Receivable Management is a vital component in the financial tapestry of any business organization. It encompasses the structured administration of accounts receivable, focusing on efficient control and optimization of processes related to credit extension, collection, and payment. In the rest of this article, we are going to know about receivable management, importance, and objectives of receivable management.

What is Receivable Management?

Receivable Management refers to the systematic process of overseeing and controlling a company’s accounts receivable, involving the administration and optimization of the collection, credit extension, and payment processes to ensure timely receipt of payments from customers.

Importance of Receivable Management:

Receivable management holds paramount importance in the financial landscape of any business organization. It serves as a linchpin for:

1. Cash Flow Enhancement: Proper receivable management is instrumental in maintaining a healthy cash flow. Timely collections and minimized bad debts contribute to a steady inflow of cash, enabling the organization to meet its financial obligations promptly.

2. Risk Mitigation: Through thorough credit assessments and the establishment of credit limits, receivable management mitigates the risk of bad debts. This proactive approach safeguards the financial stability of the organization.

3. Working Capital Optimization: The efficient management of receivables directly correlates to working capital optimization. By reducing the amount of capital tied up in accounts receivables, businesses can unlock resources for strategic investments and operational expenses.

4. Customer Relationship Building: Beyond financial implications, receivable management plays a crucial role in building and maintaining positive customer relationships. The ability to balance collection efforts with exceptional customer service fosters loyalty and repeat business.

5. Financial Reporting Accuracy: Accurate and up-to-date receivable management contributes to reliable financial reporting. This transparency not only meets regulatory requirements but also instills confidence in investors, creditors, and other stakeholders.

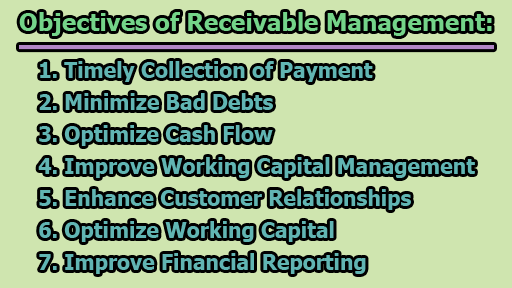

Objectives of Receivable Management:

Let’s explore some of the necessary objectives of receivable management:

1. Timely Collection of Payment: The foremost objective of receivable management is to ensure the timely collection of outstanding payments from customers. This involves setting clear payment terms, sending invoices promptly, and diligently following up on overdue payments. Timely collections enhance cash flow and contribute to the overall financial well-being of the organization.

2. Minimize Bad Debts: Another critical objective is the minimization of bad debts or uncollectible accounts. This can be achieved through thorough credit assessments before extending credit to customers, setting appropriate credit limits, and implementing effective collection strategies. Understanding the creditworthiness of customers is integral to successful receivable management.

3. Optimize Cash Flow: Effective management of accounts receivables aids in optimizing cash flow within the organization. By reducing the average collection period, businesses can expedite the conversion of receivables into cash, freeing up funds for immediate use or reinvestment. This optimization is vital for meeting financial obligations and fostering sustainable growth.

4. Improve Working Capital Management: Contributing to efficient working capital management is another key objective. By minimizing tied-up capital in accounts receivables, a company can enhance liquidity, fund operational expenses, and seize growth opportunities. The strategic management of working capital is crucial for sustained financial health.

5. Enhance Customer Relationships: While pursuing receivables, maintaining positive customer relationships is imperative. Balancing collection efforts with excellent customer service, addressing inquiries promptly, and offering flexible payment options can strengthen customer relationships. The harmony between efficient receivable management and positive customer experiences is essential for long-term success.

6. Optimize Working Capital: The optimization of working capital is a continuous process facilitated by effective receivable management. By efficiently managing receivables and minimizing the cash tied up in unpaid invoices, businesses can enhance their ability to invest in growth opportunities or meet financial obligations promptly.

7. Improve Financial Reporting: Effective receivable management ensures accurate and timely reporting of accounts receivable balances. This involves maintaining up-to-date records, reconciling customer accounts, and providing reliable information for financial statements, audits, and other reporting requirements. Transparent and accurate financial reporting is crucial for building investor confidence and facilitating strategic decision-making.

At the end of the day, we can say that receivable management stands as a linchpin in the financial operations of a business, orchestrating the effective handling of accounts receivable to safeguard cash flow and financial stability. As a dynamic and integral aspect of financial management, its impact extends beyond immediate revenue collection, influencing working capital, risk mitigation, and customer relationships. Recognizing the importance of a well-executed Receivable Management strategy is paramount for businesses seeking sustained financial success in a competitive landscape.

Library Lecturer at Nurul Amin Degree College