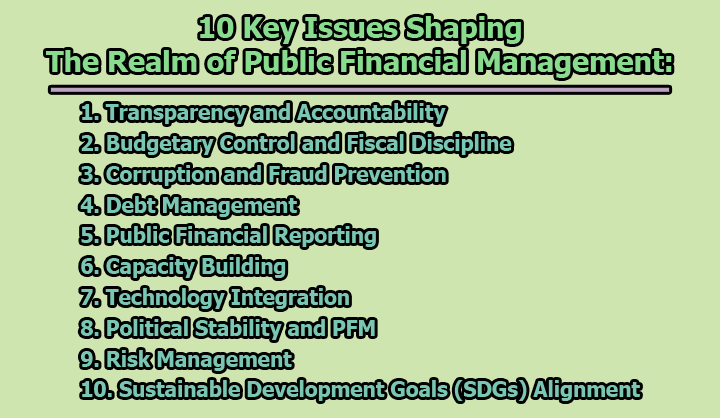

10 Key Issues Shaping the Realm of Public Financial Management:

Public Financial Management (PFM) is the backbone of effective governance, serving as the compass that guides the allocation, utilization, and monitoring of public resources. In the complex landscape of public finance, numerous challenges and issues arise, demanding attention and strategic solutions. This article delves into 10 key issues shaping the realm of Public Financial Management.

1. Transparency and Accountability: Transparency in financial processes is paramount for fostering public trust. As Nobel laureate Joseph Stiglitz emphasizes, “transparency ensures that government activities are visible, and can be monitored by citizens, which is an essential element of good governance” (Stiglitz, 1999). Ensuring that financial information is readily accessible and understandable to the public establishes the foundation for accountability in the utilization of public funds.

2. Budgetary Control and Fiscal Discipline: Achieving fiscal discipline while addressing public needs is an ongoing challenge. According to Paul Collier, Professor of Economics and Public Policy, “fiscal discipline requires aligning budgetary priorities with policy goals and avoiding the temptation of overexpansion” (Collier, 2007). Maintaining control over budgets necessitates a delicate balance to prevent budgetary overruns while meeting the evolving needs of society.

3. Corruption and Fraud Prevention: Corruption poses a pervasive threat to public finances. The International Monetary Fund (IMF) underscores the importance of anti-corruption measures in PFM, stating that “corruption undermines the effectiveness of public financial management systems and erodes public trust” (IMF, 2016). Establishing robust internal controls, promoting ethical behavior, and implementing anti-corruption measures are imperative for safeguarding public funds.

4. Debt Management: Prudent debt management is crucial for sustainable development. Renowned economist Kenneth Rogoff argues, “Debt management involves balancing the need for borrowing to finance development projects with the risk of overindebtedness” (Rogoff, 2011). Governments must carefully plan and monitor debt levels to prevent overburdening future generations and ensure fiscal sustainability.

5. Public Financial Reporting: The clarity of financial reporting is pivotal for accountability and informed decision-making. The Government Finance Officers Association (GFOA) emphasizes that “transparent and understandable financial reporting builds public trust in government” (GFOA, 2020). Timely and accurate financial reporting enhances accountability, enabling stakeholders to assess the government’s financial health and performance.

6. Capacity Building: Enhancing the skills and capacities of individuals managing public finances is a continual challenge. The International Public Management Association for Human Resources (IPMA-HR) underscores the importance of capacity building, stating that “continuous training and development are essential for public finance officials to adapt to evolving financial environments and emerging challenges” (IPMA-HR, 2018). Investments in human capital are crucial for optimizing PFM practices.

7. Technology Integration: Embracing technology is imperative for modernizing PFM. The World Bank notes that “effective use of technology, such as financial management systems, e-procurement platforms, and digital payment solutions, enhances efficiency, reduces the risk of errors, and provides real-time insights into financial transactions” (World Bank, 2019). Technology integration not only streamlines processes but also contributes to increased transparency and accountability.

8. Political Stability and PFM: The stability of PFM is intricately linked to the broader political environment. The International Budget Partnership (IBP) observes that “frequent changes in government or political instability can disrupt budgetary processes, hinder long-term financial planning, and impact the continuity of fiscal policies” (IBP, 2017). Political stability is a foundational element for the effective functioning of PFM.

9. Risk Management: Identifying and mitigating financial risks is a critical aspect of PFM. The Asian Development Bank (ADB) emphasizes that “comprehensive risk management strategies are essential for addressing economic volatility, natural disasters, and global crises that can significantly impact public finances” (ADB, 2015). Governments must proactively manage risks to safeguard fiscal stability.

10. Sustainable Development Goals (SDGs) Alignment: Aligning budgetary priorities with the Sustainable Development Goals (SDGs) demands strategic planning. The United Nations Development Programme (UNDP) highlights that “governments face the challenge of balancing immediate needs with long-term sustainability, ensuring that public resources contribute to the broader welfare of society” (UNDP, 2021). Integrating SDGs into budgetary frameworks requires a holistic approach that prioritizes both economic development and social and environmental sustainability.

In conclusion, navigating the intricate waters of Public Financial Management is an ongoing journey that demands continuous adaptation and innovation. Addressing these 10 key issues lays the foundation for resilient, transparent, and accountable financial systems, fostering the effective use of public resources for the betterment of societies. As governments grapple with these challenges, the evolution of PFM practices will shape the fiscal landscapes of the future.

References:

- ADB (Asian Development Bank). (2015). Financial Management for a Changing World: Road to Improving Governance and Fighting Corruption.

- IBP (International Budget Partnership). (2017). Budgeting for Stability: Balancing Politics and Finance in a Volatile World.

- IPMA-HR (International Public Management Association for Human Resources). (2018). A Global Assessment of Capacity Building Needs in Public Financial Management.

- UNDP (United Nations Development Programme). (2021). Budgeting for the SDGs: A Manual for Local Governments.

- World Bank. (2019). Digital Financial Services for Effective Public Financial Management.

- Collier, P. (2007). The Bottom Billion: Why the Poorest Countries are Failing and What Can Be Done About It. Oxford University Press.

- GFOA (Government Finance Officers Association). (2020). Best Practices in Financial Reporting.

- IMF (International Monetary Fund). (2016). The Role of the IMF in Governance Issues.

- Rogoff, K. (2011). This Time Is Different: Eight Centuries of Financial Folly. Princeton University Press.

- Stiglitz, J. E. (1999). More Instruments and Broader Goals: Moving Toward the Post-Washington Consensus.

Library Lecturer at Nurul Amin Degree College