Essential Features of a Financial Institution:

In the dynamic landscape of the global economy, financial institutions play a pivotal role in facilitating economic activities and ensuring the smooth functioning of financial markets. These institutions serve as the backbone of the financial system, providing a wide array of services that are crucial for individuals, businesses, and governments. In this article, we will explore the essential features of a financial institution.

1. Intermediation Role: The intermediation role of financial institutions serves as the cornerstone of their function within the economic system. At its essence, these institutions act as intermediaries between individuals, businesses, and various entities with surplus funds and those seeking financial resources for various purposes. By facilitating the movement of funds from savers to borrowers, financial institutions contribute to the efficient allocation of capital, which is vital for economic growth.

This intermediation process involves the creation of financial products and services that cater to both ends of the spectrum. Savers are provided with options to deposit their surplus funds, typically in the form of savings accounts or fixed deposits, while borrowers gain access to credit facilities like loans and overdrafts. Through this intricate process, financial institutions play a pivotal role in stimulating investment, fostering entrepreneurship, and supporting overall economic development.

2. Acceptance of Deposits: An integral aspect of a financial institution’s operations is the acceptance of deposits. This feature forms the foundation of their liabilities and represents the trust and confidence that individuals and businesses place in these institutions. Financial institutions create various types of deposit accounts, each tailored to meet different needs and preferences.

Savings accounts, offering a modest interest rate and liquidity, are popular among individuals looking to park their savings securely while maintaining accessibility. Current accounts, with minimal or no interest, cater to businesses and individuals requiring frequent and immediate access to their funds. Fixed deposits provide a higher interest rate for those willing to lock in their funds for a specified period. By offering these deposit products, financial institutions attract a diverse range of depositors, thereby building a stable base for their lending and investment activities.

3. Lending and Credit Facilities: Lending and credit facilities represent a pivotal function of financial institutions, as they serve as key players in the credit market. Through rigorous risk assessment and credit evaluation processes, these institutions extend loans to individuals and businesses, fostering economic activities and supporting various financial needs.

Financial institutions provide a spectrum of credit options, ranging from personal loans for individual needs to business loans and mortgages for corporate and real estate financing. By facilitating access to credit, financial institutions empower individuals to pursue education, entrepreneurs to establish businesses, and homeowners to acquire properties. This injection of capital into the economy stimulates growth and economic expansion, contributing to overall prosperity.

4. Payment and Settlement Services: Efficient payment and settlement services are crucial for the smooth functioning of the financial system. Financial institutions play a pivotal role in facilitating secure and seamless transactions through various channels, including electronic funds transfer, wire transfers, and online banking platforms.

By providing these services, financial institutions reduce the friction and costs associated with transactions, making it easier for individuals and businesses to conduct financial activities. Electronic payment systems, in particular, have revolutionized the speed and convenience of financial transactions, contributing to the development of a cashless economy. These services not only enhance financial inclusivity but also play a vital role in reducing systemic risks associated with payment and settlement processes.

5. Investment Services: Financial institutions are instrumental in channeling funds towards investment opportunities that align with the financial goals and risk preferences of their clients. Through investment services such as asset management, mutual funds, and investment advisory, these institutions offer a range of options for individuals and institutional investors to grow their wealth.

Asset management involves the professional management of diverse investment portfolios, including stocks, bonds, and other financial instruments. Mutual funds pool funds from various investors to invest in a diversified portfolio managed by professionals. Investment advisory services provide personalized advice based on individual financial objectives and risk tolerance. By offering these investment avenues, financial institutions contribute to capital formation, wealth creation, and the development of vibrant financial markets.

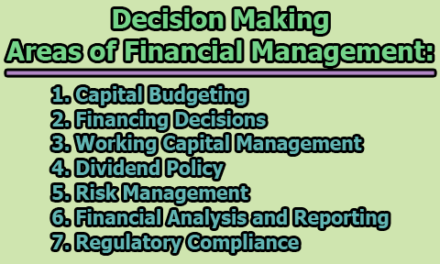

6. Risk Management: Effective risk management is a critical feature that distinguishes sound financial institutions. These entities are exposed to various risks, including credit risk, market risk, operational risk, and liquidity risk. The ability to identify, assess, and mitigate these risks is paramount for maintaining stability and safeguarding the interests of depositors and investors.

Credit risk arises from the potential default of borrowers, and financial institutions employ credit scoring models and due diligence processes to minimize this risk. Market risk is associated with fluctuations in interest rates, exchange rates, and market prices, requiring sophisticated risk management strategies. Operational risk involves the threat of losses from internal processes, systems, or human error, necessitating robust internal controls. Additionally, maintaining adequate liquidity is crucial to meet financial obligations promptly. Successful risk management ensures the resilience of financial institutions in the face of unforeseen challenges and market volatility.

7. Regulatory Compliance: Financial institutions operate within a highly regulated environment, subject to oversight from regulatory authorities. Compliance with regulatory standards is imperative to ensure the stability, integrity, and trustworthiness of the financial system. Regulatory requirements encompass capital adequacy, liquidity ratios, anti-money laundering measures, and consumer protection, among others.

To meet these regulatory standards, financial institutions establish comprehensive compliance frameworks, conduct regular audits, and invest in robust reporting systems. Regulatory compliance not only safeguards the interests of stakeholders but also contributes to the overall health of the financial sector. Institutions that adhere to regulatory guidelines are better positioned to weather economic uncertainties and maintain public trust, reinforcing the stability of the financial system.

8. Financial Advisory Services: Many financial institutions extend their services beyond traditional banking activities to provide financial advisory services. These services are designed to assist individuals and businesses in making informed financial decisions, planning for the future, and optimizing their financial resources. Financial advisory services may include retirement planning, tax planning, estate planning, and investment advice.

By offering expert guidance, financial institutions empower clients to navigate complex financial landscapes and achieve their long-term financial goals. This personalized approach fosters a deeper relationship between clients and institutions, enhancing customer loyalty and satisfaction. In turn, clients benefit from a holistic approach to financial well-being, ensuring they are well-prepared for various life stages and financial challenges.

9. Technology Integration: In the contemporary era, financial institutions are embracing technological innovations to enhance operational efficiency and meet evolving customer expectations. The integration of technologies such as artificial intelligence, blockchain, and digital platforms is reshaping the landscape of financial services. Mobile banking apps, online platforms, and digital wallets have become common, providing customers with convenient and user-friendly interfaces.

Artificial intelligence is employed for fraud detection, customer service automation, and personalized financial advice. Blockchain technology enhances the security and transparency of financial transactions. Fintech collaborations and digital transformations are becoming commonplace as financial institutions strive to stay competitive in a rapidly evolving market. Technology integration not only streamlines operations but also improves customer experience and accessibility, driving the industry towards a more interconnected and digital future.

10. Corporate Social Responsibility (CSR): Beyond their financial activities, many financial institutions recognize the importance of corporate social responsibility (CSR). Engaging in CSR initiatives allows these institutions to contribute positively to the communities they serve. CSR activities may include supporting education programs, environmental conservation, community development projects, and charitable endeavors.

By participating in CSR, financial institutions not only fulfill their ethical obligations but also enhance their reputation and brand image. Socially responsible practices resonate positively with customers, investors, and the wider community, fostering a sense of trust and goodwill. This commitment to CSR aligns with broader societal goals, demonstrating that financial institutions are not only profit-driven entities but also responsible corporate citizens dedicated to the well-being of the communities they operate in.

In conclusion, the features outlined above collectively define the multifaceted nature of financial institutions and underscore their indispensable role in the economic fabric of societies. As pillars of the financial system, these institutions not only facilitate economic transactions but also contribute to the overall stability, growth, and development of nations. Adapting to technological advancements, navigating regulatory landscapes, and embracing ethical practices are paramount for financial institutions to thrive in an ever-changing global financial environment. Understanding and appreciating these essential features is crucial for stakeholders, policymakers, and the public at large as they navigate the intricate world of finance.

Library Lecturer at Nurul Amin Degree College