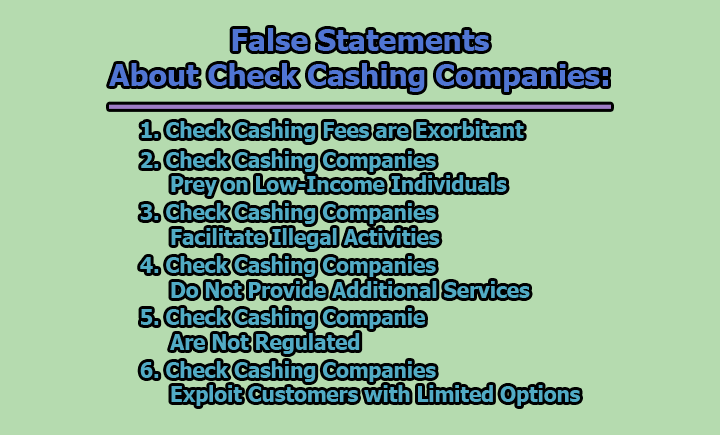

False Statements about Check Cashing Companies:

Check cashing companies play a crucial role in providing financial services to individuals who may not have access to traditional banking. Despite their significance, these establishments often face misconceptions and false statements that can tarnish their reputation. In this article, we will explore some of the false statements about check cashing companies and shed light on their importance in providing financial services to underserved communities.

1. Check Cashing Fees are Exorbitant: One prevalent misconception revolves around the notion that check cashing companies impose exorbitant fees on their customers, exploiting those who may already be facing financial challenges. However, it is crucial to recognize that these fees are not arbitrary; rather, they are a necessary component to cover the operational costs, regulatory compliance, and the inherent risks associated with handling various types of checks.

Check cashing companies operate in a competitive market and must balance the need to remain financially viable with the goal of providing accessible services. The fees charged often reflect the costs involved in processing transactions, mitigating risks, and maintaining the infrastructure required to offer these services. While the fees may be higher than those at traditional banks, it is essential to understand that check cashing companies cater to a different demographic and serve a unique purpose in the financial ecosystem.

Moreover, these establishments offer a level of convenience and accessibility that is invaluable to individuals who, for various reasons, do not have access to traditional banking services. The fees charged by check cashing companies should be viewed in the context of the services they provide and the challenges they address for their diverse customer base.

2. Check Cashing Companies Prey on Low-Income Individuals: A common misconception suggests that check cashing companies deliberately target low-income individuals, taking advantage of their financial vulnerabilities. However, this oversimplified view fails to acknowledge the diverse customer base served by these establishments, which includes individuals from various socio-economic backgrounds.

Check cashing companies play a crucial role in financial inclusion by serving the unbanked and underbanked populations. Many customers who choose these services do so out of necessity, often due to factors such as a lack of identification, poor credit history, or a preference for the flexibility and accessibility that check cashing establishments provide.

Rather than preying on vulnerable individuals, check cashing companies contribute to financial inclusivity by offering an alternative to traditional banking. By addressing the unique needs of their customers, these establishments bridge gaps in access to financial services and empower individuals who might otherwise be excluded from the mainstream banking system.

3. Check Cashing Companies Facilitate Illegal Activities: There is a misconception that check cashing companies are involved in facilitating illegal activities, such as money laundering or fraud. In reality, reputable check cashing businesses operate within a framework of strict regulatory guidelines and take significant measures to prevent any involvement in unlawful practices.

To ensure the legitimacy of the checks they handle, check cashing companies implement robust verification processes. These processes often involve identity verification, authentication of the check’s origin, and compliance with anti-money laundering (AML) regulations. By adhering to these regulatory standards, check cashing companies contribute to maintaining the integrity of the financial system and play a crucial role in preventing illicit activities within their operations.

It is essential to recognize that any industry, including traditional banking, faces risks related to illegal activities. The focus should be on the proactive measures and regulatory compliance undertaken by check cashing companies to create a secure and transparent environment for both customers and the broader financial ecosystem.

4. Check Cashing Companies Do Not Provide Additional Services: Contrary to the misconception that check cashing companies solely focus on cashing checks, many of these establishments offer a diverse range of additional financial services. Recognizing the evolving needs of their customer base, check cashing companies often provide services such as money orders, bill payment facilities, prepaid debit cards, and even small-dollar loans.

These supplementary services contribute to the convenience and accessibility that customers value. Money orders, for example, offer a secure and widely accepted alternative to traditional paper checks, enabling customers to make payments without the need for a bank account. Bill payment services provide a centralized location for customers to settle their financial obligations, promoting financial responsibility.

Prepaid debit cards offered by check cashing companies serve as an alternative banking solution for those without access to traditional accounts. These cards allow users to make purchases, pay bills, and manage their finances more efficiently. Additionally, some check cashing companies extend small-dollar loans to help individuals navigate unexpected financial challenges, offering a responsible and regulated alternative to predatory lending practices.

By diversifying their service offerings, check cashing companies demonstrate adaptability and a commitment to meeting the varied financial needs of their customers. This debunking dispels the misconception that these establishments only focus on check cashing, emphasizing their role as comprehensive financial service providers.

5. Check Cashing Companies Are Not Regulated: A common misconception suggests that check cashing companies operate in an unregulated environment, potentially putting customers at risk. In reality, these establishments are subject to stringent state and federal regulations designed to ensure consumer protection, prevent fraud, and maintain the overall integrity of the financial system.

Regulations imposed on check cashing companies vary by jurisdiction but often include requirements related to licensing, anti-money laundering (AML) compliance, and know your customer (KYC) procedures. These regulations aim to create a framework that fosters transparency, accountability, and fair business practices within the industry.

Compliance with these regulations is not optional; it is a legal obligation that reputable check cashing companies take seriously. Establishments that fail to adhere to these standards face severe penalties, including fines and the revocation of their operating licenses. Therefore, customers can have confidence that when dealing with compliant check cashing businesses, their financial transactions are being conducted within a regulated and secure framework.

Acknowledging the regulatory environment in which check cashing companies operate is crucial for dispelling the misconception that these establishments lack oversight. In fact, the regulatory framework ensures that check cashing services are provided in a responsible and lawful manner, promoting consumer confidence and financial stability.

6. Check Cashing Companies Exploit Customers with Limited Options: Contrary to the belief that check cashing companies exploit customers with limited financial options, these establishments serve as a valuable alternative for individuals facing barriers to traditional banking services. Customers who turn to check cashing companies often do so out of necessity, driven by factors such as a lack of identification, poor credit history, or a preference for the flexibility offered by these establishments.

Check cashing companies cater to the unbanked and underbanked populations, providing a lifeline for those who may be excluded from mainstream banking due to various circumstances. The competition within the check cashing industry works to keep fees reasonable and improve service quality, benefiting consumers who rely on these services.

Furthermore, the accessibility and convenience offered by check cashing companies contribute to financial inclusion by serving individuals who may not have easy access to traditional banking infrastructure. Rather than exploitation, these establishments provide a crucial service, empowering customers to manage their financial affairs efficiently and fostering a more inclusive financial landscape. Recognizing the positive impact of check cashing companies helps dispel the misconception that they take advantage of customers with limited options.

In conclusion, it is essential to dispel the misconceptions surrounding check cashing companies and recognize the vital role they play in serving the financial needs of diverse communities. These establishments are not predatory; instead, they provide a lifeline for individuals who may be excluded from mainstream banking. By debunking these false statements, we can foster a better understanding of the contributions that check cashing companies make to financial inclusion and accessibility.

Frequently Asked Questions (FAQs):

What is a check cashing company?

A check cashing company is a financial service provider that offers the service of converting checks into cash. These establishments cater to individuals who may not have access to traditional banking services or prefer the convenience and accessibility provided by check cashing services.

Why do people use check cashing companies instead of banks?

People use check cashing companies for various reasons, including being unbanked or underbanked, lacking proper identification for traditional banking, or needing immediate access to funds without waiting for check clearance. Check cashing companies often provide quick and convenient services to individuals facing these challenges.

Are check cashing fees high?

Check cashing fees can vary between establishments, but they are typically higher than those charged by traditional banks. These fees cover operational costs, regulatory compliance, and the risks associated with handling different types of checks. Despite the higher fees, check cashing companies offer a valuable service to individuals who may not have alternative options.

Do check cashing companies offer additional services?

Yes, many check cashing companies provide a range of additional financial services. These may include money orders, bill payment facilities, prepaid debit cards, and small-dollar loans. This diversification of services aims to meet the diverse financial needs of their customers beyond check cashing.

Are check cashing companies regulated?

Yes, check cashing companies are subject to stringent state and federal regulations. These regulations vary by jurisdiction but generally include licensing requirements, anti-money laundering (AML) compliance, and know your customer (KYC) procedures. Compliance with these regulations is crucial for maintaining transparency and accountability within the industry.

Do check cashing companies facilitate illegal activities?

Reputable check cashing companies operate within a framework of strict regulatory guidelines to prevent any involvement in illegal activities such as money laundering or fraud. They implement robust verification processes to ensure the legitimacy of the checks they handle, contributing to a secure financial environment.

Are check cashing companies only for low-income individuals?

No, check cashing companies serve a diverse customer base, including individuals from various socio-economic backgrounds. While they cater to the unbanked and underbanked populations, their services are not exclusive to low-income individuals. Many customers choose check cashing services for reasons beyond financial constraints, such as convenience and accessibility.

How do check cashing companies contribute to financial inclusion?

Check cashing companies contribute to financial inclusion by providing services to individuals who may face barriers to traditional banking. Their accessibility and flexibility make financial transactions more manageable for those without easy access to traditional banking infrastructure, fostering a more inclusive financial landscape.

Library Lecturer at Nurul Amin Degree College