Financial Management System (FMS):

A Financial Management System (FMS) is a software or application that is used to manage and oversee an organization’s financial operations, including accounting, budgeting, financial reporting, and cash management. The system is designed to provide a comprehensive view of the organization’s financial position and performance, enabling decision-makers to make informed financial decisions. An FMS typically includes various modules or components that are used to manage different aspects of an organization’s finances. These may include general ledger, accounts payable, accounts receivable, fixed assets, payroll, and financial reporting. The system may also include features for budgeting and forecasting, cash management, financial analysis, and compliance reporting. By automating financial processes, an FMS can help organizations to streamline operations, reduce errors, and improve efficiency. It can also provide real-time insights into financial performance, enabling organizations to make data-driven decisions and adjust their strategies as needed. So, an FMS is an essential tool for any organization that wants to manage its finances effectively and efficiently.

Definitions of Financial Management System (FMS):

Here are three different perspectives on what a Financial Management System (FMS) is:

From a Financial Expert’s Perspective: A Financial Management System (FMS) is a set of tools, processes, and procedures that are designed to help organizations manage their financial resources efficiently and effectively. It typically includes software applications that automate financial processes, such as accounting, budgeting, cash management, and financial reporting. An FMS provides decision-makers with real-time insights into the organization’s financial performance, allowing them to make data-driven decisions and adjust their strategies as needed.

From a Software Developer’s Perspective: A Financial Management System (FMS) is a software application that is designed to help organizations manage their financial operations. It typically includes modules for accounting, budgeting, financial reporting, and cash management, among others. An FMS is developed using programming languages and frameworks such as Java, Python, .NET, and React. It is designed to be scalable, secure, and customizable to meet the specific needs of each organization.

From a Business Owner’s Perspective: A Financial Management System (FMS) is a tool that helps me manage my business finances. It is a software application that I use to keep track of my income, expenses, and cash flow. With an FMS, I can create budgets, generate financial reports, and make data-driven decisions about the future of my business. It saves me time and helps me stay organized, which allows me to focus on growing my business.

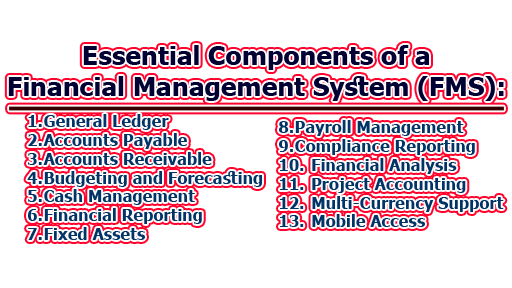

Essential Components of a Financial Management System (FMS):

A typical FMS includes various modules or components that are used to manage different aspects of an organization’s finances. Here are some essential components of an FMS:

- General Ledger: The general ledger module is the backbone of an FMS. It is used to track all financial transactions, including revenue, expenses, assets, and liabilities. It provides a real-time view of the organization’s financial position, enabling decision-makers to make informed financial decisions.

- Accounts Payable: The accounts payable module is used to manage the organization’s payments to vendors and suppliers. It includes features such as invoice processing, payment scheduling, and vendor management. It helps ensure that bills are paid on time and that the organization is not overcharged for goods and services.

- Accounts Receivable: The accounts receivable module is used to manage the organization’s incoming payments from customers and clients. It includes features such as invoicing, payment tracking, and customer management. It helps ensure that payments are collected on time and that the organization has a positive cash flow.

- Budgeting and Forecasting: The budgeting and forecasting module is used to create and manage the organization’s financial plans. It includes features such as budget creation, variance analysis, and forecasting. It helps ensure that the organization’s financial resources are allocated appropriately and that financial goals are met.

- Cash Management: The cash management module is used to manage the organization’s cash flow. It includes features such as cash forecasting, bank reconciliation, and cash position reporting. It helps ensure that the organization has enough cash on hand to meet its financial obligations.

- Financial Reporting: The financial reporting module is used to create and distribute financial reports. It includes features such as balance sheets, income statements, and cash flow statements. It helps ensure that stakeholders have access to accurate and timely financial information.

- Fixed Assets: The fixed assets module is used to manage the organization’s long-term assets, such as property, equipment, and vehicles. It includes features such as asset tracking, depreciation, and disposal. It helps ensure that the organization’s assets are properly accounted for and maintained.

- Payroll Management: The payroll management module is used to manage the organization’s payroll processing. It includes features such as employee data management, salary calculation, tax withholding, and benefits administration. It helps ensure that employees are paid accurately and on time.

- Compliance Reporting: The compliance reporting module is used to manage the organization’s regulatory reporting requirements. It includes features such as tax reporting, financial statement preparation, and audit trails. It helps ensure that the organization is in compliance with legal and regulatory requirements.

- Financial Analysis: The financial analysis module is used to analyze financial data and trends. It includes features such as ratio analysis, trend analysis, and benchmarking. It helps decision-makers to make informed financial decisions by providing insights into the organization’s financial performance.

- Project Accounting: The project accounting module is used to manage the financial aspects of specific projects. It includes features such as project budgeting, cost tracking, and revenue recognition. It helps ensure that project costs are managed effectively and that projects are profitable.

- Multi-Currency Support: The multi-currency support feature is used to manage transactions in different currencies. It includes features such as currency conversion, exchange rate management, and international tax compliance. It helps ensure that the organization can do business in multiple countries and currencies.

- Mobile Access: The mobile access feature is used to provide access to the FMS from mobile devices. It includes features such as mobile apps, mobile-optimized websites, and secure mobile access. It helps ensure that decision-makers can access financial data and reports from anywhere, at any time.

Digital Finance Transformation and New Technologies:

Digital finance transformation refers to the process of using digital technologies to transform financial operations and improve business outcomes. Digital finance transformation can encompass a wide range of technologies, including cloud computing, artificial intelligence (AI), blockchain, and robotic process automation (RPA). By leveraging these technologies, organizations can automate financial processes, reduce errors, and improve efficiency, leading to better financial performance. Here are some of the new technologies that are driving digital finance transformation:

- Cloud Computing: Cloud computing is a technology that allows organizations to access computing resources, such as servers and storage, over the internet. Cloud computing enables organizations to store and process large amounts of data without the need for expensive hardware and software. It also allows for greater flexibility and scalability, making it easier for organizations to adjust their computing resources to meet changing business needs.

- Artificial Intelligence (AI): AI refers to the ability of machines to perform tasks that typically require human intelligence, such as problem-solving and decision-making. In the context of digital finance transformation, AI can be used to automate financial processes, such as invoice processing and fraud detection. AI can also be used to analyze financial data and identify patterns, helping decision-makers to make more informed financial decisions.

- Blockchain: Blockchain is a distributed ledger technology that allows for secure and transparent transactions without the need for intermediaries, such as banks or financial institutions. In the context of digital finance transformation, blockchain can be used to create secure and transparent financial transactions, reducing the risk of fraud and increasing efficiency.

- Robotic Process Automation (RPA): RPA is a technology that uses software robots to automate repetitive and time-consuming tasks. In the context of digital finance transformation, RPA can be used to automate financial processes, such as data entry and reconciliation. RPA can also be used to reduce errors and improve efficiency, leading to better financial performance.

- Internet of Things (IoT): IoT refers to the ability of devices to connect and exchange data over the Internet. In the context of digital finance transformation, IoT can be used to collect and analyze financial data from a variety of sources, such as sensors and devices. This data can be used to identify patterns and trends, helping decision-makers to make more informed financial decisions.

- Big Data Analytics: Big data refers to the massive volumes of data that organizations generate and collect. Big data analytics involves using advanced analytical techniques, such as machine learning and predictive analytics, to identify patterns and insights in this data. In the context of digital finance transformation, big data analytics can be used to analyze financial data and identify trends and insights that can inform financial decision-making.

- Digital Payments: Digital payments refer to the use of digital technologies to facilitate financial transactions, such as online payments, mobile payments, and e-wallets. Digital payments can be faster, more secure, and more convenient than traditional payment methods, such as cash and checks. In the context of digital finance transformation, digital payments can help organizations streamline financial transactions and reduce costs.

- Open Banking: Open banking refers to the use of open APIs (application programming interfaces) to enable third-party developers to build applications and services that access financial data. In the context of digital finance transformation, open banking can help organizations share financial data securely and efficiently with third-party service providers, such as financial advisors and fintech startups.

- Digital Identity Management: Digital identity management refers to the use of digital technologies to manage and verify the identity of individuals and organizations. In the context of digital finance transformation, digital identity management can help organizations to verify the identity of customers and partners, reducing the risk of fraud and improving compliance.

- Cybersecurity: Cybersecurity refers to the practices and technologies used to protect computer systems and networks from unauthorized access, theft, and damage. In the context of digital finance transformation, cybersecurity is critical to protecting financial data and transactions from cyber threats, such as hacking, phishing, and malware attacks.

It is apparent that financial management system and digital finance transformation, we have provided a detailed overview of the essential components of a financial management system, as well as the ways in which new technologies are driving digital finance transformation. By leveraging technologies such as artificial intelligence, blockchain, robotic process automation, and the Internet of Things, financial institutions can improve their operational efficiency, enhance customer experiences, and provide greater security and transparency in financial transactions. Overall, financial management systems play a vital role in ensuring the financial health and stability of businesses and organizations, and it is essential to have a well-designed and robust system in place to achieve financial success.

References:

- “The 10 Essential Elements of an Effective Financial Management System.” Nonprofit Finance Fund. 2016.

- “5 Key Components of Financial Management for Small Business.” Entrepreneur. 2020.

- “What Is Financial Management Information Systems?” Investopedia. 2021.

- “The Components of a Financial Management System for Small Business.” The Balance Small Business. 2021.

- “Components of Financial Management.” Bizfluent. 2019.

Library Lecturer at Nurul Amin Degree College