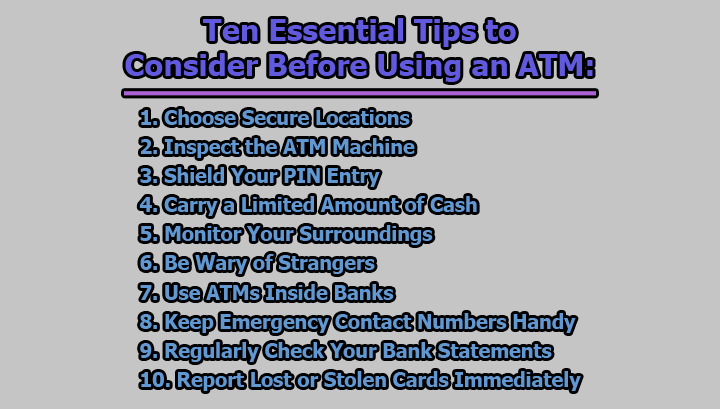

Ten Essential Tips to Consider Before Using an ATM:

Automated Teller Machines (ATMs) have become an integral part of our daily lives, providing convenient access to cash and various banking services. However, with the convenience comes the responsibility of ensuring the security of your financial transactions. Before you insert your card and enter your PIN at an ATM, it’s crucial to take certain precautions to protect yourself from potential risks. This article will outline ten essential tips to consider before using an ATM, helping you make secure and worry-free transactions.

1. Choose Secure Locations: Selecting a secure location for your ATM transactions is paramount to your safety. Opt for ATMs located in well-lit, populated areas, preferably those with constant surveillance. Busy locations are less attractive to criminals looking for an opportunity to exploit unsuspecting users. It’s advisable to avoid secluded or dimly lit areas, as these can be potential hotspots for criminal activities, including card skimming and theft. When possible, use ATMs that are situated within or in close proximity to bank branches, as these are likely to have enhanced security measures in place.

2. Inspect the ATM Machine: Before inserting your card, take a moment to inspect the ATM machine for any signs of tampering or suspicious devices. Criminals often use card skimmers, which are discreet devices attached to the card slot to capture card information. Check for any unusual attachments, loose parts, or anything that appears out of place. Run your fingers over the card slot and keypad to ensure they are uniform and securely attached. If you notice anything suspicious, refrain from using that ATM and report your findings to the respective bank immediately.

3. Shield Your PIN Entry: Protecting your Personal Identification Number (PIN) is crucial for securing your transactions. When entering your PIN, be vigilant about shielding the keypad from prying eyes. Position your body or hand in a way that obscures the view of the keypad, preventing anyone from observing or memorizing your PIN. Memorize your PIN rather than writing it down, and avoid sharing it with anyone, even if they claim to be bank officials. This simple precaution can significantly reduce the risk of unauthorized access to your account.

4. Carry a Limited Amount of Cash: Before heading to the ATM, plan your cash withdrawal carefully and carry only the amount you need for immediate expenses. Limiting the cash you carry minimizes potential losses in case your wallet or purse is lost or stolen. Additionally, avoid counting your money at the ATM; instead, secure it in your wallet or purse immediately. This practice not only protects you from potential theft but also ensures that you maintain awareness of your surroundings during and after the transaction.

5. Monitor Your Surroundings: Maintaining awareness of your surroundings is essential for your safety during ATM transactions. Before approaching the ATM, take a moment to scan the area for any suspicious individuals or activities. Be wary of people loitering nearby or exhibiting behavior that raises concern. If something feels off or you notice anything unusual, consider using a different ATM or returning at a later time. Criminals often exploit distractions, so staying alert and focused on your transaction is key to preventing potential threats.

6. Be Wary of Strangers: While at the ATM, it’s important to maintain a cautious approach towards strangers. Avoid engaging in conversations with unfamiliar individuals, especially if they seem overly interested in your transaction. Criminals may attempt to distract you with questions or offers of assistance to gain access to your card or PIN. Stay focused on your transaction, keeping interactions to a minimum. If someone makes you uncomfortable or exhibits suspicious behavior, do not hesitate to abandon the transaction and find a more secure location.

7. Use ATMs Inside Banks: Whenever possible, choose ATMs located inside bank branches. These ATMs are generally more secure due to their proximity to bank staff and the increased likelihood of surveillance. Criminals are less likely to target ATMs within the controlled environment of a bank. Additionally, bank staff can act as a deterrent to potential criminals, making it a safer option for your transactions. If you need to withdraw cash late at night or during odd hours, consider using ATMs located in well-lit areas with high foot traffic.

8. Keep Emergency Contact Numbers Handy: Before using an ATM, ensure that you have essential emergency contact numbers saved in your phone. These may include your bank’s customer service hotline, card-blocking hotline, and other relevant contacts. In the event of a lost or stolen card or any suspicious activity, having these numbers readily available allows you to take prompt action. Reporting such incidents immediately can help minimize potential losses and prevent unauthorized access to your account.

9. Regularly Check Your Bank Statements: After every ATM transaction, it’s crucial to monitor your bank statements regularly. Set aside time each month to review your statements for any unauthorized or suspicious transactions. If you spot any discrepancies, contact your bank promptly to report the issue. Timely action can help resolve problems before they escalate, ensuring that your accounts remain secure and that you are not held responsible for any fraudulent activities.

10. Report Lost or Stolen Cards Immediately: If your ATM card is lost or stolen, time is of the essence. Report the loss to your bank immediately by contacting their 24/7 hotline for lost or stolen cards. Prompt reporting allows the bank to block your card, preventing unauthorized transactions. Be prepared to provide necessary information, such as your account details and recent transactions, to expedite the process. By taking swift action, you can mitigate potential financial losses and protect your accounts from further compromise.

In conclusion, while ATMs offer unparalleled convenience, ensuring the security of your financial transactions should be a top priority. By following the ten precautionary measures outlined in this article, you can significantly reduce the risk of falling victim to fraudulent activities or compromising your financial information. Remember, a few simple steps can go a long way in ensuring that your ATM transactions are secure and worry-free. Stay vigilant, stay informed, and enjoy the convenience of ATMs responsibly.

Former Student at Rajshahi University