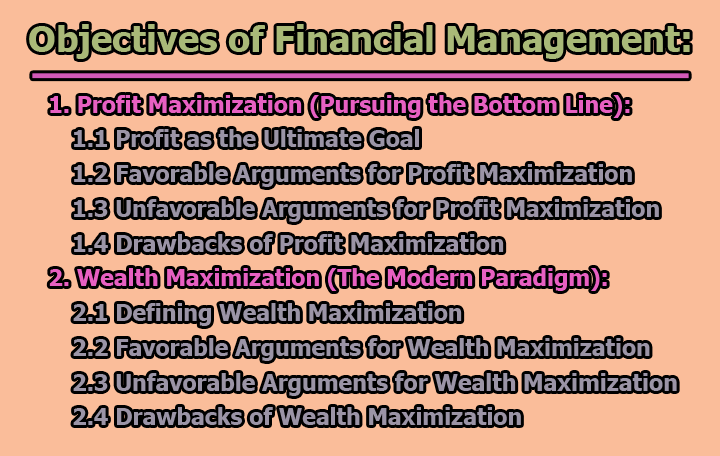

Objectives of Financial Management:

Effective financial management is the cornerstone of a thriving business, ensuring the judicious procurement and efficient utilization of finances. Central to this practice is the identification of fundamental objectives that guide financial decision-making. Broadly categorized into profit maximization and wealth maximization, these objectives shape the strategic direction of a business, influencing its operations, risk management, and societal impact. In this exploration, we dissect the objectives of financial management, examining the nuances of profit maximization and wealth maximization, their arguments in favor and against, and their implications on contemporary business practices.

1. Profit Maximization (Pursuing the Bottom Line):

1.1 Profit as the Ultimate Goal: Profit maximization, often synonymous with cash per share maximization, stands as a traditional objective of financial management. The central tenet is to maximize business operations with the overarching goal of maximizing profits. Profit, being a key metric, is not only a measure of business efficiency but also serves as a parameter for assessing the overall health of the business. The pursuit of profit as an objective also aligns with the reduction of business risks, as a profitable venture is more resilient to uncertainties.

1.2 Favorable Arguments for Profit Maximization:

- Main Aim is Earning Profit: The primary focus is on generating revenue.

- Profit as a Parameter: Profit serves as a critical metric for assessing business operations.

- Risk Reduction: Profitable ventures are better equipped to handle business risks.

- Source of Finance: Profit is a primary source of funds for future endeavors.

- Meeting Social Needs: Profitability contributes to meeting societal needs.

1.3 Unfavorable Arguments for Profit Maximization:

- Exploitation Concerns: Critics argue that it may lead to worker and consumer exploitation.

- Moral Concerns: Profit maximization might foster immoral practices like corruption and unfair trade.

- Inequalities: Objectives of profit maximization can lead to inequalities among stakeholders.

1.4 Drawbacks of Profit Maximization:

- Vagueness: Lack of a precise definition of profit creates ambiguity.

- Ignoring Time Value of Money: Neglecting the time value of money can result in discrepancies.

- Neglecting Risk: Profit maximization doesn’t account for various risks, internal or external.

2. Wealth Maximization (The Modern Paradigm):

2.1 Defining Wealth Maximization: Wealth maximization, a more contemporary approach, goes beyond the traditional pursuit of profit. Also known as value maximization or net present worth maximization, it centers on improving shareholder wealth or the wealth of individuals associated with the business. This concept is universally acknowledged and incorporates innovations and advancements in the business domain.

2.2 Favorable Arguments for Wealth Maximization:

- Focus on Shareholder Wealth: Prioritizes improving the value or wealth of shareholders.

- Value to Cost Comparison: Considers the comparison of value to the costs associated with business operations.

- Efficient Resource Allocation: Ensures efficient allocation of resources.

- Consideration of Time and Risk: Takes into account both time and risk factors.

- Ensuring Economic Interest: Aligns with the economic interests of society.

2.3 Unfavorable Arguments for Wealth Maximization:

- Prescriptive Nature: Critics argue it might be too prescriptive for modern business activities.

- Overlap with Profit Maximization: Some contend that wealth maximization is essentially profit maximization in disguise.

- Ownership-Management Controversy: Can lead to conflicts between ownership and management.

- Selective Benefits for Management: The management might enjoy certain benefits at the expense of other stakeholders.

- Ultimate Aim is Profit: Critics argue that the end goal of wealth maximization is ultimately profit.

2.4 Drawbacks of Wealth Maximization:

- Prescriptive Nature: Critics argue that wealth maximization can be too prescriptive for modern business activities, potentially limiting flexibility and adaptability.

- Ownership-Management Controversy: Wealth maximization may lead to conflicts between ownership and management, creating tensions over the distribution of benefits and decision-making authority.

- Selective Benefits for Management: Skeptics contend that management might enjoy certain benefits at the expense of other stakeholders, potentially leading to unequal distributions of wealth within the organization.

In the complex landscape of financial management, the choice between profit maximization and wealth maximization is not a binary one. While profit maximization represents a more traditional and straightforward approach, wealth maximization embodies a holistic and modern perspective. Striking the right balance between these objectives is essential, considering the evolving nature of business practices and the increasing emphasis on ethical and sustainable operations.

Both objectives have their merits and drawbacks, and their suitability might vary based on the nature of the business, industry trends, and societal expectations. Today’s financial manager must navigate this intricate terrain, recognizing that financial decisions not only impact the bottom line but also influence the broader socio-economic landscape. In the pursuit of financial success, the astute financial manager must carefully weigh the arguments for and against each objective, ensuring that the chosen path aligns with the organization’s values, societal expectations, and long-term sustainability.

As financial management continues to evolve, the objectives guiding it play a pivotal role in shaping the destiny of businesses. Whether driven by the pursuit of profit or the creation of wealth, these objectives underscore the strategic decisions that propel organizations toward success in an ever-changing global economy.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College