An Overview of Financial Inclusion:

Financial inclusion refers to the provision of access to financial services, such as banking, loans, and insurance, to individuals and businesses who are traditionally excluded from the formal financial system due to various reasons, such as low income, lack of access to financial institutions, or lack of proper identification documents. The goal of financial inclusion is to create a more inclusive and equitable financial system that provides individuals and businesses with the necessary tools to manage their finances, invest in their futures, and participate in economic growth. Financial inclusion is considered to be an important step towards reducing poverty, promoting economic development, and achieving sustainable development goals. In the rest of this article, we will explore an overview of financial inclusion.

Definitions of Financial Inclusion:

Here are three different perspectives on the definition of financial inclusion:

i. Economist Perspective: From an economist’s perspective, financial inclusion refers to the provision of affordable and accessible financial services to all segments of society, especially the marginalized and financially excluded. This includes individuals who lack access to formal financial institutions, such as banks and insurance companies, or who are unable to afford their services. The goal of financial inclusion is to promote financial stability and growth by enabling individuals and businesses to participate fully in the economy and benefit from financial products and services.

ii. Social Justice Perspective: From a social justice perspective, financial inclusion is about ensuring that all individuals, regardless of their social or economic status, have the right to access financial services and products that meet their needs. Financial exclusion can perpetuate inequality and limit opportunities for marginalized groups, including women, minorities, and low-income households. Therefore, financial inclusion is seen as a way to promote social justice and reduce poverty by providing individuals and communities with the resources they need to improve their economic well-being and achieve their goals.

iii. Business Perspective: From a business perspective, financial inclusion is viewed as a market opportunity to reach underserved or untapped segments of the population with financial products and services. By expanding access to financial services, companies can increase their customer base and revenue streams while also contributing to the development of the communities they serve. Furthermore, financial inclusion can help companies to build brand loyalty, enhance their reputation, and create a positive social impact, which can be a competitive advantage in today’s market.

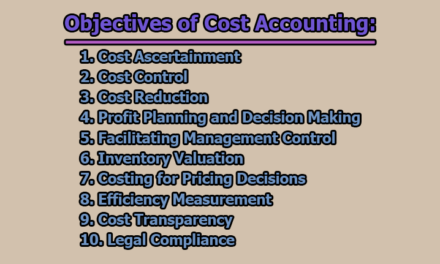

Objectives of Financial Inclusion:

Financial inclusion has a wide range of objectives that can be categorized into economic, social, and political objectives. Here are some of the key objectives of financial inclusion:

A. Economic objectives: Financial inclusion can help achieve several economic objectives, including:

- Reducing poverty: By providing access to financial services, individuals and households can better manage their money, save for the future, and invest in income-generating activities, which can help lift them out of poverty.

- Promoting economic growth: Financial inclusion can provide individuals and businesses with the necessary tools and resources to participate in the formal economy, including access to credit, insurance, and savings products, which can help promote economic growth.

- Mobilization of savings: Financial inclusion can encourage the mobilization of savings, which can be used to fund investment and development projects, leading to greater economic activity.

- Creating a larger market: By providing financial services to the previously unbanked or under-banked, financial inclusion can expand the market for financial products and services, leading to greater competition and innovation in the financial sector.

B. Social objectives: Financial inclusion can also help achieve several social objectives, including:

- Sustainable livelihoods: Financial inclusion can enable individuals to invest in their education, health, and businesses, leading to increased income and sustainable livelihoods.

- Gender equality: Financial inclusion can promote gender equality by empowering women to manage their finances, access credit, and participate in the formal economy, which can lead to greater economic and social empowerment.

- Access to essential services: Financial inclusion can provide individuals and households with access to essential services, such as healthcare and education, which can improve their overall well-being.

C. Political objectives: Financial inclusion can also help achieve several political objectives, including:

- Encouraging political stability: Financial inclusion can reduce poverty and promote economic growth, which can help foster political stability and reduce social and political unrest.

- Promoting financial transparency: Financial inclusion can encourage the use of formal financial services, which can promote financial transparency and reduce the risks of corruption and money laundering.

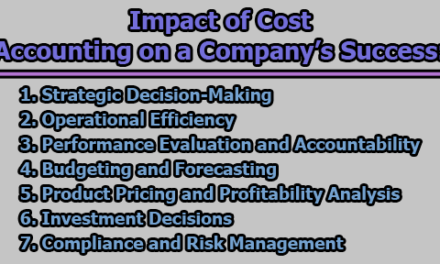

Benefits of Financial Inclusion:

Financial inclusion has numerous benefits, which can be classified into economic, social, and political benefits. Here are some of the key benefits of financial inclusion:

- Reduction in income inequality: Financial inclusion can help reduce income inequality by providing low-income households and marginalized communities with access to financial services, such as savings accounts, credit, and insurance. This can enable them to participate more fully in the formal economy, improve their economic well-being, and reduce poverty.

- Promoting Entrepreneurship: Financial inclusion can promote entrepreneurship by providing individuals and small businesses with access to credit and other financial services to start or expand their businesses. This can lead to increased economic activity, job creation, and higher incomes, especially in rural areas.

- Implementation of Anti-money laundering: Financial inclusion can help in the implementation of anti-money laundering regulations by promoting the use of formal financial services and reducing the risk of illegal financial transactions.

- Economic growth: Financial inclusion can contribute to economic growth by expanding access to credit and savings, which can fuel investment and economic activity. This can also lead to increased trade, investment, and job creation.

- Higher and better productivity: Financial inclusion can increase productivity by enabling individuals and businesses to access financial resources to invest in education, training, and technology. This can lead to higher productivity levels, better job opportunities, and higher incomes.

- Increase in employment and income opportunities: Financial inclusion can lead to increased employment and income opportunities, especially for women and other marginalized groups. By providing access to credit and other financial services, individuals and businesses can invest in education, training, and other income-generating activities.

- Faster growth in the economy: Financial inclusion can contribute to faster growth in the economy by enabling individuals and businesses to participate more fully in the formal economy, leading to increased trade, investment, and job creation. This can create a positive cycle of economic growth and development.

Significance of Financial Inclusion:

Financial inclusion is significant because it provides access to financial services to individuals and businesses, particularly in underserved and marginalized communities. This can contribute to economic growth, and poverty reduction, and create a more inclusive and equitable financial system. By expanding access to financial services, financial inclusion can empower women and marginalized groups, promote financial stability, and create greater competition and innovation in the financial sector. Overall, financial inclusion is essential for creating a more inclusive and sustainable society.

Needs for Financial Inclusion:

Financial inclusion is the process of providing access to financial services to all individuals and businesses, particularly those who are underserved or excluded from traditional financial services. Here are some of the key needs for financial inclusion:

- Access to formal financial services: One of the primary needs for financial inclusion is access to formal financial services, such as savings accounts, credit, insurance, and payment services. This can enable individuals and businesses to manage their finances more effectively, invest in their education and businesses, and protect themselves from unexpected financial shocks.

- Financial education: Another need for financial inclusion is financial education. Many individuals and businesses lack the knowledge and skills needed to effectively manage their finances and make informed financial decisions. Financial education can help them understand the benefits of formal financial services, the risks associated with informal financial services, and the importance of savings and budgeting.

- Trust in financial institutions: Trust is another critical need for financial inclusion. Many individuals and businesses in underserved communities may not trust formal financial institutions due to past experiences or cultural beliefs. Building trust in financial institutions is crucial to expanding access to financial services and promoting financial inclusion.

- Innovative financial products and services: Innovative financial products and services are also essential for financial inclusion. Traditional financial products and services may not be appropriate or accessible to individuals and businesses in underserved communities. Innovative products and services can be designed to meet their specific needs and preferences, such as mobile banking or microfinance.

- Enabling policy environment: Finally, an enabling policy environment is essential for financial inclusion. Governments and policymakers can create policies and regulations that promote financial inclusion, such as reducing barriers to entry for new financial institutions, promoting financial literacy programs, and establishing consumer protection laws.

Evolution of Financial Inclusion:

Financial inclusion has evolved significantly over the past few decades, driven by technological advancements, changing consumer behaviors, and global initiatives to promote financial inclusion. Here is a brief overview of the evolution of financial inclusion:

- Early Efforts: Early efforts to promote financial inclusion focused on expanding access to traditional banking services, such as savings accounts and loans, to underserved and marginalized communities. These efforts were typically led by governments, NGOs, and microfinance institutions, and were often targeted at low-income households and small businesses.

- Technology-Enabled Innovations: The development of new technologies, such as mobile phones and digital platforms, has enabled financial institutions to reach underserved communities more efficiently and cost-effectively. This has led to a wave of technology-enabled innovations, such as mobile banking, digital payments, and blockchain-based solutions, that have revolutionized the way financial services are delivered.

- Global Initiatives: In recent years, global initiatives have played a significant role in promoting financial inclusion. For example, in 2015, the United Nations launched the Sustainable Development Goals (SDGs), which include a target to “ensure access to affordable, reliable, sustainable, and modern energy for all.” The SDGs have catalyzed a range of global initiatives, such as the Better Than Cash Alliance and the Alliance for Financial Inclusion, that have focused on expanding access to financial services for underserved communities.

- Private Sector Participation: The private sector has also played a growing role in promoting financial inclusion, driven by the potential for new markets and customers. Many financial institutions, such as banks, insurance companies, and fintech startups, are now actively developing innovative financial products and services that are tailored to the needs of underserved communities. This has led to a surge in investment in financial inclusion, with private investors and impact funds providing capital to support the development of new financial products and services.

- Regulatory Changes: Finally, regulatory changes have also played a critical role in promoting financial inclusion. Many countries have introduced policies and regulations to promote financial inclusion, such as reducing barriers to entry for new financial institutions, providing tax incentives for financial services providers, and establishing consumer protection laws. These regulatory changes have created a more enabling environment for financial inclusion and have contributed to the growth of innovative financial products and services.

Initiatives need to take by Government for Financial Inclusion:

Financial inclusion is a critical policy objective for governments around the world. Here are some initiatives that governments can take to promote financial inclusion:

- Establish a national financial inclusion strategy: Governments can play a leadership role in promoting financial inclusion by developing and implementing a national financial inclusion strategy. This can include setting specific targets and timelines for expanding access to financial services, identifying priority areas for intervention, and coordinating efforts across different government departments and stakeholders.

- Expand access to formal financial services: Governments can expand access to formal financial services by encouraging the establishment of new financial institutions, reducing regulatory barriers to entry, and providing incentives for financial services providers to serve underserved communities. Governments can also support the development of innovative financial products and services that are tailored to the needs of underserved communities.

- Promote financial education and literacy: Financial education and literacy are essential for promoting financial inclusion. Governments can develop and implement financial education programs in schools and communities, as well as through public awareness campaigns and outreach programs. This can help individuals and businesses better understand the benefits of formal financial services and make informed financial decisions.

- Foster digital financial services: Digital financial services, such as mobile banking and digital payments, have the potential to significantly expand access to financial services, particularly in underserved and remote communities. Governments can support the development of digital infrastructure, such as mobile networks and digital payment systems, and encourage the adoption of digital financial services through regulatory and policy frameworks.

- Ensure consumer protection: Governments have a responsibility to ensure that consumers are protected from fraudulent and abusive practices in the financial sector. This can include establishing consumer protection laws, regulating financial services providers, and providing mechanisms for consumers to seek redress in cases of dispute or fraud.

- Target specific underserved populations: Governments can target specific underserved populations, such as women, rural communities, and low-income households, with tailored financial inclusion initiatives. This can include providing incentives for financial services providers to serve these populations, developing financial products and services that are tailored to their needs, and investing in digital and physical infrastructure to expand access to financial services.

- Foster public-private partnerships: Governments can work with private sector stakeholders, including financial institutions, technology companies, and civil society organizations, to promote financial inclusion. Public-private partnerships can leverage the expertise, resources, and networks of both the public and private sectors to develop innovative solutions and scale up successful initiatives.

- Address infrastructure gaps: Infrastructure gaps, such as limited physical access to financial services, inadequate digital connectivity, and poor power supply, can hinder financial inclusion. Governments can address these gaps by investing in physical and digital infrastructure, such as building bank branches in underserved areas and expanding mobile networks.

- Enhance regulatory frameworks: Governments can enhance regulatory frameworks to promote financial inclusion. This can include reducing regulatory barriers to entry for financial services providers, developing prudential standards to ensure the safety and soundness of financial institutions, and promoting competition in the financial sector to drive innovation and improve access to financial services.

- Support micro, small, and medium-sized enterprises (MSMEs): MSMEs are important drivers of economic growth and job creation, but they often face significant barriers to accessing formal financial services. Governments can support MSMEs by developing targeted financial inclusion initiatives, such as guarantee schemes and credit enhancement programs that enable MSMEs to access financing and other financial services. This can help MSMEs to grow and create jobs, contributing to broader economic development.

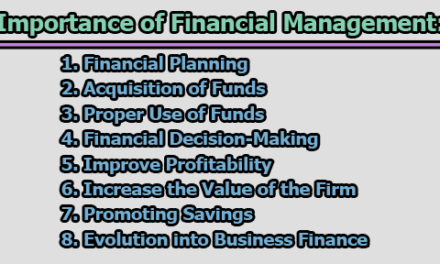

Role of Financial Institutions in Promoting Financial Inclusion:

Financial institutions play a critical role in promoting financial inclusion by expanding access to financial services and developing innovative products and services that meet the needs of underserved communities. Here are some key points about the role of financial institutions in promoting financial inclusion:

- Financial institutions can expand access to financial services by establishing new branches and distribution channels in underserved areas.

- They can develop innovative financial products and services that are tailored to the needs of underserved communities.

- Financial institutions can build financial literacy and awareness among underserved communities.

- They can leverage technology to promote financial inclusion, such as through mobile banking and digital payments.

- Financial institutions can partner with other stakeholders, such as governments and civil society organizations, to promote financial inclusion.

- They can provide microfinance products to small businesses and farmers.

- Financial institutions can offer simplified account-opening processes that are accessible to a wide range of consumers.

- They can provide insurance products that provide protection against unforeseen events.

- Financial institutions can use technology to reduce costs and expand their reach, such as through mobile banking agents and digital distribution channels.

- They can provide financial education and training programs to help consumers make informed financial decisions.

In conclusion, financial inclusion is essential for building more inclusive and sustainable economies that benefit all members of society. Financial institutions play a crucial role in promoting financial inclusion by expanding access to financial services, developing innovative financial products and services, building financial literacy and awareness, leveraging technology, and partnering with other stakeholders. By working to promote financial inclusion, financial institutions can help to bridge the gap between underserved communities and financial services, promote economic growth, and reduce income inequality. Ultimately, financial inclusion is not only a social imperative but also a sound economic strategy for building more inclusive and prosperous societies.

References:

- Allen, F., Demirgüç-Kunt, A., Klapper, L., & Pería, M. S. M. (2016). The Foundations of Financial Inclusion: Understanding Ownership and Use of Formal Accounts. Journal of Financial Intermediation, 27, 1-30. https://doi.org/10.1016/j.jfi.2015.08.001

- Collins, D., Morduch, J., Rutherford, S., & Ruthven, O. (2009). Portfolios of the Poor: How the World’s Poor Live on $2 a Day. Princeton University Press.

- Cull, R., Demirgüç-Kunt, A., & Morduch, J. (2018). Financial Inclusion and Development: Recent Impact Evidence. CGAP Focus Note, 115. https://www.cgap.org/sites/default/files/Focus-Note-Financial-Inclusion-and-Development-Recent-Impact-Evidence-May-2018.pdf

- Honohan, P., & Beck, T. (2007). Making Finance Work for Africa. World Bank.

- Sengupta, R. (2015). Financial Inclusion: Concepts, Issues, and Policies. Springer.

- World Bank. (2018). Global Financial Development Report 2017/2018: Bankers without Borders. World Bank.

- World Bank. (2020). The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution. World Bank. https://doi.org/10.1596/978-1-4648-1259-0

- Yadav, V. K. (2017). Financial Inclusion in India: A Review of Government Policies and Initiatives. Journal of Economics and Sustainable Development, 8(12), 222-232. http://iiste.org/Journals/index.php/JEDS/article/view/37532/38680

- Zins, A. H. (2015). Financial Inclusion: An Overview. Journal of Financial Perspectives, 3(3), 37-53. https://doi.org/10.3905/jfp.2015.3.3.037

- Zhou, M. (2019). Financial Inclusion in China: Policy, Performance, and Determinants. Emerging Markets Finance and Trade, 55(6), 1196-1217. https://doi.org/10.1080/1540496X.2018.1559998

Former Student at Rajshahi University