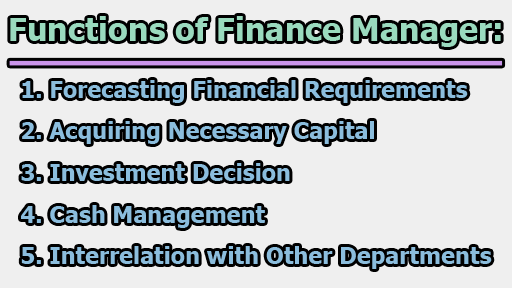

Functions of Finance Manager:

In the dynamic landscape of corporate finance, the role of a Finance Manager emerges as a linchpin for organizational success. This article embarks on an extensive journey, delving into the multifaceted functions of a Finance Manager. With a spotlight on five pivotal responsibilities – Forecasting Financial Requirements, Acquiring Necessary Capital, Investment Decision, Cash Management, and Interrelation with Other Departments – this exploration aims to unravel the intricate tapestry of financial management.

1. Forecasting Financial Requirements (Navigating the Financial Horizon):

1.1 Role as a Financial Vision: At the nucleus of financial management lies the art of forecasting financial requirements. The Finance Manager, in the role of a financial oracle, undertakes the responsibility of estimating the financial needs of the business. This involves a meticulous evaluation of both fixed asset acquisitions and the working capital requirements, painting a picture of the financial landscape that lies ahead.

1.2 Strategic Planning and Futuristic Insights: Forecasting financial requirements extends beyond mere number-crunching; it’s a strategic endeavor. Finance Managers, armed with a visionary lens, proactively plan for the future, ensuring that the organization is well-prepared to meet its financial demands. As a proponent of strategic planning, the Finance Manager becomes a custodian of the organization’s financial future.

1.3 Proactive Decision-Making and Risk Mitigation: Beyond strategic foresight, financial forecasting empowers proactive decision-making. It becomes a tool for risk mitigation, allowing Finance Managers to craft contingency plans and navigate the uncertainties that may lie ahead in the ever-evolving business landscape.

2. Acquiring Necessary Capital (Crafting the Financial Blueprint):

2.1 Navigating the Capital Landscape: Once the financial roadmap is charted, the Finance Manager transitions into the realm of acquiring necessary capital. This involves a meticulous evaluation of how and where finance can be mobilized—an endeavor that is not only critical but also foundational for the organization’s financial architecture.

2.2 Balancing Act: Acquiring necessary capital is a delicate balancing act. Finance Managers, in their role as financial architects, carefully weigh the costs of different capital sources against the overarching financial strategy of the organization. Each decision becomes a stroke in the blueprint of the financial structure that supports the organization’s growth ambitions.

2.3 Financial Instruments and Market Expertise: Steering through the intricacies of financial instruments and market dynamics, Finance Managers leverage their expertise to negotiate favorable terms. Whether delving into debt markets or orchestrating equity transactions, each financial decision is a deliberate step in crafting the financial blueprint that aligns with the organization’s objectives.

3. Investment Decision (The Art and Science of Allocating Resources):

3.1 Analyzing Investment Opportunities: The Finance Manager’s canvas extends to the realm of investment decisions, where they play the role of an artful curator, evaluating potential projects and weighing the risks and returns associated with each opportunity.

3.2 Strategic Alignment: Investment decisions transcend mere financial transactions; they are strokes that contribute to the broader canvas of organizational strategy. As stewards of financial value, Finance Managers ensure that each investment aligns seamlessly with the organization’s overarching objectives.

3.3 Risk Management Mastery: Navigating the investment landscape requires not just an eye for opportunities but also a mastery of risk management. Finance Managers deploy sophisticated tools like discounted cash flow analysis, meticulously gauging the feasibility and potential impact of investments.

4. Cash Management (Orchestrating Financial Harmony):

4.1 Ensuring Liquidity: In the financial symphony, efficient cash management becomes the melody that ensures the organization’s liquidity. Finance Managers play the role of conductors, crafting cash flow projections, anticipating financial ebbs and flows, and ensuring the availability of funds when needed.

4.2 Strategic Resource Deployment: Cash management is not merely about quantity but the strategic deployment of financial resources. Finance Managers, akin to musical conductors, ensure that each note—each financial resource—is strategically deployed to contribute to the harmonious functioning of the organization.

4.3 Balancing Act: Balancing short-term liquidity needs with long-term financial objectives, Finance Managers execute a delicate dance. It is a balancing act that requires not only financial acumen but also a profound understanding of the organization’s strategic imperatives.

5. Interrelation with Other Departments (Fostering Collaborative Harmony):

5.1 Cross-Functional Collaboration: The Finance Manager’s role transcends the boundaries of finance; it extends into the collaborative intersection with other departments. Collaborating with marketing, production, personnel, and various functional departments, Finance Managers weave financial strategies into the fabric of cross-functional decision-making.

5.2 Providing Financial Insights: Interrelation involves more than collaboration; it entails providing financial insights that empower decision-makers across departments. Finance Managers, in the role of financial storytellers, translate numbers into narratives that guide organizational decision-making.

5.3 Holistic Organizational Framework: Effective interrelation ensures that financial strategies are not siloed endeavors but integral components of the broader organizational framework. This collaborative approach fosters a holistic organizational culture where financial considerations are seamlessly integrated into the decision-making process.

In conclusion, as the exploration of a Finance Manager’s functions unfolds, the analogy of a maestro orchestrating a symphony comes to life. From forecasting financial requirements to acquiring necessary capital, making investment decisions, orchestrating cash management, and fostering interrelation with other departments, the Finance Manager stands as the maestro guiding the financial symphony of the organization.

In the grand finale of financial mastery, the Finance Manager’s bow is a stroke of strategic brilliance, directing the organization toward sustainable growth and success. Consequently, financial strategy, the Finance Manager’s artistry shines brightly, harmonizing the elements of forecasting, acquiring, investing, managing, and collaborating into a symphony of financial brilliance.

References:

- Brigham, E. F., & Ehrhardt, M. C. (2013). Financial Management: Theory & Practice. Cengage Learning.

- Ross, S. A., Westerfield, R. W., & Jordan, B. D. (2019). Essentials of Corporate Finance. McGraw-Hill.

- Gitman, L. J., & Zutter, C. J. (2019). Principles of Managerial Finance. Pearson.

- Van Horne, J. C., & Wachowicz, J. M. (2018). Fundamentals of Financial Management. Pearson.

- Berk, J., & DeMarzo, P. (2017). Corporate Finance. Pearson.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College