Since 1983, Trade Finance has been analyzing the international trade and export finance sectors. Trade finance delivers fast, efficient, reliable, and comprehensive solutions for every stage of a client’s trade value chain to support their foreign and domestic trade activities. In this article, we are going to know about trade finance methods.

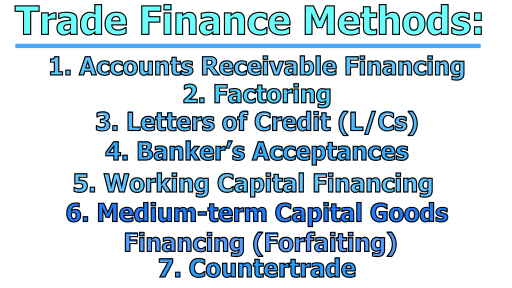

Trade Finance Methods:

A variety of trade finance methods are available that can support domestic and international trade in commodities and services. Additionally, the trade finance sector supports and allows for transactions that ease foreign payments, limit exposure to currency risk, and promote both loan and stock raising. Some of the trade finance methods are given below concisely:

1. Accounts Receivable Financing: In some cases, the exporter of goods may be willing to ship goods to the importer without assurance of payment from a bank. This could take the form of an open account shipment or a time draft. Prior to shipment, the exporter should have conducted its own credit check on the importer to determine creditworthiness. If the exporter is willing to wait for payment, it will extend credit to the buyer. If the exporter needs funds immediately, it may require financing from a bank. In what is referred to as accounts receivable financing. The bank will provide a loan to the exporter secured by an assignment of the account receivable. The bank’s loan is made to the exporter based on its creditworthiness. In the event the buyer fails to pay the exporter for whatever reason, the exporter is still responsible for repaying the bank.

2. Factoring: When an exporter ships goods before receiving payment, the accounts receivable balance increases. Unless the exporter has received a loan from a bank, it is initially financing the transaction and must monitor the collections of receivables. Since there is a danger that the buyer will never pay at all, the exporting firm may consider selling the accounts receivable to a third party, known as a factor. In this type of financing, the exporter sells the accounts receivable. The factor then assumes all administrative responsibilities involved in collecting from the buyer and the associated credit exposure. The factor performs its own credit approval process on the foreign buyer before purchasing the receivable. For providing this service, the factor usually purchases the receivable at a discount and also receives a flat processing fee.

Factoring provides several benefits to the exporter: Firstly, by selling the accounts receivable, the exporter does not have to worry about the administrative duties involved in maintaining and monitoring an accounts receivable accounting ledger. Secondly, the factor assumes credit exposure to the buyer, so the exporter does not have to maintenance personnel to assess the creditworthiness of foreign buyers. Finally, by selling the receivable to the factor, the exporter receives immediate payment and improves its cash flow.

3. Letters of Credit (L/Cs): Sometimes the exporter is uncomfortable with the issuing bank’s promise to pay because the bank is located in a foreign country. Even if the issuing bank is well known worldwide, the exporter may be concerned that the foreign government will impose exchange controls or other restrictions that would prevent payment by the issuing bank. For this reason, the exporter may request that a local bank confirm the L/C and thus assure that all the responsibilities of the issuing bank will be met. The confirming bank is obligated to honor drawings made by the beneficiary in compliance with the L/C regardless of the issuing bank’s ability to make that payment. Consequently, the confirming bank is trusting that the foreign bank issuing the L/C is sound. The exporter, however, needs to worry only about the credibility of the confirming bank.

4. Banker’s Acceptances: Banker’s acceptance is a bill of exchange, or time draft, drawn on and accepted by a bank. It is the accepting bank’s obligation to pay the holder of the draft at maturity. In the first step in creating a banker’s acceptance, the importer orders goods from the exporter. The importer then requests its local bank to issue an L/C on its behalf. The L/C will allow the exporter to draw a time draft on the bank in payment for the exported goods. The exporter presents the time draft along with shipping documents to its local bank, and the exporter’s bank sends the time draft along with shipping documents to the importer’s bank. The importer’s bank accepts the draft, thereby creating the banker’s acceptance. If the exporter does not want to wait until the specified date to receive payment, it can request that the banker’s acceptance be sold in the money market.

5. Working Capital Financing: A banker’s acceptance can allow an exporter to receive funds immediately, yet allow an importer to delay its payment until a future date. The bank may even provide short-term loans beyond the banker’s acceptance period. In the case of an importer, the purchase from overseas usually represents the acquisition of inventory. The loan finances the working capital cycle that begins with the purchase of inventory and continues with the sale of the goods, the creation of an account receivable, and conversion to cash. With an exporter, the short-term loan might finance the manufacture of the merchandise destined for export (pre-export financing) or the time period from when the sale is made until payment is received from the buyer. For example, the firm may have imported foreign beer, which it plans to distribute to grocery and liquor stores. The bank can not only provide a letter of credit for trade finance, but it can also finance the importer’s cost from the time of distribution and collection of payment.

6. Medium-term Capital Goods Financing (Forfaiting): Because capital goods are often quite expensive, an importer may not be able to make payment on the goods within a short time period. Thus, longer-term financing may be required here. The exporter might be able to provide financing for the importer but may not desire to do so since the financing may extend over several years. In this case, a type of trade finance known as forfeiting could be used. Forfeiting refers to the purchase of financial obligations, such as bills of exchange or promissory notes, without recourse to the original holder, usually the exporter. In a forfeit transaction, the importer issues a promissory note to pay the exporter for the imported goods over a period that generally ranges from 3 to 7 years. The exporter then sells the notes, without recourse, to the forfeiting bank.

7. Countertrade: The term countertrade denotes all types of foreign trade transactions in which the sale of goods to one country is linked to the purchase or exchange of goods from that same country. Some types of countertrade, such as barter, have been in existence for thousands of years. Only recently, however, has countertrade gained popularity and importance. The growth in various types of countertrade has been fueled by large balance-of-payment disequilibrium, foreign currency shortages, the debt problems of less developed countries, and stagnant worldwide demand. As a result, many MNCs have encountered countertrade opportunities, particularly in Asia, Latin America, and Eastern Europe. The most common types of countertrade include barter, compensation, and counter-purchase.

Barter is the exchange of goods between two parties without the use of any currency as a medium of exchange. Most barter arrangements are one-time transactions governed by one contract. An example would be the exchange of 100 tons of wheat from Canada for 20 tons of shrimp from Ecuador.

In a compensation or clearing-account arrangement, the delivery of goods to one party is compensated for by the seller’s buying back a certain amount of the product from that same party. The transaction is governed by one contract, and the value of the goods is expressed in monetary terms. The buy-back arrangement could be for a fraction of the original sale (partial compensation) or more than 100 percent of the original sale (full compensation). An example of the compensation would be the sale of phosphate from Morocco to France in exchange for purchasing a certain percentage of fertilizer. Such arrangements often involve the construction of large projects, such as power plants, in exchange for the purchase of the project’s output over an extended period of time. For example, Brazil sold a hydroelectric plant to Argentina and in exchange purchased a percentage of the plant’s output under a long-term contract.

The term counter purchase denotes the exchange of goods between two parties under two distinct contracts expressed in monetary terms. Delivery and payment of both goods are technically separate transactions.

It is apparent that we can say that trade finance helps settle the conflicting needs of the exporter and the importer. An exporter needs to mitigate the payment risk from the importer and it would be to their benefit to accelerate the receivables. On the other hand, the importer wants to mitigate the supply risk from the exporter and it would be to their benefit to receive extended credit on their payment. The function of trade finance is to act as a third party to remove the payment risk and the supply risk, whilst providing the exporter with accelerated receivables and the importer with extended credit.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College