Captive Real Estate Investment Trusts (REITs):

Captive Real Estate Investment Trusts (REITs) represent a unique and specialized approach to real estate investment and management. Unlike traditional REITs that focus on diversification across various tenants and property types, captive REITs are designed to cater specifically to the real estate needs of a single tenant or a small group of related tenants. The concept of captive REITs revolves around providing dedicated real estate services to a specific organization or industry. These REITs are established by large corporations, financial institutions, or private equity firms to efficiently manage their real estate assets and provide a dedicated solution for their real estate requirements.

Differentiating Captive REITs from Traditional REITs:

There are several key differences between captive REITs and traditional REITs. Some of them are as follows:

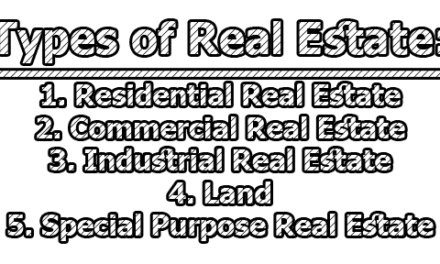

- Property Focus: Traditional REITs have diversified portfolios that encompass various property types such as residential, commercial, industrial, and retail. Captive REITs, on the other hand, focus primarily on properties that serve the needs of a single tenant or a specific industry.

- Tenant Concentration: Traditional REITs aim to minimize tenant concentration risk by diversifying their tenant base. Captive REITs intentionally concentrate their holdings on a limited number of tenants or even a single tenant, resulting in a higher level of tenant concentration risk.

- Customization: Captive REITs acquire or develop properties that are tailored to meet the specific requirements of the tenant(s) they serve. This may involve constructing specialized facilities or adapting existing properties to suit the unique needs of the tenant(s).

- Lease Agreements: Traditional REITs typically enter into lease agreements with multiple tenants, which often have varying terms and conditions. Captive REITs usually have long-term lease agreements with their primary tenant(s), providing stability and predictable rental income.

- Strategic Alignment: Captive REITs are specifically designed to align the real estate assets with the core business operations of the tenant(s). This alignment ensures that the properties effectively support the tenant’s operations and strategic objectives.

- Ownership Relationship: Traditional REITs are commonly publicly traded entities, allowing investors to buy shares and participate in the ownership of the portfolio. Captive REITs are often privately held and established by a related entity or parent company, maintaining a closer ownership relationship.

- Investment Criteria: Traditional REITs have broader investment criteria and may target properties across different geographic locations and markets. Captive REITs focus on properties that directly serve the real estate needs of a specific tenant or industry, limiting their investment scope.

- Market Exposure: Traditional REITs provide investors with exposure to a diverse range of properties and tenants, spreading risks across different markets and industries. Captive REITs have a narrower market exposure, primarily tied to the performance and stability of their specific tenant(s) and industry.

- Risk Profile: Traditional REITs may offer a more diversified risk profile due to their broad property and tenant base. Captive REITs, with their tenant concentration and dependency, may carry higher risks related to the financial health and stability of the primary tenant(s).

- Exit Strategies: Traditional REITs generally offer more liquid exit strategies for investors, such as selling shares on the public market. Captive REITs, being privately held and specialized, may have limited exit options, potentially requiring a negotiated sale or transfer of ownership.

Captive REIT Structure and Key Participants:

The structure of a captive Real Estate Investment Trust (REIT) involves several key participants who play vital roles in the operation and management of the REIT. These participants work together to acquire, manage, and lease real estate properties tailored to the specific needs of a single tenant or a small group of related tenants. Here is a brief breakdown of the captive REIT structure and its key participants:

a. Sponsor: The sponsor is the entity that establishes the captive REIT and provides the initial capital required to acquire or develop the real estate assets. The sponsor is typically a large corporation, financial institution, or private equity firm that has a significant real estate need and intends to benefit from the captive REIT structure. The sponsor often acts as the driving force behind the formation of the captive REIT and may be the parent company or a related entity to the tenant(s) that the REIT will serve.

b. REIT Entity: The captive REIT is organized as a separate legal entity, often structured as a trust, to hold and manage the real estate assets on behalf of the tenant(s). The REIT entity complies with the regulations and requirements set forth for REITs, including tax-related provisions. It serves as the vehicle through which the properties are owned and operated. The REIT entity’s main purpose is to generate rental income from the leased properties and distribute it to the REIT’s investors.

c. Property Manager: The property manager is responsible for the day-to-day operations and management of the real estate assets owned by the captive REIT. Their role involves tasks such as property maintenance, tenant relations, lease negotiations, rent collection, and property improvements. The property manager ensures that the properties are well-maintained, meet the needs of the tenant(s), and comply with regulatory requirements. In some cases, the sponsor or a related entity may also act as the property manager.

d. Tenant(s): The tenant(s) are the primary occupiers of the properties owned by the captive REIT. They enter into lease agreements with the REIT entity, establishing the terms and conditions for the occupancy of the properties. The tenant(s) may be a single company or a group of related companies that have specific real estate requirements. The lease agreements typically have long-term durations, providing stability and predictable rental income for the captive REIT.

e. Lenders and Financing Institutions: Captive REITs may involve lenders and financing institutions that provide the necessary capital for property acquisitions or developments. These lenders may include banks, financial institutions, or private investors who extend loans or lines of credit to the captive REIT. The funds obtained through financing arrangements are used to acquire real estate assets or finance their development.

f. Legal and Financial Advisors: Throughout the establishment and operation of a captive REIT, legal and financial advisors play a crucial role. These professionals provide guidance and expertise on matters such as legal structuring, compliance with regulatory requirements, tax planning, lease agreements, financing arrangements, and overall strategic decision-making. Their involvement ensures that the captive REIT operates within legal and financial frameworks while optimizing its performance and value.

g. Asset Managers: In some cases, captive REITs may involve asset managers who are responsible for strategic portfolio management and maximizing the value of the real estate assets. These professionals analyze market trends, identify investment opportunities, monitor property performance, and make recommendations for property acquisitions, dispositions, or improvements. Asset managers work closely with the property manager to ensure the overall success and profitability of the captive REIT’s real estate portfolio.

h. Property Developers: If the captive REIT engages in property development projects, property developers may be involved as key participants. These developers oversee the construction or renovation of properties to meet the specific needs of the tenant(s). They manage the design, construction process, and compliance with building codes and regulations. Property developers play a crucial role in delivering customized properties that align with the tenant(s)’ requirements.

i. Auditors and Accountants: Auditors and accountants are essential participants in the captive REIT structure to ensure financial transparency, compliance, and accurate reporting. They conduct regular financial audits, review financial statements, and verify the REIT’s compliance with accounting standards and regulations. These professionals provide an independent assessment of the REIT’s financial health, contributing to the overall credibility and trustworthiness of the captive REIT.

j. Board of Directors: The captive REIT may have a board of directors responsible for overseeing its overall management and governance. The board members, who are appointed or elected by the REIT’s shareholders, provide strategic guidance, monitor financial performance, approve major decisions, and ensure compliance with legal and regulatory obligations. The board of directors represents the interests of the REIT’s investors and stakeholders.

Advantages of Captive REITs:

- Tailored Real Estate Solutions: Captive REITs provide the opportunity for the tenant(s) to have real estate assets customized to their specific needs. The properties can be designed, constructed, or adapted to suit the tenant(s)’ operational requirements, resulting in optimized space utilization and increased efficiency.

- Strategic Alignment: Captive REITs foster a close relationship between the real estate assets and the core business operations of the tenant(s). By aligning the properties with the tenant(s)’ strategic objectives, captive REITs can enhance the overall performance and competitiveness of the tenant(s)’ business.

- Long-Term Stability: The nature of captive REITs often involves long-term lease agreements with the tenant(s). These agreements provide stability in rental income for the REIT, as well as the assurance of occupancy for the tenant(s). The long-term commitment enhances the predictability of cash flows for both parties involved.

- Cost Savings: Through the customization of real estate assets, captive REITs can achieve cost savings for the tenant(s). By tailoring the properties to specific operational requirements, efficiencies can be gained in terms of space utilization, infrastructure, and overall operating expenses.

- Strategic Capital Deployment: Captive REITs allow the sponsor to strategically deploy capital toward real estate assets that directly serve their core business operations. By focusing on properties that align with their specific needs, the sponsor can efficiently allocate resources and optimize the utilization of capital.

- Operational Control: As the owner and manager of the properties, captive REITs have greater control over the maintenance, improvements, and overall operation of the real estate assets. This control allows for customization and efficient management of the properties according to the tenant(s)’ requirements.

- Enhanced Collaboration: The close relationship between the captive REIT and the tenant(s) fosters enhanced collaboration and communication. This collaboration can lead to improved operational efficiency, better problem-solving, and the ability to address real estate needs proactively.

- Potential Tax Benefits: Like traditional REITs, captive REITs can enjoy certain tax benefits. By electing REIT status, the captive REIT can potentially benefit from favorable tax treatment, such as the avoidance of corporate-level taxation on distributed income.

- Mitigation of Market Risks: Captive REITs, by focusing on properties that serve a specific tenant or industry, may mitigate certain market risks associated with broader real estate market fluctuations. The tenant(s)’ business performance and industry dynamics become more significant factors in the REIT’s stability, potentially reducing exposure to broader market volatility.

- Strong Tenant Relationships: The dedicated nature of captive REITs allows for the development of strong relationships between the REIT and the tenant(s). This can result in increased tenant satisfaction, loyalty, and potential long-term partnerships that benefit both parties involved.

Disadvantages of Captive REITs:

- Tenant Concentration Risk: Captive REITs are inherently exposed to a higher level of tenant concentration risk. If the primary tenant(s) experience financial difficulties or decide not to renew their lease agreements, it can have a significant impact on the REIT’s cash flow and overall performance.

- Limited Diversification: Unlike traditional REITs that benefit from diversification across different property types and tenants, captive REITs are limited in their diversification potential. This lack of diversification can make the REIT more susceptible to market downturns or industry-specific risks.

- Dependency on Single Tenant: Captive REITs heavily rely on the success and stability of their primary tenant(s). If the tenant(s) face operational challenges or industry-specific disruptions, it can directly impact the REIT’s financial performance and property occupancy.

- Potential Conflicts of Interest: In some cases, captive REITs may face potential conflicts of interest. Since the sponsor of the captive REIT is often closely related to the tenant(s), conflicts may arise in terms of lease negotiations, rent setting, or property management decisions. It is essential to establish transparent governance structures and mechanisms to mitigate these conflicts and ensure fair treatment for all parties involved.

- Limited Marketability: Compared to traditional REITs that are publicly traded on stock exchanges, captive REITs often lack the same level of marketability. The limited number of investors and the specialized nature of the REIT may make it more challenging to buy or sell shares in the captive REIT.

- Restricted Investment Opportunities: Captive REITs focus on properties that cater specifically to the needs of the tenant(s). This specialization may limit the REIT’s ability to explore diverse investment opportunities in different property types or geographic regions, potentially restricting potential growth or diversification.

- Higher Initial Capital Requirement: Establishing a captive REIT often requires a significant initial capital investment. The sponsor must provide the necessary funds for property acquisitions or developments, which may pose a financial burden or limit the ability to diversify investment across other areas.

- Regulatory Compliance: Captive REITs, like traditional REITs, must comply with regulatory requirements and maintain REIT status to enjoy tax benefits. This includes adhering to specific rules regarding income distribution, asset composition, and ownership structure. The compliance burden can add complexity and administrative costs to the operation of the captive REIT.

- Limited External Funding Options: Compared to traditional REITs that have greater access to external capital through public offerings or secondary market transactions, captive REITs may have more limited options for external funding. This reliance on internal funding or a close relationship with the sponsor may impact the REIT’s ability to seize growth opportunities or respond to changing market conditions.

- Tenant-Specific Risks: Captive REITs are exposed to tenant-specific risks that can impact their financial performance. These risks include changes in the tenant’s financial health, market competitiveness, industry-specific disruptions, or changes in the tenant’s real estate needs. Captive REITs must carefully assess and monitor these risks to ensure the continued stability and profitability of the REIT.

In conclusion, captive REITs provide an avenue for companies to leverage real estate assets as a strategic tool to support their core operations. By tailoring properties to meet specific needs, optimizing space utilization, and fostering close relationships with tenants, captive REITs can create a symbiotic relationship between real estate and business objectives.

Library Lecturer at Nurul Amin Degree College