Investment Strategies of Employees in Banking and Insurance Sectors:

The banking and insurance sectors are two of the most significant pillars of any economy. They play a vital role in providing financial services to individuals and businesses, helping to facilitate growth and development. As employees in these sectors, it is essential to understand the various investment strategies that can help maximize returns and build wealth over time. Investment strategies can range from conservative options such as savings accounts and bonds to more aggressive options such as stocks and mutual funds. Factors such as age, risk tolerance, and financial goals can also influence an individual’s investment strategy. By understanding the various investment options available and the risks and rewards associated with each, employees in the banking and insurance sectors can make informed investment decisions that align with their financial goals and objectives. In this context, it is crucial to explore the various investment strategies that employees in the banking and insurance sectors can adopt to grow their wealth while managing their risks effectively. In the rest of this article, we will explore the investment strategies of employees in banking and insurance sectors.

Awareness of Employees about Investment Avenues:

Investment is an important aspect of an individual’s financial planning. It helps in meeting one’s long-term financial goals such as retirement, buying a house, children’s education, etc. However, not everyone is aware of the various investment avenues available to them. Here, we will discuss the different investment options available to employees, including non-marketable financial assets, real estate, precious objects, insurance policies, pension funds, money market instruments, bonds, and capital market instruments.

- Non-Marketable Financial Assets: Non-marketable financial assets are those investments that are not traded on any stock exchange or public market. These include investments such as certificates of deposit, savings bonds, and money market accounts. These investments are generally considered to be safe and conservative. Certificates of deposit are a type of investment where an individual deposits money in a bank or financial institution for a specific period of time, and in return, they receive a fixed interest rate. Savings bonds are issued by the government and are also a safe investment option. Money market accounts are similar to savings accounts, but they generally offer higher interest rates.

- Real Estate/Residential House: Real estate is another investment option available to employees. Investing in real estate can be a good way to build wealth over time, as the value of the property increases. Residential houses are an attractive option for investment because they offer several benefits, including rental income, potential capital appreciation, and tax benefits. Rental income from the property can provide a steady stream of income, and capital appreciation occurs as the value of the property increases over time. Additionally, owning a residential house can provide tax benefits in the form of deductions for property taxes and mortgage interest payments.

- Precious Objects: Investing in precious objects such as gold, silver, and other precious metals, gemstones, and artwork is another investment option available to employees. The value of precious objects tends to increase over time, making them a good long-term investment option. However, investing in precious objects requires knowledge and expertise in the field. Additionally, storage and insurance costs can be high.

- Insurance Policies: Insurance policies are a type of investment that can provide financial security and protection in the event of an unforeseen event such as illness, disability, or death. There are several types of insurance policies available, including life insurance, health insurance, and disability insurance. Life insurance policies provide a lump sum payment to the beneficiaries in the event of the policyholder’s death, while health insurance policies provide coverage for medical expenses. Disability insurance policies provide income replacement in the event that an individual is unable to work due to a disability.

- Pension Funds: Pension funds are a type of investment option available to employees that provide retirement benefits. These funds are typically managed by employers and offer employees a source of income in retirement. There are two main types of pension funds: defined benefit plans and defined contribution plans. Defined benefit plans provide employees with a fixed amount of income in retirement, while defined contribution plans allow employees to contribute a certain amount of their income to the plan, with the employer matching a portion of the contribution.

- Money Market Instruments: Money market instruments are short-term, low-risk investment options that are generally considered to be safe and conservative. These instruments include treasury bills, certificates of deposit, and commercial paper. Treasury bills are issued by the government and have a maturity period of less than one year. Certificates of deposit are issued by banks and financial institutions and offer a fixed interest rate. Commercial paper is a type of short-term debt issued by corporations to raise capital.

- Bonds or Fixed-Income Securities: Bonds or fixed-income securities are another investment option available to employees. These securities are issued by corporations or governments and provide a fixed income stream to the investor. Bonds have a fixed maturity date and pay a fixed interest rate. They are generally considered a safe investment option, as the issuer has a legal obligation to pay back the principal and interest to the investor. However, bond prices can be affected by changes in interest rates and inflation.

- Capital Market Instruments: Capital market instruments are long-term investment options that are traded on public markets. These instruments include stocks, mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs). Stocks represent ownership in a company and provide investors with a share of the company’s profits. Mutual funds are a type of investment vehicle that pools money from multiple investors to invest in a portfolio of stocks, bonds, and other securities. ETFs are similar to mutual funds but are traded on public markets like stocks. REITs are a type of investment vehicle that invests in real estate and provides investors with a share of the rental income and capital appreciation.

Importance of Awareness:

It is important for employees to be aware of the different investment options available to them. Investing can be a good way to build wealth over time, but it requires knowledge and expertise in the field. Additionally, different investment options have different risks and potential returns. Employees should understand the risks and potential returns associated with each investment option before making an investment decision.

Investment Planning:

Investment planning is an important aspect of an individual’s financial planning. It involves setting investment goals, determining the amount of money to invest, and selecting the appropriate investment options. Employees should consider their risk tolerance, investment horizon, and financial goals when selecting an investment option. Additionally, it is important to diversify investments to reduce risk.

In summary, there are several investment options available to employees, including non-marketable financial assets, real estate, precious objects, insurance policies, pension funds, money market instruments, bonds, and capital market instruments. It is important for employees to be aware of these different investment options and to understand the risks and potential returns associated with each option. Investing can be a good way to build wealth over time, but it requires knowledge and expertise in the field. Investment planning is an important aspect of an individual’s financial planning and involves setting investment goals, determining the amount of money to invest, and selecting the appropriate investment options.

Investment Pattern:

Investment is an essential aspect of financial planning. It is a means of putting money to work in order to generate income or capital appreciation over time. Investment options can range from low-risk to high-risk, depending on the investor’s risk appetite and investment horizon. Here, we will discuss some of the most popular investment options in India, including bank deposits, flexi deposits, post office deposits, monthly income schemes of the post office, national savings certificates, and company deposits.

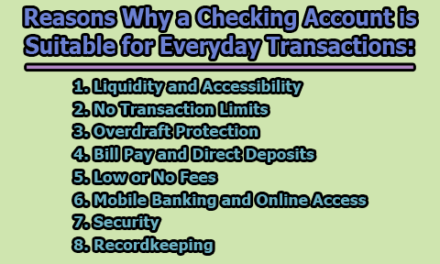

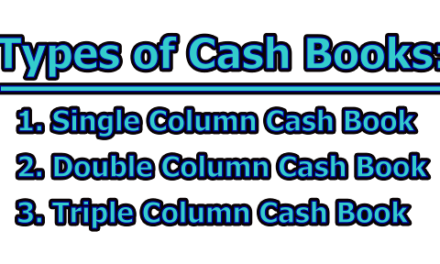

a. Bank Deposits: Bank deposits are one of the most popular investment options among Indians. Banks offer several types of deposit schemes, including fixed deposits, recurring deposits, and savings deposits. Fixed deposits are a type of deposit scheme where the investor deposits a lump sum amount for a fixed period of time, and the bank pays a fixed rate of interest on the deposit. Recurring deposits are a type of deposit scheme where the investor deposits a fixed amount of money every month for a fixed period of time, and the bank pays a fixed rate of interest on the deposit. Savings deposits are a type of deposit scheme where the investor can deposit and withdraw money at any time, and the bank pays interest on the deposit balance.

b. Flexi Deposits: Flexi deposits are a new type of deposit scheme offered by banks. In this scheme, the investor can deposit any amount of money at any time, and the bank pays a higher rate of interest than savings deposits. The investor can withdraw money at any time, subject to a minimum balance requirement. Flexi deposits are a good investment option for those who want to earn higher interest than savings deposits but also want the flexibility to withdraw money at any time.

c. Post Office Deposits (POTD): Post office deposits are a popular investment option among Indians. The post office offers several types of deposit schemes, including fixed deposits, recurring deposits, and savings deposits. Fixed deposits are a type of deposit scheme where the investor deposits a lump sum amount for a fixed period of time, and the post office pays a fixed rate of interest on the deposit. Recurring deposits are a type of deposit scheme where the investor deposits a fixed amount of money every month for a fixed period of time, and the post office pays a fixed rate of interest on the deposit. Savings deposits are a type of deposit scheme where the investor can deposit and withdraw money at any time, and the post office pays interest on the deposit balance.

d. Monthly Income Scheme of The Post Office (MISPO): Monthly Income Scheme of the Post Office (MISPO) is a type of investment option that provides a monthly income to investors. In this scheme, the investor deposits a lump sum amount for a fixed period of time, and the post office pays a fixed rate of interest on the deposit. The investor receives a fixed amount of money every month for the duration of the investment period. This scheme is ideal for retired individuals who want to earn a regular income.

e. National Savings Certificate (NSC): National Savings Certificate (NSC) is a type of government-backed investment option that provides guaranteed returns. In this scheme, the investor deposits a lump sum amount for a fixed period of time, and the government pays a fixed rate of interest on the deposit. The interest earned is reinvested in the scheme, and the investor receives the maturity amount at the end of the investment period. NSC is a safe investment option, as it is backed by the government.

f. Company Deposits: Company deposits are a type of investment option where the investor deposits money with a company for a fixed period of time, and the company pays a fixed rate of interest on the deposit. Company deposits are higher-risk investment options than bank deposits, as the investor is exposed to the risk of the company defaulting on the deposit. It is important to carefully research the company’s financials and credibility before investing in company deposits.

Here are some things to consider when investing in company deposits:

- Credit Rating: Before investing in a company deposit, it is important to check the company’s credit rating. Credit rating agencies such as CRISIL, ICRA, and CARE provide ratings based on the company’s financial strength and ability to meet its debt obligations. A higher credit rating indicates a lower risk of default.

- Interest Rate: The interest rate offered on company deposits is usually higher than bank deposits. However, it is important to compare the interest rate offered by different companies before investing. It is also important to consider the tax implications of the interest earned.

- Investment Period: Company deposits usually have a fixed investment period. It is important to carefully consider the investment period before investing, as premature withdrawal may result in penalties or lower interest rates.

- The credibility of the Company: It is important to research the credibility of the company before investing in its deposits. Factors such as the company’s financials, track record, and reputation in the market should be considered.

Bank deposits, flexi deposits, post office deposits, monthly income schemes of the post office, national savings certificates, and company deposits are all popular investment options in India. Each investment option has its own features and benefits. It is important to carefully consider the investment options and their associated risks before investing. A well-diversified investment portfolio can help investors minimize their risks and achieve their financial goals.

Preferences of Investment Avenues:

Investment preferences may vary from person to person based on their financial goals, risk tolerance, and investment horizon. Here are some factors that can influence an investor’s preference for different investment avenues:

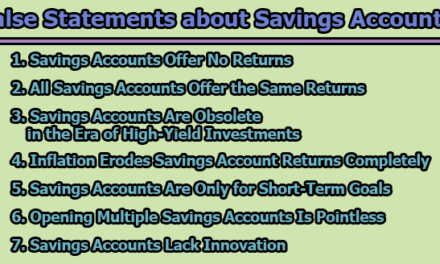

- Deposits: Deposits such as bank fixed deposits, recurring deposits, and flexi deposits are popular among investors who prefer the safety of capital and a fixed rate of return. These investments are ideal for conservative investors who are not willing to take on significant risks. However, the returns on deposits may be lower than other investment options, and may not keep pace with inflation.

- Financial Assets: Non-marketable financial assets such as stocks, mutual funds, and bonds are popular among investors who are willing to take on more risk for higher returns. These investments are suitable for long-term investors who can tolerate market volatility. Stocks and mutual funds offer the potential for capital appreciation and dividends, while bonds provide a fixed rate of return. However, these investments may be subject to market risks and require careful monitoring.

- Insurance Schemes: Insurance schemes such as term plans, endowment plans, and ULIPs are popular among investors who want to secure their financial future and provide for their loved ones in case of unforeseen circumstances. These investments provide financial protection and may offer tax benefits. However, the returns on insurance schemes may be lower than other investment options, and may not be suitable for investors looking for high returns.

- Pension Fund Schemes: Pension fund schemes such as National Pension System (NPS) and Employees’ Provident Fund (EPF) are popular among investors who want to build a retirement corpus. These investments offer tax benefits and long-term capital appreciation. However, the returns on pension fund schemes may be subject to market risks and require careful monitoring.

- Post Office Schemes: Post office schemes such as the Public Provident Fund (PPF), National Savings Certificate (NSC), and Monthly Income Scheme (MIS) are popular among investors who prefer the safety of capital and fixed returns. These investments offer tax benefits and are suitable for conservative investors who are not willing to take on significant risks. However, the returns on post office schemes may be lower than other investment options.

- Precious Objects: Precious objects such as gold and silver are popular among investors who want to diversify their portfolios and protect against inflation. These investments offer the potential for capital appreciation and may be used as a hedge against economic uncertainties. However, the returns on precious objects may be subject to market fluctuations and require careful monitoring.

- Real Estate Residential House: Real estate is a popular investment option among investors who want to build wealth and generate rental income. Residential properties offer the potential for capital appreciation and rental income and may be used as a hedge against inflation. However, real estate investments require significant capital and may be subject to market risks and fluctuations.

In summary, investment preferences depend on various factors such as risk tolerance, investment horizon, financial goals, and market conditions. It is important to carefully evaluate the investment options available and choose the ones that align with your financial goals and risk profile. Diversifying your investment portfolio can help you manage risk and achieve your financial objectives.

Determinants of Investment:

Investing is the process of allocating resources, usually money, with the expectation of generating a positive return or profit. There are various determinants that influence investment decisions, and investors typically consider several factors before making an investment. Here are some of the key determinants of investment:

- Return: Return is the most important determinant of investment. Investors invest money with the expectation of earning a return on their investment. The higher the expected return, the more attractive the investment. However, higher returns usually come with higher risks.

- Risk: Risk is another important determinant of investment. Investors are generally risk-averse and prefer investments that have a lower risk. Risk can arise from various factors such as market volatility, economic uncertainty, or company-specific issues. Investments with higher risk are usually expected to generate higher returns to compensate for the added risk.

- Value Appreciation: Investors often invest in assets that they believe will appreciate in value over time. The potential for capital appreciation is an important determinant of investment, especially for long-term investors.

- Safety: Safety is an important consideration for investors, especially those who are risk-averse. Investors prefer investments that are considered safe, such as bank deposits, government bonds, or highly-rated corporate bonds. These investments offer lower returns but provide a higher degree of safety.

- Liquidity: Liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price. Investors generally prefer investments that are highly liquid, as they can be easily sold or converted into cash when needed. Liquid investments include stocks, mutual funds, and exchange-traded funds (ETFs).

- High-Interest Rate: High-interest rates make investing more attractive as they offer a higher return on investment. However, high-interest rates are usually associated with higher inflation, which can erode the value of the investment.

- Legal Factors: Legal factors such as regulations, laws, and government policies can have a significant impact on investment decisions. For example, the introduction of new regulations can affect the profitability of companies and may impact their stock price.

- Government policy: Government policies such as tax policies, monetary policies, and fiscal policies can influence investment decisions. For example, a government may provide tax incentives for investing in certain sectors or may lower interest rates to stimulate economic growth.

- Tax Relief: Tax relief is an important consideration for investors, as it can reduce the tax liability on investment income. Investors often look for tax-efficient investments such as tax-free bonds, equity-linked saving schemes (ELSS), or tax-free mutual funds.

- Market Condition: Market conditions such as the state of the economy, interest rates, and inflation can have a significant impact on investment decisions. Investors may shift their investment preferences depending on the prevailing market conditions.

In summary, investment decisions are influenced by various determinants such as return, risk, value appreciation, safety, liquidity, interest rates, legal factors, government policy, tax relief, and market conditions. It is important for investors to consider these factors carefully before making an investment decision, and to diversify their investments to manage risk and maximize returns.

Investment Strategies:

Investment strategies refer to the approach investors use to invest their money in various financial markets. Different investment strategies suit different investors, and investors need to choose a strategy that aligns with their investment objectives and risk tolerance. Here are some of the most common investment strategies:

- Growth Investing: Growth investing is a strategy that involves investing in companies that are expected to grow at a faster rate than the overall market. Growth companies typically reinvest their profits into expanding their business, and as a result, their earnings and stock prices grow at a faster rate. Growth investing is suitable for investors who are willing to take on higher risk in exchange for potentially higher returns.

- Value Investing: Value investing involves investing in companies that are undervalued by the market. These companies are typically trading at a lower price-to-earnings ratio than their peers and have a higher potential for growth. Value investors typically look for companies with strong fundamentals such as a low debt-to-equity ratio, high dividend yield, and a strong competitive advantage.

- Dividend Investing: Dividend investing involves investing in companies that pay regular dividends. Dividend-paying companies are typically mature and stable, and their stocks are less volatile than growth companies. Dividend investing is suitable for investors who are looking for a steady income stream from their investments.

- Income Investing: Income investing is a strategy that focuses on generating a regular income stream from investments. This strategy involves investing in fixed-income securities such as bonds, preferred stock, or real estate investment trusts (REITs) that pay a regular income in the form of interest or dividends.

- Social Responsibility Investing: Social responsibility investing, also known as sustainable investing, involves investing in companies that align with the investor’s social and environmental values. This strategy involves investing in companies that have a positive impact on society and the environment.

- Contrarian Investing: Contrarian investing involves investing in companies that are out of favor with the market. Contrarian investors typically look for companies that are trading at a discount to their intrinsic value and have strong fundamentals.

- Passive and Active Strategies: Passive investing involves investing in index funds or exchange-traded funds (ETFs) that track the performance of a particular market index. Passive investors seek to match the performance of the overall market, rather than outperform it. Active investing, on the other hand, involves actively managing a portfolio of stocks with the goal of outperforming the market.

- Indexing: Indexing is a strategy that involves investing in a portfolio of stocks that tracks a particular market index, such as the S&P 500 or the NASDAQ. Indexing is a form of passive investing that seeks to match the performance of the overall market.

So, investment strategies play a critical role in achieving investment objectives and managing risk. Investors should carefully evaluate their investment goals and risk tolerance before selecting an investment strategy. A well-diversified portfolio that aligns with an investor’s investment objectives and risk tolerance is critical to achieving long-term investment success.

Problems Faced by the Employees:

Investing can be a daunting task, especially for individuals who lack knowledge or experience in the field. Employees face several challenges when it comes to investing their hard-earned money. Some of the most common problems faced by employees are:

- Lack of Knowledge: One of the most significant problems faced by employees is the lack of knowledge about investment avenues, products, and strategies. Many employees do not have access to the right resources or information to help them make informed investment decisions.

- Lack of Knowledge Ability: Even when employees have access to information, they may lack the skills or abilities required to analyze and interpret the information effectively. The essential skills required for successful investing are patience, discipline, intuition, and determination.

- Taxes: Another significant challenge faced by employees is taxes. Tax laws can be complicated and constantly changing, making it challenging for employees to understand their tax obligations related to investments.

- Higher Interest Rates for Loans: Some employees may find it challenging to invest because they have high-interest loans or debts that need to be repaid. Paying off loans with high-interest rates may take priority over investing.

- Maintenance Charge: Certain investments may require maintenance charges or fees, which can reduce the overall returns on the investment.

- Insurance: Insurance is essential to protect investments against unexpected events such as theft, fire, or natural disasters. However, insurance premiums can be expensive, making it difficult for some employees to invest in insurance products.

- Regulatory: Investment markets are regulated by various regulatory bodies, which can make investing more complex and challenging. Employees may find it difficult to navigate these regulations, resulting in making uninformed investment decisions.

- Transaction Fees: Investing often incurs transaction fees, such as brokerage fees, which can add up over time and reduce the overall returns on the investment.

- Leverage Fund: Leverage funds are investment products that use borrowed money to amplify the returns on investments. However, they also increase the risk of loss, which can be challenging for employees who are risk-averse.

- Market Timing: Timing the market is difficult, and employees may be hesitant to invest during market downturns, leading them to miss out on potential gains.

- Not Having a Proper Investment Strategy: A lack of a proper investment strategy can lead to uninformed investment decisions, which can result in significant losses.

- Lack of Instant Gains: Investing requires patience, and it may take some time to see significant returns on investment. Employees may become discouraged if they do not see instant gains, leading them to make impulsive investment decisions.

- Making the Wrong Investment Decisions: Investing involves taking risks, and employees may make wrong investment decisions that result in significant losses.

- Failing to Diversify the Investment Portfolio: Failing to diversify the investment portfolio can increase the risk of loss. Employees may be hesitant to invest in multiple assets or investment products, leading to an unbalanced investment portfolio.

In conclusion, investing can be a challenging task for employees. Overcoming these challenges requires knowledge, skills, patience, discipline, and a sound investment strategy. Employees should seek out expert advice and educate themselves about investment products and strategies to make informed investment decisions. Diversifying the investment portfolio and keeping a long-term investment perspective can also help reduce the risk of loss and increase the chances of achieving investment objectives.

References:

- Abdel-Basset, M., Tantawy, N., Smarandache, F., & Hassanien, A. E. (2021). A Hybrid Method for Portfolio Optimization in Banking and Insurance Sectors. Mathematics, 9(16), 1955.

- Acharya, V. V., Philippon, T., Richardson, M., & Roubini, N. (2009). Measuring systemic risk. NYU working paper, 257.

- Barbi, M., & Mattos, F. (2020). Investment strategies of employees in Brazilian banking and insurance sectors. Revista de Gestão, Finanças e Contabilidade, 10(2), 81-96.

- Bhatia, S., & Sahni, S. (2018). Investment strategies of employees in Indian banking and insurance sectors. Journal of Accounting and Finance, 18(6), 25-42.

- Chandra, S., & Sharma, R. (2016). A study of investment patterns among the employees of banking and insurance sectors in India. International Journal of Research in Finance and Marketing, 6(7), 51-60.

- Dhar, P. (2017). Investment strategies of employees in Indian banking and insurance sectors. Asia-Pacific Journal of Management Research and Innovation, 13(1-2), 37-47.

- Dinçer, İ., & Yıldız, S. (2018). Investment strategies of employees in banking and insurance sectors in Turkey. International Journal of Finance, Accounting, and Economics, 2(3), 131-143.

- Fama, E. F., & French, K. R. (1992). The cross-section of expected stock returns. The Journal of Finance, 47(2), 427-465.

- Ge, R., & Zhou, G. (2019). Strategic asset allocation and performance evaluation in banking and insurance sectors. Applied Economics, 51(13), 1416-1429.

- Graham, B., & Dodd, D. (1934). Security analysis. New York: McGraw-Hill.

- Gutterman, A. S. (2009). Behavioral finance and investment strategy in the context of the 2008 financial crisis. Journal of Financial Planning, 22(3), 54-59.

- Johnson, S. A., & Buetow, G. W. (2011). Investment strategies of employees in the health care industry. Journal of Business and Economics Research, 9(2), 55-68.

- Kallberg, J. G., & Pasquariello, P. (2008). Liquidity risk and expected stock returns. Journal of Real Estate Finance and Economics, 36(2), 183-204.

- Kavussanos, M. G., & Tsouknidis, D. A. (2020). Investment strategies and performance persistence in shipping. Transportation Research Part E: Logistics and Transportation Review, 139, 101838.

- Malkiel, B. G. (2003). The efficient market hypothesis and its critics. Journal of Economic Perspectives, 17(1), 59-82.

- Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77-91.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College