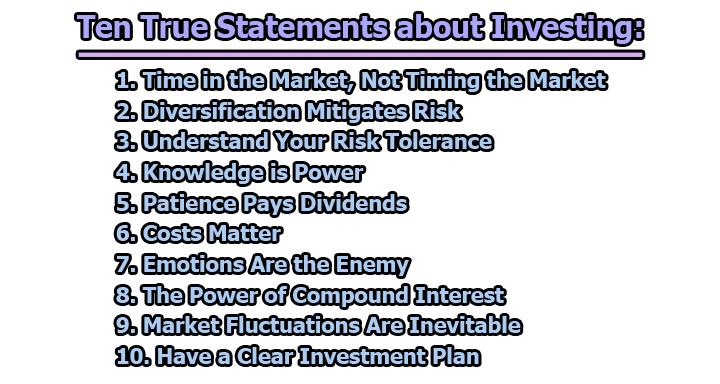

Ten True Statements about Investing:

Investing is both an art and a science, a delicate connection between risk and reward that can shape financial purposes. In a world where markets fluctuate, economies evolve, and global dynamics shift, understanding the fundamental truths about investing becomes paramount. In this article, we will explore ten true statements about investing, providing insights and guidance for both novice and seasoned investors.

1. Time in the Market, Not Timing the Market:

The axiom “it’s time in the market, not timing the market” is a cornerstone of successful investing. Attempting to predict short-term market movements is a perilous pursuit that often leads to suboptimal results. Historical data consistently reveals that investors who remain committed to the market over the long term fare better than those who try to time their entry and exit points.

The rationale behind this statement lies in the inherent volatility of financial markets. Predicting when the market will peak or trough with precision is notoriously difficult, if not impossible. Even seasoned professionals struggle to consistently time the market accurately. As a result, investors who adopt a long-term perspective and remain invested through market fluctuations are better positioned to weather short-term storms and capitalize on the overall growth trajectory of the market.

This principle is grounded in the compounding nature of returns. Over extended periods, the compounding effect can significantly enhance the growth of investments. Every market downturn, rather than being a cause for panic, becomes an opportunity to accumulate assets at potentially lower prices. By staying invested, investors allow their portfolios to benefit from the upward trajectory of the market over time.

2. Diversification Mitigates Risk:

Diversification is a prudent strategy employed by savvy investors to manage risk within their portfolios. The principle behind diversification is straightforward: by spreading investments across different asset classes, industries, and geographical regions, the impact of a poor-performing investment on the overall portfolio is mitigated.

Imagine a scenario where an investor allocates their entire portfolio to a single stock or asset class. If that particular investment performs poorly, the entire portfolio bears the brunt of the downturn. On the other hand, a diversified portfolio, with investments in various sectors and regions, is less susceptible to the negative impact of a single underperforming asset.

Diversification is not about eliminating risk but rather about managing and mitigating it. Different asset classes have varying levels of correlation, meaning they respond differently to market forces. By strategically combining assets with low or negative correlations, investors create a portfolio that can withstand the volatility inherent in financial markets.

Furthermore, diversification is not a one-time action; it requires periodic reassessment and adjustments. Market conditions change, and the performance of different assets evolves over time. Regularly rebalancing a diversified portfolio ensures that it stays aligned with an investor’s risk tolerance and financial goals.

3. Understand Your Risk Tolerance:

Investing inherently involves risk, and each investor has a unique risk tolerance – the ability and willingness to withstand fluctuations in the value of their investments. Understanding your risk tolerance is paramount for constructing a portfolio that aligns with your financial goals and emotional resilience.

Risk tolerance is influenced by various factors, including financial objectives, time horizon, and personal comfort with market volatility. An investor with a long-term horizon and a higher risk tolerance may be comfortable with a more aggressive, growth-oriented portfolio, while someone with a shorter time horizon or lower risk tolerance might prefer a more conservative approach.

It’s crucial to conduct a thorough risk assessment before embarking on an investment journey. This involves not only understanding your financial capacity to absorb losses but also acknowledging your emotional response to market fluctuations. An investor who loses sleep over a minor portfolio dip may need to adjust their risk exposure, even if their financial situation allows for a higher-risk strategy.

Having a clear understanding of risk tolerance guides investment decisions and helps prevent emotional reactions during turbulent market conditions. It ensures that the chosen investment strategy aligns with an investor’s comfort level, reducing the likelihood of panic-driven decisions that can negatively impact long-term financial objectives.

4. Knowledge is Power:

In the realm of investing, knowledge is a potent tool that empowers investors to make informed decisions, identify opportunities, and navigate the complexities of financial markets. An understanding of investment principles, financial instruments, and economic indicators is fundamental for achieving success in the world of finance.

Continuous education is key for investors to stay abreast of market trends and developments. This includes keeping up with financial news, understanding the factors that influence asset prices, and being aware of economic indicators that provide insights into the health of various sectors and regions. A well-informed investor is better equipped to make strategic choices that align with their financial objectives.

Moreover, financial markets are dynamic and influenced by a myriad of factors, from macroeconomic trends to geopolitical events. Investors who actively seek knowledge and stay informed are better positioned to adapt to changing market conditions. This adaptability is crucial for making timely and well-informed decisions that can positively impact the performance of an investment portfolio.

Investors can acquire knowledge through various means, including reading financial literature, attending seminars, and leveraging online resources. Additionally, seeking advice from financial professionals can provide valuable insights and guidance. The goal is to develop a solid foundation of financial literacy that forms the basis for sound investment decisions.

5. Patience Pays Dividends:

Patience is a virtue that holds immense value in the world of investing. Markets are inherently unpredictable, and short-term fluctuations are inevitable. Successful investors exhibit discipline and resist the temptation to make impulsive decisions based on momentary market movements.

The principle of patience in investing is closely tied to the concept of time in the market. While short-term market movements may be erratic, the long-term trajectory tends to be upward. Investors who react hastily to every market fluctuation risk missing out on the overall growth potential of their investments.

Patience is particularly crucial during market downturns. Rather than succumbing to fear and panic-selling during a bear market, patient investors recognize the opportunity that arises. Market downturns present a chance to acquire quality assets at potentially discounted prices, setting the stage for future gains when the market rebounds.

Long-term wealth accumulation often requires enduring temporary setbacks and allowing investments to grow over time. The compounding effect, where earnings generate additional earnings, is more pronounced over extended periods. Patience allows investors to harness the full potential of compounding and achieve their financial goals with a steady and measured approach.

Consequently, patience is not merely the ability to wait; it’s the ability to wait with a purpose. Successful investors understand that the market operates in cycles, and temporary setbacks are part of the journey. By maintaining a patient and disciplined approach, investors position themselves for long-term success and avoid the pitfalls of emotional decision-making.

6. Costs Matter:

Investors often underestimate the impact of fees and expenses on their investment returns. The principle that “costs matter” emphasizes the importance of minimizing expenses to enhance overall portfolio performance. Whether it’s management fees, transaction costs, or taxes, every dollar spent on expenses is a dollar that could have been working for you in the market.

High fees erode investment returns over time, making it crucial for investors to be mindful of the cost structure associated with their investments. This is especially relevant in the context of actively managed funds, where higher fees are typically charged for the expertise of fund managers. While active management can offer benefits, the cumulative impact of fees over the long term can significantly diminish returns.

Choosing low-cost investment vehicles, such as index funds or exchange-traded funds (ETFs), is one way investors can minimize expenses. These passively managed funds aim to replicate the performance of a specific market index at a lower cost compared to actively managed counterparts. By opting for cost-efficient investment options, investors retain more of their returns, contributing to the compounding effect over time.

Additionally, being mindful of transaction costs is essential. Excessive buying and selling within a portfolio can lead to higher transaction fees, reducing the net returns. Strategic portfolio management that minimizes unnecessary trading helps keep costs in check.

Understanding the tax implications of investment decisions is another aspect of cost management. Taxes on capital gains and dividends can impact after-tax returns. Investors can employ tax-efficient strategies, such as tax-loss harvesting or utilizing tax-advantaged accounts, to optimize their overall tax position.

Ultimately, the principle of “costs matter” underscores the importance of being a vigilant steward of your investment capital. Minimizing expenses wherever possible contributes to a more efficient portfolio, allowing investors to reap the full benefits of their investment returns.

7. Emotions Are the Enemy:

Emotional decision-making is one of the most significant challenges investors face. The principle that “emotions are the enemy” emphasizes the detrimental impact of fear, greed, and impatience on investment outcomes. Successful investors cultivate emotional resilience, making decisions based on logic, research, and a thorough understanding of their financial objectives.

Fear and greed are often the driving forces behind irrational investment decisions. In times of market volatility, fear can lead to panic-selling, locking in losses and undermining long-term objectives. Conversely, greed can result in chasing performance, buying assets at inflated prices, and exposing the portfolio to unnecessary risks.

Disciplined investors recognize that emotions are natural but must be managed effectively. Establishing a well-thought-out investment plan, grounded in realistic financial goals and risk tolerance, serves as a compass during turbulent times. Regularly reviewing and rebalancing the portfolio based on the plan helps maintain a rational and systematic approach to investing.

Avoiding impulsive decisions requires a commitment to the long-term vision and an understanding that short-term market fluctuations are part of the investment journey. Successful investors focus on the fundamentals of their investments rather than reacting emotionally to market noise. By separating emotions from investment decisions, individuals are better positioned to navigate the complexities of the financial markets with a steady hand.

Investor education plays a crucial role in building emotional resilience. Understanding market cycles, historical trends, and the inevitability of volatility helps investors contextualize short-term movements within the broader investment landscape. Additionally, seeking advice from financial professionals or mentors can provide valuable perspectives and guidance during emotionally charged market conditions.

Thus, the principle that “emotions are the enemy” underscores the importance of maintaining a disciplined and rational approach to investing. By mitigating the impact of emotional decision-making, investors can make more informed choices that align with their long-term financial objectives.

8. The Power of Compound Interest:

The eighth principle, “the power of compound interest,” is often hailed as the eighth wonder of the world. This principle highlights the exponential growth potential that compound interest offers over time and underscores the importance of starting to invest early and consistently contributing to investment accounts.

Compound interest is a concept where the interest earned on an investment generates additional earnings over subsequent periods. In simple terms, it’s the interest on both the initial principal and the accumulated interest. The longer the money is invested, the more time it has to compound, leading to accelerated growth.

This principle is particularly impactful for long-term investors. Even modest returns, when compounded over several years, can result in substantial wealth accumulation. Starting to invest early allows individuals to take advantage of the full compounding effect, as each year’s returns contribute to a larger base for future growth.

Consistent contributions to investment accounts further amplify the power of compound interest. Regularly adding funds to a portfolio not only increases the initial principal but also ensures a continuous flow of new capital for compounding. This systematic approach, often referred to as dollar-cost averaging, helps investors navigate market fluctuations and capitalize on opportunities created by temporary downturns.

Understanding the power of compound interest encourages investors to adopt a patient and long-term perspective. It emphasizes the value of staying invested and avoiding the temptation to make frequent changes to the portfolio. By harnessing the compounding effect, investors can build a solid foundation for financial success and achieve their long-term objectives.

9. Market Fluctuations Are Inevitable:

The principle that “market fluctuations are inevitable” serves as a sobering reminder that volatility is an inherent aspect of financial markets. Whether influenced by economic conditions, geopolitical events, or other factors, market fluctuations are an inescapable reality that investors must navigate.

Acceptance of the inevitability of market fluctuations is foundational for building a resilient investment strategy. Rather than viewing fluctuations as obstacles, successful investors see them as opportunities. Volatility can create openings to acquire undervalued assets, adjust portfolio allocations, or capitalize on market trends.

Market fluctuations are driven by a myriad of factors, including changes in interest rates, economic indicators, corporate earnings, and geopolitical developments. Investors need to stay informed about these factors to contextualize market movements and make informed decisions.

Moreover, recognizing that market fluctuations are normal helps investors avoid knee-jerk reactions during periods of volatility. Panicking and making impulsive decisions in response to short-term market movements can hinder long-term investment objectives. Instead, investors should adhere to their well-defined investment plan, reassess the portfolio strategically, and consider opportunities that arise during market downturns.

Diversification, discussed earlier as a key principle, plays a crucial role in mitigating the impact of market fluctuations. A well-diversified portfolio is less vulnerable to the adverse effects of a single asset or sector experiencing volatility. By spreading investments across different asset classes and industries, investors create a more resilient portfolio that can withstand market turbulence.

Therefore, understanding that “market fluctuations are inevitable” empowers investors to approach the uncertainties of financial markets with a pragmatic mindset. Rather than fearing volatility, investors can harness it to their advantage, using it as a tool for strategic decision-making and wealth accumulation.

10. Have a Clear Investment Plan:

The final principle, “have a clear investment plan,” encapsulates the importance of a structured and well-defined approach to investing. An investment plan serves as a roadmap, outlining financial goals, risk tolerance, and the overall strategy for achieving long-term success.

A clear investment plan provides guidance and discipline, helping investors stay focused on their objectives during both favorable and challenging market conditions. The process of creating a plan involves assessing current financial status, defining short and long-term goals, and establishing a realistic timeline for achieving those goals.

One of the foundational elements of an investment plan is determining risk tolerance. Understanding how much risk an investor can comfortably tolerate ensures that the chosen investment strategy aligns with their psychological and financial capacity to absorb fluctuations in portfolio value. This risk assessment informs decisions regarding asset allocation, investment types, and the overall level of portfolio diversification.

An effective investment plan also includes a well-thought-out asset allocation strategy. This involves determining the appropriate mix of different asset classes, such as stocks, bonds, and alternative investments, based on an investor’s goals, time horizon, and risk tolerance. Asset allocation is a dynamic component of the plan, requiring periodic adjustments as market conditions and an investor’s circumstances evolve.

Regular reviews and updates to the investment plan are essential. Life circumstances, financial goals, and market conditions change over time, necessitating adjustments to the plan. Periodic reviews also provide opportunities to assess the performance of the portfolio, rebalance asset allocations, and incorporate new investment opportunities.

Having a clear investment plan instills confidence and discipline, helping investors resist the temptation to make impulsive decisions based on short-term market movements or external noise. It provides a framework for decision-making, ensuring that every investment choice is aligned with the overarching financial objectives.

Subsequently, the principle of “having a clear investment plan” is the capstone of successful investing. It synthesizes the preceding principles into a comprehensive strategy, guiding investors through the complexities of financial markets with purpose and resilience. A well-crafted investment plan is the foundation upon which successful financial journeys are built, providing a roadmap to navigate the ever-changing landscape of investing.

In conclusion, embracing above ten true statements can serve as a compass, guiding investors through the ever-changing financial landscape. By recognizing the significance of time, diversification, knowledge, and emotional discipline, investors can navigate the markets with confidence. Building wealth through patience, understanding risk, and harnessing the power of compound interest transforms investing from a daunting task into a strategic journey towards financial prosperity. Remember, successful investing is not about outsmarting the market; it’s about aligning your financial decisions with your long-term goals and staying committed to the principles that stand the test of time.

Frequently Asked Questions (FAQs):

What is the best investment strategy for beginners?

For beginners, a good starting point is a diversified portfolio of low-cost index funds or exchange-traded funds (ETFs). This provides exposure to a broad range of assets, reducing risk. Additionally, focusing on long-term goals, regularly contributing to the portfolio, and staying informed are essential strategies.

How do I determine my risk tolerance?

Assess your ability and willingness to endure fluctuations in the value of your investments. Consider factors such as your financial goals, time horizon, and emotional comfort with market volatility. A risk assessment questionnaire or consultation with a financial advisor can help determine your risk tolerance.

Why is diversification important in investing?

Diversification helps manage risk by spreading investments across different asset classes, industries, and geographical regions. This minimizes the impact of poor-performing assets on the overall portfolio. Diversified portfolios are generally more resilient during market fluctuations.

How can I minimize investment costs?

Minimizing investment costs involves choosing low-cost investment vehicles, such as index funds or ETFs, and being mindful of transaction fees. Regularly reviewing and adjusting your investment strategy to minimize taxes is also crucial. Keeping expenses low contributes to better long-term returns.

What role do emotions play in investing?

Emotions can significantly impact investment decisions. Fear and greed, in particular, can lead to impulsive actions. Successful investors cultivate emotional resilience, sticking to a well-defined plan and focusing on long-term goals. Emotional discipline is crucial for making rational investment decisions.

How does compound interest work in investing?

Compound interest is the concept where the interest on an investment earns additional interest over time. The longer the money is invested, the more significant the compounding effect. Consistently reinvesting earnings and contributing regularly to investment accounts enhance the power of compound interest.

Is market timing a viable strategy?

Market timing, or attempting to predict short-term market movements, is generally considered risky and challenging. Successful investors focus on a long-term strategy, remaining invested through market ups and downs. Time in the market tends to be more impactful than trying to time entry and exit points.

What should be included in an investment plan?

An investment plan should include clear financial goals, a risk assessment, an asset allocation strategy, and a timeline for achieving objectives. Regular reviews and updates are crucial to adapt the plan to changing circumstances. Having a well-defined plan helps investors stay disciplined and focused.

How can I navigate market fluctuations?

Recognize that market fluctuations are inevitable. Maintain a diversified portfolio, stay informed about market conditions, and avoid making impulsive decisions during downturns. Market volatility can present opportunities; having a clear investment plan and disciplined approach helps navigate fluctuations.

When is the right time to start investing?

The right time to start investing is as early as possible. Time in the market is a powerful factor for long-term returns due to the compounding effect. Regardless of market conditions, getting started, even with small amounts, allows you to benefit from the growth potential of your investments over time.

Library Lecturer at Nurul Amin Degree College