When a person is unable to work, life insurance provides protection against financial loss. The planning of one’s finances must include it. Prior to approval, a number of requirements must be completed. Once accepted, the insured agrees to pay a premium in exchange for the insurance provider paying a specified sum to a beneficiary in the event of death. In this article, we are going to discuss types of life insurance, guidelines for purchasing life insurance, and the advantages of developing life insurance.

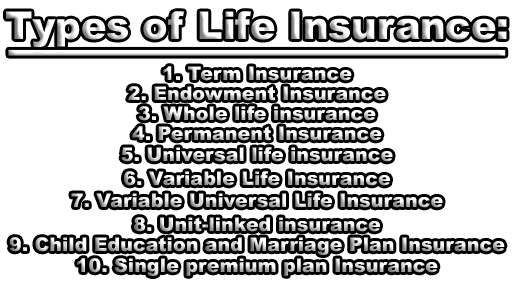

Types of Life Insurance:

- Term Insurance: An insurance policy that provides coverage for a specific number of years and pays a death benefit. Term insurance is the cheapest insurance in the sense that the benefit received is greatest compared to the premium paid. This way this type of insurance can especially be recommended to people who at present are not in a financial situation to have savings of greater volume. These can be for example young householders, who are currently trying to build the bases of their living (building a house, starting a business, etc.). They don’t have much money that could be saved up but are afraid that their family could be deprived of a promising possibility of financial prosperity due to their sudden death. In relation to the above example, we can also mention using term insurance as credit life or loan insurance. If the guarantee of repaying a loan on an enterprise or simply on building a house is the entrepreneur or the householder himself, his family is in a difficult situation if he dies. This situation should be parried by a loan cover or credit life insurance.

- Endowment Insurance: Pure endowment insurance is an important theoretical design and is a building stone of many other insurances, but it practically doesn’t exist on its own. Endowment insurance policies are becoming popular in developing nations, particularly for ‘micro-insurance’ where the amounts involved are small. It is hard for small investors to achieve good rates of return on investments, because of heavy expense charges. By pooling the death and survival benefits under the endowment contract, the policyholder gains on the investment side from the resulting economies of scale, and from the investment expertise of the insurer.

- Whole life insurance: Whole life insurance is the simplest form of cash value insurance that comprises a protection and investment component. The investment component builds accumulated cash value that the insured individual can borrow against or withdraw. Under whole life, the policyholder’s entire life is covered, and all death benefits are paid, and premiums recovered by the family upon the death of the policyholder, whenever that may be. Whole life insurance differs from universal life insurance with respect to premium payments. Under whole life insurance premiums are not flexible, and fixed payments are required to be made, whereas universal life insurance allows flexible premium payments.

- Permanent Insurance: Commonly refers to Whole Life insurance. An insurance policy that provides coverage and builds a cash value over your lifetime and pays a death benefit.

- Universal life insurance: Universal life insurance falls under the permanent life insurance category and includes both the protection and savings component. The protection component is the minimum amount of premium that is required to keep the policy in force, while the interest on the saving component or the accumulated cash value of the saving component can be used to pay the premium related to the protection component, instead of paying it from external funds. The saving component earns a profit to which the policyholder is entitled. The cash value of the policy may be obtained anytime during the term of the policy in the form of a loan against the policy or at maturity or death. Universal life insurance offers flexibility to the policyholders in respect of premium payments, death benefits, and saving components of their policy.

- Variable Life Insurance: Variable life insurance is a permanent life insurance policy with an investment component. The policy has a cash-value account, which is invested in a number of sub-accounts available in the policy. A sub-account acts similar to a mutual fund, except it’s only available within a variable life insurance policy Variable life insurance is an insurance policy in which the payout amounts are determined by the performance of the underlying securities in the policy. Variable life insurance policies are considered more volatile than standard life insurance policies and are ideal only for those who can stomach the additional risk. Variable policies have tax advantages whether or not the underlying investments perform well (Investopedia).

- Variable Universal Life Insurance: Variable universal life (VUL) insurance is a type of permanent life insurance policy that allows for the cash component to be invested to produce greater returns. VUL insurance policies are built like traditional universal life insurance policies but let you invest the cash value in the market via subaccounts. As a result, the return to the cash component is not guaranteed year after year. VUL policies are not intended to be standalone investments, but rather a form of life insurance (Investopedia).

- Unit-linked insurance: The unit-linked insurance plan is offered as a further refinement of the universal life insurance such that the investment component is unitized i.e. units of the fund are purchased from the premium attributable to the investment. These policies also offer the policyholder the protection and investment option through one product. The premium comprises protection and investment components and the units of a suitable investment fund are purchased at the Net Asset Value (price per unit) with the premium amount attributable to the investment component. The return earned on the units of the fund is accumulated as the cash value of the policy.

- Child Education and Marriage Plan Insurance: The child education and marriage plans are offered to meet the financial needs at the time of occurrence of such events along with the protection of life. The policy has preset tenure, and if the death of the policyholder occurs during the policy tenure, the insurance company pays periodic payments (or annuity) in the form of premiums on behalf of the policyholder (i.e. plan continuation benefit), and often periodic family income (i.e. pension) to the family of the deceased (policy beneficiary). Additionally, the insurance policy also pays a lump sum at policy maturity for meeting the expenses of marriage or education.

- Single premium plan Insurance: Under Single premium plan insurance one lump sum payment is made at the beginning of the policy term that entitles the policy beneficiary to a death benefit i.e. payment of a predetermined amount on the death of the insured. The death benefit is the amount paid as premiums plus the returns earned, as a result of investing in the instruments of the policyholder’s choice.

Guidelines for Purchasing Life Insurance:

- To fulfill your individual insurance needs, pick an insurance agent and company you are comfortable doing business with.

- Determine the amount, duration, and cost of the life insurance you require.

- Choose the sort of coverage that is best for you by learning about life insurance and consulting with your advisor.

- Before you sign the insurance application, be sure everything is accurate.

- Decide carefully, and only buy life insurance if you’re prepared to keep the policy in force. Early termination can be highly expensive.

- Make the insurance company, not the agent, the beneficiary of the check.

- Inquire about returning a policy and the free look time as required by Michigan law from your insurance agent.

Advantages of developing life insurance:

Enhancing individual financial security: From the individual’s perspective, life insurance offers many advantages:

- Life insurance guarantees to pay a stated sum to a family on the death of its income earner(s).

- Cash value life insurance can serve as a means through which individuals save.

- Life insurance products, especially annuities, provide a convenient, if not unique, means by which individuals can make financial provisions for retirement.

- Life insurance can permit more favorable credit terms to borrowers – both individuals and businesses – and can decrease the risk of default.

Reducing the cost of government expenditure on social welfare: Private life insurance can supplement, if not substitute for, benefits provided by the government. This assertion is substantiated by a significant negative correlation between social spending and life insurance premiums. Governments can now concentrate their efforts on core social protection benefits while allowing individuals to choose for themselves their desired level and type of additional protection.

Impact on economic development: Apart from the social role it plays by relieving the government of some of the burden of meeting financial security needs, life insurance can assist economic development in general and the development of financial markets in particular. Because they have thousands of policyholders, insurance companies are able to amass quantities of funds that are important in supporting investment and the national economy. They thereby serve as financial intermediaries between investors and economic agents that lack sufficient financing: households, businesses, and in some cases even governments.

Finally, we can say that you will probably invest a significant amount of money in insurance over the course of your lifetime and buy several policies. To be able to choose the right insurance, you must be aware of what each sort of insurance covers and how it operates. Do not base your decision on just what is cheapest, but look at what it provides. Find the best insurance for your needs by investing the time to look around. Despite the fact that many people claim they cannot afford insurance, they actually cannot afford to go without it. When unforeseen circumstances develop, it can prevent them from incurring unforeseen costs of tens of thousands of dollars or more. The correct insurance policy can protect you and your family against unplanned calamities, but you don’t want to squander your money on products that don’t match your needs.

Library Lecturer at Nurul Amin Degree College