How would You Reconcile Your Bank Account to Avoid Spending More Than You Have?

In the fast-paced world of modern finance, managing your bank account effectively is crucial to maintaining financial stability and avoiding unnecessary debt. One of the fundamental practices for sound financial management is the regular reconciliation of your bank account. Reconciliation involves comparing your personal records of transactions with those provided by your bank to ensure accuracy and identify any discrepancies. This process is essential for preventing overspending, detecting errors, and fostering a clear understanding of your financial standing. In the rest of this article, we will explore the following statement “How would you reconcile your bank account to avoid spending more than you have?”

Importance of Reconciliation in Financial Management:

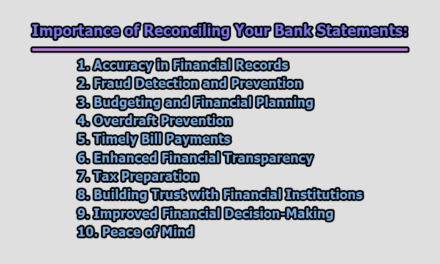

Before we embark on the detailed steps of reconciliation, it is essential to underscore the significance of this financial practice. Reconciliation is not merely a procedural task; it serves as a crucial checks-and-balances system for your finances, playing a pivotal role in safeguarding your financial well-being and fostering a sound financial future.

1. Detecting Discrepancies and Errors: One of the primary purposes of reconciliation is to identify any discrepancies between your personal records and the transactions reported by your bank. Discrepancies can arise from various sources, including data entry errors, missing transactions, or even technical glitches. By reconciling regularly, you can promptly catch and rectify these errors, ensuring the accuracy of your financial records.

2. Uncovering Unauthorized Transactions: Reconciliation acts as a vigilant guardian against unauthorized or fraudulent activities on your account. In the unfortunate event of unauthorized transactions, early detection is crucial for minimizing financial losses and preventing further harm. Regular reconciliation allows you to spot any unfamiliar transactions, potentially saving you from falling victim to fraud and protecting your hard-earned money.

3. Safeguarding Your Financial Well-being: In an era where financial transactions occur seamlessly and electronically, the risk of financial fraud is ever-present. Reconciliation serves as a proactive measure to protect your financial well-being by providing a comprehensive overview of your transactions. This awareness empowers you to take swift action in the face of discrepancies or suspicious activities, reinforcing the security of your financial assets.

4. Enhancing Budgeting and Financial Planning: Beyond its role as a security measure, reconciliation is a powerful tool for budgeting and financial planning. By comparing your personal records with the bank statement, you gain valuable insights into your income, expenses, and overall spending habits. This information forms the foundation for informed financial decisions, allowing you to allocate resources efficiently, set realistic budgets, and plan for future expenses.

5. Providing a Realistic Financial Snapshot: Your bank statement is a mirror reflecting your financial reality. Reconciliation ensures that this reflection is accurate and clear. It provides you with a realistic snapshot of your financial situation, encompassing your cash flow, account balances, and transaction history. Armed with this knowledge, you can make strategic financial decisions that align with your goals and aspirations.

6. Building Financial Discipline: Regular reconciliation fosters financial discipline by instilling a habit of active financial engagement. It encourages you to pay attention to the details of your financial transactions, promoting a heightened awareness of your spending patterns and financial responsibilities. This discipline is a cornerstone for long-term financial success and stability.

7. Strengthening Financial Accountability: Reconciliation instills a sense of accountability in your financial management. By taking the time to ensure that your personal records match the bank’s records, you demonstrate a commitment to accuracy and transparency in your financial dealings. This accountability is not only crucial for your personal financial well-being but also for building trust with financial institutions.

Step-by-Step Guide to Reconciliation:

Reconciling your bank account is a fundamental financial practice that ensures your personal records align with those of your bank, helping you manage your finances effectively and prevent overspending. Follow this step-by-step guide to navigate the reconciliation process with ease:

1. Gather Your Documents: Begin by collecting all relevant financial documents. This includes your bank statements, checkbook register, receipts, and any other transaction records. Having these documents at hand will facilitate a smooth reconciliation process.

2. Review Your Bank Statement: Carefully examine your most recent bank statement. Take note of all transactions, including deposits, withdrawals, checks, and electronic transactions. Make sure to check for any fees or charges imposed by the bank. Online banking platforms usually provide easily accessible digital statements.

3. Update Your Checkbook Register: If you maintain a checkbook register or use a personal finance app, update it with any transactions that occurred since the last reconciliation. Include details such as dates, transaction descriptions, and amounts. Accuracy at this stage is crucial for a successful reconciliation.

4. Identify Discrepancies: Compare the transactions in your updated checkbook register with those on your bank statement. Look for any discrepancies, such as missing transactions, incorrect amounts, or unauthorized charges. Anomalies may be indicative of errors or potential issues that need further investigation.

5. Investigate and Rectify Errors: If you find any discrepancies, investigate them promptly. Check for data entry errors, duplicate transactions, or any signs of fraudulent activity. Contact your bank’s customer service if you identify unauthorized transactions. Work with the bank to rectify errors and keep a record of all communication for future reference.

6. Reconcile Your Accounts: Start the formal reconciliation process by comparing the ending balance on your bank statement with the balance in your checkbook register. Ideally, these two balances should match. If they don’t, carefully review each transaction to identify the source of the discrepancy.

7. Adjust Your Checkbook Register: Make necessary adjustments to your checkbook register to reconcile it with the ending balance on your bank statement. This may involve adding any missed transactions, correcting amounts, or accounting for fees. The goal is to ensure that your personal records accurately reflect the financial activity reported by the bank.

8. Update Your Budget: Use the insights gained from the reconciliation process to update your budget. Analyze your spending patterns, identify areas for improvement, and set realistic financial goals. Regularly revisiting and adjusting your budget based on accurate financial information is essential for effective financial planning.

Tips for Successful Reconciliation:

Reconciling your bank account is a crucial aspect of maintaining financial accuracy and control. To ensure a successful reconciliation process, consider incorporating the following tips into your routine:

1. Stay Consistent: Make reconciliation a regular and consistent part of your financial routine. Whether you choose to reconcile monthly, bi-monthly, or weekly, maintaining a routine ensures that you promptly identify and address any discrepancies, preventing them from becoming larger issues over time.

2. Utilize Technology: Leverage the power of technology to streamline the reconciliation process. Many banks offer online banking platforms that provide real-time updates on transactions. Additionally, there are various personal finance apps that can sync with your bank accounts, automatically categorizing transactions and minimizing manual entry errors.

3. Keep Detailed Records: Maintain thorough and organized records of your financial transactions. Whether you use a traditional checkbook register, a spreadsheet, or a personal finance app, ensure that your records capture essential details such as dates, descriptions, and amounts. Detailed records not only facilitate reconciliation but also serve as valuable references for future financial decisions.

4. Monitor for Fraud: Part of the reconciliation process involves vigilant monitoring for any signs of fraudulent activity. Regularly review your bank statements for unfamiliar transactions or suspicious patterns. Set up alerts for large transactions or any activity that deviates from your normal spending habits. Promptly reporting potential fraud can help mitigate financial losses and protect your accounts.

5. Reconcile Immediately After Statements: Aim to reconcile your bank account as soon as your monthly statement becomes available. This allows you to address any discrepancies promptly and ensures that your financial records are up-to-date. Delaying reconciliation increases the likelihood of overlooking or forgetting important transactions.

6. Balance as You Go: Instead of waiting for the end of the month to reconcile, consider balancing your checkbook or updating your personal finance app regularly as transactions occur. This “balancing as you go” approach minimizes the chances of overlooking transactions and makes the reconciliation process more manageable.

7. Compare Receipts and Documentation: Keep all receipts and documentation related to your transactions. When reconciling, compare these documents with your bank statement and checkbook register. This practice not only helps verify the accuracy of transactions but also serves as a backup in case of disputes or discrepancies.

8. Seek Professional Guidance When Needed: If you find the reconciliation process challenging or have complex financial situations, consider seeking advice from a financial professional. Accountants or financial advisors can provide personalized guidance, ensuring that you are reconciling your accounts accurately and efficiently.

9. Use Reconciliation as a Financial Checkup: View the reconciliation process as an opportunity to conduct a financial checkup. Analyze your spending habits, review your budget, and assess your overall financial health. This proactive approach empowers you to make informed decisions and adjustments to enhance your financial well-being.

10. Educate Yourself on Banking Tools: Familiarize yourself with the various tools and resources provided by your bank for monitoring and managing your accounts. Understanding how to use online banking features, mobile apps, and automated alerts can simplify the reconciliation process and enhance your overall financial management.

In conclusion, “How would you reconcile your bank account to avoid spending more than you have?” reconciling your bank account is an indispensable practice for maintaining financial health and preventing overspending. By following the step-by-step guide and incorporating the provided tips into your financial routine, you can approach reconciliation with confidence and clarity. Remember, the goal is not only to balance your accounts but also to gain insights into your financial habits, make informed decisions, and secure your financial well-being. In the ever-evolving landscape of personal finance, embracing the discipline of reconciliation empowers you to take control of your financial destiny. As you reconcile your bank account regularly, you not only safeguard your hard-earned money but also embark on a journey towards financial freedom and prosperity.

Former Student at Rajshahi University