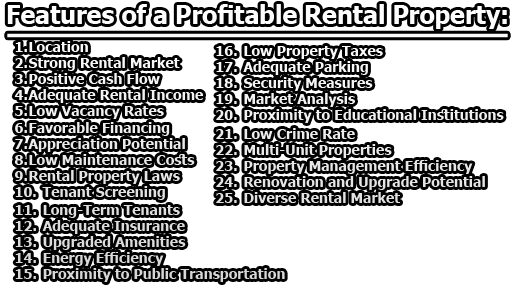

Features of a Profitable Rental Property:

There are several features of a profitable rental property, mentionable some of them are given below:

1. Location: The location of a rental property is crucial to its profitability. Look for properties in areas with high demand and desirability. Consider factors such as proximity to amenities (grocery stores, restaurants, shopping centers), schools, transportation hubs, and job opportunities. Properties in prime locations are more likely to attract tenants and command higher rental rates.

2. Strong Rental Market: Research the local rental market to ensure there is consistent demand for rental properties. Look for areas with low vacancy rates and increasing rental rates. A strong rental market indicates a stable demand for housing and the potential for rental income growth.

3. Positive Cash Flow: Positive cash flow is essential for a profitable rental property. This means that the rental income exceeds the property’s expenses, including the mortgage payment, property taxes, insurance, maintenance costs, and property management fees. Positive cash flow ensures a steady income stream and allows for potential reinvestment or savings.

4. Adequate Rental Income: The rental income generated by the property should be sufficient to cover all expenses and leave room for profit. Analyze the local market to determine competitive rental rates for similar properties. Set the rent at a level that is attractive to tenants while still providing a healthy return on investment.

5. Low Vacancy Rates: A profitable rental property should have low vacancy rates. Aim for properties in areas with historically low vacancy rates, as this indicates consistent tenant demand. Minimizing vacancies reduces income gaps and helps maintain a steady cash flow.

6. Favorable Financing: Seek favorable financing terms to enhance profitability. Look for low-interest mortgages and reasonable down payment requirements. Lower financing costs translate into lower monthly expenses and higher potential returns on investment.

7. Appreciation Potential: Consider properties in areas with a history of property value appreciation. While rental income is a primary source of profit, the property’s appreciation over time can significantly boost profitability when you decide to sell it. Research the local market and consider factors like economic growth, development projects, and future prospects to assess the property’s appreciation potential.

8. Low Maintenance Costs: Properties with low maintenance requirements are more profitable in the long run. Look for properties with newer construction, durable materials, and efficient systems (HVAC, plumbing, electrical). These features help minimize maintenance expenses and reduce the likelihood of costly repairs.

9. Rental Property Laws: Familiarize yourself with local rental property laws and regulations. Compliance with legal requirements is crucial for a profitable rental property. Understand tenant rights, landlord obligations, eviction procedures, and fair housing laws. Non-compliance can lead to penalties, legal disputes, and financial losses.

10. Tenant Screening: Implement a thorough tenant screening process to attract reliable tenants. Conduct background checks, credit checks, and verify employment and income history. Look for tenants with a good rental track record, stable income, and positive references. Selecting responsible tenants reduces the likelihood of late payments, property damage, or evictions.

11. Long-Term Tenants: A profitable rental property benefits from long-term tenants who renew their leases. Minimizing turnover reduces vacancy periods and the associated costs of finding new tenants. Build good relationships with your tenants, address their concerns promptly, and provide incentives for lease renewals.

12. Adequate Insurance: Protect your investment by obtaining appropriate landlord insurance coverage. This typically includes liability coverage and property insurance. Landlord insurance protects against unexpected events, property damage, or liability claims. Adequate insurance coverage safeguards your profitability and mitigates potential financial risks.

13. Upgraded Amenities: Properties with desirable amenities attract quality tenants and can command higher rental rates. Consider upgrading amenities such as modern appliances, updated bathrooms, spacious closets, in-unit laundry facilities, or outdoor living spaces. These features make the property more appealing and justify higher rental rates, increasing your potential profitability.

14. Energy Efficiency: Energy-efficient features in a rental property can reduce utility costs, benefiting both the landlord and the tenants. Consider properties with energy-efficient windows, insulation, appliances, and lighting. These features not only attract environmentally conscious tenants but also lower ongoing expenses, contributing to profitability.

15. Proximity to Public Transportation: Rental properties located near public transportation hubs or with convenient access to transportation options are highly desirable. Tenants value the convenience and cost-effectiveness of commuting options, which can increase demand and rental rates. Properties with easy access to buses, trains, or subway stations have a competitive advantage in the rental market.

16. Low Property Taxes: Property taxes can significantly impact the profitability of a rental property. Research the property tax rates in the area and consider properties in locations with lower tax rates. Lower property taxes can help reduce expenses and improve your overall profitability.

17. Adequate Parking: Properties with ample parking spaces or easy access to parking are attractive to tenants, especially in urban areas or areas with limited street parking. Sufficient parking options for tenants and their guests can increase the property’s desirability and justify higher rental rates.

18. Security Measures: Safety and security are priorities for tenants. Look for rental properties with secure entrances, well-lit common areas, and features like alarm systems, security cameras, or on-site security personnel. Properties with enhanced security measures attract quality tenants and can justify higher rental rates.

19. Market Analysis: Conduct a comprehensive market analysis to understand the local rental market dynamics. Analyze historical rental data, vacancy rates, rental growth trends, and economic indicators. Identify emerging trends, potential future developments, and changes that may affect the rental market in the area. This analysis helps you make informed decisions and maximize profitability.

20. Proximity to Educational Institutions: Rental properties near universities, colleges, or schools often have a steady demand. Students, faculty, and staff frequently seek nearby housing options. Consider properties located within a reasonable distance from educational institutions to tap into this rental market segment.

21. Low Crime Rate: Safe neighborhoods are appealing to tenants and contribute to long-term stability. Research the crime rates in the area and choose rental properties located in neighborhoods with low crime rates. Properties in safer areas are more likely to attract quality tenants and experience lower turnover rates.

22. Multi-Unit Properties: Investing in multi-unit properties, such as duplexes, triplexes, or apartment complexes, can provide multiple streams of rental income and spread the risk. The income generated from multiple units can offset expenses and improve profitability. Additionally, economies of scale can be realized in terms of property management and maintenance.

23. Property Management Efficiency: Efficient property management practices are crucial for profitability. Streamline processes for rent collection, maintenance requests, tenant communication, and lease renewals. Implementing effective property management systems reduces vacancy periods, ensures timely rent collection, and minimizes operational costs.

24. Renovation and Upgrade Potential: Properties with renovation or upgrade potential provide an opportunity to add value and increase profitability. Look for properties that can be improved through cosmetic upgrades, functional enhancements, or expansion. Renovations can attract higher-paying tenants and justify higher rental rates.

25. Diverse Rental Market: Consider properties that cater to a diverse rental market. Targeting a broader tenant demographic increases the pool of potential tenants. For example, properties suitable for families, professionals, or students allow for a more diversified tenant base, reducing the risk of vacancy and maximizing rental income potential.

26. Strong Employment Opportunities: Investing in areas with robust job markets and employment opportunities enhances the profitability of a rental property. A stable economy and growing job market attract more tenants, ensuring a consistent demand for rental properties.

27. Professional Networking: Establish relationships with local real estate agents, property managers, and industry professionals to enhance your knowledge and network in the rental property market. These professionals can provide valuable insights, market information, potential investment opportunities, and referrals. Collaborating with experts in the field can help you make informed decisions and increase the profitability of your rental property.

28. Adequate Property Size: Consider the property size in relation to the target rental market. Larger properties, such as single-family homes or multi-bedroom units, are suitable for families or groups, commanding higher rental rates. Smaller units, such as studios or one-bedroom apartments, are often preferred by young professionals or students. Understanding the needs of the local rental market helps you maximize rental income potential.

29. Amenities and Services: Properties with additional amenities and services can attract tenants willing to pay higher rents. Consider features such as fitness centers, swimming pools, communal areas, laundry facilities, concierge services, or pet-friendly policies. These amenities enhance the tenant experience, differentiate your property, and justify higher rental rates.

30. Flexible Financing Options: Explore various financing options to optimize your profitability. In addition to traditional mortgages, consider private financing, partnerships, or creative financing arrangements. Flexible financing can provide opportunities for better terms, reduced costs, and increased cash flow, ultimately improving the property’s profitability.

31. Low Competition: Investing in areas with low competition can lead to higher profitability. Look for rental properties in locations where the supply of rental housing is limited compared to the demand. Low competition allows you to have more control over rental rates, attract quality tenants, and minimize vacancies.

32. Tax Benefits: Familiarize yourself with tax benefits specific to rental property investments. Deductions for mortgage interest, property taxes, depreciation, and maintenance expenses can reduce your tax liability and increase your profitability. Consult with a tax professional to maximize the tax advantages available to rental property owners.

33. Resilient Property Type: Consider investing in property types that have demonstrated resilience during economic downturns. Affordable housing, rental properties near medical facilities, or properties in stable rental markets are examples of resilient property types. These types of properties tend to maintain demand even during challenging economic conditions, ensuring consistent rental income.

34. Scalability: If your goal is to build a rental property portfolio, consider properties that offer scalability. Apartment buildings, townhouses, or multiple units in close proximity allow for easier management, potential cost savings, and increased rental income. Scalability provides opportunities for portfolio growth and improved profitability.

35. Market Stability: Evaluate the stability of the local rental market. Look for areas with steady rental growth, low vacancy rates, and a diversified economy. A stable rental market ensures a consistent demand for housing, reducing the risk of income fluctuations and contributing to long-term profitability.

36. Long-Term Investment Strategy: Approach rental property investment with a long-term perspective. Real estate values generally appreciate over time, building equity in your property. Rental income provides a steady cash flow that can be reinvested or saved for future opportunities. A long-term investment strategy allows you to maximize profitability through property appreciation and consistent rental income.

Remember, assessing the features of a profitable rental property requires thorough research, careful analysis, and ongoing management. Each property and market is unique, so it’s important to adapt these features to your specific investment goals and local conditions.

Library Lecturer at Nurul Amin Degree College