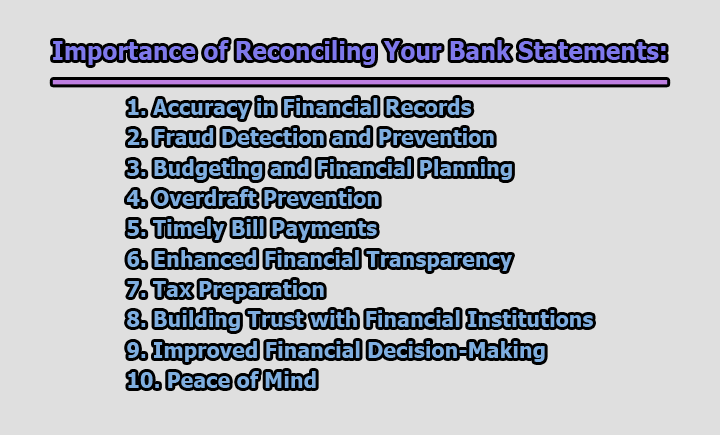

Importance of Reconciling Your Bank Statements:

In the dynamic landscape of personal and business finance, the importance of reconciling bank statements cannot be overstated. This fundamental process ensures that your financial records align accurately with those of your bank, guaranteeing transparency and reliability in managing your financial affairs. In this guide, we will explore the importance of reconciling your bank statements.

1. Accuracy in Financial Records: The cornerstone of responsible financial management lies in the accuracy of your records. Discrepancies between your records and the bank’s records can lead to a myriad of issues, including misguided budgeting, erroneous tax filings, and even potential financial strain. Reconciling your bank statements on a regular basis provides a systematic approach to identifying and rectifying any disparities promptly.

Consider a scenario where an electronic payment you made did not reflect in your bank statement due to a technical glitch. Without reconciliation, you might inadvertently believe you have more funds available than you actually do. This discrepancy could lead to overspending, potential overdrafts, and unnecessary financial stress. By reconciling, you catch these discrepancies early, ensuring that your financial records accurately reflect your current financial standing.

2. Fraud Detection and Prevention: As financial transactions become increasingly digital, the risk of fraud has also risen. Reconciling your bank statements serves as a robust defense against unauthorized transactions, identity theft, or any other form of financial fraud. Regularly reviewing your transactions allows you to spot any suspicious activity promptly and take immediate action.

Imagine a situation where a fraudulent charge appears on your bank statement. Without regular reconciliation, this activity might go unnoticed for an extended period, giving fraudsters ample time to inflict more damage. However, by meticulously reviewing your bank statements, you can quickly identify any irregularities, report them to your bank, and mitigate potential financial losses. This proactive approach to fraud detection is a fundamental reason why reconciling bank statements is a vital financial practice.

3. Budgeting and Financial Planning: Effective budgeting is contingent upon accurate and up-to-date financial information. Reconciling bank statements allows you to track your income and expenses meticulously, providing the foundation for informed budgeting and financial planning. This process empowers you to make data-driven decisions about your spending habits, savings goals, and investments.

Consider the importance of budgeting in achieving financial objectives. Without an accurate understanding of your financial situation, you may set unrealistic goals or fail to allocate funds properly. Reconciliation ensures that your budget reflects your actual financial standing, facilitating a realistic and achievable financial plan.

4. Overdraft Prevention: Overdraft fees can be an unwelcome surprise and a drain on your financial resources. Reconciling your bank statements serves as a preemptive measure against accidental overdrafts, helping you maintain control over your account balance and avoid unnecessary fees.

Picture a scenario where you forget to account for an automatic bill payment in your mental tally of available funds. Without reconciliation, you may unknowingly spend more than what’s in your account, resulting in overdraft fees. However, by regularly reconciling your bank statements, you are aware of your actual account balance, reducing the likelihood of accidental overdrafts and the associated financial consequences.

5. Timely Bill Payments: Late payments can have cascading effects on your financial health, from incurring late fees to damaging your credit score. Reconciling your bank statements allows you to stay on top of due dates for bills and other financial obligations, ensuring timely payments and avoiding the negative repercussions of late payments.

Consider the importance of meeting your financial commitments promptly. Without reconciliation, you might lose track of due dates, leading to missed payments and the associated consequences. By reconciling regularly, you create a system that helps you stay organized, pay your bills on time, and maintain a positive financial reputation.

6. Enhanced Financial Transparency: Financial transparency is a cornerstone of responsible financial management, and reconciling bank statements is a pivotal step towards achieving this transparency. It involves systematically comparing your financial records with those of your bank, ensuring that your reported financial information aligns accurately with external records.

Consider the scenario of a business seeking investors or stakeholders. A lack of financial transparency can erode trust and confidence, hindering potential partnerships and investments. By reconciling bank statements, businesses can showcase a commitment to accuracy and transparency. This not only instills confidence in stakeholders but also helps in complying with regulatory requirements, reinforcing the integrity of financial reporting.

7. Tax Preparation: Accurate financial records are indispensable when it comes to tax preparation. Reconciling your bank statements ensures that your income, expenses, and deductions are meticulously documented, streamlining the tax filing process and reducing the risk of errors.

Imagine the stress and complications that can arise during tax season if your financial records are inaccurate or incomplete. Without reconciliation, you might overlook deductible expenses or fail to report certain income accurately. This can lead to filing errors, potential audits, and even financial penalties. By regularly reconciling bank statements, you create a solid foundation for seamless tax preparation, allowing you to file confidently and accurately.

8. Building Trust with Financial Institutions: A strong and trustworthy relationship with your bank is paramount. Regular reconciliation demonstrates your commitment to financial responsibility and accuracy, fostering a positive rapport with your financial institution.

Consider a situation where there’s a dispute or discrepancy in your account. If your financial records are well-maintained and regularly reconciled, you can quickly provide the necessary documentation to resolve the issue. This efficiency in resolving discrepancies not only saves time but also strengthens the trust between you and your bank. It showcases your diligence in managing your finances and enhances your standing as a responsible account holder.

9. Improved Financial Decision-Making: Informed decision-making is contingent upon reliable information, especially in financial matters. Reconciling your bank statements provides accurate data that is crucial for making sound decisions regarding investments, savings, and other financial strategies.

Imagine a scenario where you are contemplating a significant financial investment. Without up-to-date and accurate financial records, you may lack the necessary information to assess the potential impact of the investment on your overall financial health. Reconciliation ensures that you have a clear understanding of your current financial situation, empowering you to make decisions aligned with your long-term goals.

10. Peace of Mind: Ultimately, the overarching benefit of reconciling bank statements is the peace of mind it brings. Knowing that your financial records are accurate and up-to-date alleviates stress and anxiety related to money management.

Consider the mental and emotional toll of financial uncertainty. Without regular reconciliation, you may constantly worry about the accuracy of your records, the possibility of fraudulent activities, or the potential for overdrafts. Reconciliation provides assurance and confidence in your financial standing, allowing you to focus on your goals and aspirations without the constant worry of financial instability.

In conclusion, from ensuring the accuracy of financial records to preventing fraud, facilitating budgeting, and enhancing financial transparency, this process plays a crucial role in maintaining financial health. By incorporating regular reconciliation into your financial routine, you not only safeguard your financial well-being but also build a foundation for informed decision-making and long-term financial success. Take the time to reconcile your bank statements – it’s an investment in the reliability and security of your financial future.

Frequently Asked Questions (FAQs):

What does it mean to reconcile bank statements?

Reconciling bank statements involves comparing your personal or business financial records with those of your bank to ensure they match. This process helps identify any discrepancies, errors, or fraudulent activities, ensuring the accuracy and reliability of your financial information.

How often should I reconcile my bank statements?

It is recommended to reconcile your bank statements monthly. This frequency allows for prompt detection and resolution of any discrepancies, helps in maintaining an accurate financial picture, and supports effective budgeting and financial planning.

Why is accuracy in financial records important?

Accuracy in financial records is crucial for making informed decisions, budgeting effectively, and complying with tax obligations. It also helps prevent financial errors, overdrafts, and ensures that your reported financial information aligns with external records, fostering transparency and trust.

How does reconciling bank statements prevent fraud?

Regularly reconciling bank statements allows you to review all transactions, helping you spot any unauthorized or suspicious activities. By identifying and reporting fraudulent transactions promptly, you can prevent further financial damage and protect your accounts from potential security threats.

Can reconciling bank statements help with budgeting?

Yes, reconciling bank statements is essential for effective budgeting. It provides an accurate overview of your income and expenses, enabling you to make informed decisions about your spending habits and financial priorities. This, in turn, contributes to achieving your short-term and long-term financial goals.

How does reconciling bank statements aid in tax preparation?

Accurate financial records obtained through regular reconciliation simplify the tax preparation process. By ensuring that all income, expenses, and deductions are properly documented, you reduce the risk of errors in your tax filings, making the process smoother and minimizing the potential for audits or penalties.

What role does financial transparency play in personal finance and businesses?

Financial transparency is essential for both individuals and businesses. It builds trust with stakeholders, investors, and regulatory bodies. For businesses, transparent financial reporting is crucial for gaining investor confidence, meeting regulatory requirements, and fostering a positive reputation in the market.

How does reconciling bank statements contribute to peace of mind?

Regular reconciliation provides assurance and peace of mind by confirming the accuracy of your financial records. This helps alleviate stress and anxiety related to financial management, ensuring that you can focus on your financial goals without the constant worry of errors, fraud, or other financial uncertainties.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College