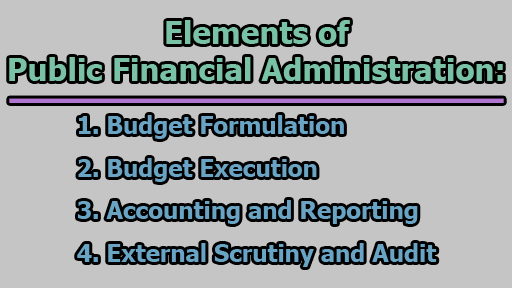

Elements of Public Financial Administration:

Public financial management is the heartbeat of effective governance, ensuring the transparent and efficient allocation, utilization, and reporting of public resources. Central to this process is the annual budget cycle, which comprises four key elements: budget formulation, budget execution, accounting and reporting, and external scrutiny through audit and oversight. In this article, we are going to explore four main elements of public financial administration.

1. Budget Formulation (Crafting the Blueprint for Public Finances):

1.1 Understanding the Essence: Budget formulation marks the inception of the annual budget cycle, representing the strategic planning phase where the government outlines its financial priorities and allocates resources to various sectors. This process is not merely a number-crunching exercise but a reflection of the government’s policy objectives, socio-economic priorities, and commitment to fiscal responsibility.

1.2 Key Components and Steps:

- Needs Assessment: Governments begin by identifying the needs and priorities of the society, considering factors such as infrastructure development, healthcare, education, and social welfare.

- Revenue Projections: Accurate estimation of revenue sources, including taxes, grants, and loans, is crucial for determining the financial capacity available for expenditure.

- Allocation Priorities: Decision-makers must establish clear priorities for resource allocation, balancing competing demands and ensuring alignment with the government’s overall vision.

- Stakeholder Consultation: Public participation and stakeholder consultation play a vital role in incorporating diverse perspectives and ensuring inclusivity in the budgetary process.

1.3 Challenges and Strategies:

- Resource Constraints: Limited resources often pose challenges in meeting diverse needs. Governments must employ strategic prioritization, focusing on high-impact areas.

- Macroeconomic Uncertainty: Economic fluctuations can impact revenue projections. Governments may adopt conservative estimates and contingency plans to address uncertainties.

1.4 Role of Technology: Technological tools, such as budgeting software, enhance the efficiency and accuracy of the budget formulation process, facilitating data analysis and scenario planning.

2. Budget Execution (Transforming Plans into Action):

2.1 Execution Dynamics: Budget execution is the phase where plans laid out in the budget formulation stage come to life. It involves the actual implementation of programs and projects outlined in the budget, making it a critical juncture in public financial management.

2.2 Critical Components:

- Financial Management Systems: Efficient financial management systems are essential for tracking expenditures, ensuring compliance with budgetary allocations, and preventing overspending.

- Procurement Procedures: Transparent and accountable procurement processes are vital to prevent corruption and ensure that resources are utilized effectively.

- Monitoring and Oversight: Continuous monitoring and oversight mechanisms help identify deviations from the budget, allowing for timely adjustments and corrective actions.

2.3 Challenges and Mitigation:

- Implementation Bottlenecks: Delays and obstacles in project implementation may occur. Governments must employ agile project management methodologies and risk mitigation strategies.

- Expenditure Control: Effective internal controls are crucial to prevent wastage, fraud, or misuse of funds. Regular audits and reviews can strengthen expenditure control mechanisms.

2.4 Technology Integration: Modern financial information systems streamline budget execution by providing real-time data, enhancing decision-making, and improving transparency.

3. Accounting and Reporting (The Language of Fiscal Transparency):

3.1 Importance of Accurate Accounting: Accounting and reporting form the bedrock of fiscal transparency, providing stakeholders with a clear and comprehensive view of the government’s financial performance. Accurate and transparent accounting practices build trust and accountability.

3.2 Key Components:

- Double-Entry Accounting: Governments employ double-entry accounting to ensure accuracy and accountability in financial transactions.

- Financial Statements: Comprehensive financial statements, including the balance sheet, income statement, and cash flow statement, present a holistic picture of the government’s financial health.

- Accrual Accounting: Adopting accrual accounting principles enhances the accuracy of financial reporting by recognizing revenues and expenses when incurred, providing a more realistic financial portrayal.

3.3 Compliance and Standards:

- International Public Sector Accounting Standards (IPSAS): Adhering to globally recognized accounting standards, such as IPSAS, enhances comparability and credibility of financial statements.

3.4 Challenges and Solutions:

- Complexity and Volume: Large volumes of financial data can be challenging to manage. Robust financial management systems and trained personnel are essential to handle complex accounting requirements.

- Ensuring Accuracy: Regular internal and external audits are crucial for ensuring the accuracy and reliability of financial reports.

3.5 Technology as a Catalyst: Advanced accounting software automates financial processes, reduces errors, and ensures compliance with accounting standards.

4. External Scrutiny and Audit (Fortifying Accountability Mechanisms):

4.1 Role of External Scrutiny: External scrutiny through audit and oversight mechanisms is the final frontier in public financial management. It acts as a safeguard, ensuring that public resources are utilized efficiently, transparently, and in accordance with legal and regulatory frameworks.

4.2 Types of Audits:

- Financial Audits: Examine the accuracy and reliability of financial statements.

- Performance Audits: Assess the efficiency and effectiveness of government programs and activities.

- Compliance Audits: Ensure adherence to laws, regulations, and internal policies.

4.3 Independent Oversight Bodies:

- Supreme Audit Institutions (SAIs): SAIs, such as the Government Accountability Office (GAO) in the United States, play a crucial role in conducting independent audits and providing recommendations for improvement.

4.4 Challenges and Enhancements:

- Political Interference: Maintaining independence is a challenge. Establishing autonomous oversight bodies insulated from political pressures is essential.

- Capacity Building: Continuous training and capacity building for audit professionals enhance the effectiveness of external scrutiny.

4.5 Technology-driven Audit Enhancements:

- Data Analytics: Utilizing data analytics tools enables auditors to analyze large datasets efficiently, identify patterns, and detect anomalies.

- Blockchain Technology: Blockchain enhances transparency and accountability by providing an immutable and auditable record of financial transactions.

In conclusion, public financial administration, encapsulated in the annual budget cycle, weaves a tapestry of interconnected elements that shape the fiscal landscape of nations. From the strategic visioning of budget formulation to the meticulous execution, transparent accounting, and external scrutiny, each phase plays a pivotal role in fostering fiscal health and public trust. As governments navigate the complexities of contemporary challenges, the integration of technology emerges as a potent ally, amplifying the efficiency, transparency, and accountability of public financial management. In mastering the art of public financial administration, nations lay the groundwork for sustainable development, resilience, and the equitable distribution of resources, ensuring the well-being of current and future generations.

References:

- Kristensen, J. K., Bowen, M., Zrinski, U., Long, C., & Mustapha, S. (2019). Introduction: What Is PFM and Why Is It Important? PEFA, Public Financial Management, and Good Governance. https://doi.org/10.1596/978-1-4648-1466-2_ch1

- World Bank. (2019). Digital Financial Services for Effective Public Financial Management.

- Stiglitz, J. E. (1998). More Instruments and Broader Goals: Moving Toward the Post-Washington Consensus.

- IMF (International Monetary Fund). (2014). Fiscal Policy and Long-Term Growth.

- Collier, P. (2007). The Bottom Billion: Why the Poorest Countries are Failing and What Can Be Done About It. Oxford University Press.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College