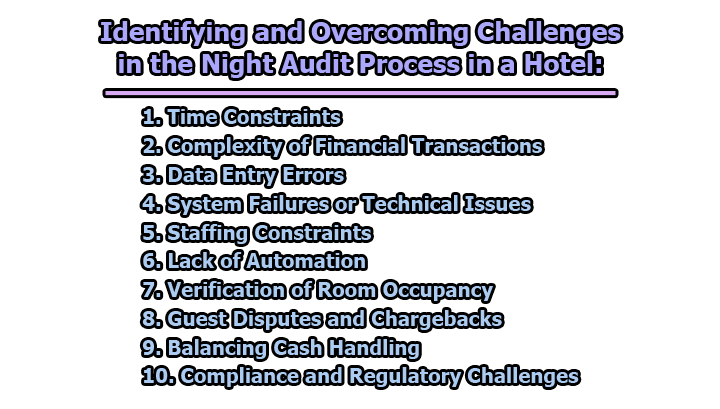

Identifying and Overcoming Challenges in the Night Audit Process in a Hotel:

The night audit process in a hotel is a pivotal task that ensures the accuracy of financial transactions and operational records. Despite its significance, this process often encounters various challenges, which if not addressed effectively, can hinder operational efficiency and financial integrity. In this article, we will explore “identifying and overcoming challenges in the night audit process in a hotel”.

1. Time Constraints: Conducting the night audit within a limited timeframe is a significant challenge for hotel staff. Typically scheduled during late-night hours when guest activity is minimal, auditors face pressure to complete a multitude of tasks efficiently. These tasks include reconciling accounts, verifying room occupancy, generating financial reports, and addressing any discrepancies.

Example: In a large hotel with extensive amenities and high occupancy rates, auditors may find themselves overwhelmed by the sheer volume of transactions and the complexity of financial records. With only a few hours available for the night audit, there is a constant race against time to ensure that all tasks are completed accurately and on schedule.

Solution: To overcome the challenge of time constraints, hotels can implement streamlined procedures and leverage automation tools. Investing in advanced accounting software that automates tasks such as account reconciliation and report generation can significantly reduce the time required for the night audit process. Additionally, establishing clear priorities and efficient workflows, along with adequate staffing levels during the audit period, can help ensure that tasks are completed within the allotted time frame.

2. Complexity of Financial Transactions: Financial transactions within a hotel can be intricate, involving various payment methods, discounts, and adjustments. Ensuring the accuracy of these transactions during the night audit requires meticulous attention to detail and thorough reconciliation of accounts.

Example: A guest’s bill may include charges for room accommodations, dining expenses, room service, spa treatments, and other amenities. Each of these transactions must be carefully reviewed and reconciled to ensure that the guest is accurately billed and that the hotel’s financial records are correct.

Solution: To address the complexity of financial transactions, hotels can implement standardized procedures for recording and categorizing transactions. Staff should receive comprehensive training on these procedures to ensure consistency and accuracy in transaction handling. Additionally, utilizing accounting software with built-in auditing features can help automate the reconciliation process and minimize errors.

3. Data Entry Errors: Manual data entry is prone to errors, posing a significant challenge during the night audit process. Even minor mistakes in entering transaction details can lead to discrepancies in financial reports and misinterpretation of data.

Example: A cashier may inadvertently enter the wrong room number or transaction amount when recording guest charges, resulting in inaccuracies during the night audit. These errors can go unnoticed if not promptly identified and corrected.

Solution: Implementing controls such as double-entry verification can help mitigate the risk of data entry errors. Auditors should conduct regular audits of transaction records to identify and correct any discrepancies. Staff training on accurate data entry practices and the importance of attention to detail is essential for minimizing errors.

4. System Failures or Technical Issues: System failures or technical glitches can disrupt the night audit process, impeding access to critical information and hindering auditing tasks.

Example: The hotel’s accounting software may experience a technical glitch or crash during the night audit, preventing auditors from accessing transaction records or generating reports. This can cause delays in the audit process and impact the overall efficiency of operations.

Solution: To address system failures or technical issues, hotels should implement backup systems and contingency plans. Regular maintenance and updates of hardware and software systems can help prevent technical glitches. Additionally, staff should be trained on alternative procedures for conducting audits in the event of a system outage, ensuring continuity of operations.

5. Staffing Constraints: Limited staffing during late-night hours presents a challenge for hotels, particularly smaller establishments or those experiencing peak occupancy. With fewer personnel available to conduct the audit, essential tasks may be overlooked or delayed.

Example: A boutique hotel may have only one staff member assigned to the night audit, struggling to manage all responsibilities effectively. This can lead to inefficiencies in the audit process and potential errors in financial reporting.

Solution: To overcome staffing constraints, hotels can cross-train staff members to perform audit tasks and provide additional support during peak periods. Outsourcing certain audit functions to third-party providers can also help alleviate staffing constraints. By optimizing staffing resources and ensuring adequate coverage during the audit period, hotels can enhance the efficiency and effectiveness of the night audit process.

6. Lack of Automation: The absence of automation in audit processes can hinder efficiency and increase the risk of errors. Manual reconciliation and report generation are time-consuming and prone to inaccuracies.

Example: Auditors may spend significant time manually sifting through transaction records and spreadsheets, leading to inefficiencies in the audit process. This manual approach leaves room for human error and oversight.

Solution: To address the lack of automation, hotels should invest in technology solutions that streamline audit procedures. Advanced accounting software with automation capabilities can automate tasks such as account reconciliation, report generation, and data analysis. By leveraging automation tools, hotels can enhance accuracy, efficiency, and productivity in the night audit process.

7. Verification of Room Occupancy: Accurately verifying room occupancy is crucial for the night audit process, ensuring that billing records align with actual guest stays. However, discrepancies in occupancy data can complicate this verification process.

Example: Inconsistencies between the property management system and physical room inventory can lead to inaccuracies in occupancy records. This can result in errors in guest billing and revenue reporting.

Solution: To address this challenge, hotels should implement robust verification procedures for room occupancy. This may include conducting regular physical counts of room inventory and cross-referencing with data from the property management system. By ensuring the accuracy of occupancy records, hotels can minimize billing discrepancies and maintain financial integrity.

8. Guest Disputes and Chargebacks: Guest disputes and chargebacks can disrupt the night audit process, requiring careful investigation and resolution. Failure to address these disputes promptly can impact financial reporting and guest satisfaction.

Example: A guest disputes a charge on their bill, alleging that they did not authorize the transaction or receive the service. Resolving such disputes requires thorough examination of transaction records and effective communication with the guest.

Solution: To mitigate the impact of guest disputes and chargebacks, hotels should establish clear protocols for handling such incidents. Staff should be trained to address guest concerns promptly and professionally, with a focus on resolving disputes to the guest’s satisfaction. Effective communication and documentation of dispute resolution efforts are essential for maintaining financial transparency and guest trust.

9. Balancing Cash Handling: Balancing cash handling during the night audit process is critical for financial accuracy and security. Discrepancies in cash counts can indicate errors or potential fraud.

Example: During cash reconciliation, a discrepancy is discovered between the expected cash amount and the actual cash on hand. This raises concerns about the accuracy of cash handling procedures and the potential for theft or misappropriation.

Solution: To ensure the accuracy of cash handling, hotels should implement strict controls and reconciliation procedures. Cash counts should be conducted regularly, with multiple staff members involved in the process to minimize the risk of errors or discrepancies. Additionally, staff should receive training on proper cash handling techniques and be aware of the importance of maintaining accurate records.

10. Compliance and Regulatory Challenges: Adhering to regulatory standards and compliance requirements poses a significant challenge for hotels during the night audit process. Non-compliance can result in penalties, fines, or reputational damage.

Example: Failure to report taxes accurately or protect guest data in accordance with privacy regulations can lead to compliance violations. This can have serious consequences for the hotel, including legal liabilities and damage to its reputation.

Solution: To address compliance and regulatory challenges, hotels should stay informed about industry regulations and ensure that audit procedures are aligned with legal requirements. Regular audits of compliance practices should be conducted to identify any areas of non-compliance and take corrective action as necessary. Staff should receive training on regulatory requirements and be vigilant in adhering to established procedures to mitigate compliance risks.

In conclusion, the night audit process in a hotel is essential for maintaining financial integrity and operational efficiency. By identifying and overcoming common challenges such as time constraints, data entry errors, and compliance issues, hotels can streamline their audit procedures and ensure accuracy. Implementing practical solutions, such as automation tools, standardized procedures, and staff training, is crucial for a successful night audit process. By addressing these challenges proactively, hotels can enhance financial transparency, optimize operational performance, and deliver exceptional guest experiences.

Library Lecturer at Nurul Amin Degree College