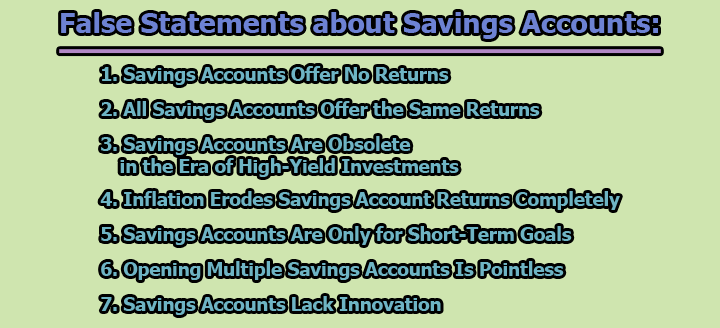

False Statements about Savings Accounts:

Savings accounts have long been considered a cornerstone of personal finance, providing individuals with a secure and accessible way to save money. However, despite their ubiquity, there are numerous misconceptions and false statements surrounding savings accounts that can mislead individuals and impact their financial decisions. In this article, we will delve into some of false statements about savings accounts, offering an examination of the truth behind savings accounts.

1. Savings Accounts Offer No Returns: One common misconception is that savings accounts provide negligible returns, making them an unattractive option for long-term wealth accumulation. While it’s true that savings account interest rates are generally lower compared to riskier investment options, they still offer a valuable advantage: security.

Savings accounts are characterized by their low-risk nature, providing a safe haven for funds. The interest earned may seem modest, but it acts as a buffer against inflation, helping to preserve the purchasing power of your money over time. Furthermore, the peace of mind that comes with knowing your funds are secure is an invaluable aspect often overlooked when evaluating the benefits of savings accounts.

2. All Savings Accounts Offer the Same Returns: Another misconception is that all savings accounts are created equal in terms of interest rates. In reality, there is a significant variation in interest rates offered by different banks and financial institutions.

Financial institutions set their own interest rates based on various factors such as market conditions, economic indicators, and the institution’s policies. It is crucial for savers to shop around and compare interest rates offered by different banks to ensure they are maximizing their returns. Online banks and credit unions, for example, may offer higher interest rates compared to traditional brick-and-mortar banks, making them worth considering for savers looking to optimize their returns.

3. Savings Accounts Are Obsolete in the Era of High-Yield Investments: The rise of high-yield investment options has led some to believe that traditional savings accounts have become obsolete. While it’s true that there are alternative investment opportunities that may offer higher returns, they often come with higher risks and volatility.

Savings accounts, with their stability and liquidity, play a crucial role in a well-rounded financial strategy. High-yield investments typically involve a higher level of risk, and the potential for significant gains is accompanied by the potential for significant losses. Savings accounts, on the other hand, provide a safe and easily accessible option for emergency funds and short-term financial goals.

4. Inflation Erodes Savings Account Returns Completely: A common misconception is that inflation negates any benefits gained from the interest earned on savings accounts. While it’s true that inflation can erode the purchasing power of money over time, savings accounts still serve as a valuable tool for preserving wealth in the face of inflation.

The key lies in understanding the role of savings accounts within a diversified financial portfolio. While the interest rates on savings accounts may not always outpace inflation, they act as a stable foundation, preventing the complete erosion of wealth. Additionally, the liquidity provided by savings accounts allows individuals to access their funds quickly when needed, providing a crucial buffer against unexpected expenses.

5. Savings Accounts Are Only for Short-Term Goals: Some individuals believe that savings accounts are only suitable for short-term financial goals and emergencies, overlooking their potential for long-term financial planning. While it’s true that savings accounts are excellent for maintaining liquidity and addressing immediate needs, they can also play a role in achieving long-term objectives.

Savings accounts provide a secure environment for accumulating a portion of one’s wealth, especially for individuals who prioritize safety over higher returns. They can serve as a foundation for a diversified investment portfolio, offering stability and a sense of security while other parts of the portfolio may involve higher risk.

6. Opening Multiple Savings Accounts Is Pointless: There’s a misconception that having multiple savings accounts is unnecessary and overly complicated. In reality, maintaining multiple savings accounts can be a strategic and practical approach to financial management.

Multiple savings accounts can be designated for different purposes, such as emergency funds, specific financial goals (e.g., vacations, home down payment), or to separate short-term and long-term savings. This compartmentalization helps individuals track and manage their financial objectives more effectively. Additionally, having accounts with different banks may offer diversification and access to varying interest rates.

7. Savings Accounts Lack Innovation: In the age of technological advancement, some people believe that savings accounts lack innovation and are outdated. Contrary to this belief, many financial institutions have embraced technology to enhance the features and accessibility of savings accounts.

Online banking has revolutionized the way individuals manage their savings accounts. Features such as mobile banking apps, automated transfers, and online statements provide convenience and flexibility. Furthermore, some financial institutions offer high-tech tools that help account holders set savings goals, track spending, and make informed financial decisions.

In conclusion, savings accounts remain a fundamental and versatile financial tool, despite the misconceptions that surround them. While they may not offer the highest returns compared to riskier investment options, their stability, security, and accessibility make them an essential component of a well-rounded financial strategy.

It is crucial for individuals to be aware of these false statements and myths about savings accounts, as falling prey to misinformation can lead to poor financial decisions. By understanding the true benefits and limitations of savings accounts, individuals can make informed choices that align with their financial goals and preferences.

Frequently Asked Questions (FAQs):

Do all savings accounts have the same interest rates?

No, interest rates on savings accounts can vary significantly between different banks and financial institutions. It’s essential to compare rates and choose an account that offers competitive returns.

Are savings accounts only for short-term goals?

While savings accounts are commonly used for short-term goals and emergencies, they can also be part of a long-term financial strategy. They provide a stable foundation within a diversified portfolio, offering security and liquidity.

Do savings accounts offer no returns?

Savings accounts do provide returns in the form of interest, although the rates may be lower compared to riskier investments. The primary advantage is the security and stability they offer, making them an essential component of a balanced financial approach.

Is inflation rendering savings account returns useless?

While inflation can impact the purchasing power of money, savings accounts play a crucial role in preserving wealth. They act as a stable foundation, preventing complete erosion of wealth, especially when combined with a diversified investment portfolio.

Are high-yield investments a better alternative to savings accounts?

High-yield investments may offer higher returns, but they come with increased risk and volatility. Savings accounts provide a safe and accessible option for emergency funds and short-term financial goals, balancing the overall risk in a financial portfolio.

Is having multiple savings accounts unnecessary?

Maintaining multiple savings accounts can be a strategic approach for financial management. Each account can be designated for specific purposes, helping individuals track and manage different financial goals effectively.

Are savings accounts outdated and lacking innovation?

Contrary to the belief that savings accounts lack innovation, many financial institutions have embraced technology. Online banking, mobile apps, and high-tech tools enhance the features and accessibility of savings accounts, making them more convenient for account holders.

Can I rely solely on savings accounts for long-term wealth accumulation?

While savings accounts provide stability and security, relying solely on them for long-term wealth accumulation may not be the most effective strategy. Diversifying your investment portfolio with a mix of assets can help optimize returns and manage risk over the long term.

Are all savings accounts insured?

Most savings accounts are insured by government agencies, such as the FDIC in the United States, up to a certain limit. It’s crucial to confirm the insurance coverage of a savings account to ensure the safety of your deposits.

Is it true that savings accounts are obsolete in the era of high-yield investments?

Savings accounts are not obsolete; they serve a specific purpose in providing stability and liquidity. While high-yield investments exist, they come with higher risk, and savings accounts remain a crucial component of a diversified financial strategy.

Library Lecturer at Nurul Amin Degree College