Objectives and Essential Parts of Managerial Accounting:

Managerial accounting, also known as management accounting, is a branch of accounting that provides financial and non-financial information to the management of an organization to support decision-making, planning, and control. In this article, we will explore the objectives and essential parts of managerial accounting.

Objectives of Managerial Accounting:

1. Decision-Making Support:

- Cost Analysis: Managerial accounting helps in analyzing and understanding various costs associated with different products, services, or business activities. This information is crucial for making decisions on pricing, product mix, and resource allocation.

- Profitability Analysis: Managers use managerial accounting data to assess the profitability of different segments, products, or customers. This aids in identifying areas of strength and weakness, allowing for strategic decision-making.

2. Planning and Forecasting:

- Budgeting: Managerial accountants assist in the preparation of budgets, which are detailed plans outlining the financial goals of an organization. Budgets serve as a roadmap for resource allocation and performance evaluation.

- Forecasting: By analyzing past financial data and trends, managerial accountants help in forecasting future financial performance. This aids management in anticipating potential challenges and opportunities.

3. Performance Evaluation:

- Variance Analysis: Managerial accounting involves comparing actual performance against budgeted or expected performance. Variances are analyzed to understand the reasons behind deviations and to take corrective actions when necessary.

- Key Performance Indicators (KPIs): Managerial accountants identify and measure key performance indicators that are aligned with organizational objectives. This enables management to evaluate the success of strategies and initiatives.

4. Resource Allocation:

- Capital Budgeting: Managerial accountants assist in evaluating and selecting capital investment projects. This involves analyzing the expected cash flows, risks, and returns associated with long-term investments to ensure optimal resource allocation.

- Cost-Benefit Analysis: Before making significant decisions, managers rely on managerial accounting to conduct cost-benefit analyses. This helps in assessing whether the benefits of a particular action justify the associated costs.

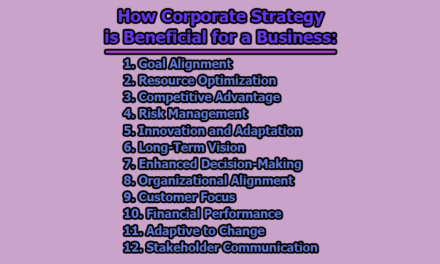

5. Risk Management:

- Scenario Analysis: Managerial accountants analyze different scenarios to evaluate the potential impact of various risks and uncertainties on the organization’s financial performance. This information is crucial for developing risk mitigation strategies.

- Sensitivity Analysis: By assessing how changes in variables impact financial outcomes, managerial accounting helps in identifying sensitive areas and planning for potential fluctuations.

6. Continuous Improvement:

- Performance Measurement: Managerial accounting provides tools for measuring and evaluating the efficiency and effectiveness of business processes. This information is used to identify areas for improvement and to implement continuous process enhancements.

- Feedback Loop: Through regular reporting and analysis, managerial accounting establishes a feedback loop that enables management to learn from past experiences and adjust strategies for continuous improvement.

Essential Parts of Managerial Accounting:

1. Encouraging Experimentation and Innovation: In a rapidly evolving business landscape, innovation and experimentation are keys to staying competitive. Managerial accounting encourages these by providing the necessary financial insights. Cost accounting, for instance, enables managers to evaluate the financial feasibility of new ideas or projects. Budgeting processes can be adapted to include allowances for experimentation, fostering a culture where calculated risks are not only tolerated but embraced.

2. Creating a Balance for Control Functions and Planning: Managerial accounting strikes a delicate balance between control functions and planning. On one hand, it helps establish control mechanisms through variance analysis, performance measurement, and adherence to budgets. On the other hand, it is instrumental in the planning process by offering insights into resource allocation, budget formulation, and strategic decision-making. This equilibrium ensures that organizations maintain financial discipline while remaining adaptable to changing circumstances.

3. Increasing Cost Consciousness: An essential part of managerial accounting is instilling cost consciousness throughout the organization. Cost accounting methods allow for a detailed examination of various costs associated with production, distribution, and other activities. By fostering an understanding of cost structures, managerial accountants contribute to a culture where employees at all levels are mindful of costs, leading to better resource utilization and efficiency improvements.

4. Improvement of Cost Analysis: Cost analysis is at the core of managerial accounting, providing a comprehensive understanding of the costs incurred in various business operations. This involves both fixed and variable costs, direct and indirect costs, and marginal costs. Continuous improvement in cost analysis allows management to identify areas for cost reduction, efficiency enhancement, and strategic resource allocation.

5. Monitoring and Cost Estimation: Managerial accountants play a pivotal role in monitoring financial performance. Through regular reporting and analysis, they provide real-time information on key performance indicators, financial ratios, and other metrics. Additionally, cost estimation involves predicting future costs based on historical data and market trends. This proactive approach aids in anticipating financial challenges and opportunities, enabling management to make timely and informed decisions.

6. Performance Standards Setting: Setting performance standards is crucial for evaluating the efficiency and effectiveness of organizational processes. Managerial accounting establishes benchmarks for performance in various areas, enabling management to assess actual performance against these standards. This process not only facilitates control but also provides a basis for continuous improvement initiatives.

7. Accommodation of External Reporting Standards: While managerial accounting primarily serves internal management needs, it is also essential to accommodate external reporting standards. Compliance with generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) ensures that financial information is transparent, comparable, and reliable. This, in turn, enhances the credibility of the organization in the eyes of external stakeholders such as investors, creditors, and regulatory bodies.

8. Providing Real-Time Information: In the digital age, the importance of real-time information cannot be overstated. Managerial accounting systems are designed to provide timely and relevant information to decision-makers. With the aid of advanced technologies, organizations can access up-to-the-minute financial data, enabling agile decision-making in response to market dynamics or internal changes.

9. Creating a Decentralized Framework of Management: Managerial accounting supports the creation of a decentralized management framework. This involves delegating decision-making authority to lower levels of the organization. Cost centers, for instance, allow departments or teams to be responsible for their costs and performance. This decentralization enhances agility and responsiveness, as decision-makers closer to the action can adapt quickly to changing circumstances.

10. Utilization of Cost Categories: Cost categories are fundamental in managerial accounting as they classify costs based on their nature and behavior. Direct costs, indirect costs, fixed costs, variable costs, and overhead costs are examples of cost categories. By categorizing costs, managerial accountants provide clarity on the composition of expenses, facilitating better decision-making and cost control.

11. Allocation of Resources and Development: Managerial accounting aids in the allocation of resources to various departments or projects based on their strategic importance and financial viability. This involves capital budgeting, where long-term investments are evaluated and selected. The allocation of resources aligns with organizational goals and ensures that scarce resources are directed towards initiatives that contribute most significantly to the overall success of the organization.

12. Complying with Legal Requirements: Compliance with legal requirements is a crucial aspect of managerial accounting. This includes adherence to taxation laws, financial reporting regulations, and other legal obligations. Managerial accountants work closely with legal and compliance teams to ensure that financial practices align with local and international laws, minimizing legal risks and ensuring the organization’s ethical standing.

13. Tracking Cash Flow: Cash flow management is a critical function of managerial accounting. By monitoring cash inflows and outflows, managerial accountants help ensure that the organization maintains sufficient liquidity to meet its short-term obligations. Effective cash flow tracking involves budgeting, forecasting, and managing working capital efficiently.

14. Supporting Research Projects: Innovation often involves research and development initiatives. Managerial accounting supports these projects by providing financial insights into the costs and potential returns associated with research endeavors. This facilitates decision-making regarding the allocation of resources to projects with the highest likelihood of success and aligns with the organization’s long-term growth strategy.

15. Effective Reports: Managerial accountants are responsible for generating reports that convey financial information in a clear and concise manner. These reports, such as budget reports, performance reports, and variance analyses, are essential tools for management decision-making. Well-designed reports facilitate effective communication and enable managers to grasp the financial health of the organization quickly.

16. Creating Cost Management and Cost Centers: Cost management involves controlling and optimizing costs throughout the organization. Managerial accounting establishes cost centers, which are specific areas or departments responsible for their costs. This not only aids in cost control but also enables performance evaluation at a granular level. Cost centers provide a framework for accountability and transparency in financial management.

In conclusion, managerial accounting serves as a linchpin that connects financial data with managerial decision-making, ensuring that organizations not only survive but thrive in the face of challenges and opportunities. As businesses evolve and face increasing uncertainties, the role of managerial accounting becomes even more critical. It is not merely a tool for number crunching; it is a strategic enabler that facilitates agility, innovation, and sustainable growth.

As organizations navigate the ever-changing landscape of global markets, technological advancements, and regulatory complexities, the importance of managerial accounting cannot be overstated. It is the compass that guides management through the complexities of resource allocation, risk management, and performance optimization. By embracing the objectives and essential components of managerial accounting, organizations can foster a culture of financial acumen, strategic thinking, and continuous improvement, positioning themselves for long-term success and resilience in an unpredictable business environment.

Library Lecturer at Nurul Amin Degree College