

- Location and Accessibility: Industrial properties should be strategically located near transportation hubs, major highways, and industrial zones to attract tenants and facilitate efficient logistics operations. Consider proximity to ports, rail terminals, airports, and major distribution routes.

- Specialized Knowledge: Investing in industrial properties requires understanding the unique requirements and considerations of industrial tenants. Familiarize yourself with zoning regulations, environmental permits, and building specifications to ensure compliance and attract suitable tenants.

- Maintenance and Repairs: Industrial properties may require specialized maintenance and repairs due to the nature of the operations conducted on-site. Regularly inspect the property, address maintenance needs promptly, and ensure compliance with safety regulations and industry standards.

3.3.2 Financing Options: Financing options for industrial properties are similar to those for other commercial real estate investments, including the following:

- Commercial Mortgages: Commercial mortgages are commonly used to finance industrial property acquisitions. Lenders evaluate factors such as the property’s location, condition, tenant strength, and cash flow potential when considering loan applications.

- Small Business Administration (SBA) Loans: SBA loans can be utilized for owner-occupied industrial properties, providing favorable terms and lower down payment requirements for eligible borrowers.

- Private Investors or Equity Partnerships: Partnering with private investors or forming equity partnerships can offer access to additional capital for industrial property investments.

3.3.3 Managing Industrial Properties: Managing industrial properties involves specific considerations to ensure efficient operations and tenant satisfaction:

- Property Maintenance and Upkeep: Maintain industrial properties to high standards to ensure tenant satisfaction and compliance with safety regulations. Regularly inspect the property, address maintenance needs promptly, and prioritize the functionality of industrial infrastructure, such as HVAC systems, electrical equipment, and loading docks.

- Tenant Relations and Lease Management: Foster strong relationships with industrial tenants by providing responsive communication, addressing their needs promptly, and offering lease terms that align with their operational requirements. Understand the unique needs of industrial tenants, such as space configuration, storage capacity, and access to transportation routes.

- Environmental Compliance: Industrial properties may require compliance with environmental regulations and permits due to the nature of the operations conducted on-site. Stay informed about environmental laws, waste management requirements, and potential environmental risks associated with industrial activities.

- Security and Safety: Implement robust security measures to protect industrial properties, considering factors such as access control, surveillance systems, and emergency preparedness. Promote a safe working environment for tenants and employees by adhering to occupational health and safety standards.

- Property Optimization: Continuously assess the property’s layout, infrastructure, and functionality to identify opportunities for improvement and optimization. Consider upgrades or modifications to accommodate changing tenant needs, enhance operational efficiency, and attract high-quality tenants.

- Lease Administration and Financial Management: Efficiently manage lease administration, including rent collection, lease renewals, and compliance with lease terms. Maintain accurate financial records, monitor cash flow, and implement sound financial management practices to maximize the property’s profitability.

4. Rental Properties:

Rental properties offer an opportunity for real estate investors to generate income through tenant rent payments. There are various types of rental properties, each with its own advantages and considerations. Let’s explore three common types of rental properties: traditional long-term rentals, short-term rentals, and rent-to-own properties.

4.1 Traditional Long-Term Rentals:

4.1.1 Advantages and Considerations: Traditional long-term rentals involve leasing residential properties to tenants for an extended period, typically a year or longer. Here are some advantages and considerations of investing in traditional long-term rentals:

Advantages:

- Stable Rental Income: Long-term rentals provide consistent and predictable rental income, offering stability to investors. Monthly rent payments contribute to cash flow and can help cover expenses, mortgage payments, and generate profit.

- Tenant Stability: Long-term leases often result in more stable tenancies as tenants are committed to living in the property for an extended period. This reduces turnover and the associated costs of finding new tenants.

- Property Appreciation: Over time, long-term rental properties have the potential to appreciate in value, providing an opportunity for capital appreciation and wealth accumulation.

- Property Management: Long-term rentals generally require less intensive management compared to other rental types, as tenants tend to be responsible for routine maintenance and repairs.

Considerations:

- Tenant Screening: Thorough tenant screening is crucial to select reliable and responsible tenants. Conduct background checks, verify employment and income, and check references to minimize the risk of tenant defaults or property damage.

- Vacancy Risk: Long-term rentals may experience periods of vacancy between tenants. Account for potential vacancies by maintaining a reserve fund to cover expenses during these periods.

- Property Maintenance: While tenants are responsible for day-to-day maintenance, landlords are typically responsible for major repairs and property upkeep. Regular property inspections and prompt response to maintenance requests are essential for tenant satisfaction and property preservation.

- Rent Control and Regulations: Be aware of local rent control laws and regulations that may affect rental pricing and lease terms. Familiarize yourself with landlord-tenant laws to ensure compliance and protect both your rights and the rights of your tenants.

4.1.2 Financing Options: Financing options for traditional long-term rentals are similar to those for other real estate investments. Consider the following options:

- Conventional Mortgages: Conventional mortgages are widely used to finance long-term rental properties. Lenders typically assess factors such as the property’s value, rental income potential, borrower’s creditworthiness, and down payment when evaluating loan applications.

- Private Financing: Private lenders or investors may provide financing for long-term rental properties, offering flexible terms and potentially faster approval processes.

- Home Equity: If you already own a property, you may leverage your home equity to finance the purchase of additional rental properties.

4.1.3 Managing Long-Term Rentals: Managing long-term rentals requires effective property management to ensure tenant satisfaction and maximize investment returns. Here are some key considerations:

- Tenant Relations: Foster positive relationships with tenants by providing clear communication, addressing their concerns promptly, and ensuring a safe and comfortable living environment.

- Lease Agreements: Use well-drafted lease agreements that outline tenant responsibilities, rent payment terms, and property rules. Establish policies regarding rent increases, lease renewals, and maintenance obligations.

- Rent Collection: Implement a reliable rent collection system to ensure timely payment of rent. Use online payment platforms or set up direct debit options for convenience and efficiency.

- Property Maintenance: Regularly inspect the property to identify maintenance needs and address them promptly. Maintain the property’s condition, including repairs, landscaping, and necessary upgrades, to attract and retain tenants.

- Financial Management: Keep detailed financial records, including rental income, expenses, and tax documentation. Implement sound financial management practices to monitor cash flow, track expenses, and maximize profitability in long-term rentals. Here are additional strategies for managing long-term rental properties effectively:

- Tenant Screening: Implement a thorough tenant screening process to select reliable and responsible tenants. Conduct background checks, verify income and employment, and contact references to assess their suitability as long-term tenants.

- Lease Renewals: Actively engage with tenants nearing the end of their lease to discuss lease renewal options. Offer incentives, such as lease extensions or rent discounts, to encourage tenants to renew their lease, minimizing vacancies and turnover.

- Property Inspections: Conduct regular property inspections to ensure compliance with lease terms and identify any maintenance or repair needs. Promptly address issues raised by tenants to maintain a safe and comfortable living environment.

- Tenant Communication: Establish effective channels of communication with tenants, such as email, phone, or online portals, to address their inquiries, concerns, and maintenance requests promptly. Foster open and transparent communication to build trust and enhance tenant satisfaction.

- Rent Increases: Evaluate market trends and rental rates in the area to determine appropriate rent increases. Communicate rent increases to tenants in advance, following local regulations and lease terms, and provide justifications for the adjustments.

- Legal Compliance: Stay informed about local, state, and federal landlord-tenant laws to ensure compliance. Familiarize yourself with fair housing regulations, eviction procedures, and safety requirements to protect both your interests and those of your tenants.

- Insurance Coverage: Obtain appropriate insurance coverage for your rental property, including landlord insurance, liability insurance, and coverage for potential property damage or loss. Regularly review and update your insurance policies to mitigate risks effectively.

- Property Upgrades: Assess the property periodically to identify potential upgrades or improvements that can enhance its desirability and rental value. Consider renovations, energy-efficient features, or amenities that appeal to tenants and increase the property’s competitive advantage.

- Professional Property Management: If managing the property becomes overwhelming or if you prefer to focus on other aspects of your real estate portfolio, consider hiring a professional property management company. They can handle day-to-day operations, tenant relations, maintenance, and financial management on your behalf.

By implementing these strategies, landlords can effectively manage their long-term rental properties, maximize occupancy rates, and ensure a positive rental experience for their tenants.

4.2 Short-Term Rentals:

4.2.1 Advantages and Considerations: Short-term rentals, also known as vacation rentals or Airbnb rentals, involve renting out a property to guests for shorter durations, typically ranging from a few nights to a few weeks. Here are some advantages and considerations of investing in short-term rentals:

Advantages:

- Higher Rental Income Potential: Short-term rentals often generate higher rental income compared to long-term rentals. Depending on the location and demand, short-term rentals can command higher nightly rates, especially during peak travel seasons.

- Flexibility and Use: Short-term rentals offer flexibility for property owners to use the property themselves when it’s not rented. Owners can enjoy personal use of the property during specific periods while still generating income from rentals.

- Market Demand and Seasonality: Popular travel destinations or areas with high tourism demand can provide lucrative opportunities for short-term rentals. Seasonal fluctuations in demand can allow property owners to adjust rental rates accordingly.

Considerations:

- Market Demand and Competition: Research the local market to assess the demand for short-term rentals and the level of competition. Consider factors such as tourist attractions, events, and the availability of other accommodation options in the area.

- Regulations and Zoning: Understand the local regulations, zoning restrictions, and any legal requirements related to short-term rentals. Some areas have specific regulations governing vacation rentals, such as permits, licensing, or occupancy limits.

- Property Management and Turnover: Short-term rentals require more active management, including guest communications, cleaning, and regular turnovers between guests. Consider the logistics and costs associated with managing the property, such as cleaning services, maintenance, and coordinating check-ins and check-outs.

4.2.2 Financing Options: When financing a short-term rental property, consider the following options:

- Conventional Mortgages: Traditional mortgages can be used to finance short-term rental properties. However, lenders may have specific requirements for properties used as vacation rentals, so it’s important to communicate your intentions to the lender.

- Vacation Rental Loans: Some lenders offer specialized vacation rental loans designed specifically for short-term rental properties. These loans may have different terms and requirements compared to traditional mortgages.

- Home Equity Loans or Lines of Credit: If you already own a property, you can tap into your home equity through a home equity loan or line of credit to finance a short-term rental property.

4.2.3 Managing Short-Term Rentals: Effective management is crucial for successful short-term rentals. Here are some strategies to consider:

- Listing and Marketing: Create an appealing listing with high-quality photos, accurate property descriptions, and competitive pricing. Leverage online platforms and channels, such as Airbnb, VRBO, or other vacation rental websites, to reach a broader audience.

- Guest Communication: Maintain prompt and professional communication with guests, promptly responding to inquiries, providing information about the property and local attractions, and addressing any concerns or issues during their stay.

- Property Cleaning and Maintenance: Ensure the property is clean and well-maintained between guest stays. Establish a reliable cleaning schedule and consider hiring professional cleaning services to maintain high standards.

- Check-in and Check-out Procedures: Streamline the check-in and check-out process for guests. Provide clear instructions, access codes, and keyless entry options if possible. Consider implementing self-check-in procedures to provide flexibility and convenience.

- Guest Reviews and Feedback: Encourage guests to leave reviews and feedback after their stay. Positive reviews can enhance your property’s reputation and attract more bookings. Address any negative feedback constructively to continuously improve the guest experience.

- Property Security: Implement appropriate security measures to ensure the safety of guests and protect the property. Install secure locks, provide emergency contact information, and consider using smart home technology for added convenience and security.

- Compliance with Regulations: Stay updated on local regulations and laws governing short-term rentals. Ensure compliance with permits, taxes, occupancy limits, and other legal requirements to avoid any penalties or issues.

- Pricing and Revenue Management: Continuously monitor market trends, local events, and demand fluctuations to adjust your pricing strategy. Consider implementing dynamic pricing techniques to optimize rental income based on demand and seasonality.

- Guest Experience and Amenities: Provide a positive guest experience by offering amenities that enhance their stay. Consider amenities such as Wi-Fi, fully equipped kitchens, comfortable furnishings, and thoughtful touches that cater to their needs.

Successful management of short-term rentals requires attentiveness, responsiveness, and attention to detail. By providing a memorable guest experience and maintaining a well-managed property, you can maximize occupancy rates, rental income, and guest satisfaction.

4.3 Rent-to-Own Properties:

4.3.1 Advantages and Considerations: Rent-to-own properties, also known as lease-to-own or lease-purchase properties, provide an alternative path to homeownership for tenants who may not be ready to purchase a home immediately. Here are some advantages and considerations of investing in rent-to-own properties:

Advantages:

- Potential Higher Rental Income: Rent-to-own properties typically command higher rental rates compared to traditional long-term rentals. This higher income can help offset the property expenses and potentially provide a future purchase price premium if the tenant exercises the option to buy.

- Future Sale Potential: Rent-to-own properties offer the potential for a future sale to the tenant-buyer. If the tenant chooses to exercise the purchase option, you can benefit from the appreciation of the property’s value over the rental period.

- Tenant-Buyer Responsibility: During the rental period, the tenant assumes responsibility for maintenance and repairs, reducing your obligations as the landlord. This can help minimize your expenses and management responsibilities.

Considerations:

- Tenant Qualification: Thoroughly screen potential tenant-buyers to ensure they have the financial capacity and willingness to fulfill the terms of the lease and exercise the purchase option. Assess their creditworthiness, income stability, and commitment to homeownership.

- Legal and Documentation: Work with legal professionals to draft clear and comprehensive lease-purchase agreements that outline the terms, conditions, purchase price, and timeline for the tenant-buyers option to buy. Ensure compliance with applicable laws and regulations governing rent-to-own transactions.

- Property Maintenance: Although the tenant assumes responsibility for maintenance, it’s important to maintain regular communication and periodic inspections to ensure the property is well-maintained. Establish clear guidelines regarding the tenant’s maintenance obligations.

- Market Conditions: Consider the local real estate market conditions and property appreciation potential when setting the purchase price and rental rates. Monitor market trends to ensure the agreed-upon purchase price aligns with the property’s current market value.

- Tenant-Buyer Financing: Be aware that the tenant-buyers ability to secure financing at the end of the lease term is crucial for the successful completion of the purchase. It’s advisable to work with a mortgage professional who can guide the tenant-buyer through the financing process.

- Flexibility and Risks: Rent-to-own agreements involve some level of uncertainty and risks. The tenant may choose not to exercise the purchase option, leaving you with the property and the need to find new tenants. Mitigate these risks by setting clear terms and evaluating the tenant-buyers commitment.

4.3.2 Financing Options: When financing a rent-to-own property, consider the following options:

- Seller Financing: As the property owner, you may choose to offer financing to the tenant-buyer. This can provide flexibility and potentially attract more buyers who may not qualify for traditional mortgages.

- Lease-Option Fee: Consider charging a non-refundable lease-option fee, separate from the security deposit, which the tenant pays upfront. This fee can serve as additional income and may be credited toward the down payment or purchase price if the tenant exercises the option to buy.

- Traditional Financing: If the tenant-buyer intends to secure traditional financing, work with them to ensure they have a clear plan and understanding of the requirements and timelines involved in obtaining a mortgage.

4.3.3 Managing Rent-to-Own Properties: Managing rent-to-own properties requires careful attention to ensure a smooth transition from tenant to owner. Here are some key considerations:

- Clear Communication: Maintain open and transparent communication with the tenant-buyer throughout the lease term. Clarify expectations, timelines, and the process for exercising the purchase option. Discuss any concerns or questions they may have.

- Documentation and Agreements: Ensure all lease-purchase agreements and legal documents are properly prepared and executed. Clearly outline the terms, including the rental amount, option fee, purchase price, and any applicable credits or incentives.

- Property Inspections: Conduct periodic property inspections to assess the tenant-buyers maintenance of the property. Address any issues promptly to protect the property’s condition and value.

- Financial Management: Keep accurate records of rental payments, lease-option fees, and any other financial transactions related to the rent-to-own agreement. Maintain transparency and provide periodic statements to the tenant-buyer.

- Tenant-Buyer Support: Guide the tenant-buyer through the financing process by providing resources and connections to mortgage professionals who can assist them in securing a mortgage. Ensure they understand the steps involved and offer support as needed.

- Option Exercise: If the tenant chooses to exercise the purchase option, follow the agreed-upon process outlined in the lease-purchase agreement. Work closely with the tenant-buyer and their lender to facilitate a smooth transition to homeownership.

- Property Transfer: Once the tenant-buyer secures financing and is ready to purchase the property, facilitate the transfer of ownership. Work with legal professionals to ensure all necessary documentation, such as a sales contract and deed, is prepared accurately.

- Property Condition: Before the transfer of ownership, conduct a final property inspection to assess its condition and address any outstanding maintenance or repair issues. Ensure the property is in the agreed-upon condition as stipulated in the lease-purchase agreement.

- Closing Process: Guide the tenant-buyer through the closing process, including coordinating with their lender, escrow, and title companies. Ensure all required documents are properly executed and funds are transferred smoothly.

- Post-Sale Support: Even after the sale is complete, offer support and guidance to the new homeowners as they settle into their new property. Provide information about local resources, utility providers, and any warranties or guarantees associated with the property.

Rent-to-own properties require diligent management to ensure successful outcomes for both parties involved. By maintaining clear communication, proper documentation, and proactive property management, you can effectively navigate the rent-to-own process and facilitate a smooth transition from tenant to owner.

5. Real Estate Investment Trusts (REITs):

5.1 Understanding REITs: A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate properties. REITs offer investors an opportunity to invest in real estate without the need for direct property ownership. They pool investors’ capital to invest in a diversified portfolio of real estate assets, such as commercial properties, residential complexes, office buildings, hotels, or shopping centers.

REITs are required to distribute a significant portion of their taxable income to shareholders in the form of dividends, which makes them attractive for income-oriented investors. They are subject to certain regulations and must meet specific criteria to qualify as a REIT, including having a minimum percentage of assets invested in real estate and distributing a substantial portion of their income to shareholders.

5.2 Advantages and Considerations:

Advantages of investing in REITs include:

- Diversification: REITs provide investors with exposure to a diversified portfolio of real estate assets across different sectors and geographic locations. This diversification can help reduce risk compared to investing in a single property or location.

- Liquidity: REITs are publicly traded on stock exchanges, making them a liquid investment. Investors can easily buy or sell REIT shares, providing flexibility and accessibility.

- Income Generation: REITs are required to distribute a significant portion of their income as dividends to shareholders. This feature makes them an attractive investment for those seeking regular income.

- Professional Management: REITs are managed by professional teams with expertise in real estate acquisition, operation, and management. Investors benefit from the experience and knowledge of these professionals.

- Potential for Capital Appreciation: In addition to dividend income, REITs have the potential for capital appreciation if the value of the underlying real estate properties increases over time.

Considerations when investing in REITs include:

- Market Risks: REITs are subject to market risks, including fluctuations in real estate values, interest rates, and overall economic conditions. These factors can impact the performance of REITs and the value of their shares.

- Dividend Risk: The dividend income from REITs can vary over time based on the performance of the underlying properties. Economic downturns or specific property-related issues can affect the ability of a REIT to generate consistent dividends.

- Management Quality: The performance of a REIT depends on the quality of its management team. It’s essential to research the track record and expertise of the management team before investing.

- Tax Considerations: Dividends received from REITs may be subject to different tax treatment compared to other investments. Consult with a tax professional to understand the tax implications of investing in REITs.

5.3 Types of REITs: There are several types of REITs, each with its own investment focus and specialization:

- Equity REITs: The most common type of REIT, equity REITs invest in and own income-generating properties. They generate income from property rentals, leasing, and property sales. Equity REITs typically focus on specific sectors such as residential, commercial, industrial, or retail properties.

- Mortgage REITs: Mortgage REITs invest in real estate mortgages or mortgage-backed securities. They generate income through the interest earned on these investments. Mortgage REITs are more focused on the financing aspect of real estate rather than property ownership.

- Hybrid REITs: Hybrid REITs combine elements of both equity and mortgage REITs. They invest in both properties and mortgages, providing investors with a diversified approach to real estate investing.

- Publicly Traded REITs: These REITs are listed on major stock exchanges and can be purchased and sold like stocks. They offer liquidity and the opportunity for broader ownership among individual investors.

- Non-Traded REITs: Non-traded REITs are not listed on public exchanges, and their shares are typically sold through broker-dealers or investment advisors. They may have limited liquidity compared to publicly traded REITs and often have specific holding periods before investors can redeem their shares.

- Sector-Specific REITs: Some REITs specialize in specific sectors, such as healthcare, hospitality, data centers, or self-storage facilities. These REITs focus their investments on a particular industry or asset class, allowing investors to target specific segments of the real estate market.

5.4 Investing in REITs: When investing in REITs, consider the following:

- Research and Due Diligence: Conduct thorough research on the REIT, including its management team, track record, investment strategy, and performance history. Review financial statements, annual reports, and prospectuses to gain insights into the REIT’s operations and investment portfolio.

- Investment Goals and Risk Tolerance: Determine your investment goals, whether it’s generating income, capital appreciation, or a combination of both. Assess your risk tolerance and align it with the volatility and potential risks associated with investing in REITs.

- Diversification: Consider diversifying your portfolio by investing in a mix of REITs across different sectors and geographic locations. This diversification can help spread risk and potentially enhance returns.

- Dividend Reinvestment Plans (DRIPs): Some REITs offer dividend reinvestment plans, allowing shareholders to automatically reinvest their dividends into additional shares of the REIT. DRIPs can help compound returns over time.

- Monitor Performance: Regularly monitor the performance of the REIT and review its financial statements and reports. Stay updated on any changes in the market, the overall real estate sector, or specific factors that may impact the REIT’s performance.

- Consult with Professionals: Consider consulting with financial advisors, real estate professionals, or investment professionals who specialize in REITs. They can provide valuable insights, guidance, and help you make informed investment decisions.

It’s important to note that investing in REITs involves risks, including the potential for loss of capital and fluctuations in dividend income. Investors should carefully assess their financial situation, investment goals, and risk tolerance before investing in REITs. Consider consulting with a financial advisor or investment professional to determine if REITs align with your overall investment strategy.

6. Real Estate Crowdfunding:

6.1 Introduction to Real Estate Crowdfunding: Real estate crowdfunding is a relatively new method of investing in real estate that utilizes online platforms to pool funds from multiple investors to finance real estate projects. It allows individual investors to participate in real estate investments that were traditionally limited to institutional investors or high-net-worth individuals. Real estate crowdfunding platforms connect investors with real estate developers or operators seeking capital for their projects.

6.2 Platforms and Regulations: There are various real estate crowdfunding platforms available, each with its own investment focus, structure, and requirements. These platforms act as intermediaries, facilitating the investment process and providing a marketplace for investors and real estate developers to connect. It’s important to research and evaluates different platforms based on factors such as track record, transparency, due diligence process, and investment opportunities.

Real estate crowdfunding is subject to regulations to protect investors. In many countries, including the United States, crowdfunding activities are governed by securities regulations. The specific regulations and requirements may vary depending on the jurisdiction. It’s crucial for both investors and platform operators to comply with applicable securities laws, including registration, disclosure, and investor protection requirements.

6.3 Benefits and Considerations: Benefits of investing in real estate crowdfunding include:

- Access to Diversified Investment Opportunities: Real estate crowdfunding provides access to a wide range of real estate projects across different locations, types, and risk profiles. Investors can diversify their portfolios by investing in multiple projects and spreading risk.

- Lower Capital Requirements: Real estate crowdfunding allows investors to participate in real estate projects with lower capital requirements compared to direct property ownership. This makes real estate investment more accessible to a broader range of investors.

- Transparency and Information: Crowdfunding platforms typically provide detailed information about investment opportunities, including project details, financial projections, and risk factors. This transparency helps investors make informed investment decisions.

- Passive Investment: Investing through crowdfunding platforms enables investors to take a passive role in real estate projects. The platform manages the investment process, property management, and reporting, reducing the investors’ involvement and administrative responsibilities.

- Potential for Returns: Real estate crowdfunding offers the potential for attractive returns through rental income, property appreciation, or profit sharing. However, it’s important to assess the projected returns and associated risks for each investment opportunity.

Considerations when investing in real estate crowdfunding include:

- Risk Assessment: Conduct thorough due diligence on the investment opportunities presented on the crowdfunding platform. Assess the project’s feasibility, market conditions, developer’s track record, and potential risks associated with the investment.

- Platform Selection: Choose reputable and reliable crowdfunding platforms that have a track record of successful projects, strong due diligence processes, and transparent reporting. Research the platform’s history, investor reviews, and regulatory compliance.

- Investment Horizon: Consider the investment horizon and lock-up periods associated with real estate crowdfunding. Some investments may have longer holding periods, limiting liquidity compared to other investment options.

- Platform Fees: Understand the fee structure of the crowdfunding platform, including any upfront fees, management fees, or performance-based fees. Evaluate the impact of these fees on potential returns.

- Regulatory Compliance: Ensure that both the crowdfunding platform and the investment opportunities comply with applicable securities regulations in your jurisdiction. Verify that the platform has the necessary licenses and registrations to operate legally.

6.4 Investing in Real Estate Crowdfunding: When investing in real estate crowdfunding, follow these steps:

- Research Platforms: Research different crowdfunding platforms and select a reputable platform that aligns with your investment goals, risk tolerance, and preferred investment types.

- Due Diligence: Conduct thorough due diligence on each investment opportunity presented on the platform. Review project details, financial projections, market analysis, and the track record of the developers or operators involved.

- Risk Assessment: Evaluate the potential risks associated with the investment, such as market risks, construction risks, regulatory risks, and the financial stability of the project. Consider the location, demand drivers, and the project’s feasibility in relation to market conditions.

- Investment Allocation: Determine the amount of capital you are willing to invest in real estate crowdfunding and diversify your investments across different projects to spread risk. Consider your overall investment portfolio and ensure that real estate crowdfunding aligns with your investment strategy.

- Understand Terms and Returns: Review the terms of the investment, including the expected returns, holding period, and any profit-sharing arrangements. Understand the risks and potential rewards associated with the investment opportunity.

- Monitor Investments: Once you have invested in a project, actively monitor the progress and performance of the investment. Stay informed about project updates, financial reports, and any changes that may impact your investment.

- Exit Strategy: Evaluate the exit strategy for each investment. Some projects may have a predetermined exit plan, such as property sale or refinancing, while others may have longer holding periods. Understand the potential liquidity and exit options available.

- Seek Professional Advice: Consider consulting with financial advisors, real estate professionals, or legal experts who specialize in real estate crowdfunding. They can provide guidance, help assess investment opportunities, and ensure compliance with regulations.

It’s important to note that real estate crowdfunding carries inherent risks, including the potential loss of invested capital. Investors should carefully assess each investment opportunity, conduct thorough due diligence, and diversify their investments to mitigate risks. Real estate crowdfunding should be considered as part of a well-rounded investment strategy, taking into account individual financial goals, risk tolerance, and time horizon.

7. Fix and Flip Strategy:

7.1 Understanding Fix and Flip Strategy: The fix and flip strategy involves purchasing a property, renovating it to improve its value, and then selling it for a profit. It is a short-term investment strategy that requires careful property selection, accurate renovation cost estimation, effective project management, and a market with strong demand for renovated homes.

7.2 Identifying Properties for Fix and Flip: When identifying properties for fix and flip projects, consider the following:

- Location: Choose properties in desirable locations with strong market demand and potential for appreciation. Look for neighborhoods with amenities, good schools, transportation access, and a stable real estate market.

- Purchase Price: Identify properties that can be acquired at a favorable price, allowing room for renovation costs and profitable resale. Look for distressed properties, foreclosures, auctions, or properties in need of significant repairs.

- Market Analysis: Analyze the local market to understand the demand for renovated properties. Consider factors such as recent sales prices, comparable properties, market trends, and the potential selling price after renovations.

- Property Condition: Assess the property’s condition and identify its renovation needs. Look for properties with cosmetic issues or minor structural problems that can be fixed within a reasonable budget and timeline.

7.3 Assessing Renovation Costs: Accurately estimating renovation costs is crucial for the success of a fix-and-flip project. Consider the following factors:

- Property Inspection: Conduct a thorough inspection of the property to identify all necessary repairs and renovations. Engage professionals, such as contractors or architects, to assess the property’s condition and provide cost estimates.

- Renovation Plan: Develop a detailed renovation plan that outlines the scope of work, materials required, and associated costs. Break down the costs into categories such as structural repairs, cosmetic upgrades, electrical/plumbing work, and landscaping.

- Contingency Fund: Allocate a contingency fund to account for unexpected expenses or unforeseen issues that may arise during the renovation process. It is recommended to set aside 10-20% of the total renovation budget for contingencies.

- Contractor Bids: Obtain multiple bids from licensed and reputable contractors to ensure competitive pricing. Compare the bids, review the contractor’s qualifications, and select the one that offers the best combination of quality work and reasonable pricing.

7.4 Financing Fix and Flip Projects: Fix and flip projects require financing to cover the purchase price, renovation costs, and other associated expenses. Several financing options are available, including:

7.4.1 Traditional Financing Options:

- Conventional Loans: Traditional mortgage loans can be used to finance fix and flip projects, especially if the investor intends to hold the property for a longer period before selling. These loans often require a good credit score, a down payment, and proof of income.

- Home Equity Line of Credit (HELOC): If you own a property with equity, you can consider tapping into a HELOC to finance the purchase and renovations of the fix and flip property. HELOCs allow you to borrow against the equity in your existing property.

7.4.2 Hard Money Loans: Hard money loans are a common financing option for fix and flip investors. These loans are typically provided by private lenders or companies that specialize in real estate investing. Key features of hard money loans include:

- Speed and Convenience: Hard money lenders can provide funding quickly, often within a few days, allowing investors to seize opportunities promptly.

- Asset-Based Lending: Hard money loans are secured by the property itself, with less emphasis on the borrower’s creditworthiness. The loan amount is based on a percentage of the property’s after-repair value (ARV).

- Higher Interest Rates and Fees: Hard money loans usually come with higher interest rates and fees compared to traditional financing options. These costs are associated with the convenience and speed of obtaining the loan, as well as the higher risk associated with fix and flip projects.

- Short-Term Loans: Hard money loans are typically short-term loans with a duration of 6 months to 2 years. This aligns with the timeline of a fix-and-flip project, allowing investors to complete the renovation and sale within the loan term.

- Loan-to-Value (LTV) Ratio: Hard money lenders often offer loans based on a percentage of the property’s ARV, typically ranging from 70% to 90% of the ARV. The ARV is the estimated value of the property after renovations.

- Points and Fees: Hard money loans may include points, which are upfront fees calculated as a percentage of the loan amount. Additionally, lenders may charge origination fees and other closing costs. It’s essential to consider these costs when evaluating the profitability of the fix and flip project.