Corporate business refers to the business activities carried out by a corporation, which is a legal entity that is separate from its owners. Corporations are typically established to generate profits for their shareholders, who own shares in the company. Corporate business activities may include a wide range of operations such as manufacturing, marketing, sales, distribution, finance, and administration. These activities are managed by a board of directors and a team of executives who are responsible for making strategic decisions, setting goals, and overseeing day-to-day operations. Corporations are often organized into departments or divisions that focus on specific aspects of the business, such as human resources, finance, or research and development. They may also engage in mergers and acquisitions to expand their operations or diversify their business activities. Corporate businesses are often characterized by their size, complexity, and formal structure. They may operate in multiple countries and have large numbers of employees, which can pose unique challenges for management and require specialized expertise. In this article, we will discuss types of corporate businesses, and how corporate businesses work.

Types of Corporate Businesses:

There are several types of corporate businesses, each with its own unique characteristics and legal structures. Here are some of the most common types:

- C Corporation: A C Corporation is the most common type of corporation in the United States. It is a separate legal entity from its owners, who are known as shareholders. C Corporations are taxed separately from their shareholders and can have an unlimited number of shareholders.

- S Corporation: An S Corporation is a type of corporation that is taxed similarly to a partnership. It is limited to 100 shareholders, and all shareholders must be U.S. citizens or residents. S Corporations are not subject to federal income tax, but instead, profits and losses are passed through to the shareholders, who report them on their individual tax returns.

- Limited Liability Company (LLC): An LLC is a type of business that combines the liability protection of a corporation with the tax benefits of a partnership. It is a separate legal entity from its owners, known as members, who are not personally liable for the company’s debts or obligations. LLCs can have an unlimited number of members and are taxed similarly to partnerships.

- Limited Partnership (LP): A Limited Partnership is a type of business that has both general partners and limited partners. General partners manage the day-to-day operations of the business and are personally liable for the company’s debts and obligations, while limited partners contribute capital to the business but have limited liability.

- B Corporation: A B Corporation, also known as a Benefit Corporation, is a type of corporation that is legally required to consider the impact of its decisions on its stakeholders, including the environment, employees, and the community. B Corporations are certified by the nonprofit organization B Lab and must meet certain social and environmental performance standards.

- Professional Corporation (PC): A Professional Corporation is a type of corporation that is typically used by professionals such as doctors, lawyers, and accountants. The PC provides liability protection for its shareholders while allowing them to retain their professional licenses and credentials.

- Close Corporation: A Close Corporation is a type of corporation that is owned by a small group of shareholders, typically family members or close friends. Close corporations are not required to follow the same formalities as larger corporations, such as holding annual meetings or keeping detailed records.

- Nonprofit Corporation: A Nonprofit Corporation is a type of corporation that is organized for charitable, educational, or religious purposes. Nonprofit corporations are exempt from federal income tax but must follow certain rules and regulations to maintain their tax-exempt status.

- Cooperative Corporation: A Cooperative Corporation is a type of corporation that is owned and controlled by its members, who are typically consumers or producers of a particular product or service. Cooperative corporations operate on a democratic basis, with each member having an equal vote in the company’s decision-making process.

How Corporate Businesses Work:

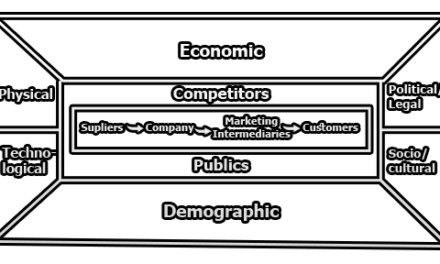

Corporate businesses are complex organizations with a legal and financial structure designed to protect owners, shareholders, and stakeholders while generating profits. Here are some key aspects of how corporate businesses work:

Legal Structure: A corporate business is a separate legal entity from its owners or shareholders, which means it can enter into contracts, own property, and sue or be sued. This legal structure provides limited liability protection to shareholders, which means they are not personally liable for the company’s debts or legal obligations.

Governance: Corporate businesses are governed by a board of directors, which is responsible for making strategic decisions and overseeing the company’s management. The board of directors is elected by the shareholders, who have the right to vote on major issues such as mergers and acquisitions, changes to the company’s bylaws, and the election of new board members.

Shareholders: Shareholders own a portion of the company’s stock, which gives them certain rights and privileges such as the right to vote on major issues and the right to receive dividends if the company is profitable. Shareholders can also sell their shares to other investors, which can affect the company’s ownership structure and control.

Management: The day-to-day operations of a corporate business are managed by executives and employees, who are responsible for implementing the company’s strategy and achieving its goals. The CEO is typically the highest-ranking executive and is responsible for overall leadership and decision-making.

Financial Structure: Corporate businesses typically raise capital by selling stock or issuing bonds, which provides funds for investment, expansion, and other business activities. The company’s financial performance is closely monitored by shareholders, analysts, and regulators, who use financial statements and other data to evaluate the company’s health and prospects for growth.

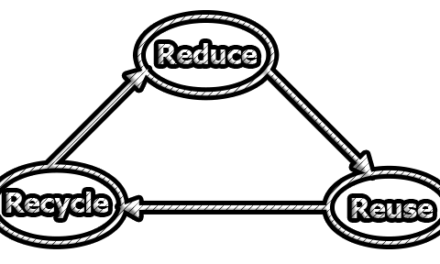

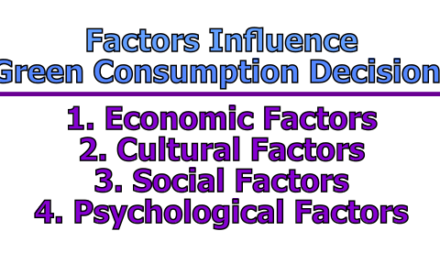

Corporate Social Responsibility: Many corporate businesses are also committed to corporate social responsibility (CSR), which involves making decisions that consider the impact on society and the environment, as well as generating profits. This can include initiatives such as sustainable business practices, philanthropy, and employee volunteer programs.

Risk Management: Corporate businesses also implement various risk management strategies to identify and mitigate potential risks that could impact their operations, reputation, or financial performance. This can include insurance policies, contingency plans, and compliance programs to ensure that the company is operating within legal and ethical boundaries.

Merger and Acquisition: Corporate businesses also engage in mergers and acquisitions to expand their market share, diversify their products or services, or gain access to new technologies or geographic regions. These transactions can be complex and require careful evaluation of financial, legal, and regulatory factors.

Investor Relations: Corporate businesses must also maintain positive relationships with investors and analysts, providing regular updates on the company’s financial performance, strategic plans, and other key information. This can include quarterly earnings reports, annual shareholder meetings, and other communications to ensure transparency and trust with stakeholders.

Globalization: Many corporate businesses are also operating in a global marketplace, which requires understanding and compliance with different cultural, legal, and economic environments. Globalization can provide opportunities for growth and expansion but also requires careful management of risks and challenges.

In conclusion, corporate businesses are complex entities with a legal and financial structure designed to protect owners, shareholders, and stakeholders while generating profits. They operate within a complex ecosystem of legal, financial, social, and economic factors that require careful management and strategic decision-making. Effective corporate management requires a deep understanding of these factors and a commitment to responsible and ethical business practices. By implementing sound governance, risk management, financial management, social responsibility, and other key strategies, corporate businesses can achieve long-term success and generate value for all their stakeholders.

References:

- “Types of Business Entities” by the U.S. Small Business Administration (SBA) – https://www.sba.gov/business-guide/launch-your-business/choose-business-structure/types-business-entities

- “What is a B Corporation?” by B Lab – https://bcorporation.net/what-are-b-corps

- “What is an LLC?” by the IRS – https://www.irs.gov/businesses/small-businesses-self-employed/limited-liability-company-llc

- “Types of Business Entities” by the U.S. Small Business Administration (SBA) – https://www.sba.gov/business-guide/launch-your-business/choose-business-structure/types-business-entities

- “What is a Professional Corporation?” by Investopedia – https://www.investopedia.com/terms/p/professionalcorporation.asp

- “What is a Nonprofit Corporation?” by the National Council of Nonprofits – https://www.councilofnonprofits.org/tools-resources/what-nonprofit-organization

- “How Corporations Work” by Investopedia – https://www.investopedia.com/terms/c/corporation.asp

- “Corporate Governance” by the National Association of Corporate Directors – https://www.nacdonline.org/Resources/FAQs/Corporate_Governance_FAQs/

- “Corporate Social Responsibility” by the Harvard Business Review – https://hbr.org/topic/corporate-social-responsibility

- “Corporate Risk Management” by the Harvard Business Review – https://hbr.org/topic/risk-management

- “Mergers and Acquisitions” by Investopedia – https://www.investopedia.com/terms/m/mergersandacquisitions.asp

- “Investor Relations” by the National Investor Relations Institute – https://www.niri.org/about-niri/investor-relations-101

- “Globalization and Corporate Social Responsibility” by the Journal of Business Ethics – https://link.springer.com/article/10.1007/s10551-010-0646-6

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College