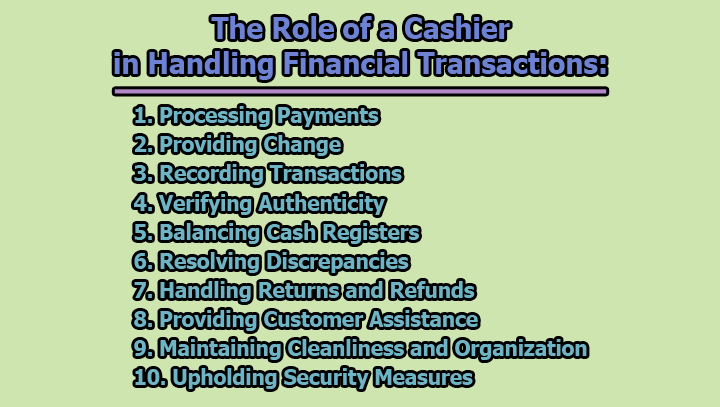

The Role of a Cashier in Handling Financial Transactions:

Cashiers serve as the frontline representatives in managing financial transactions within various industries, ranging from retail stores to restaurants, and especially within the hospitality sector. Their role is pivotal in ensuring smooth and secure monetary exchanges, while also maintaining high standards of customer service. Here are some of the role of a cashier in handling financial transactions:

1. Processing Payments: The primary responsibility of a cashier is to process payments from customers for goods or services. This involves accepting various forms of payment, including cash, credit cards, debit cards, and mobile payments. Cashiers must accurately calculate the total amount due, including taxes or discounts, and ensure that customers receive a receipt as proof of purchase.

During busy periods, such as peak shopping hours or meal times, cashiers must efficiently manage queues and process payments in a timely manner to minimize wait times for customers. Providing fast and efficient service contributes to a positive customer experience and encourages repeat business.

2. Providing Change: When customers make cash payments, cashiers must accurately calculate the change owed based on the total amount of the transaction and the cash tendered by the customer. This requires strong mathematical skills and attention to detail to avoid errors.

Cashiers must also possess excellent communication skills to inform customers of the amount of change they will receive and to ensure that they count the change back accurately. Providing correct change promptly enhances customer satisfaction and builds trust in the cashier’s competence.

3. Recording Transactions: Every transaction processed by a cashier must be accurately recorded to maintain comprehensive financial records. Cashiers use electronic point-of-sale (POS) systems or manual registers to input details such as the items purchased, their prices, the payment method used, and any applicable taxes or discounts.

Accurate record-keeping is essential for tracking sales, managing inventory, and reconciling cash register balances at the end of each shift. Cashiers must ensure that all transactions are recorded correctly to maintain the integrity of the business’s financial data and facilitate smooth operations.

4. Verifying Authenticity: Cashiers are responsible for verifying the authenticity of currency, checks, and other forms of payment to prevent fraud and counterfeit activity. They undergo training to recognize security features on banknotes, such as watermarks, security threads, and color-shifting ink.

When accepting checks or other forms of payment, cashiers carefully inspect them for signs of tampering or forgery. They may use ultraviolet lights or counterfeit detection pens to verify the legitimacy of documents and ensure that they comply with the business’s payment acceptance policies.

5. Balancing Cash Registers: At the beginning and end of each shift, cashiers are required to balance their cash registers to ensure that the amount of cash on hand matches the total recorded transactions. This process helps identify discrepancies, errors, or potential instances of theft.

To balance a cash register, cashiers count the cash in the drawer, compare it to the total sales recorded in the POS system or register tape, and reconcile any discrepancies. They may also verify the amounts of checks, credit card receipts, and other forms of payment against transaction records to ensure accuracy.

Balancing cash registers is a critical aspect of a cashier’s role, as it ensures the integrity of the business’s financial records and helps identify any irregularities that may require further investigation or corrective action. By maintaining accurate cash register balances, cashiers contribute to the overall financial health and security of the business.

6. Resolving Discrepancies: Discrepancies in cash register balances or transaction records can occur for various reasons, such as errors in processing payments, discrepancies in inventory counts, or instances of theft or fraud. Cashiers are responsible for promptly identifying and resolving these discrepancies to ensure the accuracy and integrity of financial records.

When a discrepancy is detected, cashiers must conduct a thorough investigation to determine the root cause. This may involve reviewing transaction records, recounting cash, verifying payment details, and examining other relevant documentation. Once the cause of the discrepancy is identified, cashiers take appropriate corrective action, such as adjusting transaction records or reporting discrepancies to management for further investigation.

Resolving discrepancies requires strong problem-solving skills, attention to detail, and the ability to work efficiently under pressure. Cashiers must remain vigilant and proactive in identifying and addressing discrepancies to maintain the trust and confidence of customers and stakeholders.

7. Handling Returns and Refunds: In addition to processing payments, cashiers are responsible for handling returns and refunds for customers. When a customer wishes to return a purchased item or request a refund for a service, cashiers follow established policies and procedures to facilitate the process smoothly and efficiently.

Cashiers verify the condition of returned items, ensuring that they meet the business’s return policy criteria, such as being unused and in their original packaging. They process refunds by issuing credit back to the customer’s original form of payment or providing store credit, as appropriate.

Handling returns and refunds requires patience, empathy, and effective communication skills to address customer concerns and resolve issues satisfactorily. Cashiers strive to provide a positive experience for customers seeking returns or refunds, reinforcing the business’s commitment to customer satisfaction and loyalty.

8. Providing Customer Assistance: Cashiers serve as frontline representatives of the business and often act as the first point of contact for customers. In addition to processing payments, they provide assistance, answer questions, and address customer concerns or inquiries with professionalism and courtesy.

Customers may seek guidance on product selection, inquire about pricing or promotions, or require assistance with using self-service checkout systems or other equipment. Cashiers must possess comprehensive knowledge of the business’s products, services, and policies to provide accurate information and guidance to customers.

Effective communication skills are essential for cashiers to interact positively with customers and create a welcoming and supportive environment. By providing exceptional customer assistance, cashiers enhance the overall shopping or dining experience and contribute to customer satisfaction and loyalty.

9. Maintaining Cleanliness and Organization: Cashiers are responsible for maintaining cleanliness and organization in their work area, including the cash register, checkout counters, and surrounding space. This involves regularly cleaning surfaces, removing clutter, and organizing merchandise or supplies to create a neat and inviting environment for customers.

A clean and organized workspace not only enhances the appearance of the business but also contributes to operational efficiency and safety. Cashiers ensure that checkout areas are free from hazards or obstacles that could impede customer traffic or pose a risk of injury.

By maintaining cleanliness and organization, cashiers uphold the business’s standards for professionalism and create a positive impression on customers. A well-maintained workspace reflects positively on the business’s reputation and contributes to a pleasant and memorable customer experience.

10. Upholding Security Measures: Cashiers play a critical role in upholding security measures to prevent theft, fraud, and unauthorized access to cash, merchandise, or sensitive information. They are trained to recognize suspicious behavior, such as attempts to tamper with cash registers, manipulate transaction records, or conceal merchandise.

Cashiers follow established security protocols, such as verifying customer identification for certain transactions, securing cash drawers and valuables, and monitoring surveillance cameras to deter theft or fraudulent activity. They also report any security concerns or incidents to management or security personnel for further investigation.

Maintaining vigilance and adherence to security measures is essential for protecting the business’s assets and ensuring the safety and well-being of customers and employees. Cashiers play a vital role in maintaining a secure environment and minimizing the risk of security breaches or losses.

In conclusion, the role of a cashier in handling financial transactions extends beyond merely processing payments. Cashiers serve as ambassadors for their organizations, ensuring accuracy, security, and exceptional customer service with each transaction. Their diligence, attention to detail, and commitment to professionalism are essential in maintaining the financial integrity and reputation of the businesses they represent.

Library Lecturer at Nurul Amin Degree College