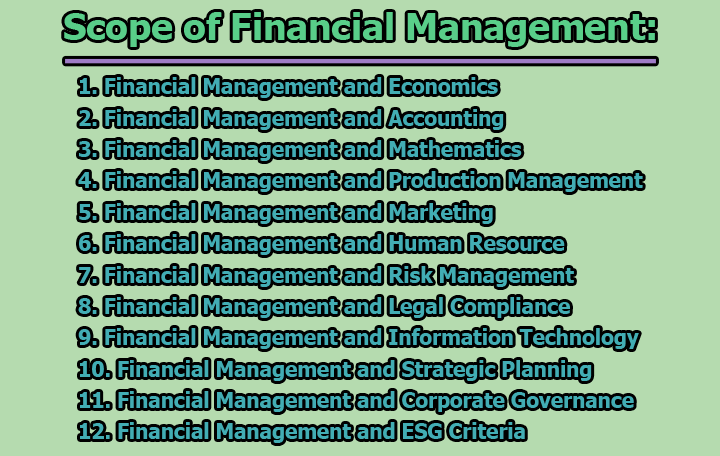

Scope of Financial Management:

Financial Management, a dynamic field at the intersection of economics, accounting, mathematics, production management, marketing, and human resources, plays a pivotal role in steering organizations toward success. In the rest of this article, we will delve into the multifaceted scope of financial management.

1. Financial Management and Economics (The Symbiotic Alliance): At the core of financial management lies a symbiotic alliance with economic concepts. Micro and macroeconomics become integral components as financial managers navigate investment decisions and assess the impact of environmental factors on organizational finance. Economic equations such as money value discount factors and economic order quantity become tools in the financial manager’s arsenal, contributing to the evolving landscape of financial economics—an area ripe with opportunities for synergy between finance and economics.

2. Financial Management and Accounting (A Historical Evolution): The historical evolution of financial management and accounting reveals a deep-rooted connection. In ancient times, these disciplines were treated as one, eventually merging into management accounting due to its pivotal role in decision-making. However, contemporary perspectives recognize them as separate yet deeply interrelated entities. Accounting records, serving as the financial repository of a business, form the basis for financial decisions. The modern financial manager, while distinct from the accountant, relies on accounting data for strategic insights.

3. Financial Management and Mathematics (The Precision of Numbers): In the contemporary landscape of financial management, mathematics takes center stage. Modern approaches embrace a plethora of mathematical and statistical tools, often referred to as econometrics. From economic order quantity to discount factors, time value of money, cost of capital, and ratio analysis, these tools guide financial decision-making. The precision of numbers becomes a cornerstone, ensuring that financial managers navigate the complexities of investment, capital structure, and working capital with accuracy and foresight.

4. Financial Management and Production Management (Fueling Profitability): The operational heartbeat of a business is production management, where the alchemy of turning investments into profits occurs. Production performance is intricately linked to financial requirements, as the production department demands resources like raw materials, machinery, wages, and operational expenses. The financial manager becomes a strategic architect, allocating finances judiciously to fuel the production engine. A profound understanding of operational processes and financial needs at each production stage becomes imperative for financial success.

5. Financial Management and Marketing (Finance Fuels Innovation): In the marketplace, where goods transform into revenue, the collaboration between financial management and marketing becomes apparent. Marketing departments, the vanguards of innovation, rely on financial support to meet their dynamic requirements. The financial manager, in this partnership, allocates the necessary funds to propel marketing initiatives. The synergy between financial management and marketing becomes a catalyst for growth, where financial backing facilitates the introduction of products and services to the market with strategic finesse.

6. Financial Management and Human Resource (Nurturing the Workforce): Human resources, the lifeblood of any organization, finds its connection with financial management. The financial manager shoulders the responsibility of evaluating the human resource requirements across various departments. From wages and salaries to bonuses, pensions, and other monetary benefits, the allocation of finances to the human resource department becomes a strategic endeavor. Financial management, in this context, is a guardian of workforce vitality, ensuring that the right resources are allocated to sustain and nurture the human capital of the organization.

7. Financial Management and Risk Management (Safeguarding the Future): Financial management is intricately connected with the realm of risk management. The financial manager, as a steward of the organization’s financial health, must assess and mitigate risks that could impact the bottom line. This involves employing risk management strategies, financial derivatives, and insurance mechanisms to safeguard the organization against potential financial threats.

8. Financial Management and Legal Compliance (Upholding Integrity): In the intricate web of financial transactions, adherence to legal standards is paramount. Financial management extends its scope to ensure legal compliance in financial activities. This includes navigating complex tax laws, financial reporting regulations, and international financial standards. The financial manager collaborates with legal experts to uphold integrity and navigate the legal landscape seamlessly.

9. Financial Management and Information Technology (Embracing Digital Transformation): In the era of digital transformation, financial management is closely linked to information technology. Modern financial systems leverage technology for real-time data analytics, automation of financial processes, and cybersecurity. The financial manager collaborates with IT specialists to ensure the seamless integration of technology into financial operations, enhancing efficiency and mitigating risks associated with the digital landscape.

10. Financial Management and Strategic Planning (Charting the Course): Financial management is the compass guiding strategic planning within organizations. The financial manager plays a pivotal role in aligning financial goals with broader strategic objectives. This involves forecasting future financial needs, evaluating investment opportunities, and charting a financial course that aligns with the organization’s long-term vision. Strategic financial planning ensures that financial resources are allocated strategically to achieve sustainable growth.

11. Financial Management and Corporate Governance (Ensuring Accountability): Financial management extends to the realm of corporate governance, ensuring that financial decisions align with ethical standards and stakeholder expectations. The financial manager collaborates with governing bodies to establish transparent financial reporting, ethical financial practices, and accountability. This connection between financial management and corporate governance is essential for building trust among stakeholders.

12. Financial Management and ESG Criteria (Embracing Sustainability): In the modern business landscape, financial management has expanded its scope to embrace environmental, social, and governance (ESG) criteria. The financial manager considers the environmental and social impact of financial decisions, aligning them with sustainable business practices. This involves evaluating investments based on ESG criteria, promoting corporate social responsibility, and contributing to a more sustainable and responsible financial ecosystem.

In conclusion, the scope of financial management is expansive and multidimensional, encompassing economics, accounting, mathematics, and extending to production, marketing, human resources, risk management, legal compliance, digital transformation, strategic planning, corporate governance, and sustainability. Financial management, guided by a master conductor – the financial manager – harmonizes diverse elements to navigate the complexities of the business landscape, ensuring strategic alignment, risk mitigation, and ethical financial practices. This holistic mastery is essential for shaping the destiny of organizations in a dynamic and interconnected global economy.

Assistant Teacher at Zinzira Pir Mohammad Pilot School and College