Investment strategy refers to a plan or approaches that an investor or investment manager uses to make decisions about how to allocate capital and manage investment portfolios. The investment strategy typically takes into account an investor’s financial goals, risk tolerance, investment horizon, and market conditions. A well-designed investment strategy includes the selection of various asset classes, such as stocks, bonds, and commodities, as well as the allocation of capital among these asset classes based on the investor’s goals and risk tolerance. Other aspects of an investment strategy may include diversification, sector or industry focus, active versus passive management, and the use of various financial instruments to achieve specific investment objectives. Investment strategies can be tailored to meet the needs of different investors, such as those seeking long-term growth, current income, or capital preservation. It is important for investors to have a clear understanding of their investment objectives and to develop an appropriate investment strategy to achieve those objectives while managing risk appropriately. In the rest of this article, we are going to discuss different types of investment strategy, the advantages and limitations of investment strategies, and tips for investing.

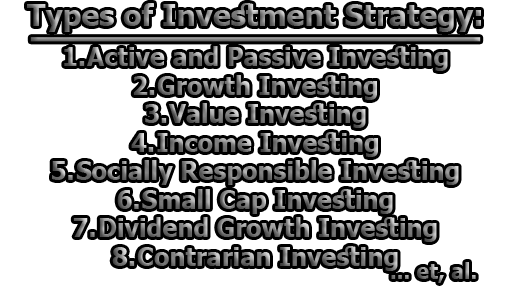

Types of Investment Strategy:

An investment strategy is a pattern followed by investors that shapes his or her portfolio. Based on some fundamental beliefs these investment strategies are assumed. If an investor is looking forward for value investing then he will seeks stocks that are undervalued and are selling for less than their true worth. But if the investor is looking forward for a growth investment, then his aims is to find investment opportunities in companies that have high potential for growth.

1. Active and Passive Investing: Active investing is a strategy that involves making frequent trades and attempting to beat the market by picking individual stocks or securities. Active investors rely on research and analysis to identify opportunities in the market and aim to achieve returns that exceed the benchmark index.

In contrast, passive investing involves investing in a diversified portfolio of securities that tracks a benchmark index, such as the S&P 500. Passive investors seek to achieve returns that are similar to the market as a whole and typically make fewer trades than active investors. Passive investing is also associated with lower fees and expenses compared to active investing.

2. Growth Investing: Growth investing is a strategy that focuses on investing in companies that have strong potential for growth in their earnings or revenue. Growth investors typically look for companies that are expected to have high earnings growth rates or have a disruptive technology or business model. Growth stocks tend to have higher valuations and are often associated with higher risk.

3. Value Investing: Value investing is a strategy that involves investing in companies that are trading at a lower valuation than their intrinsic value. Value investors look for stocks that are undervalued relative to their earnings, cash flow, or assets. Value stocks are often associated with lower risk compared to growth stocks.

4. Income Investing: Income investing is a strategy that focuses on generating a steady stream of income from an investment portfolio. Income investors typically invest in securities that pay a high dividend yield, such as blue-chip stocks or bonds. Income investing is often associated with lower risk compared to growth or value investing.

5. Socially Responsible Investing: Socially responsible investing (SRI) is a strategy that involves investing in companies that meet certain environmental, social, and governance (ESG) criteria. SRI investors seek to achieve financial returns while promoting social and environmental goals, such as sustainability and social justice.

6. Small Cap Investing: Small cap investing is a strategy that involves investing in companies with a smaller market capitalization, typically less than $2 billion. Small-cap stocks are often associated with higher risk compared to large-cap stocks, but they can also offer higher potential returns.

7. Dividend Growth Investing: Dividend growth investing is a strategy that focuses on investing in companies that have a history of increasing their dividend payments over time. Dividend growth investors seek to generate a steady stream of income from dividend payments while also benefiting from potential capital appreciation.

8. Contrarian Investing: Contrarian investing is a strategy that involves investing in assets that are currently out of favor or unpopular with other investors. Contrarian investors seek to identify assets that are undervalued or oversold and have the potential to rebound in the future.

9. Indexing: Indexing is a passive investing strategy that involves investing in a diversified portfolio of securities that tracks a benchmark index, such as the S&P 500. Indexing is often associated with lower fees and expenses compared to active investing and can provide broad exposure to the stock market as a whole.

10. No Strategy: Investing without a strategy is not recommended, as it can lead to haphazard decision-making and poor investment outcomes. Investors should carefully consider their investment objectives, risk tolerance, and time horizon, and develop an appropriate investment strategy to achieve their goals.

11. Momentum Trading: Momentum trading is a strategy that involves buying assets that have recently experienced strong price momentum, with the expectation that the trend will continue in the short term. Momentum traders seek to profit from short-term price movements and may hold assets for a few days or weeks.

12. Buy and Hold: Buy and hold investing is a long-term strategy that involves buying stocks or other assets and holding them for an extended period of time, typically several years or more. Buy-and-hold investors seek to benefit from long-term trends in the market and may avoid frequent trading and market timing.

13. Long-Short Strategy: A long-short strategy involves taking long positions in assets that are expected to increase in value and short positions in assets that are expected to decrease in value. Long-short strategies can be used to hedge against market volatility or to generate returns in both bullish and bearish market conditions.

14. Pairs Trading: Pairs trading is a strategy that involves buying and selling two highly correlated assets at the same time. Pairs traders seek to profit from small differences in price between the two assets and may hold positions for a short period of time.

15. Dollar Cost Averaging: Dollar cost averaging is an investment strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. Dollar-cost averaging can help to reduce the impact of short-term market volatility and can provide a disciplined approach to investing over the long term.

16. Smaller Companies: Investing in smaller companies can be a high-risk, high-reward strategy. Smaller companies may have greater growth potential than larger companies, but they may also be more susceptible to economic downturns and market volatility. Investors who choose to invest in smaller companies should carefully research potential investments and consider their risk tolerance before making any decisions.

Advantages of Investment Strategies:

Investment strategies offer a number of advantages for investors. Some of the main advantages include:

- Consistency: An investment strategy provides a consistent approach to investing, which can help investors avoid making impulsive decisions based on market fluctuations or emotional reactions. By sticking to a strategy, investors can stay focused on their long-term goals and avoid being swayed by short-term market trends.

- Discipline: Many investment strategies require a disciplined approach to investing, which can help investors stay on track and avoid making costly mistakes. By adhering to a predetermined set of rules and guidelines, investors can avoid getting caught up in the excitement of the market and making irrational decisions.

- Diversification: Many investment strategies emphasize diversification, which can help to spread risk across different assets and minimize the impact of any one investment on the overall portfolio. By diversifying their investments, investors can potentially reduce volatility and generate more consistent returns over time.

- Customization: Different investment strategies are designed to meet different goals and objectives, which means investors can choose a strategy that aligns with their unique needs and preferences. Whether an investor is looking for growth, income, or a specific level of risk, there is likely an investment strategy that can help them achieve their goals.

- Transparency: Many investment strategies are based on well-defined rules and guidelines, which can make them more transparent and easier to understand. By knowing exactly how a strategy works and what it aims to achieve, investors can make more informed decisions about their investments.

- Access to Expertise: Some investment strategies are managed by experienced professionals who have a deep understanding of the market and the factors that influence investment performance. By investing in these strategies, investors can gain access to this expertise and potentially benefit from the insights and analysis provided by these professionals.

Limitations of Investment Strategies:

While investment strategies can offer many advantages, they also have certain limitations that investors should be aware of. Some of the main limitations include:

- Risk: No investment strategy is without risk, and investors must be prepared to accept a certain level of risk in order to potentially generate returns. Different investment strategies carry different levels of risk, and investors should carefully evaluate their risk tolerance and financial situation before choosing a strategy.

- Market Volatility: Investment strategies are often designed to perform well in specific market conditions, but these conditions can change rapidly and unexpectedly. When market conditions shift, an investment strategy may no longer be effective, and investors may need to adjust their strategy accordingly.

- Fees: Many investment strategies are managed by professionals, and these professionals typically charge fees for their services. These fees can reduce the overall returns generated by the strategy and may make it more difficult to achieve investment goals.

- Complexity: Some investment strategies are complex and may require a deep understanding of financial markets, economics, and other specialized knowledge. Investors who lack this knowledge may struggle to implement these strategies effectively and may be more likely to make costly mistakes.

- Unforeseen Circumstances: Investment strategies may not account for unforeseen circumstances, such as changes in tax laws, economic shocks, or unexpected geopolitical events. These events can impact investment performance in ways that are difficult to predict or prepare for.

- Overreliance: Some investors may become over-reliant on a particular investment strategy, leading them to overlook other opportunities or fail to diversify their investments properly.

It is very important to have an investment strategy. It will help the investors rule out poor portfolios and will increase the chances of success. Ask a few basic questions like; how much do I want to invest? How much return do I need? How much is my risk tolerance? What will be my investment horizon? Why did I need to invest? Etc. The clearer investors are with investment objectives, the better decision will make regarding the investment. Always lookout for good opportunities and never invest at one go. Building a portfolio is like building a house brick by brick, money by money.

Tips for Investing:

Investing can be a complex and challenging process, but by following a few key tips and best practices, investors can increase their chances of success. Here are some important tips to keep in mind when investing:

- Set Goals: One of the most important steps in investing is to set clear and realistic goals. This means thinking carefully about what you want to achieve through your investments, whether it’s generating income, growing your wealth, or preserving your capital. By setting specific goals, you can create a roadmap for your investments and ensure that you are making choices that align with your objectives.

- Research and Trend Analysis: Before making any investment decisions, it’s important to conduct thorough research and analysis of the markets and individual assets. This can involve analyzing trends, evaluating economic indicators, and reviewing financial statements and other relevant data. By staying informed about market conditions and individual investments, you can make more informed decisions and potentially generate higher returns.

- Portfolio Optimization: Another important aspect of investing is portfolio optimization. This involves carefully selecting a mix of assets that balance risk and reward and align with your investment goals. By diversifying your portfolio across different asset classes, industries, and geographies, you can potentially reduce risk and generate more consistent returns over time.

- Find the Best Advisor/Consultancy: Many investors choose to work with a financial advisor or consultancy to help them make investment decisions. When selecting an advisor or consultancy, it’s important to do your research and choose a reputable, experienced professional who has a track record of success. Look for professionals who are transparent about their fees, communicate clearly and regularly, and prioritize your goals and interests above their own.

- Consider Risk Tolerance: Investing always involves some level of risk, and it’s important to understand your own risk tolerance when making investment decisions. This means thinking carefully about how much risk you are willing to take on in pursuit of higher returns. By balancing risk and reward and choosing investments that align with your risk tolerance, you can avoid taking on more risk than you can handle.

- Diversify Risk: Diversification is a key aspect of portfolio optimization, but it’s also important to diversify risk within individual investments. This means selecting assets that have different risk profiles and exposure to different economic and market factors. By spreading risk across different investments, you can potentially reduce the impact of any one investment on your overall portfolio.

In summary, investing requires careful research, goal setting, and risk management. By following these tips and best practices, investors can increase their chances of success and achieve their long-term financial goals.

Library Lecturer at Nurul Amin Degree College