Working capital management is the process of effectively managing a company’s current assets and current liabilities to ensure that it can meet its short-term financial obligations while optimizing operational efficiency. Current assets are the assets that a company expects to convert into cash or use up within one year, such as cash, accounts receivable, and inventory. Current liabilities are the obligations that a company is expected to settle within one year, including accounts payable and short-term debt. In the rest of this article, we will explore the importance, goals, and components of working capital management.

Importance of Working Capital Management:

1. Liquidity and Solvency: The most fundamental role of working capital management is to ensure a company’s liquidity and solvency. Liquidity refers to a firm’s ability to convert its assets into cash quickly, while solvency refers to its capacity to meet long-term financial obligations. As Gitman and Zutter (2018) highlight, working capital management is crucial because it directly affects an organization’s ability to meet short-term obligations, ensuring liquidity and contributing to overall solvency.

2. Operational Efficiency: Efficient working capital management can enhance operational efficiency by optimizing the allocation of resources. This includes the management of current assets, such as cash, accounts receivable, and inventory. By ensuring that these assets are neither excessive nor inadequate, a company can run its operations more smoothly. Van Horne and Wachowicz (2008) suggest that it helps to minimize idle cash and reduce the opportunity cost of holding excess current assets, thus enhancing operational efficiency.

3. Cost Reduction: Proper working capital management can lead to cost savings in various ways. For instance, holding excess inventory ties up capital that could be better employed elsewhere, while inadequate inventory levels can lead to expensive stockouts and rush orders. As Weston et al. (2013) point out, “Effective working capital management helps reduce carrying costs, insurance costs, and opportunity costs of tying up funds in non-productive assets.”

4. Optimal Use of Credit: Efficient management of accounts payable is essential for better relationships with suppliers and access to favorable credit terms. Paying suppliers on time can often lead to negotiations for discounts and improved payment terms, thus reducing financing costs. Shim and Siegel (2008) argue that an efficient working capital management strategy includes optimizing the use of trade credit to reduce financing costs.

5. Growth and Investment: Adequate working capital is essential for funding growth and investment initiatives. Whether a company is expanding, investing in new projects, or simply weathering economic downturns, a strong working capital position allows for flexibility and the pursuit of opportunities. Garrison et al. (2011) highlight that “sufficient working capital is essential to sustain growth and innovation, enabling a company to seize strategic opportunities.”

6. Risk Mitigation: Effective working capital management reduces financial risk. A robust working capital position acts as a buffer against economic uncertainties and reduces the risk of financial distress. As Brigham and Ehrhardt (2017) suggest, it allows companies to navigate unexpected disruptions or downturns with greater ease, thus mitigating financial risks.

7. Working Capital Financing: Working capital management also involves optimizing the sources of financing for short-term needs. Efficient use of short-term debt, trade credit, and lines of credit can lower the cost of capital and reduce the financial risk associated with long-term debt. As mentioned by Ross et al. (2017), “Managing the mix of short-term and long-term financing can lead to substantial cost savings.”

8. Monitoring and Control: Effective working capital management involves constant monitoring and control of current assets and liabilities. This not only helps in maintaining financial stability but also allows for proactive adjustments in response to changing market conditions. A company that regularly analyzes its working capital position can make informed decisions for both short-term and long-term planning.

Goals of Working Capital Management:

The primary goals of working capital management are:

1. Ensuring Adequate Liquidity: It aims to maintain sufficient current assets (particularly cash) to cover the company’s short-term financial obligations, such as paying suppliers, salaries, and other operating expenses.

- Maintaining Cash Reserves: This aspect of working capital management involves ensuring that the company maintains an adequate level of cash on hand to cover its short-term financial obligations. Cash is essential for paying suppliers, salaries, rent, utilities, and other day-to-day operational expenses.

- Risk Mitigation: Having sufficient liquidity in the form of cash and other liquid assets provides a buffer against unexpected financial challenges or economic downturns. It ensures the company can navigate through tough times without resorting to emergency borrowing, which can be costly.

- Smooth Operations: Adequate liquidity contributes to the smooth functioning of the business. It prevents disruptions in the supply chain, production process, or customer service due to a lack of funds.

2. Optimizing Operational Efficiency: Effective working capital management seeks to strike a balance between having too much and too little working capital. Having excess working capital can be inefficient as it ties up funds that could be invested elsewhere, while having too little can result in operational disruptions.

- Balancing Current Assets and Liabilities: Effective working capital management is about finding the right balance between current assets (like inventory and accounts receivable) and current liabilities (like accounts payable and short-term debt). Holding too much working capital can be inefficient, as it ties up capital that could be put to better use elsewhere, such as investments in growth initiatives.

- Cost Reduction: By managing current assets efficiently, a company can reduce carrying costs, minimize storage expenses, and decrease the opportunity cost associated with holding excess inventory or idle cash.

- Preventing Stockouts: Balancing inventory levels ensures that a company doesn’t run out of essential materials or products, which can result in lost sales and damage to the company’s reputation.

3. Minimizing Financing Costs: It involves managing the company’s working capital in a way that minimizes financing costs. This includes effectively using short-term loans, trade credit, and lines of credit to meet short-term obligations.

- Short-Term Financing: Working capital management includes optimizing the use of short-term financing options, such as trade credit from suppliers, lines of credit from banks, or short-term loans. Using these sources judiciously can minimize financing costs and reduce the burden of interest expenses.

- Enhancing Credit Terms: Maintaining a strong financial position can enable a company to negotiate more favorable credit terms with suppliers. This may include discounts for early payment or extended payment periods, both of which can reduce financing costs.

4. Maximizing Profitability: By ensuring that the right amount of current assets is available to support sales and operations, a company can maximize its profitability and avoid the opportunity cost of holding excessive assets.

- Asset Efficiency: Managing current assets efficiently means that the company has the right amount of inventory and accounts receivable to support its sales and operations. This optimization can contribute to higher revenue and profitability.

- Avoiding Opportunity Costs: Holding excessive assets in the form of cash, inventory, or accounts receivable can result in opportunity costs. These are the potential earnings that the company foregoes by not investing or using those assets more effectively.

5. Mitigating Risk: Effective working capital management helps reduce financial risk. With adequate working capital, a company is better equipped to handle unexpected financial challenges, economic downturns, and disruptions.

- Buffer Against Uncertainty: Adequate working capital acts as a financial cushion, protecting the company from unexpected financial challenges, such as economic downturns, sudden market changes, or emergencies. It reduces the risk of financial distress and ensures business continuity.

- Financial Resilience: With sufficient working capital, a company can be more resilient in the face of disruptions like supply chain interruptions, natural disasters, or unexpected changes in the business environment.

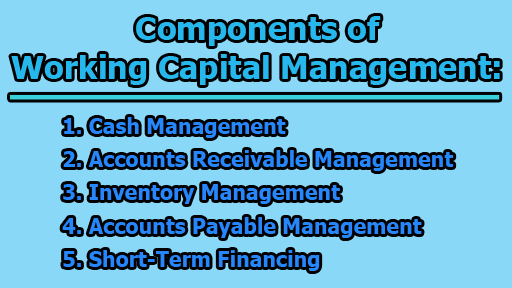

Components of Working Capital Management:

Key components of working capital management include:

1. Cash Management: Managing cash flow to ensure there is enough cash on hand to cover daily operational expenses and unexpected costs.

- Cash Flow Forecasting: Effective cash management begins with accurate cash flow forecasting. Companies must analyze past cash flows and anticipate future cash needs to ensure that there is always enough cash on hand to cover daily operational expenses.

- Liquidity Maintenance: Businesses maintain liquidity by holding an appropriate amount of cash or cash-equivalents, like marketable securities, which can be quickly converted into cash if needed. This ensures they can meet both expected and unexpected financial obligations.

- Optimal Use of Idle Cash: Managing idle cash effectively is essential. Companies should aim to invest excess cash in short-term, low-risk, interest-bearing instruments to generate returns on their idle funds.

2. Accounts Receivable Management: Optimizing the credit terms extended to customers and collecting receivables promptly to improve cash flow.

- Credit Terms: Optimizing credit terms involves deciding how much credit to extend to customers. Striking a balance between offering favorable terms to attract sales and minimizing credit risk is essential.

- Credit Evaluation: Thoroughly assessing the creditworthiness of customers is crucial to avoid late payments or defaults. This may involve credit checks and setting appropriate credit limits.

- Collections Process: Having an efficient collections process in place is vital. Timely follow-up on outstanding invoices and implementing a clear collections policy helps in promptly collecting receivables to improve cash flow.

3. Inventory Management: Balancing inventory levels to avoid stockouts while minimizing carrying costs.

- Demand Forecasting: Businesses must accurately forecast demand for their products to maintain the right level of inventory. This can involve using historical data, market trends, and sales projections.

- Minimizing Carrying Costs: Inventory carrying costs include expenses like warehousing, insurance, and depreciation. Effective inventory management seeks to minimize these costs while ensuring an adequate supply to meet customer demand.

- Just-in-Time (JIT) Systems: JIT systems involve ordering and receiving inventory just in time for production or sale. These systems reduce carrying costs and minimize the risk of obsolescence.

4. Accounts Payable Management: Managing accounts payable to ensure that payments are made on time, maintain good supplier relationships, and possibly take advantage of discounts.

- Payment Scheduling: Managing accounts payable involves carefully scheduling payments to suppliers. The goal is to ensure that payments are made on time to maintain good supplier relationships while taking advantage of any available discounts for early payment.

- Supplier Relations: Strong relationships with suppliers can lead to favorable terms, such as extended payment periods or discounts. Maintaining open communication with suppliers is crucial for effective accounts payable management.

- Cash Flow Considerations: Businesses should align their accounts payable schedule with their cash flow, ensuring that they have the necessary funds to meet their payment obligations when they come due.

5. Short-Term Financing: Utilizing short-term loans, lines of credit, and trade credit to meet short-term financial needs.

- Credit Lines: Companies often rely on lines of credit from banks or other financial institutions to bridge short-term financing gaps. These lines provide flexible access to funds when needed.

- Trade Credit: Trade credit, offered by suppliers, is another form of short-term financing. By negotiating favorable terms with suppliers, a company can delay payments while maintaining a good relationship.

- Short-Term Loans: Short-term loans from banks or financial institutions can be used to cover short-term financial needs, such as purchasing inventory or meeting seasonal demands.

Effective working capital management is crucial for a company’s financial stability and success. It helps businesses maintain liquidity, improve operational efficiency, reduce costs, optimize credit terms, seize growth opportunities, and mitigate financial risks, ensuring that the company can meet its short-term and long-term goals.

Library Lecturer at Nurul Amin Degree College