Corporate governance is a multifaceted collaboration of mechanisms and processes implemented by individuals managing a corporation to establish a pattern for its operation. This practice significantly influences the decision-making processes of both small and large corporations, leading to a range of advantages. In this article, we will explore the role of corporate governance in organizational success.

What is Corporate Governance?

Corporate governance refers to the system of principles, practices, and structures through which a company is directed and controlled. It involves balancing the interests of various stakeholders, such as shareholders, management, customers, suppliers, financiers, government, and the community, and encompasses mechanisms for goal setting, decision-making, accountability, and performance monitoring within the organization.

Advantages of Corporate Governance:

Here is an exploration of the advantages associated with effective corporate governance:

1. Economic Growth: Well-organized corporate governance is a catalyst for economic growth. By implementing transparent and accountable practices, corporations can enhance their efficiency, attract investment, and contribute to the overall economic development of the region in which they operate. When governance structures are robust, businesses are better positioned to navigate challenges, leading to sustained growth.

2. Investor Attraction: A company with strong corporate governance becomes an attractive prospect for investors. Investors are more likely to trust and invest in organizations that demonstrate transparency, ethical practices, and effective oversight. This increased investor confidence often translates into a positive impact on share prices, making the company more appealing to a broader range of investors.

3. Share Price and Capital Cost: Companies with effective corporate governance often experience positive impacts on share prices. Investors are more willing to pay a premium for shares in companies that adhere to sound governance principles. Additionally, the reduced perception of risk associated with well-governed companies leads to a decrease in capital costs, enabling the organization to access capital at more favorable terms.

4. Waste and Risk Reduction: Managed corporate governance contributes to minimizing wastage and risk. Through systematic oversight and risk management, corporations can identify inefficiencies and potential risks in their operations. This, in turn, allows for the implementation of strategies to streamline processes, reduce unnecessary costs, and navigate risks effectively, ensuring the long-term sustainability of the business.

5. Brand Formation and Development: Corporate governance practices have a direct impact on a company’s brand. Ethical and transparent governance contributes to the positive perception of the organization in the eyes of customers, stakeholders, and the public. A positive brand image, built on the foundation of sound governance, enhances the company’s reputation and can lead to increased customer loyalty and trust.

Principles of Corporate Governance:

Here are some of the key principles of corporate governance:

1. Structure of Governance: The principle of governance structure emphasizes the importance of an efficient and accountable board of directors. It stipulates that all companies should be led by a board that is both competent and capable. Clear lines of accountability and responsibilities should be defined to ensure that decision-making processes are transparent, effective, and aligned with the organization’s objectives.

2. Procedure for Director Appointment: This principle underscores the necessity for a well-structured process for the appointment, induction, election, and re-election of directors. The objective is to ensure that the individuals occupying key leadership positions possess the requisite skills, experience, and ethical values to effectively contribute to the organization’s success.

3. Defined Duties of Directors: The duties of directors must be clearly defined to ensure that each board member has a precise understanding of their roles and responsibilities. This principle aims to facilitate active participation in decision-making processes, enhance accountability, and prevent conflicts of interest.

4. Risk Governance and Control: Corporate governance principles highlight the importance of a robust risk governance and control framework. This involves the board of directors taking responsibility for identifying, assessing, and managing risks according to their share in the company. An internal control system should be maintained to safeguard the organization’s assets and ensure compliance with relevant regulations.

5. Transparent Reporting: Transparency in reporting is a fundamental principle of corporate governance. It involves establishing clear communication channels within the organization and ensuring that reporting structures are well-defined. Everyone within the organization should be aware of who they report to, promoting effective communication and accountability.

Golden Rules of Corporate Governance:

The golden rules of corporate governance represent a set of foundational practices that guide organizations in maintaining ethical standards, fostering transparency, and ensuring responsible decision-making. These rules serve as a moral compass, aligning the behavior of individuals within the organization with principles that contribute to its long-term success. Here’s a brief exploration of the golden rules of corporate governance:

1. Morals: The foremost golden rule of corporate governance is the establishment of clear morals or ethical standards. This involves defining a set of values and principles that govern the behavior of individuals within the organization. Ethical conduct forms the basis for decision-making processes, ensuring that actions align with a higher standard of integrity.

2. Lined-up Business Goals: Another crucial golden rule is the presence of lined-up business goals. Organizations must have a set pattern of goals that align with their mission and vision. These goals serve as a guiding framework for decision-making, policy formulation, and strategic planning. Clear alignment ensures that every action contributes to the overarching objectives of the organization.

3. Strategic Management: Corporate strategy plays a vital role in maintaining good corporate governance. Strategic management involves the formulation, execution, and adaptation of strategies that align with the organization’s long-term objectives. This rule emphasizes the importance of strategic thinking and planning to ensure sustainable growth, adaptability to changing market conditions, and the fulfillment of the organization’s mission.

4. Reporting Clarity: Clarity in reporting structures is a golden rule essential for effective corporate governance. Establishing a clear reporting system ensures that information flows seamlessly within the organization. This transparency in reporting facilitates efficient communication, accountability, and informed decision-making. Each individual within the organization should be aware of their reporting responsibilities, contributing to a well-organized and accountable corporate structure.

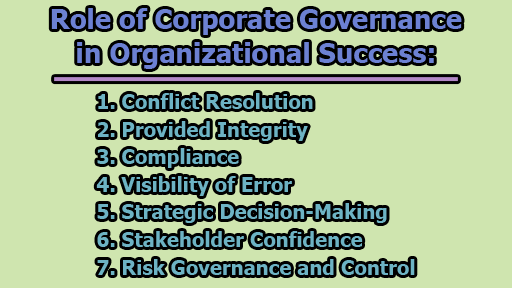

Role of Corporate Governance in Organizational Success:

The role of corporate governance is pivotal in shaping the functioning, decision-making, and overall success of organizations. It encompasses a set of practices, principles, and rules designed to ensure transparency, accountability, and ethical conduct within the corporate structure. Here’s an exploration of the multifaceted role of corporate governance:

1. Conflict Resolution: Corporate governance plays a crucial role in resolving conflicts within an organization. By defining the roles and responsibilities of each member, particularly those at the leadership level, it provides a clear framework for decision-making. This clarity helps prevent conflicts of interest and provides a structured mechanism for addressing and resolving disputes among directors, executives, and other stakeholders.

2. Provided Integrity: One of the primary roles of corporate governance is to provide integrity to the organization. By establishing and enforcing rules and regulations derived from governance policies, it ensures that the company operates with a high level of integrity and adheres to ethical standards. This, in turn, contributes to the organization’s reputation and fosters trust among stakeholders.

3. Compliance: Corporate governance ensures compliance with relevant laws, regulations, and industry standards. This role is essential for mitigating legal risks and preventing regulatory sanctions. Governance frameworks guide companies in conducting their operations ethically and in accordance with the applicable laws, thereby reducing the likelihood of legal disputes and enhancing the overall compliance posture.

4. Visibility of Error: Effective governance structures provide visibility into the functioning of an organization. By defining clear roles, responsibilities, and reporting structures, corporate governance facilitates the identification of errors and inefficiencies within different processes. This visibility enables companies to address issues promptly, implement corrective measures, and continually improve their operations.

5. Strategic Decision-Making: Corporate governance contributes significantly to strategic decision-making. It ensures that decision-making processes are transparent, well-informed, and aligned with the long-term objectives of the organization. This involves formulating clear strategies, risk management policies, and overseeing the execution of plans to achieve sustainable growth and success.

6. Stakeholder Confidence: The role of corporate governance extends to building and maintaining stakeholder confidence. By demonstrating transparency, accountability, and ethical behavior, organizations instill trust among stakeholders such as investors, customers, employees, and regulatory bodies. This confidence is vital for sustaining long-term relationships and fostering a positive corporate image.

7. Risk Governance and Control: Corporate governance places a strong emphasis on risk governance and control. Boards of directors are held responsible for identifying, assessing, and managing risks according to their share in the company. This involves maintaining an internal control system that safeguards the organization’s assets and ensures resilience in the face of potential challenges.

In conclusion, corporate governance serves as the bedrock for the effective and responsible management of organizations. It establishes a framework of principles and practices that not only directs the decision-making processes within a company but also ensures accountability, transparency, and ethical conduct. By balancing the interests of diverse stakeholders, corporate governance contributes to the long-term sustainability and success of a business. It is a dynamic and evolving aspect of corporate management that plays a pivotal role in fostering trust among stakeholders, resolving conflicts, providing visibility into organizational processes, and steering strategic decision-making. In essence, corporate governance is indispensable for maintaining the integrity of businesses and cultivating a corporate culture that aligns with ethical standards and regulatory requirements.

Former Student at Rajshahi University