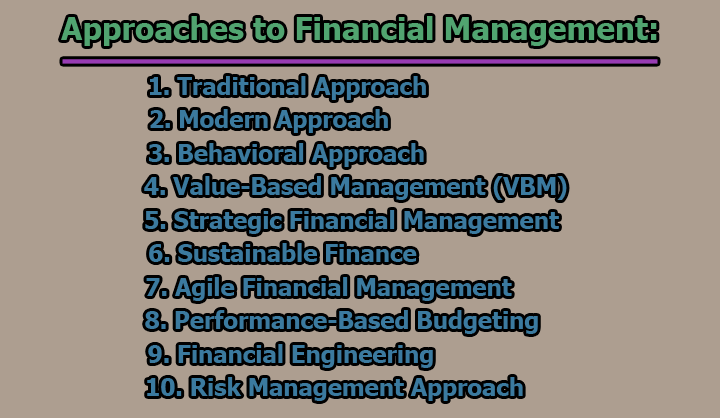

Approaches to Financial Management:

Financial management involves the strategic planning, organizing, directing, and controlling of an organization’s financial resources to achieve its goals and objectives. Various approaches guide financial management practices, each offering distinct perspectives on how to manage resources efficiently. Here are key approaches to financial management:

1. Traditional Approach:

Description: The traditional approach emphasizes financial control and cost minimization. It aims to ensure that expenses stay within budgeted limits while maximizing profits. This approach is rule-based, focusing on adherence to financial policies and procedures.

Application: Commonly used in stable and predictable environments, the traditional approach suits organizations where minimizing costs is a primary concern.

2. Modern Approach:

Description: The modern approach is more dynamic, focusing on strategic financial management to enhance shareholder value. It considers factors like risk, time value of money, and the cost of capital. Techniques such as discounted cash flow analysis and risk management play a crucial role.

Application: Suited for organizations operating in complex and dynamic environments, where financial decisions require a forward-looking, strategic perspective.

3. Behavioral Approach:

Description: The behavioral approach recognizes that financial decisions are influenced by human behavior and psychology. It incorporates insights from behavioral economics to understand how individuals and groups make financial choices.

Application: Valuable in contexts where understanding the psychological factors affecting financial decision-making is essential, such as investment choices or employee financial wellness programs.

4. Value-Based Management (VBM):

Description: VBM is an approach that aligns financial decisions with the creation of shareholder value. It emphasizes maximizing the long-term value of the organization by making decisions that enhance profitability and sustainable growth.

Application: Particularly relevant for publicly traded companies where shareholders’ interests are paramount. It encourages decisions that contribute to the organization’s intrinsic value.

5. Strategic Financial Management:

Description: Strategic financial management integrates financial decision-making with the overall strategic objectives of the organization. It involves aligning financial goals with the broader mission and vision to drive sustainable success.

Application: Essential for organizations facing strategic challenges or transformations, where financial decisions must support and propel the achievement of long-term objectives.

6. Sustainable Finance:

Description: Sustainable finance integrates financial decision-making with environmental, social, and governance (ESG) considerations. It involves ethical and responsible investment practices that contribute to long-term societal and environmental well-being.

Application: Gaining prominence in organizations committed to corporate social responsibility and sustainable development, aligning financial strategies with ethical and environmental values.

7. Agile Financial Management:

Description: Agile financial management adapts principles from agile project management to financial processes. It emphasizes flexibility, responsiveness to change, and iterative planning, allowing organizations to navigate uncertainty.

Application: Particularly useful in rapidly changing industries or during economic uncertainty, where the ability to quickly adjust financial strategies is crucial.

8. Performance-Based Budgeting:

Description: This approach ties budgeting directly to the expected performance outcomes. Resources are allocated based on the expected impact on organizational goals, enhancing the efficiency and effectiveness of budget allocation.

Application: Commonly used in the public sector and organizations with a focus on outcome-driven initiatives, where performance metrics guide resource allocation.

9. Financial Engineering:

Description: Financial engineering involves the creation and use of innovative financial products and strategies to achieve specific financial goals. It often involves complex financial instruments and modeling techniques.

Application: Commonly employed in the financial services industry and by large corporations seeking advanced financial solutions to address specific challenges or opportunities.

10. Risk Management Approach:

Description: This approach focuses on identifying, assessing, and mitigating financial risks. It involves strategies to manage uncertainties, including market risks, credit risks, and operational risks, to safeguard the organization’s financial health.

Application: Essential in industries and organizations exposed to significant financial risks, such as fluctuations in currency exchange rates, interest rates, or commodity prices.

In conclusion, these approaches are not mutually exclusive, and organizations often integrate elements from multiple approaches based on their specific needs, goals, and operating environments. The choice of approach depends on factors such as organizational structure, industry dynamics, and the prevailing economic landscape. Successful financial management requires a judicious blend of these approaches to navigate the complexities of the business world.

Library Lecturer at Nurul Amin Degree College