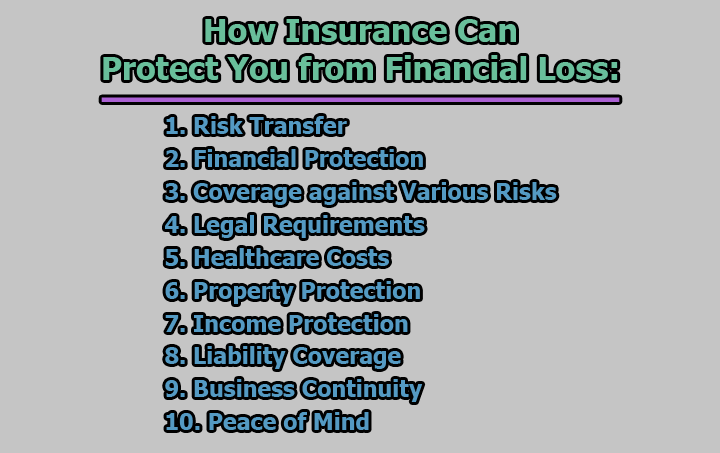

How Insurance Can Protect You from Financial Loss:

Insurance is a financial arrangement that provides protection against the risk of financial loss. It operates on the principle of risk pooling, where individuals or entities pay premiums to an insurance company in exchange for coverage against specified risks. Here’s an explanation of how insurance can protect you from financial loss:

1. Risk Transfer: Insurance operates on the fundamental principle of risk transfer. When you purchase an insurance policy, you are essentially transferring the financial risk of a specific event to the insurance company. Instead of bearing the entire burden of potential loss yourself, the insurer agrees to take on that risk in exchange for regular premium payments. This allows individuals or businesses to protect their financial well-being without having to set aside large sums of money to cover potential losses.

2. Financial Protection: The primary purpose of insurance is to provide financial protection in the face of unexpected events. In the event of a covered loss, the insurance company steps in to compensate the policyholder or a third party, depending on the type of insurance. For example, if you have auto insurance and your car is damaged in an accident, the insurance company will cover the repair costs. This financial assistance helps individuals or businesses recover without experiencing a significant hit to their savings or being forced into financial hardship.

3. Coverage against Various Risks: Insurance comes in diverse forms to address specific risks that individuals and businesses may face. For instance:

- Health Insurance: Covers medical expenses, providing a financial safety net for individuals in times of illness or injury.

- Auto Insurance: Protects against financial losses related to vehicle accidents, theft, or damage.

- Homeowners/Renters Insurance: Offers coverage for property damage, theft, or liability claims related to the home.

- Life Insurance: Provides a financial benefit to beneficiaries in the event of the policyholder’s death.

- Business Insurance: Covers a range of risks, including property damage, liability claims, and business interruption, to ensure the continuity of operations.

4. Legal Requirements: In many jurisdictions, certain types of insurance are legally required. For example, auto insurance is mandatory in most places. The purpose of these requirements is not only to protect individuals from financial loss but also to ensure that all parties involved in specific activities are financially responsible. Failure to comply with these legal requirements can result in penalties, fines, or other consequences.

5. Healthcare Costs: Health insurance plays a crucial role in managing the high costs associated with healthcare. It covers a variety of medical expenses, including hospitalization, surgeries, prescription medications, and preventive care. Without health insurance, individuals might find it challenging to afford necessary medical treatments, leading to potential financial strain. Health insurance ensures that individuals can access the healthcare they need without facing exorbitant out-of-pocket expenses, contributing to their overall well-being.

6. Property Protection: Homeowners and renters insurance are essential for safeguarding against potential property damage or loss. These policies typically cover events such as fires, theft, vandalism, and natural disasters. In the event of a covered incident, the insurance company assists in covering the costs of repairing or replacing damaged property. Without this protection, individuals could face significant financial setbacks, especially if they need to rebuild a home or replace valuable belongings.

7. Income Protection: Disability insurance and life insurance are critical for preserving financial stability in the face of unforeseen circumstances. Disability insurance provides income replacement if the policyholder becomes unable to work due to a disability, ensuring ongoing financial support. Life insurance, on the other hand, provides a financial benefit to beneficiaries upon the death of the insured individual, helping to replace lost income and support dependents.

8. Liability Coverage: Liability insurance protects individuals and businesses from the financial implications of legal claims or lawsuits. For instance, auto liability insurance covers the costs if you are found responsible for an accident, including medical expenses and property damage for the other party involved. Liability coverage in homeowners insurance protects against legal claims for injuries or property damage that occur on your property. Without liability coverage, individuals could be personally responsible for significant legal expenses and damages.

9. Business Continuity: Business insurance is crucial for protecting companies from various risks that could disrupt operations. This may include property damage due to events like fires or natural disasters, liability claims from customers or employees, and business interruption coverage for situations that temporarily halt business activities. Having comprehensive business insurance ensures that, in the face of unexpected events, a company can recover and continue its operations without facing insurmountable financial challenges.

10. Peace of Mind: Beyond the tangible financial protection, insurance provides peace of mind. Knowing that you have coverage in place for potential risks alleviates the stress and anxiety associated with uncertainties. This peace of mind allows individuals and businesses to focus on their daily activities and long-term goals without the constant fear of significant financial setbacks due to unforeseen events.

In conclusion, insurance serves as a financial safety net, offering protection and peace of mind by transferring the financial risk associated with various events to insurance companies. Whether it’s protecting your health, property, income, or business, insurance plays a crucial role in mitigating the impact of unexpected events on your financial well-being.

Library Lecturer at Nurul Amin Degree College