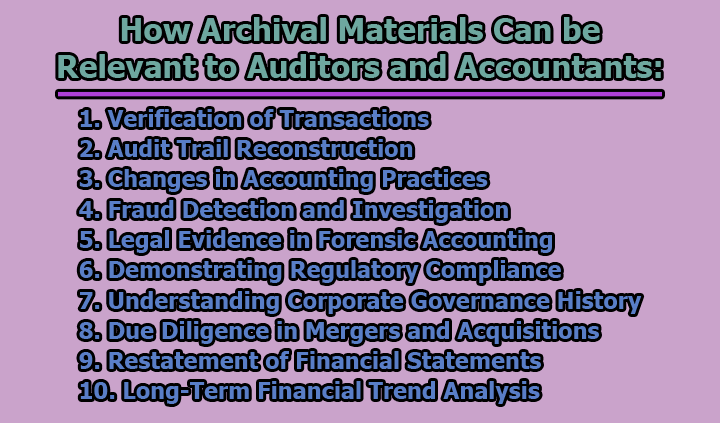

How Archival Materials Can be Relevant to Auditors and Accountants:

Auditors and accountants can be interested in archival materials, particularly when conducting historical financial audits or forensic accounting investigations. Archival materials, in this context, refer to historical records, documents, and financial transactions that are preserved in archives or organizational repositories. Here’s how archival materials can be relevant to auditors and accountants:

- Verification of Transactions:

- Role in Audits: Archival materials, including historical ledgers, receipts, and invoices, play a pivotal role in the verification of transactions during financial audits. These documents serve as tangible evidence of financial activities, allowing auditors to cross-reference them with reported figures in financial statements.

- Ensuring Accuracy: Auditors use archival materials to ensure that the transactions reported in financial statements are accurate and legitimate. By comparing the information in these historical records with current financial data, auditors can verify the consistency and reliability of an organization’s financial reporting.

- Audit Trail Reconstruction:

- Importance of Trail: Auditors often need to reconstruct the audit trail to understand the sequence of financial transactions. Archival materials serve as the building blocks for this reconstruction, enabling auditors to trace the flow of funds and identify any discrepancies or irregularities in the financial data.

- Enhancing Transparency: Reconstruction of the audit trail enhances the transparency of financial activities. Archival materials provide auditors with a historical perspective, allowing them to assess the completeness of the audit trail and ensuring that all financial transactions are appropriately documented.

- Changes in Accounting Practices:

- Tracking Changes Over Time: Archival materials are crucial for tracking changes in an organization’s accounting practices and policies over time. By examining historical financial records, auditors can identify shifts in accounting methodologies, ensuring that these changes comply with accounting standards and have been consistently applied.

- Consistency Checks: Auditors use archival materials to conduct consistency checks, ensuring that accounting practices remain uniform across different reporting periods. This is essential for maintaining the integrity and comparability of financial statements over time.

- Fraud Detection and Investigation:

- Tracing the Origin: Archival materials are invaluable in forensic accounting investigations, especially when dealing with financial fraud. Forensic accountants use these materials to trace the origin of suspicious transactions, helping to uncover patterns of financial misconduct and identify potential fraudulent activities.

- Building a Case: Historical documents serve as a foundation for building a robust case in instances of financial fraud. Archival research allows forensic accountants to establish a timeline of events, providing a comprehensive understanding of the financial history that can be presented as evidence in legal proceedings.

- Legal Evidence in Forensic Accounting:

- Documenting Financial Activities: Archival research provides forensic accountants with documented evidence of past financial activities. This documentation serves as legal evidence in court, supporting the findings of forensic investigations and strengthening the case against individuals or entities involved in financial wrongdoing.

- Establishing Credibility: The use of archival materials in forensic accounting not only aids in uncovering financial irregularities but also establishes the credibility of the investigative process. Historical records offer a verifiable trail of evidence that adds weight to the conclusions drawn by forensic accountants.

- Demonstrating Regulatory Compliance:

- Consistency in Adherence: Auditors utilize archival materials to demonstrate an organization’s historical compliance with financial regulations. These materials serve as a record of financial practices, showcasing that the entity has consistently adhered to accounting principles and regulatory requirements over time.

- Documentation for Audits: During regulatory audits, archival materials provide tangible evidence of past compliance. Auditors can refer to historical financial records to verify that the organization has followed regulatory guidelines, contributing to a thorough assessment of current compliance.

- Understanding Corporate Governance History:

- Insights into Decision-Making: Archival materials offer auditors insights into the historical context of corporate governance practices and decision-making processes. By analyzing board meeting minutes, reports, and memoranda, auditors gain a deeper understanding of how financial decisions were made, ensuring they align with sound governance principles.

- Identifying Governance Trends: Examining historical records allows auditors to identify trends in corporate governance, facilitating the assessment of whether an organization has evolved its governance practices over time or if there are patterns that require closer scrutiny.

- Due Diligence in Mergers and Acquisitions:

- Comprehensive Financial Assessment: Auditors and accountants engaged in due diligence for mergers and acquisitions rely on archival materials to conduct a comprehensive assessment of the financial health of the entities involved. Historical financial data provides a broader perspective on the financial performance and stability of the organizations under consideration.

- Risk Identification: Archival materials aid in the identification of long-term financial trends and potential risks associated with the entities undergoing the transaction. This historical perspective is essential for making informed decisions regarding the viability and potential challenges of the merger or acquisition.

- Restatement of Financial Statements:

- Comparative Analysis: In situations where financial statements need to be restated, auditors refer to archival materials to understand the reasons behind the restatement. Historical records facilitate a comparative analysis between the original and restated financial information, aiding auditors in identifying discrepancies, errors, or changes in accounting practices.

- Ensuring Accuracy in Restatements: Archival materials serve as a reference point for auditors to ensure that restatements are accurate and appropriately reflect the adjustments needed. This historical context contributes to the integrity of the restatement process.

- Long-Term Financial Trend Analysis:

- Strategic Planning Insights: Auditors and accountants use archival materials to analyze long-term financial trends. By examining historical financial data, they gain insights into the success of past financial strategies, helping organizations make informed decisions in strategic planning for the future.

- Assessing Financial Stability: Historical records contribute to assessing an organization’s financial stability over an extended period. Auditors can identify patterns, fluctuations, or consistent growth, providing valuable information for evaluating the overall financial health and sustainability of the entity.

In conclusion, while auditors and accountants typically focus on current financial information for routine audits, there are situations where a historical perspective becomes essential, such as during forensic investigations, restatements of financial statements, or assessments of long-term financial trends. In these cases, archival materials play a valuable role in providing a historical context for financial analysis and decision-making.

Former Student at Rajshahi University