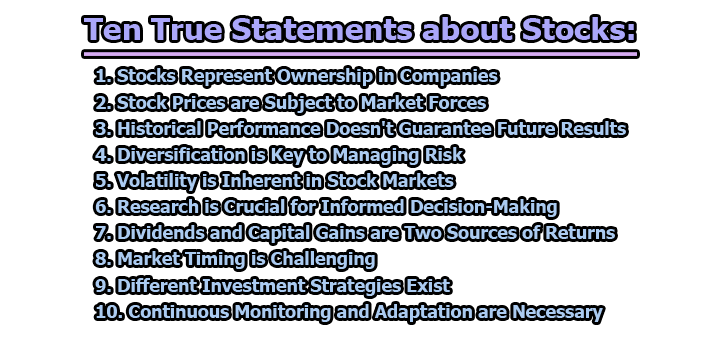

Ten True Statements about Stocks:

Investing in stocks is a dynamic and potentially lucrative venture that attracts individuals seeking to grow their wealth. However, the world of stocks is complex and can be daunting for newcomers. To navigate this financial landscape successfully, it’s crucial to understand some fundamental truths about stocks. In this article, we’ll explore ten true statements about stocks, shedding light on the realities that every investor should be aware of.

1. Stocks Represent Ownership in Companies: When an individual buys shares of a company’s stock, they are essentially purchasing ownership in that company. These shares represent a claim on the company’s assets and earnings. Shareholders, as part owners, have the right to vote on certain company decisions, such as electing the board of directors. The degree of influence a shareholder has depends on the number of shares they hold. Understanding this foundational concept is crucial for investors as it establishes a direct link between their financial stake and the company’s performance.

2. Stock Prices are Subject to Market Forces: The second fundamental truth revolves around the dynamic nature of stock prices. While a company’s fundamentals, such as earnings and growth potential, play a significant role in determining its stock price, external factors also exert influence. Market forces, including supply and demand, economic conditions, and investor sentiment, contribute to the daily fluctuations in stock prices. Investors should be aware that these external factors can lead to short-term volatility, emphasizing the importance of a long-term perspective when assessing the value of their investments.

3. Historical Performance Doesn’t Guarantee Future Results: While reviewing a company’s historical performance can provide valuable insights, it’s crucial to recognize that past success doesn’t guarantee future results. Market conditions, economic factors, and industry trends can change over time, impacting a company’s prospects. Investors need to conduct comprehensive research, considering both historical data and current market dynamics, to make well-informed investment decisions. Relying solely on historical performance can lead to misplaced expectations and increased risk.

4. Diversification is Key to Managing Risk: Diversification is a fundamental risk management strategy in the world of stocks. It involves spreading investments across different asset classes, industries, and geographic regions to reduce the impact of poor performance in any single area. By diversifying their portfolio, investors can mitigate the risk associated with the potential decline of a specific stock or sector. This approach aims to achieve a balance between risk and reward, promoting a more stable and resilient investment portfolio.

5. Volatility is Inherent in Stock Markets: Volatility is a natural characteristic of stock markets. Prices can experience significant fluctuations over short periods, driven by various factors such as economic data releases, geopolitical events, and market sentiment. Investors must be mentally prepared for the inherent ups and downs of the market. Understanding personal risk tolerance and having a long-term investment horizon can help investors weather the volatility without succumbing to impulsive decisions. While volatility can pose challenges, it also presents opportunities for those who remain patient and strategic in their investment approach.

6. Research is Crucial for Informed Decision-Making: Informed decision-making in the stock market is heavily reliant on thorough research. Investors should go beyond simply looking at a company’s stock price and delve into its financial statements, management team, competitive positioning, and growth prospects. Fundamental analysis, technical analysis, and a comprehensive understanding of the industry are essential components of effective research. Additionally, staying informed about macroeconomic factors, global events, and emerging trends can provide valuable insights into potential market movements. Successful investors prioritize continuous learning and remain vigilant in their pursuit of knowledge to make well-informed decisions.

7. Dividends and Capital Gains are Two Sources of Returns: Investors can earn returns from their stock investments through two primary sources: dividends and capital gains. Dividends are periodic payments made by companies to shareholders from their profits. They represent a tangible reward for holding onto the stock and are particularly appealing to income-focused investors. On the other hand, capital gains occur when the market value of a stock increases, allowing investors to sell their shares at a higher price than their initial purchase. A balanced approach that considers both dividends and capital gains can contribute to a more diversified and resilient investment strategy.

8. Market Timing is Challenging: Timing the market – attempting to buy stocks at the lowest prices and sell them at the highest – is a challenging and risky endeavor. Even seasoned professionals often struggle to consistently time the market accurately. The unpredictable nature of market movements, influenced by various factors such as economic indicators, geopolitical events, and investor sentiment, makes precise timing elusive. Instead of trying to predict short-term fluctuations, investors are generally better off adopting a long-term investment strategy based on their financial goals and risk tolerance. This approach helps mitigate the impact of market volatility and reduces the stress associated with attempting to time the market.

9. Different Investment Strategies Exist: Investors can choose from various investment strategies based on their financial goals, risk tolerance, and time horizon. Some common strategies include value investing, growth investing, income investing, and momentum investing. Each strategy has its own set of principles and considerations. For example, value investors focus on undervalued stocks with the potential for long-term growth, while income investors prioritize stocks that pay regular dividends. Understanding these different strategies and aligning them with personal financial objectives is crucial for building a well-rounded and successful investment portfolio.

10. Continuous Monitoring and Adaptation are Necessary: The stock market is dynamic, and economic conditions evolve over time. Investors must recognize the importance of continuous monitoring and adaptation in their investment approach. Regular portfolio reviews, risk assessments, and adjustments to investment allocations are necessary to navigate changing market conditions. Staying informed about industry trends, economic indicators, and geopolitical events enables investors to make informed decisions and optimize their portfolios for long-term success. A proactive and adaptive mindset is essential for investors seeking to stay ahead in the ever-changing landscape of the stock market.

In conclusion, investing in stocks can be a rewarding journey, but it requires a solid understanding of the fundamental truths that govern the market. By recognizing the ownership aspect of stocks, understanding market forces, embracing diversification, and staying informed through research, investors can position themselves for success. Additionally, acknowledging the inherent volatility of stock markets, the importance of research, and the challenges of market timing can contribute to a more realistic and informed approach to investing. Ultimately, by adopting a well-thought-out investment strategy and remaining vigilant in the face of market changes, investors can maximize their chances of achieving their financial goals.

Library Lecturer at Nurul Amin Degree College