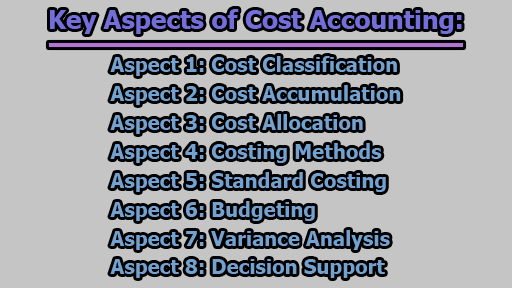

Key Aspects of Cost Accounting:

Cost accounting is a branch of accounting that focuses on the recording, analysis, and management of a company’s costs. Its primary purpose is to provide information to management for decision-making, cost control, and performance evaluation. Cost accounting is especially crucial for manufacturing and production-oriented businesses, but it is also applicable to various other industries. Key aspects of cost accounting include:

Aspect 1: Cost Classification:

1.1 Direct Costs: These are costs directly traceable to a specific product, service, or department. Examples include direct materials (materials used in the production process), direct labor (labor directly involved in manufacturing), and direct expenses.

1.2 Indirect Costs: Indirect costs are not easily traceable to a specific product or service. Instead, they are incurred for the benefit of multiple cost objects. Examples include factory overhead (e.g., rent, utilities) and administrative expenses.

1.3 Variable Costs: Variable costs vary in direct proportion to the level of production or activity. Examples include raw materials and direct labor. As production increases, variable costs increase, and vice versa.

1.4 Fixed Costs: Fixed costs remain constant within a certain range of production or activity. They do not fluctuate with changes in production levels. Examples include rent, insurance, and salaries of certain staff.

Aspect 2: Cost Accumulation:

Cost accountants gather and record costs associated with various aspects of business operations. This involves collecting information on direct materials, direct labor, and indirect costs.

Accumulation is typically done in ledger accounts, providing a systematic record of costs. This information forms the basis for further analysis and decision-making.

Accurate cost accumulation is crucial for determining the total cost of production, evaluating the profitability of products, and assessing overall business performance.

Aspect 3: Cost Allocation:

Once costs are accumulated, they need to be assigned or allocated to specific cost objects. Cost objects can include products, services, departments, projects, or any other activity that requires cost analysis.

Allocation methods vary based on the nature of the cost and the cost object. For example, direct costs like direct labor can be easily assigned to a specific product, while indirect costs may require allocation based on factors like machine hours or labor hours.

The goal of cost allocation is to distribute costs in a manner that reflects the actual consumption of resources by each cost object, providing a more accurate picture of costs associated with each activity.

Aspect 4: Costing Methods:

4.1 Job Costing: This method is used when products or services are produced in distinct batches or jobs. Costs are accumulated and assigned to specific jobs, allowing for a detailed analysis of costs associated with each job.

4.2 Process Costing: Process costing is suitable for continuous or repetitive production processes where products are homogeneous and pass through multiple stages of production. Costs are averaged over all units produced during a specific period.

4.3 Activity-Based Costing (ABC): ABC assigns costs based on the activities that drive costs rather than traditional volume-based allocation. It provides a more accurate representation of the resources consumed by each activity, offering insights into the true cost drivers.

4.4 Standard Costing: Standard costing involves setting predetermined costs for various cost elements. Actual costs are then compared to these standards to identify variances, helping management assess performance and take corrective actions.

Aspect 5: Standard Costing:

5.1 Definition: Standard costing involves setting predetermined costs for various elements like direct materials, direct labor, and overhead. These predetermined costs are based on expected or standard levels of performance.

5.2 Purpose: Standard costing provides a benchmark for evaluating actual performance. By comparing actual costs with standard costs, businesses can identify variances and analyze the reasons behind them. Variances can be favorable (costs are lower than expected) or unfavorable (costs are higher than expected).

5.3 Benefits: Standard costing helps in cost control, performance evaluation, and decision-making. It provides a basis for assessing efficiency, improving production processes, and facilitating budgeting and planning.

Aspect 6: Budgeting:

6.1 Role in Cost Accounting: Budgets play a crucial role in cost accounting by providing a financial plan for the future. Cost accountants work with management to develop budgets that align with the organization’s goals and objectives.

6.2 Types of Budgets: Budgets can include operating budgets (for revenue and expenses), capital budgets (for long-term investments), and cash budgets (for cash flow management).

6.3 Importance: Budgets serve as a roadmap for financial activities. They help in allocating resources effectively, setting targets, and monitoring performance. Comparing actual results against budgeted figures allows for proactive management and adjustments as needed.

Aspect 7: Variance Analysis:

7.1 Definition: Variance analysis involves comparing actual costs or performance against the budgeted or standard costs. Variances are the differences between the actual and expected outcomes.

7.2 Types of Variances: Variances can be categorized into different types, such as material variances, labor variances, and overhead variances. Each type provides insights into specific areas of the business where performance may deviate from expectations.

7.3 Management Action: Variances highlight areas that may need attention or improvement. Management can take corrective actions to address unfavorable variances and reinforce positive practices that lead to favorable variances.

Aspect 8: Decision Support:

8.1 Information for Decision-Making: Cost accounting provides valuable information for managerial decision-making. Managers use cost data to assess the profitability of products or services, make pricing decisions, and evaluate the financial impact of various business strategies.

8.2 Product Profitability: By allocating costs accurately, cost accounting helps determine the true profitability of each product or service. This information is crucial for making decisions about product lines, pricing strategies, and resource allocation.

8.3 Make or Buy Decisions: Cost accounting aids in decisions such as whether to produce a component in-house or outsource it. By comparing the costs of production with the costs of outsourcing, management can make informed decisions that impact the bottom line.

8.4 Strategic Planning: Cost accounting supports strategic planning by providing insights into the financial implications of different courses of action. It helps management evaluate the costs and benefits of potential strategies and choose the most cost-effective options.

In conclusion, cost accounting is a vital discipline within the realm of accounting, focusing on the systematic recording, classification, and analysis of costs associated with business operations. Through methods such as cost classification, accumulation, allocation, and various costing techniques, cost accountants provide essential information for decision-making, cost control, and performance evaluation. Standard costing, budgeting, variance analysis, and decision support further enhance the role of cost accounting in aiding organizations in efficient resource allocation, strategic planning, and overall financial management. Its application is crucial for businesses seeking to understand and optimize their cost structures, ultimately contributing to sustained profitability and competitiveness.

Former Student at Rajshahi University