Opportunities in Internet-based Banking:

In the ever-evolving landscape of the financial sector, the emergence of internet-based banking has revolutionized the way individuals and businesses manage their finances. Internet-based banking, often referred to as online banking or e-banking, has rapidly gained momentum as a secure and convenient way to conduct various financial activities. This article will explore the opportunities in internet-based banking, delving into its impact on customers, financial institutions, and the broader economy.

Section 1: Evolution of Internet-based Banking:

Internet-based banking represents a culmination of various technological advancements and financial innovations. It can be traced back to the mid-1990s when the internet began to penetrate households and businesses. The development of secure protocols and encryption technologies paved the way for online financial transactions, leading to the birth of Internet banking.

Initially, internet-based banking was limited to basic services such as checking account balances and transaction history. Over the years, it has expanded to encompass a wide range of financial activities, including fund transfers, bill payments, loan applications, investment management, and even customer support. Today, internet banking is a comprehensive platform that bridges the gap between traditional banking and the digital age.

Section 2: Customer-Centric Opportunities:

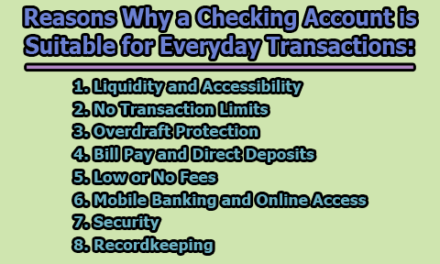

2.1 Convenience and Accessibility: Internet-based banking provides customers with unparalleled convenience. It allows them to access their accounts and conduct transactions 24/7 from any location with an internet connection. This level of accessibility is particularly beneficial for individuals with busy schedules or those living in remote areas.

2.2 Cost Savings: For customers, internet banking can lead to significant cost savings. Traditional brick-and-mortar banks often charge fees for services that are provided free or at a lower cost online. Customers can avoid these fees and also save money on commuting expenses and time spent waiting in queues.

2.3 Enhanced Financial Management: Internet banking platforms offer robust tools for financial management. Customers can track their expenses, set budget goals, and monitor their financial health with ease. These tools empower individuals to make informed financial decisions and improve their overall financial well-being.

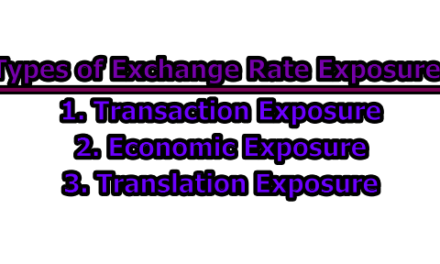

2.4 Global Access: Internet-based banking transcends geographical boundaries. It provides opportunities for customers to manage their finances internationally, whether for personal travel or global business endeavors. This global access is invaluable for expatriates, frequent travelers, and businesses engaged in cross-border transactions.

2.5 Secure Transactions: Security is a paramount concern in online banking. Financial institutions invest heavily in state-of-the-art security measures, including encryption, multi-factor authentication, and monitoring for suspicious activities. This heightened security has led to a decrease in financial fraud and unauthorized access to accounts.

Section 3: Opportunities for Financial Institutions:

3.1 Reduced Overheads: One of the key opportunities for financial institutions lies in the reduction of overhead costs associated with brick-and-mortar branches. Online banking minimizes the need for physical locations, thereby decreasing expenses related to rent, utilities, and staff. This cost efficiency can translate into higher profits or more competitive interest rates for customers.

3.2 Expanded Customer Base: Internet-based banking extends the reach of financial institutions far beyond their local branches. This allows banks to tap into a broader customer base, reaching individuals who may not have physical access to their services. This expanded reach is particularly beneficial for banks with a limited physical presence.

3.3 Customized Financial Products: Online banking platforms enable financial institutions to offer a wide range of customized financial products. Banks can tailor services and features to meet the specific needs of different customer segments, from students and small businesses to high-net-worth individuals and corporations.

3.4 Data Analytics and Personalization: The vast amount of data generated through online banking transactions can be harnessed for data analytics. Financial institutions can gain valuable insights into customer behavior, preferences, and trends. This information can be used to personalize marketing strategies and enhance the overall customer experience.

3.5 Cross-Selling Opportunities: Internet-based banking facilitates cross-selling opportunities, allowing banks to promote a range of financial products and services to their existing customers. This can lead to increased revenue streams and customer retention.

Section 4: Impact on the Broader Economy:

4.1 Financial Inclusion: Internet-based banking plays a pivotal role in promoting financial inclusion. It allows individuals who were previously excluded from the traditional banking system to access basic financial services. This, in turn, contributes to poverty reduction and economic development.

4.2 Economic Efficiency: The efficiency of Internet banking extends to the broader economy. Businesses can make faster transactions, access credit more easily, and streamline their financial operations. This efficiency can lead to increased economic growth and productivity.

4.3 Reduced Cash Transactions: Internet banking encourages the move away from cash transactions, which are costly to produce and handle. Reduced cash usage can result in cost savings for governments and central banks.

4.4 Economic Resilience: During times of crisis, internet-based banking has demonstrated its resilience. It enables essential financial services to continue even when physical branches are inaccessible, as witnessed during the COVID-19 pandemic. This resilience contributes to economic stability.

4.5 Innovation Ecosystem: Internet-based banking fosters an ecosystem of innovation. Fintech startups and established financial institutions collaborate to develop new products and services, further enhancing the financial sector.

Section 5: Challenges and Risks:

While internet-based banking offers numerous opportunities, it is not without its challenges and risks. These include:

5.1 Security Concerns: Despite robust security measures, online banking is susceptible to cyber threats and attacks. Phishing, malware, and identity theft are ongoing concerns.

5.2 Digital Divide: Not everyone has access to the internet or possesses the necessary digital skills. This creates a digital divide where some individuals are excluded from the benefits of internet banking.

5.3 Data Privacy: The collection and use of customer data by financial institutions raise concerns about data privacy and the potential for misuse.

5.4 Regulatory Compliance: Internet banking is subject to a complex web of regulatory and compliance requirements, which can be challenging for financial institutions to navigate.

5.5 Technological Advancements: Keeping up with the rapid pace of technological advancements is an ongoing challenge for banks and financial service providers.

Section 6: Future Trends and Opportunities:

The future of internet-based banking is poised to be even more transformative. Several trends and opportunities are expected to shape the industry in the coming years:

6.1 Blockchain and Cryptocurrency: The adoption of blockchain technology and cryptocurrencies presents new opportunities for secure and efficient financial transactions. Decentralized finance (DeFi) and central bank digital currencies (CBDCs) are emerging trends to watch.

6.2 Artificial Intelligence: AI-powered chatbots and virtual assistants will enhance customer support and machine learning will be employed for risk assessment and fraud detection.

6.3 Biometric Authentication: Enhanced biometric authentication methods, such as facial recognition and fingerprint scanning, will improve security and convenience.

6.4 Open Banking: Open banking initiatives will foster collaboration between financial institutions and fintech companies, leading to innovative financial products and services.

6.5 Financial Education: Internet-based banking platforms will increasingly incorporate financial education tools to empower customers with better financial literacy.

6.6 Sustainable Banking: Environmental, social, and governance (ESG) principles will play a more prominent role in online banking, offering customers the opportunity to align their investments with their values.

6.7 Cross-Border Banking: The facilitation of cross-border transactions and international account access will continue to grow, benefiting both individuals and businesses engaged in global trade.

In conclusion, internet-based banking represents a profound shift in the financial industry. It offers a multitude of opportunities for customers, financial institutions, and the broader economy. As technology continues to advance and the industry evolves, internet banking will play an increasingly central role in how we manage our finances, fostering greater financial inclusion, efficiency, and innovation. However, it is crucial to address the challenges and risks associated with online banking to ensure its continued growth and success in the digital age.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College