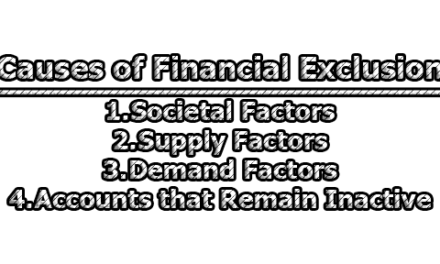

Financial literacy refers to the knowledge and skills needed to make informed and effective decisions regarding financial matters. It involves understanding basic financial concepts such as budgeting, saving, investing, borrowing, and managing debt. Financial literacy also includes the ability to evaluate financial products and services, such as credit cards, loans, and insurance, and to assess the risks and benefits associated with them. It helps individuals to make better decisions about their money, avoid financial pitfalls, and achieve financial goals such as saving for retirement or buying a house. Financial literacy is an important life skill that can lead to greater financial security, stability, and independence. In this article, we are going to explore the importance of financial literacy and personal finance basics.

Definitions of Financial Literacy:

Here are a few different definitions of financial literacy from various authors and organizations:

According to the Organisation for Economic Co-operation and Development (OECD), financial literacy is “a combination of awareness, knowledge, skill, attitude, and behavior necessary to make sound financial decisions and ultimately achieve individual financial well-being.”

The National Financial Educators Council defines financial literacy as “possessing the knowledge and skills to make informed and effective decisions regarding earning, spending, and saving money.”

Dave Ramsey defines financial literacy as “the ability to understand how money works in the world: how someone manages to earn or make it, how that person manages it, how he/she invests it, and how that person donates it to help others.”

European Union defines financial literacy as “the ability to understand financial issues and to make informed and effective decisions regarding personal finance.”

The Financial Industry Regulatory Authority (FINRA) defines financial literacy as “the ability to understand financial markets, manage personal finances, and make informed financial decisions.”

The Consumer Financial Protection Bureau (CFPB) defines financial literacy as “the knowledge, skills, and confidence to make responsible financial decisions.”

The World Bank defines financial literacy as “the ability to understand and use financial information to make decisions and solve financial problems in everyday life.”

The Jump$tart Coalition for Personal Financial Literacy defines financial literacy as “the ability to use knowledge and skills to manage financial resources effectively for a lifetime of financial well-being.”

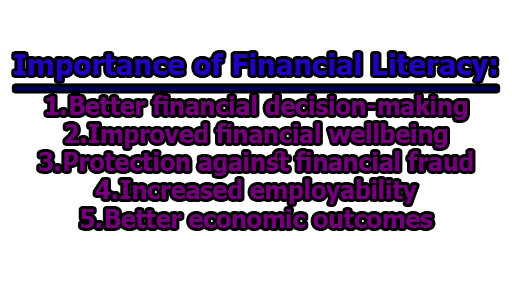

Importance of Financial Literacy:

Financial literacy is an important life skill that has become increasingly crucial in today’s complex financial landscape. It allows individuals to make informed and effective decisions regarding financial matters, such as budgeting, saving, investing, borrowing, and managing debt. In this section, we will discuss the importance of financial literacy:

- Better financial decision-making: Financial literacy equips individuals with the knowledge and skills needed to make better financial decisions. According to a study by the National Bureau of Economic Research, individuals who receive financial education are more likely to plan for retirement, save for emergencies, and avoid high-cost borrowing than those who do not receive such education.

- Improved financial well-being: Financial literacy can improve an individual’s overall financial well-being. For example, individuals who are financially literate are more likely to have higher credit scores, lower debt levels, and greater wealth accumulation than those who are not.

- Protection against financial fraud: Financial literacy can help protect individuals from financial fraud and scams. According to a survey by the Federal Trade Commission, individuals who reported being victims of fraud had lower levels of financial literacy than those who did not report being victims.

- Increased employability: Financial literacy can also increase an individual’s employability. Employers value employees who have a basic understanding of financial concepts, such as budgeting and managing debt. A study by PwC found that 60% of millennials said they would be more interested in a job if it offered financial education as a benefit.

- Better economic outcomes: Financial literacy can also have positive economic outcomes at the national level. For example, a report by the Global Financial Literacy Excellence Center found that increasing financial literacy can lead to higher economic growth, lower income inequality, and greater financial stability.

Overall, financial literacy is an essential life skill that can have significant importance for individuals and society as a whole. It allows individuals to make better financial decisions, improves their financial well-being, protects them from financial fraud, increases their employability, and can lead to better economic outcomes.

Personal Finance Basics:

Personal finance is a crucial life skill that everyone should possess. It involves managing your money effectively to achieve your financial goals and secure your financial future. However, financial literacy is not something that is taught in schools, and many people are left to figure it out on their own. Here, we will cover some of the basics of personal finance that everyone should know.

- Budgeting: The first step to managing your finances effectively is to create a budget. A budget is a plan that outlines how you will spend your money over a specific period. To create a budget, you need to determine your income and expenses. Income includes your salary, bonuses, and any other sources of income. Expenses include your rent/mortgage, utilities, groceries, transportation, and other bills. By creating a budget, you can identify areas where you can cut back on expenses and save more money.

- Saving: Saving is an essential aspect of personal finance. It is the process of setting aside a portion of your income for future use. There are different types of savings, including emergency savings, retirement savings, and long-term savings. Emergency savings are for unexpected expenses, such as medical bills or car repairs. Retirement savings are for your post-work years, and long-term savings are for big-ticket items, such as a down payment on a house or a child’s education. By saving regularly, you can build a financial cushion and achieve your financial goals.

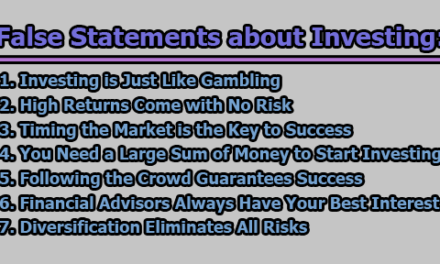

- Investing: Investing is the process of putting your money to work to generate a return. There are different types of investments, including stocks, bonds, real estate, and mutual funds. Investing carries some risk, but it can also provide significant returns over the long term. Before investing, it’s essential to understand your risk tolerance and investment goals. It’s also essential to diversify your portfolio to minimize risk.

- Managing Debt: Managing debt is an essential aspect of personal finance. Debt can be a useful tool for achieving your financial goals, such as buying a home or starting a business. However, too much debt can be detrimental to your financial health. To manage debt effectively, you need to understand the different types of debt, such as credit card debt, student loans, and mortgages. You should also develop a debt repayment plan to pay off your debt as soon as possible.

- Credit Scores: Credit scores are a measure of your creditworthiness. They are based on your credit history, including your payment history, credit utilization, and length of credit history. A good credit score is essential for getting approved for loans and credit cards. To maintain a good credit score, you should pay your bills on time, keep your credit utilization low, and avoid opening too many new credit accounts.

In summary, financial literacy is a vital skill that everyone should possess. By understanding the basics of personal finance, you can manage your money effectively and achieve your financial goals. Remember, it’s never too late to start building your financial literacy.

References:

- Organisation for Economic Co-operation and Development (OECD). (2017). Recommendation of the Council on Financial Literacy. https://www.oecd.org/daf/fin/financial-education/OECD-Recommendation-Financial-Education-Adopted-Council-15-July-2015.pdf

- National Financial Educators Council. (n.d.). Definition of Financial Literacy. https://www.financialeducatorscouncil.org/financial-literacy/

- Ramsey, D. (2009). The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness. Thomas Nelson.

- European Union. (2017). Financial Literacy: The Bridge from School to Life. European Commission. https://publications.europa.eu/en/publication-detail/-/publication/e7d8cc20-1cc9-11e7-a3f4-01aa75ed71a1/language-en

- Financial Industry Regulatory Authority (FINRA). (n.d.). Financial Literacy. https://www.finra.org/investors/financial-literacy

- Consumer Financial Protection Bureau (CFPB). (n.d.). Financial Education and Capability Definitions. https://www.consumerfinance.gov/practitioner-resources/financial-education-and-capability-definitions/

- World Bank. (2012). Financial Capability and Consumer Protection: Overview of Good Practices. https://openknowledge.worldbank.org/handle/10986/11807

- Jump$tart Coalition for Personal Financial Literacy. (n.d.). What is Financial Literacy? https://www.jumpstart.org/what-is-financial-literacy/

- Lusardi, A., & Mitchell, O. S. (2014). The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature, 52(1), 5–44. https://doi.org/10.1257/jel.52.1.5

- Huston, S. J. (2010). Measuring Financial Literacy. Journal of Consumer Affairs, 44(2), 296–316. https://doi.org/10.1111/j.1745-6606.2010.01170.x

- Federal Trade Commission. (2013). The Impact of Financial Literacy Education on Subsequent Financial Behavior. https://www.ftc.gov/system/files/documents/reports/impact-financial-literacy-education-subsequent-financial-behavior-040313/130406financialliteracyrpt.pdf

- (2017). Employee Financial Wellness Survey. https://www.pwc.com/us/en/private-company-services/publications/financial-well-being-retirement-survey.html

- Global Financial Literacy Excellence Center. (2018). The Economic Effects of Financial Education: Evidence from the Field. https://www.usfinancialcapability.org/downloads/The_Economic_Effects_of_Financial_Education_Evidence_from_the_Field.pdf

- “Budgeting 101: How to Create a Budget and Stick to It.” The Balance, 25 August 2021, thebalance.com/how-to-create-a-budget-1289587.

- “Saving 101: How to Start Saving Money.” Investopedia, 26 July 2021, investopedia.com/articles/personal-finance/090814/saving-101-start-your-savings-now.asp.

- “Investing 101: A Tutorial for Beginner Investors.” The Balance, 27 July 2021, thebalance.com/investing-101-4073969.

- “Debt Management 101: How to Manage Your Debt.” NerdWallet, 27 July 2021, nerdwallet.com/article/finance/debt-management-101.

- “What Is a Credit Score?” Experian, 8 August 2021, experian.com/blogs/ask-experian/credit-education/score-basics/what-is-a-credit-score/.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College