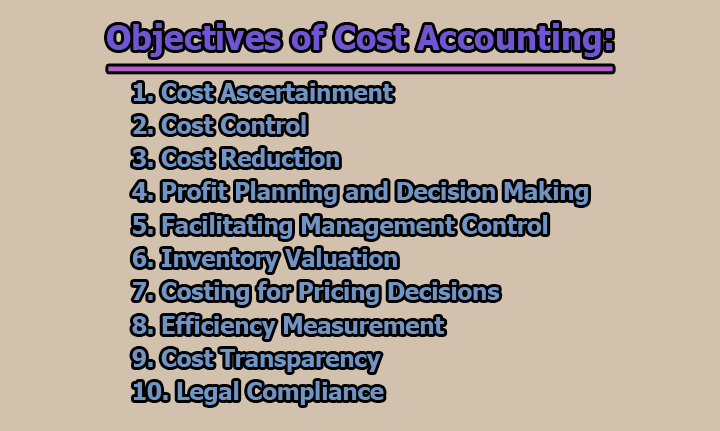

Objectives of Cost Accounting:

Cost accounting is a branch of accounting that focuses on the analysis, recording, and management of costs associated with the production of goods or services within an organization. The primary objectives of cost accounting are to provide detailed information about costs, assist in decision-making, and facilitate better control over the cost structure of a business. Here are the key objectives of cost accounting:

1. Cost Ascertainment: The fundamental objective of cost ascertainment is to determine and record all costs associated with the production of goods or services within an organization. This involves identifying and classifying costs based on their nature, i.e., whether they are direct or indirect costs. Direct costs are those that can be directly traced to a specific product or service, while indirect costs are shared across multiple products or services.

Cost accountants employ various methods to ascertain costs, including job costing, process costing, and activity-based costing. They track direct costs like raw materials, labor, and direct expenses, and allocate indirect costs to different cost centers or cost objects. The goal is to have a comprehensive understanding of the cost components involved in the production process.

2. Cost Control: Cost control is the systematic management of costs to ensure they are kept within acceptable limits and do not exceed the budgeted amounts. The primary purpose is to regulate and manage costs effectively to prevent wastage, inefficiencies, and unnecessary expenditures.

To implement cost control, organizations establish cost standards based on historical data and industry benchmarks. Actual costs are then compared with these standards, and any variances are analyzed. If unfavorable variances are identified, management can take corrective actions, such as improving operational efficiency, renegotiating supplier contracts, or revising budgetary allocations.

3. Cost Reduction: Cost reduction aims to identify areas where costs can be minimized without compromising the quality or efficiency of operations. This objective is crucial for enhancing the overall profitability of the organization.

Cost accountants engage in continuous analysis of cost structures, production processes, and resource utilization. By identifying inefficiencies, redundancies, or areas where cost savings are possible, management can implement measures to reduce costs. This may involve process optimization, technological advancements, renegotiating supplier contracts, or finding alternative, more cost-effective resources.

4. Profit Planning and Decision Making: Cost accounting provides valuable information for profit planning and facilitates informed decision-making by management. This involves analyzing costs in relation to revenue, helping organizations make strategic choices regarding pricing, product mix, and resource allocation.

Cost accountants provide detailed cost information to calculate break-even points, contribution margins, and profitability ratios. This information is then used by management to make decisions on product pricing, discontinuation of unprofitable products, investment in new projects, and other strategic initiatives. It aids in assessing the financial viability and impact of various decisions on the overall profitability of the organization.

5. Facilitating Management Control: Cost accounting plays a crucial role in facilitating management control by providing tools and reports to monitor and control the performance of different departments and units within the organization.

Budgetary control is a key method used for management control. Budgets are prepared based on expected costs and revenues, and actual performance is regularly compared against these budgets. Variance analysis helps identify discrepancies, enabling management to take corrective actions. Performance reports and key performance indicators (KPIs) are also utilized to assess the efficiency and effectiveness of different business units, ensuring that the organization is on track to meet its strategic goals.

6. Inventory Valuation: Inventory valuation is a critical aspect of cost accounting, aiming to determine the value of the goods or products held in stock. This valuation is crucial for accurate financial reporting and assessing the overall financial health of the organization.

Cost accountants employ various methods for inventory valuation, such as FIFO (First-In-First-Out), LIFO (Last-In-First-Out), and weighted average cost. These methods assign costs to inventory items based on the order in which they were acquired or produced. The chosen method can have a significant impact on reported profits and taxable income.

7. Costing for Pricing Decisions: Costing for pricing decisions involves incorporating all relevant costs into the pricing strategy to establish suitable prices for goods or services. The objective is to set prices that cover costs and ensure profitability while remaining competitive in the market.

Cost accountants consider both variable and fixed costs when determining the cost of producing a product or delivering a service. This comprehensive cost information enables management to set prices that not only recover costs but also contribute to the organization’s overall profitability. Pricing decisions are crucial for long-term sustainability and market positioning.

8. Efficiency Measurement: The objective of efficiency measurement is to assess the efficiency and productivity of various processes and activities within the organization. This involves identifying areas for improvement and optimizing resource utilization.

Cost accountants develop performance indicators and benchmarks to measure the effectiveness of resource allocation and utilization. By comparing actual performance against established benchmarks, management can identify areas of inefficiency and implement measures to enhance productivity, reduce lead times, and improve overall operational efficiency.

9. Cost Transparency: Cost transparency ensures that relevant and clear information about costs is available to all levels of management. This transparency is essential for effective decision-making and understanding the cost structure of the organization.

Cost accountants generate reports and analyses that present cost information in a comprehensible manner. This information is communicated to various stakeholders, including executives, managers, and department heads, enabling them to make informed decisions. Transparency in cost reporting also fosters accountability and helps in aligning the actions of different departments with overall organizational goals.

10. Legal Compliance: Cost accounting practices must adhere to accounting standards, taxation regulations, and other legal requirements. Ensuring legal compliance is essential for maintaining the integrity of financial reporting and avoiding legal consequences.

Cost accountants stay updated on relevant accounting principles, taxation laws, and other regulations that impact cost accounting practices. They work in conjunction with legal and financial experts to ensure that the organization’s cost accounting processes align with applicable legal and regulatory standards.

In conclusion, cost accounting plays a crucial role in providing relevant and timely information to assist management in making effective decisions, controlling costs, and ensuring the overall financial health of an organization.

Library Lecturer at Nurul Amin Degree College